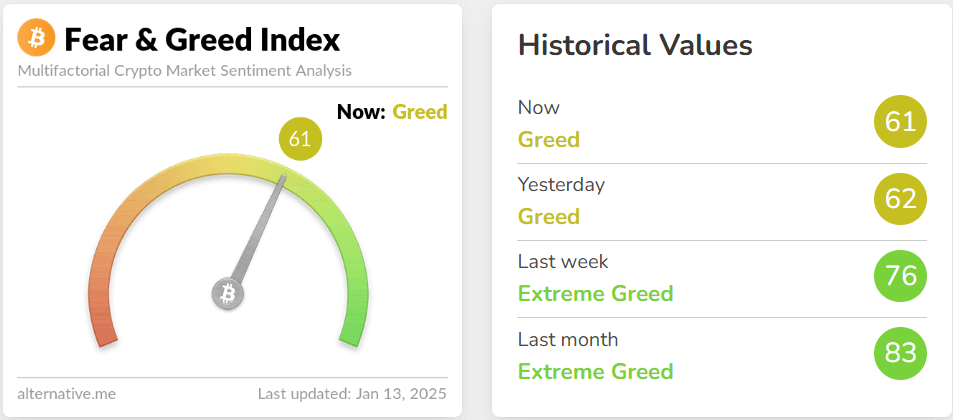

- Cryptocurrency costs have been on a downtrend final week, pushed primarily by newly launched Fed assembly notes and risk-off sentiment concerning financial indicators.

- The Fed has expressed warning about inflation, particularly as President Trump's insurance policies take impact after he takes workplace on January twentieth.

- In the meantime, spot crypto ETFs recorded outflows beginning Wednesday, January eighth.

Bitcoin

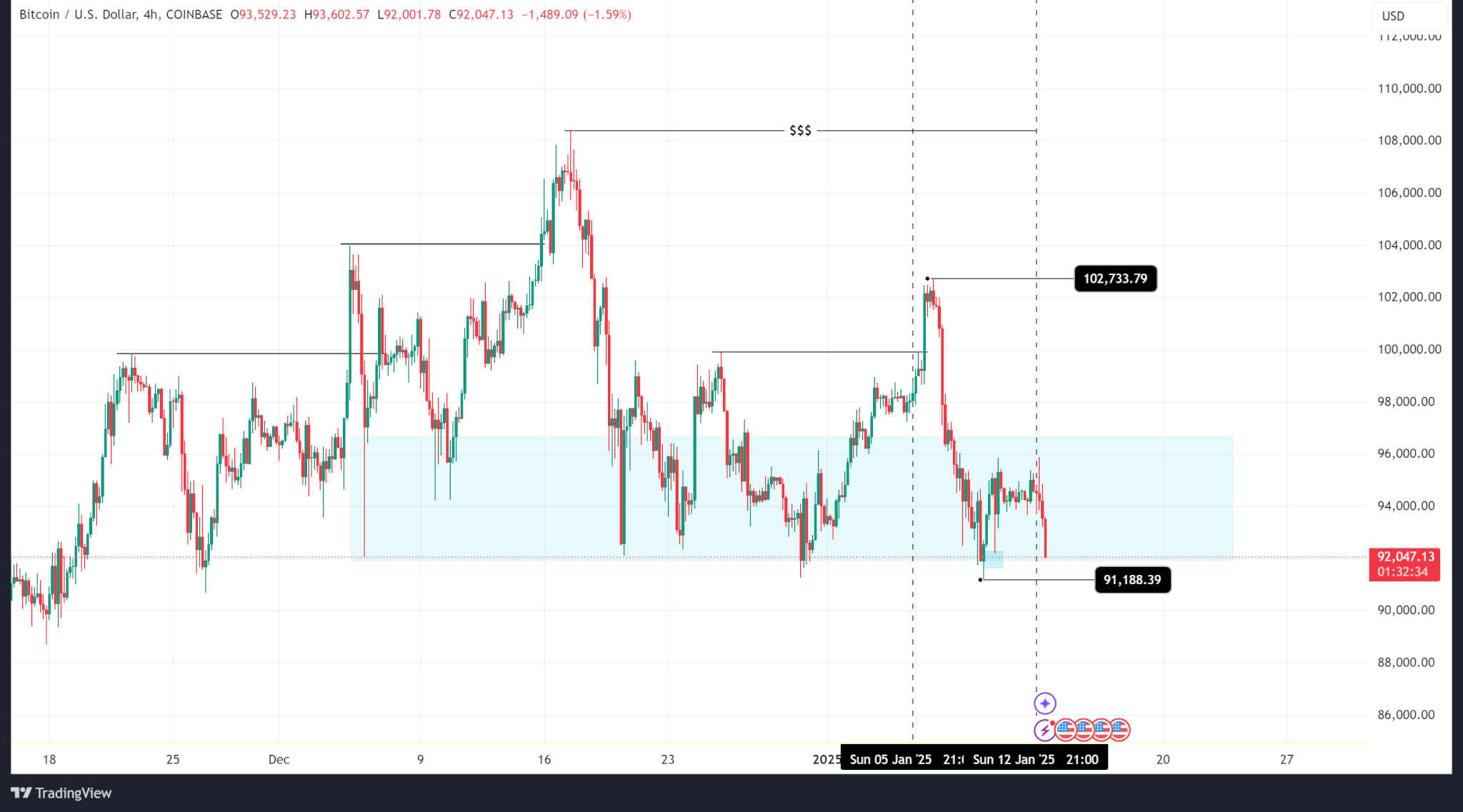

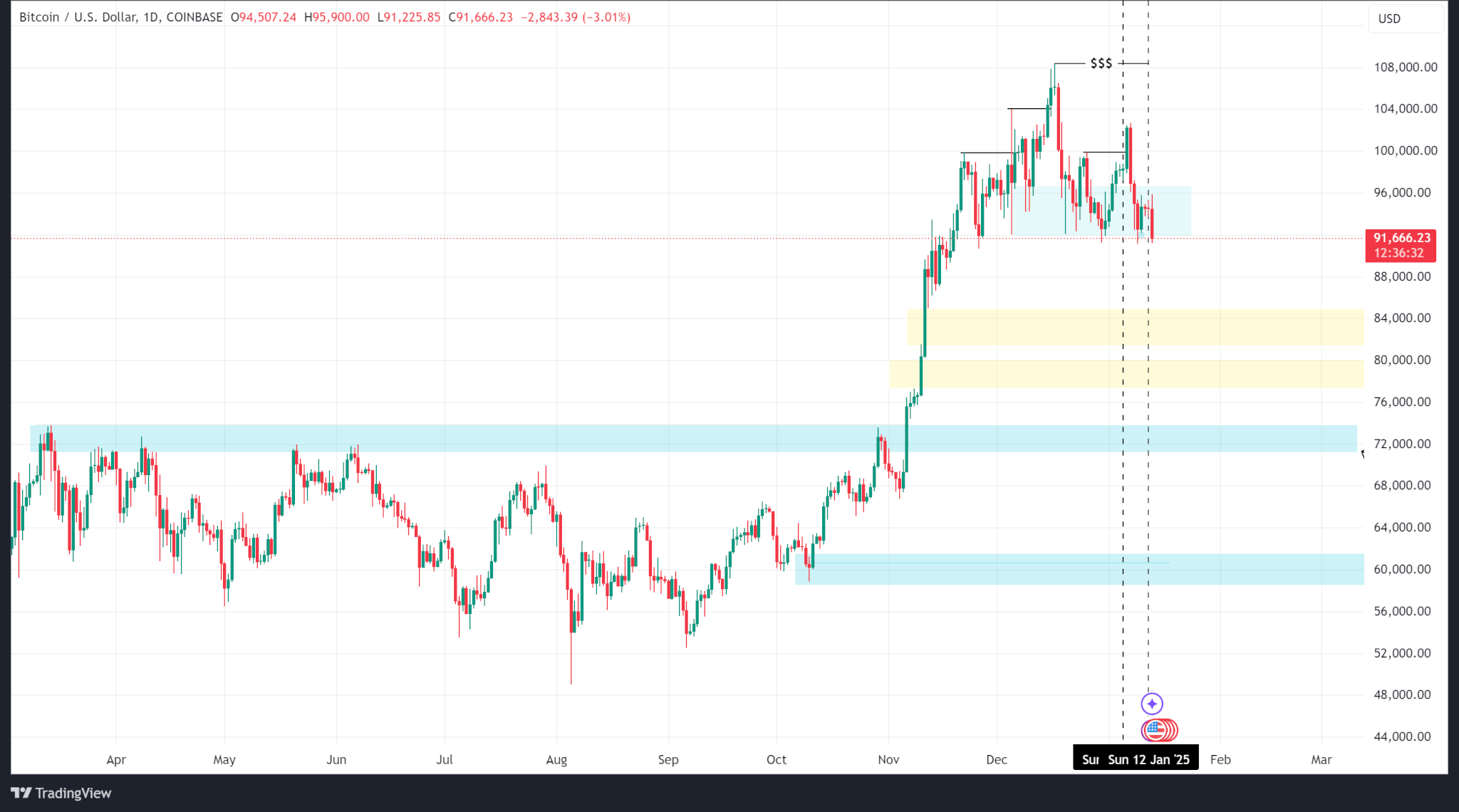

Bitcoin worth fell from a excessive of $102,733 to a low of $91,188 and at last closed at $94,547.

Technical evaluation reveals that the worth has damaged above the earlier low excessive and pushed again into the H4 demand zone. Which means that though costs have turned bearish, they’re nonetheless in bullish territory general.

A lot of this bearish sentiment is pushed by the grim financial outlook. Fed assembly minutes launched on January 8 confirmed the Reserve Financial institution to be cautious about inflation anticipated to observe President Trump's insurance policies.

This makes it much less seemingly that rates of interest will proceed to be minimize, with some analysts saying they count on them to finish early this 12 months. Market response displays this newest risk-off sentiment.

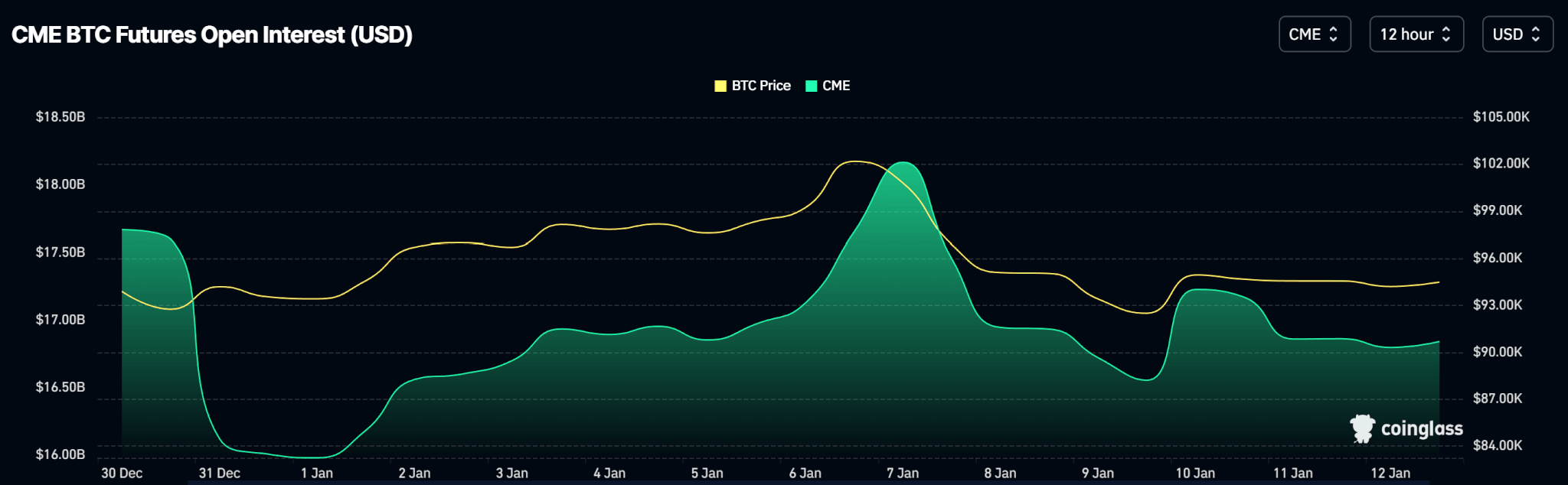

Bitcoin's open curiosity chart reveals that the variety of open pursuits has decreased between Wednesday and now. CME's open curiosity reached a weekly excessive of $18.16 billion on Tuesday, fell to a low of $16.55 billion on Thursday, and settled down for the remainder of the week.

In the meantime, the Spot Bitcoin ETF recorded outflows after the discharge of Wednesday's Fed assembly minutes. Outflows totaled $718.2 million, and inflows totaled $1.03 billion.

outlook

Bitcoin worth is at the moment hovering close to the underside of its demand zone. If it falls beneath this, the worth might fall to $85,100, with the truthful worth distinction probably performing as assist.

On the time of publication, BTC is buying and selling at $91,622.

Ethereum

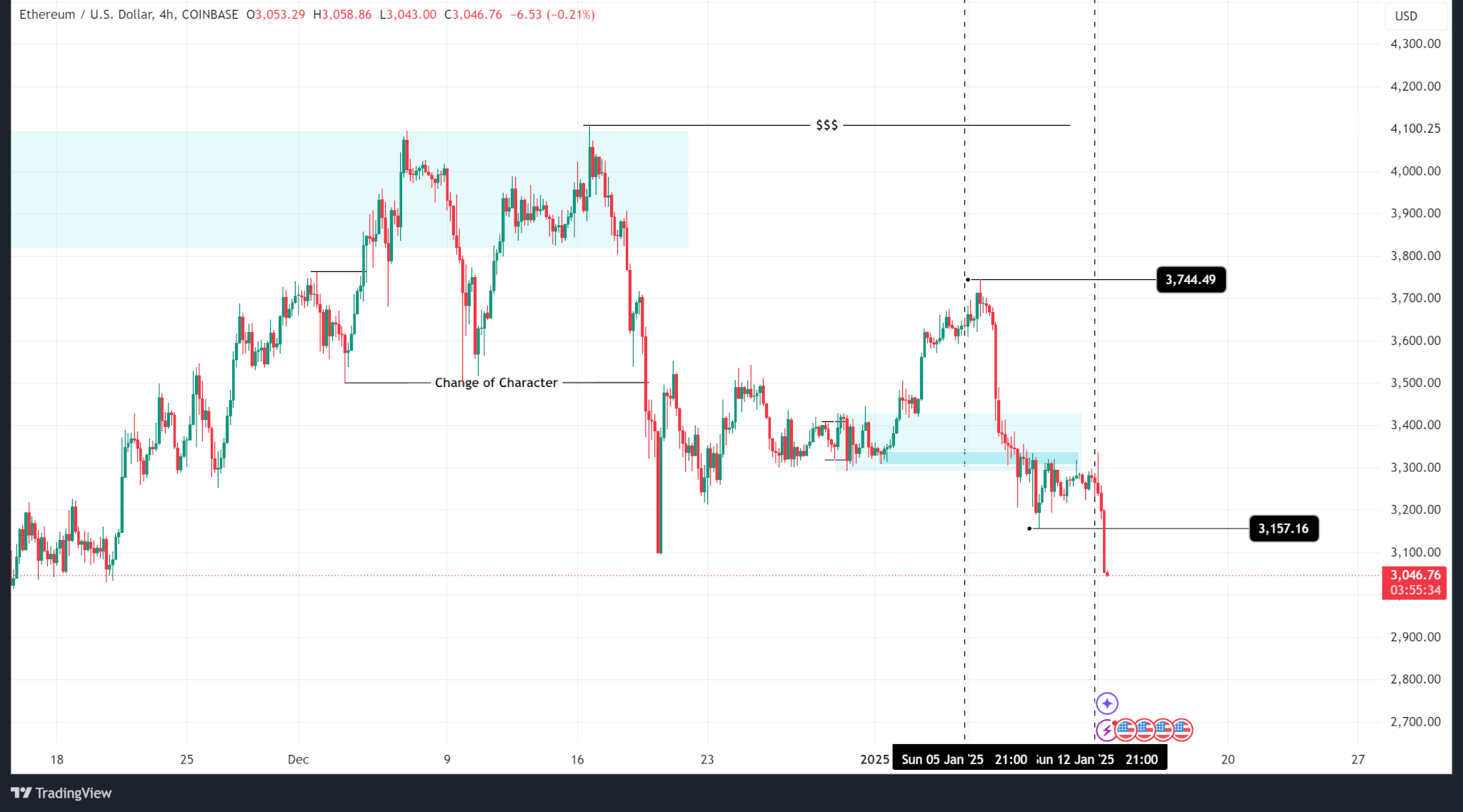

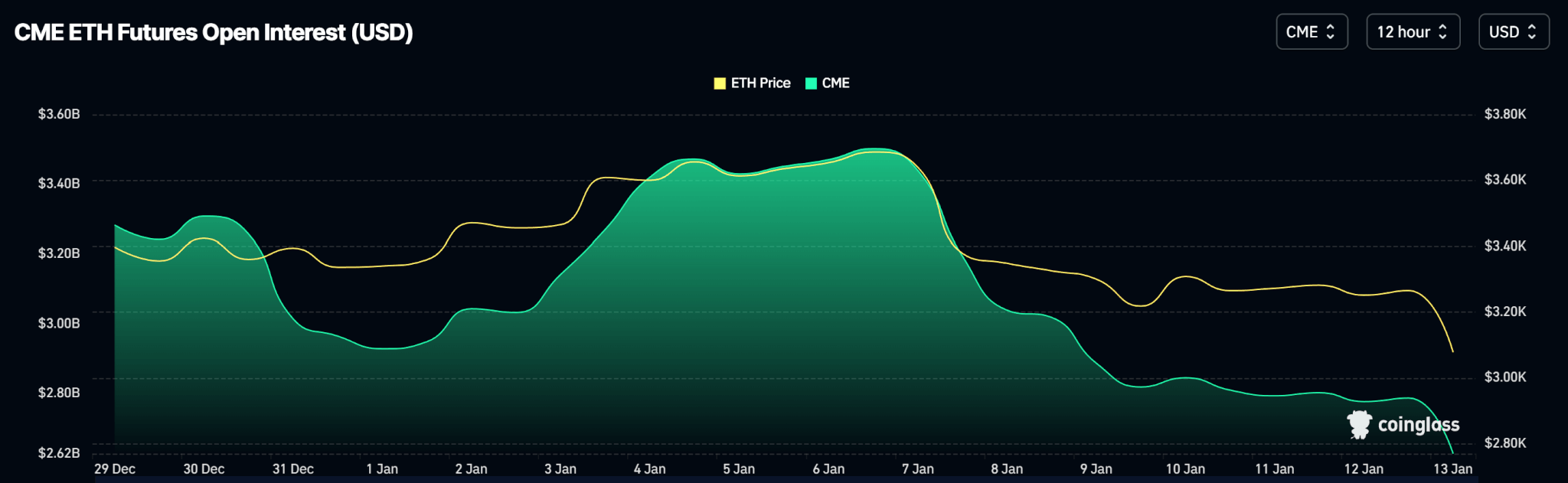

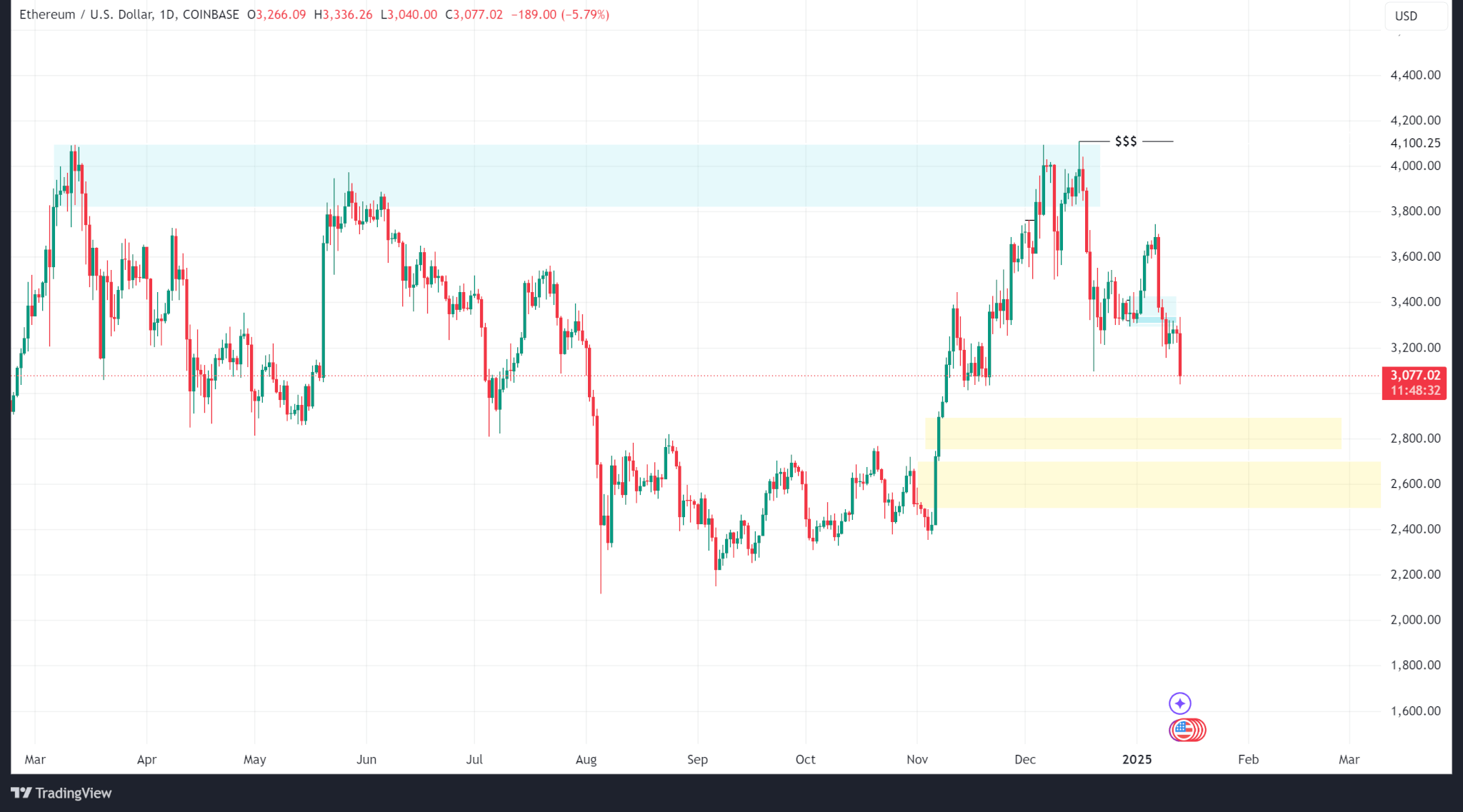

Ethereum worth additionally turned destructive this week, falling from a excessive of $3,744 to a low of $3,157, earlier than closing at $3,236. ETH worth development examined the March 2024 excessive of $4,089 in early December 2024, however failed to interrupt above it and has been at lows ever since.

Open curiosity has declined from a excessive of $3.5 billion on January 7 and continued to say no to $2.63 billion as of this text.

In the meantime, the Ethereum Spot ETF recorded internet outflows of $186 million for the week because of the market's risk-off sentiment.

outlook

As Ethereum worth continues its downward development, the subsequent technical stage that would present assist is the truthful worth hole on the $2,893 worth stage.

ETH is buying and selling at $3,071 on the time of publication.

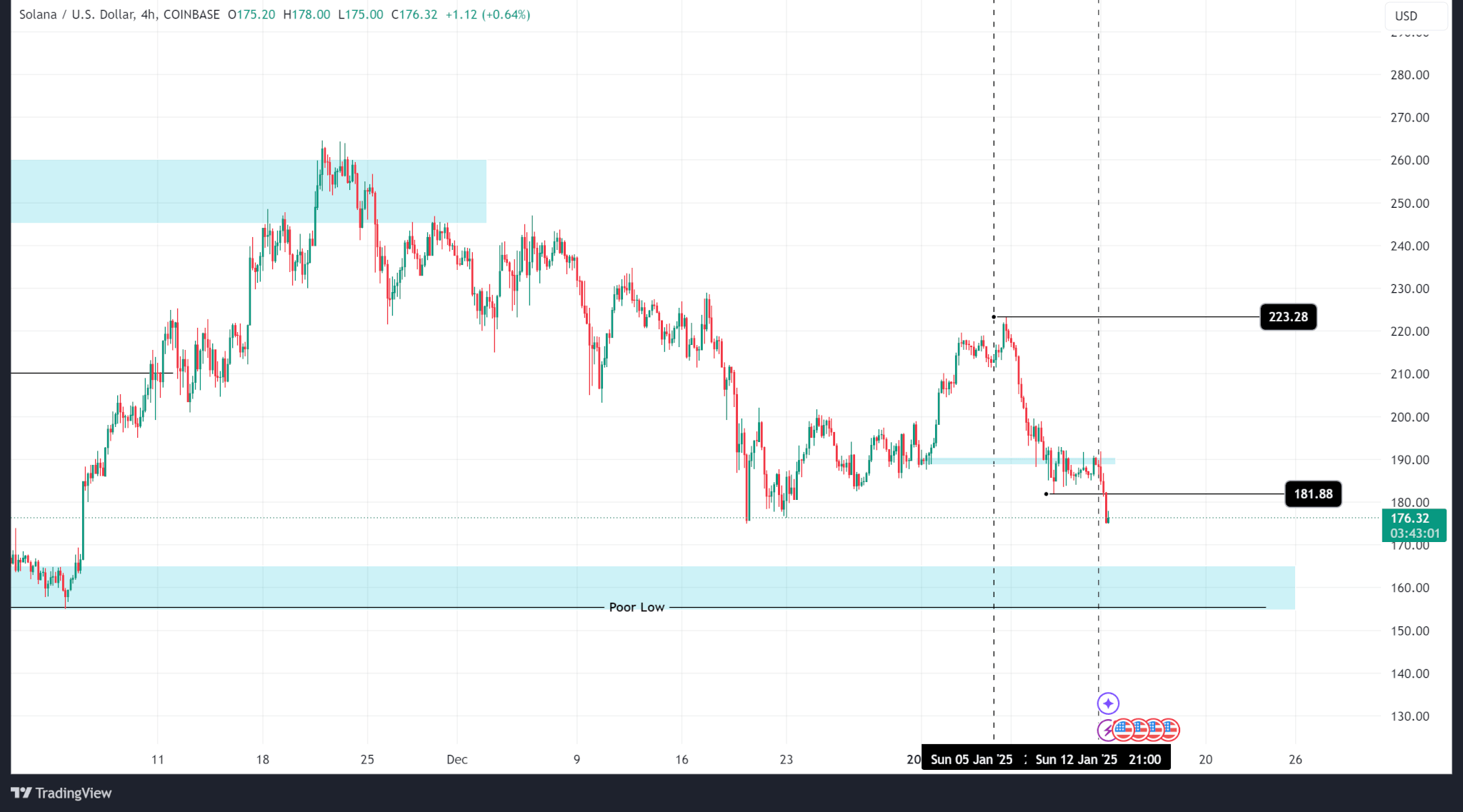

Solana

Solana’s worth fell from a weekly excessive of $223 to a weekly low of $181, and at last closed at $188, for a complete lack of 12.53%. SOL was unable to exceed its closing worth of $260, its all-time excessive, and continues to development downward.

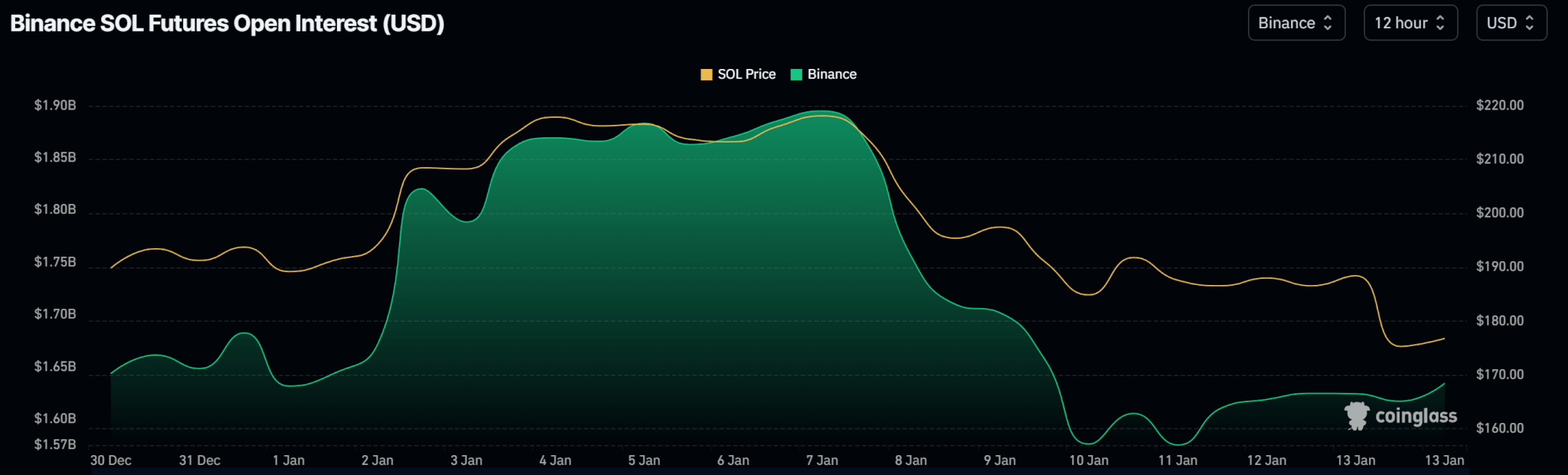

Based on open curiosity knowledge, Binance noticed a pointy decline from $1.89 billion on January seventh to $1.58 billion on January tenth. As of the publication of this text, the OI stage has improved to $1.63 billion.

outlook

The following technical assist zone is the $164 worth stage. Nevertheless, though the order block is a assist, it’s a poor low that would fall even when the worth reverses from that zone.

SOL is buying and selling at $176 on the time of publication.

ripple

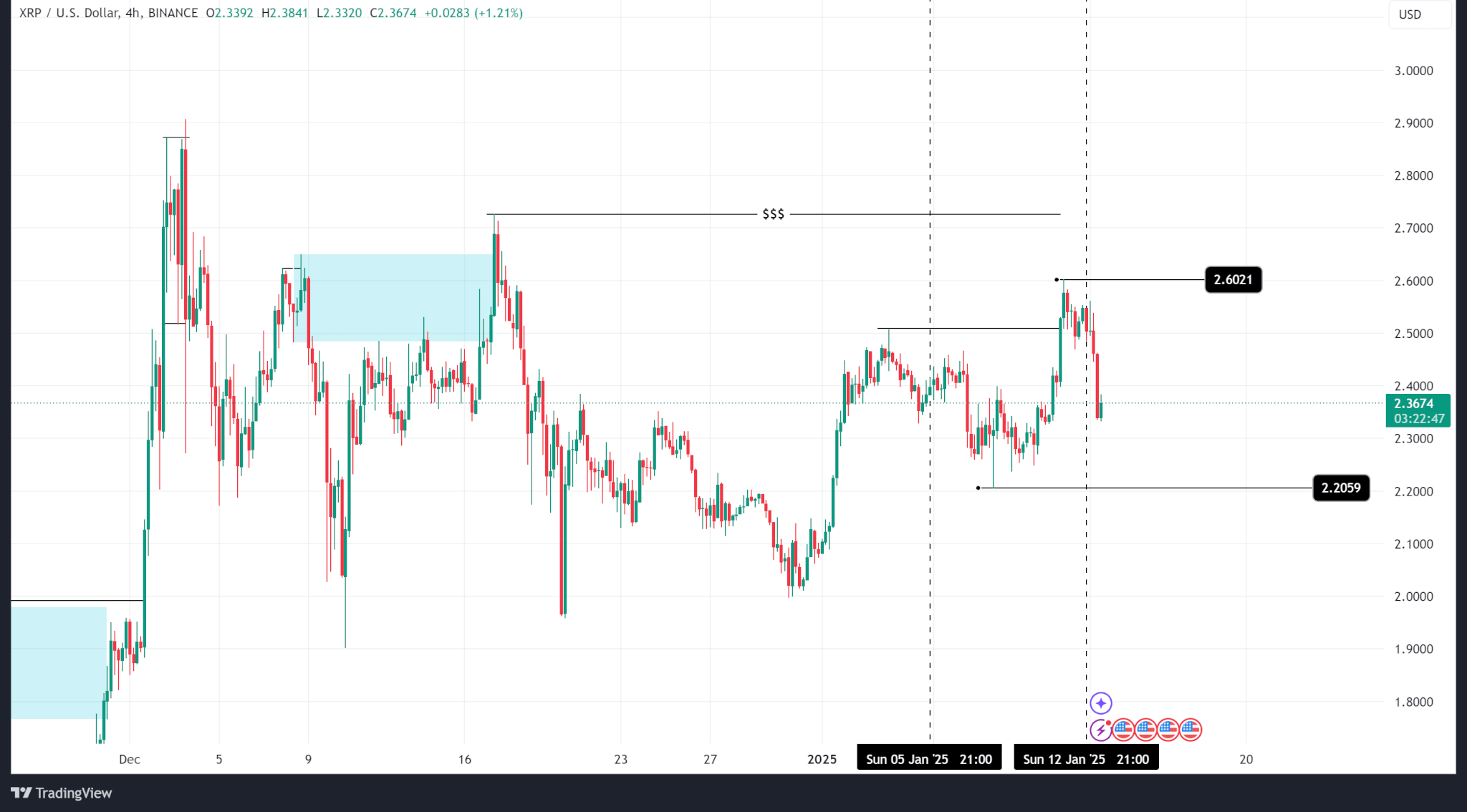

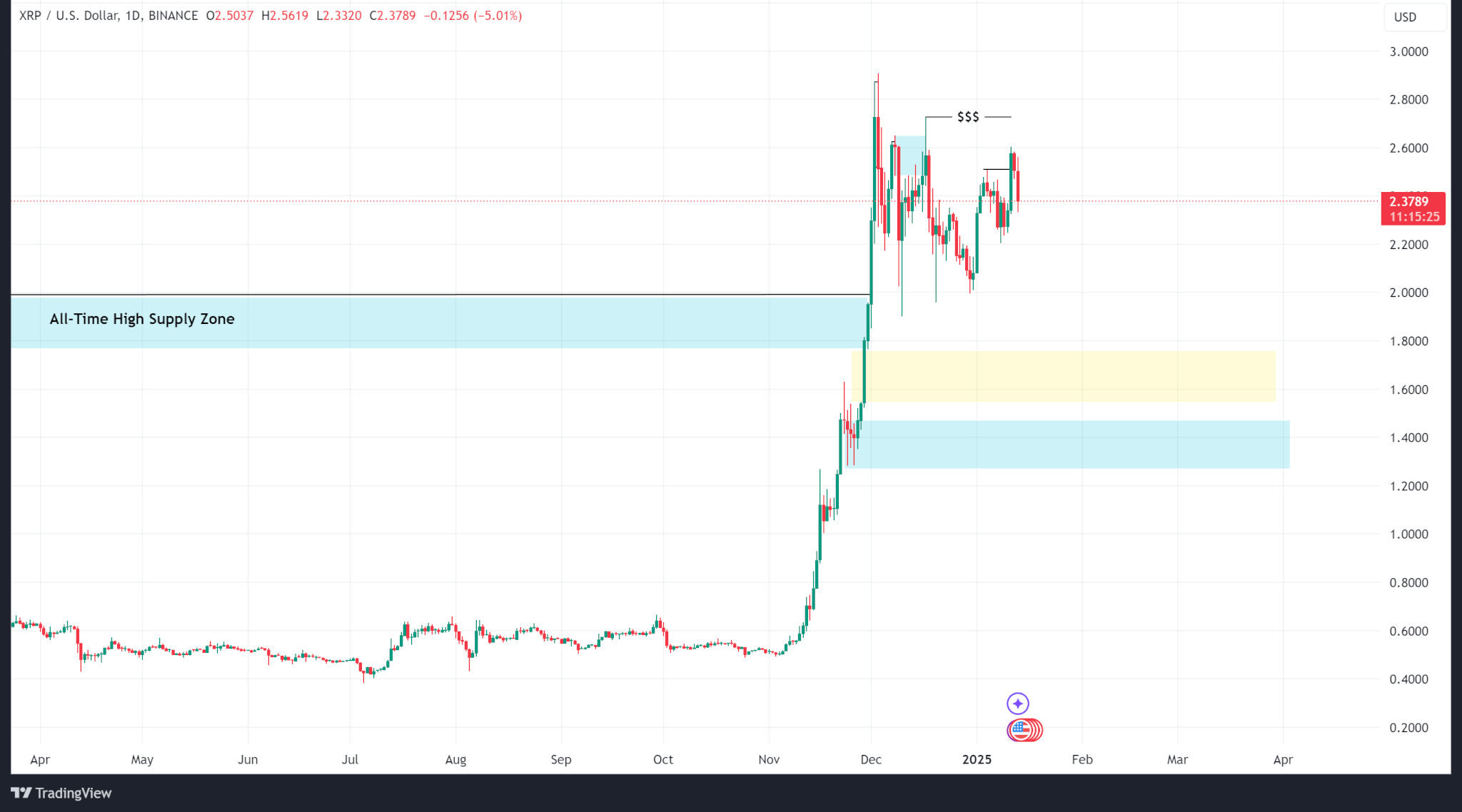

Ripple worth did properly final week, ending at $2.55 from $2.38 originally of the week as the worth continued to make new highs. Zooming out, costs proceed to hover between $1.90 and $2.90 because the market cools.

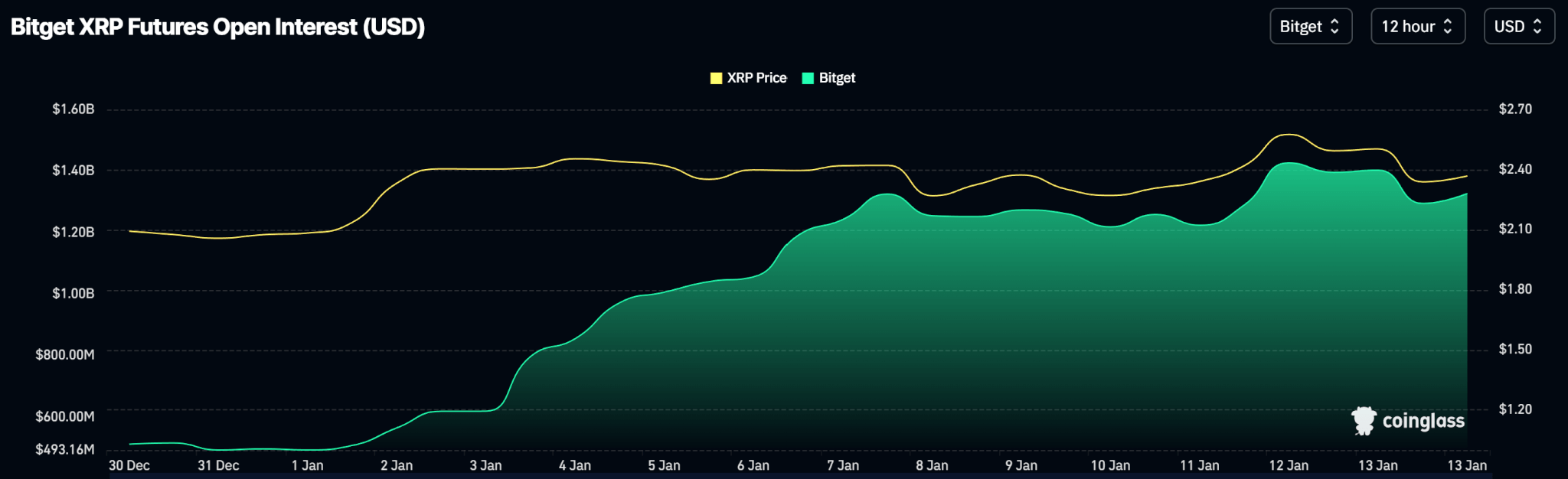

Open curiosity on BitGet, the change with the best buying and selling quantity for XRP derivatives, rose final week, supporting the rally as optimistic information concerning Ripple's lawsuit with the SEC boosted sentiment.

outlook

Ripple's worth has been rising on information surrounding an SEC lawsuit towards its father or mother firm, which may very well be deserted with the outgoing administration.

Nevertheless, technical evaluation reveals that XRP is buying and selling at a premium and is anticipated to fall. The more than likely ranges are a good worth hole of $1.75 and an order block of $1.46.

XRP is buying and selling at $2.37 on the time of publication.

(Tag translation) Evaluation