Bitcoin skilled vital volatility within the days main as much as President Donald Trump’s inauguration on January twentieth. The market had seen sharp worth actions within the earlier week, with elevated exercise from US merchants over the weekend. Political uncertainty surrounding the inauguration and the launch of the $TRUMP and $MELANIA meme cash added to the turmoil, sending Bitcoin’s worth as much as a brand new ATH of $109,460 earlier than being withdrawn.

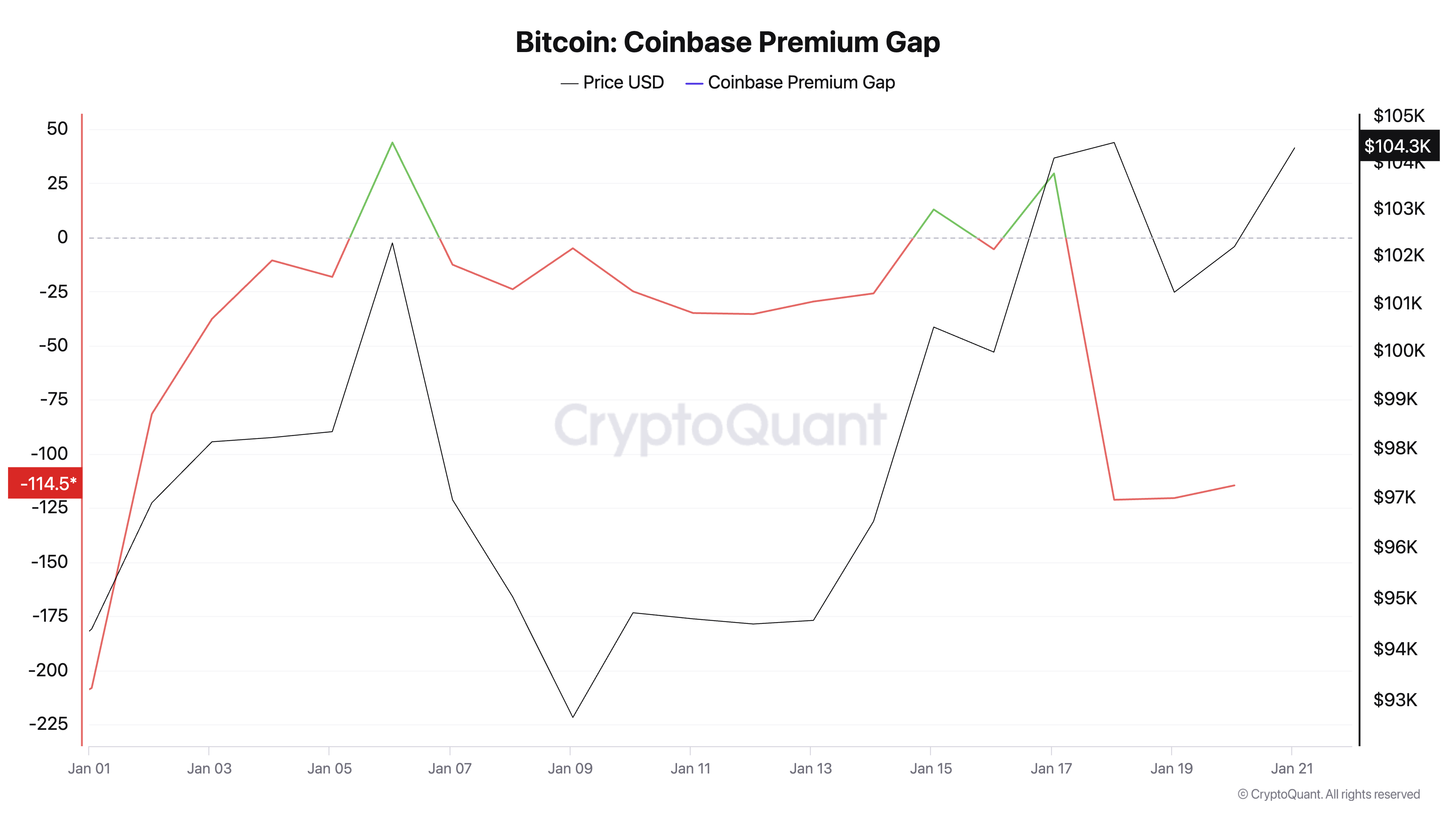

CryptoQuant information means that the US market is the primary driver of this volatility. The Coinbase Premium, which measures the distinction in Bitcoin costs between Coinbase and Binance, dropped considerably within the days main as much as the launch.

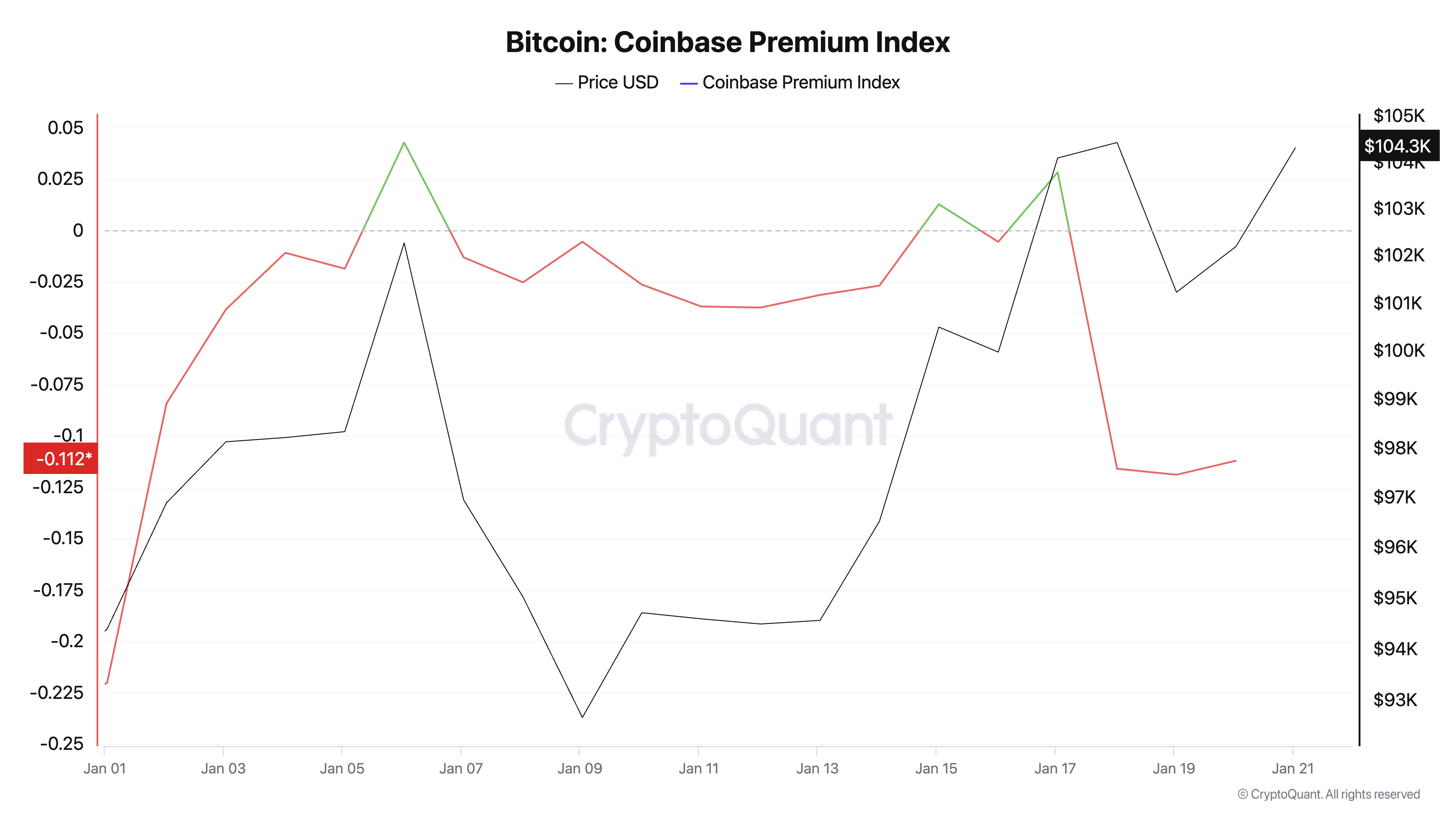

Its relative measure, the Coinbase Premium Index, additionally turned unfavourable.

These declines point out both decreased demand or elevated promoting strain from U.S. buyers. Traditionally, Coinbase’s optimistic premium displays robust institutional demand, and this decline is a transparent sign of uncertainty amongst US buyers.

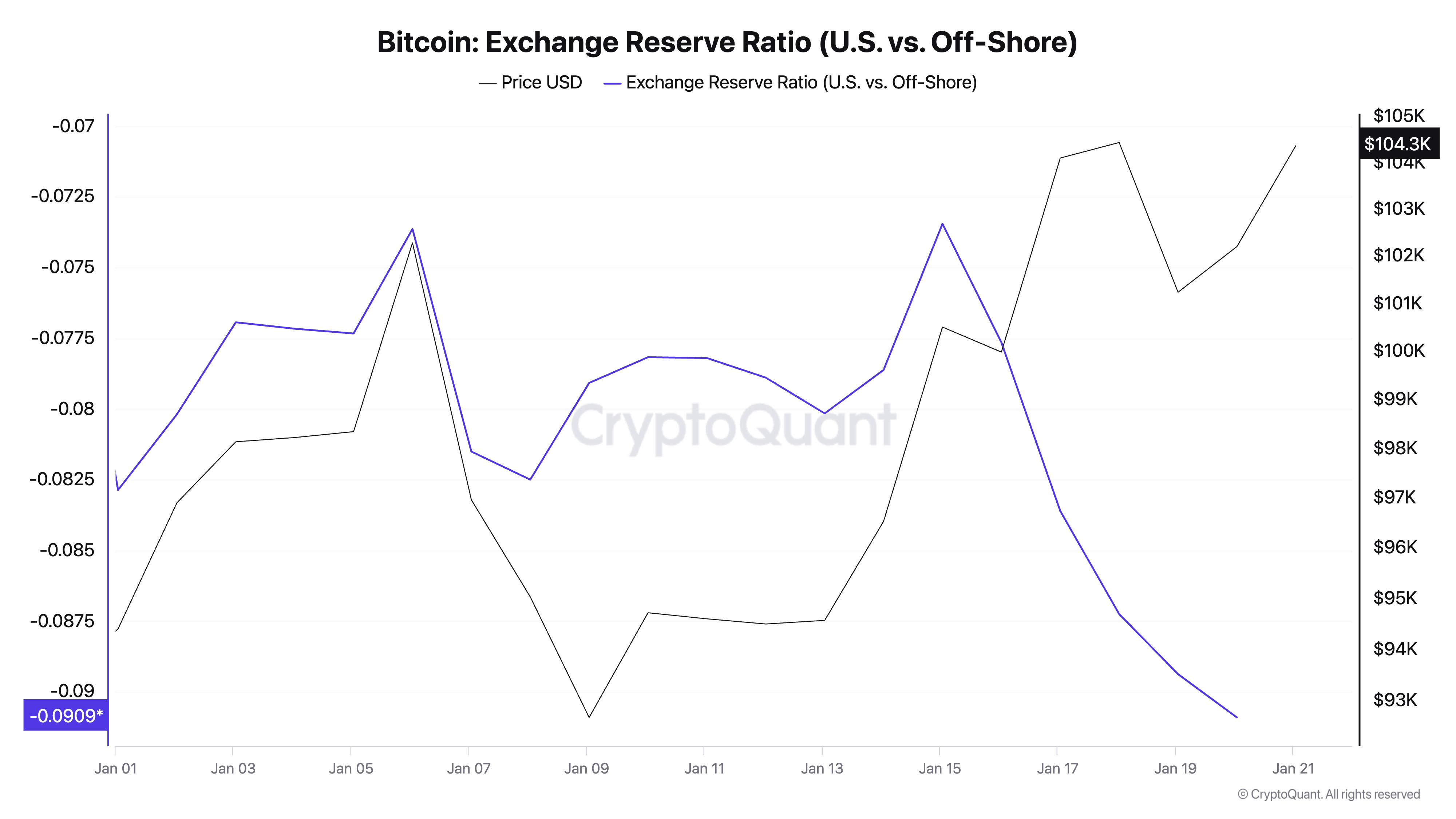

The rise in promoting from US buyers can be seen within the trade reserve ratio, which tracks the relative reserves of US exchanges in comparison with offshore platforms. The overseas trade reserve ratio has been trending downward since January 15, indicating that US-based exchanges’ Bitcoin reserves have declined sooner than offshore exchanges. Such actions usually point out elevated withdrawals or decreased home liquidity, amplifying volatility in U.S. markets.

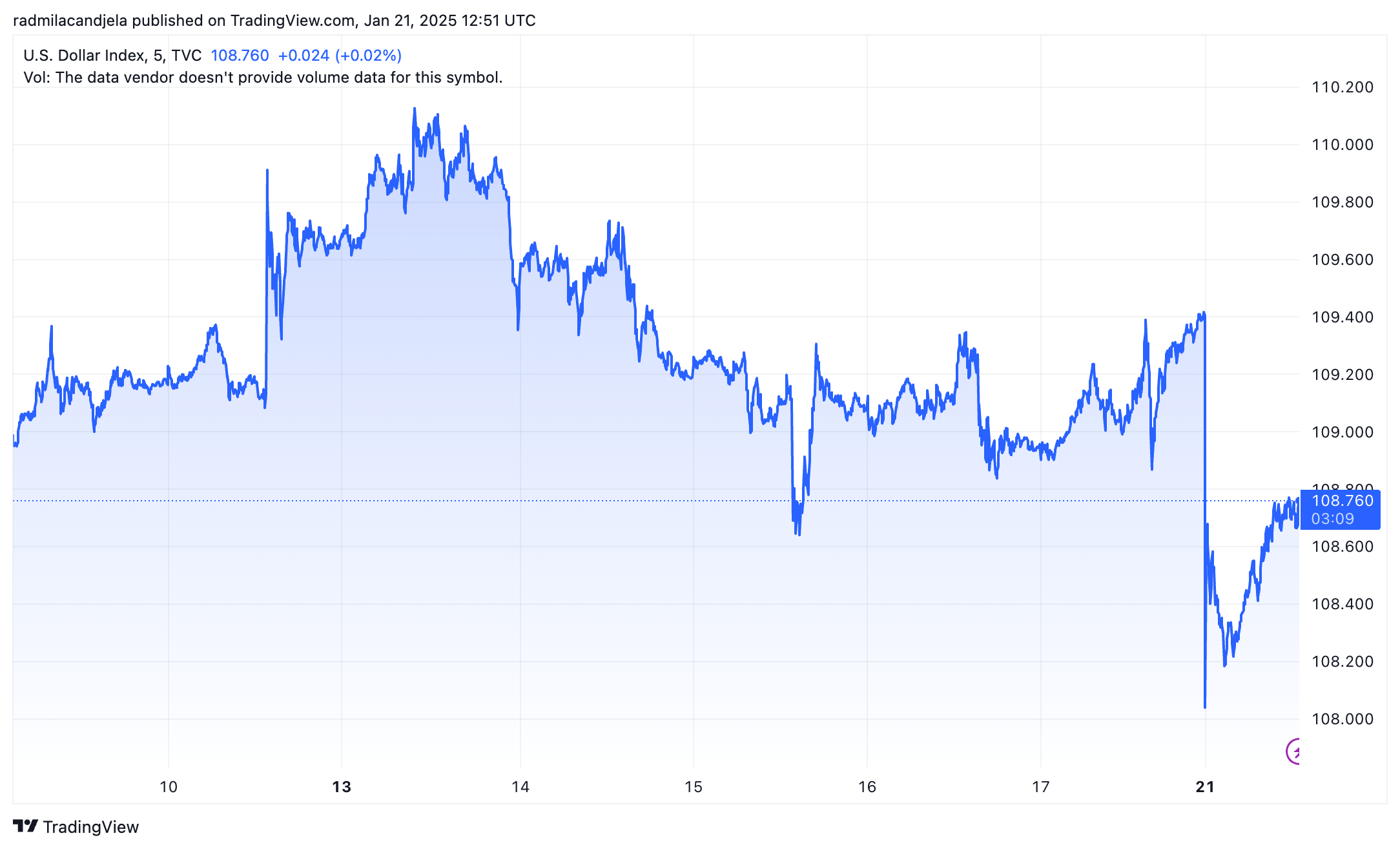

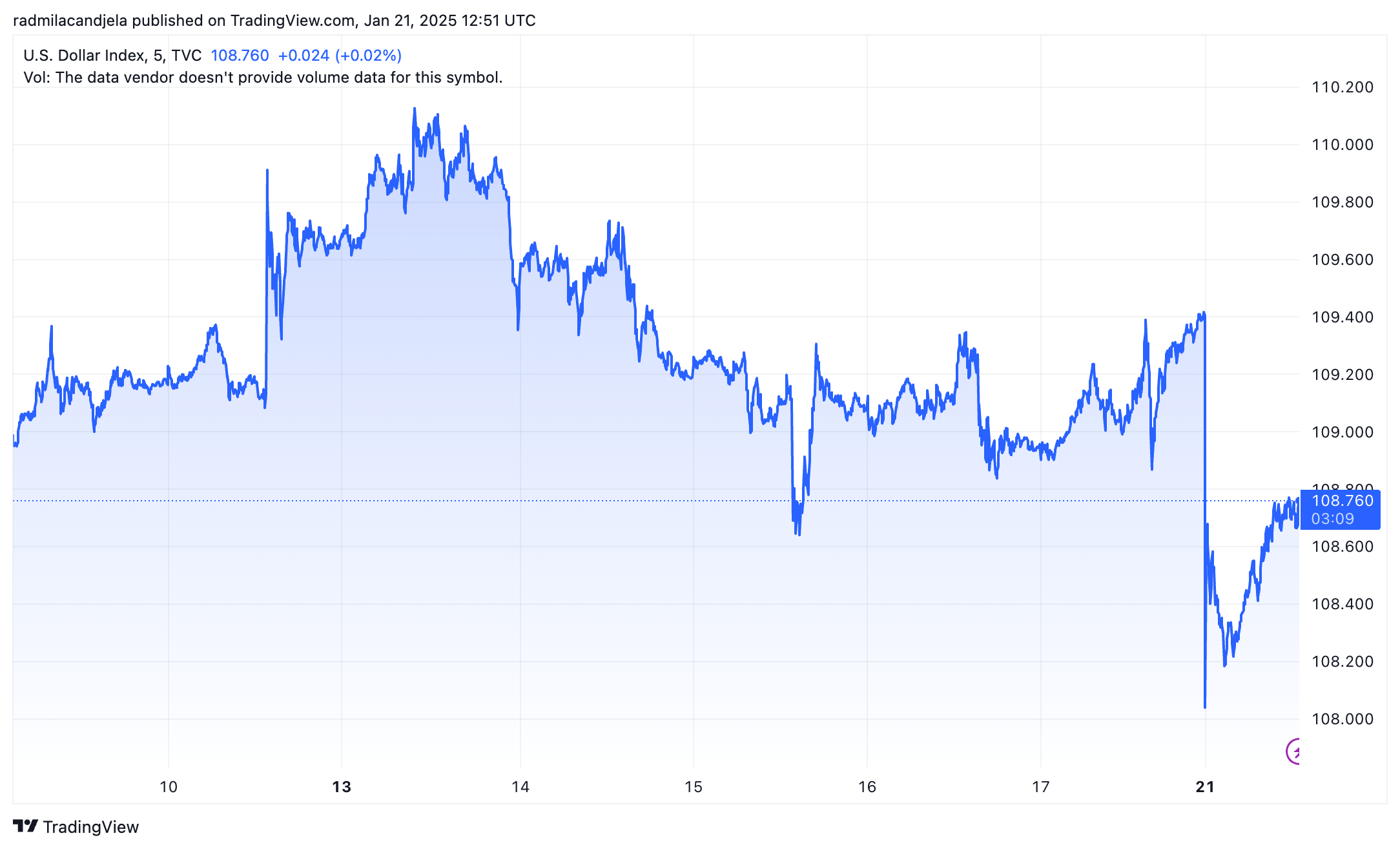

The US greenback index (DXY) additionally fell considerably over the identical interval, reflecting the macroeconomic uncertainty related to the political transition. The inverse correlation between Bitcoin and the greenback additional helps the idea that the US-based sell-off was pushed by widespread market danger aversion.

Whereas the US market noticed some preliminary volatility, international markets stabilized Bitcoin costs. Offshore exchanges confirmed relative energy, with reserves growing as US reserves declined. This exhibits that contributors all over the world, particularly these exterior america, collected Bitcoin throughout the decline. Absorbing this promoting strain prevented the value from falling considerably.

The slight restoration in Coinbase premium since January nineteenth signifies continued international demand. Offshore liquidity doubtless supported Bitcoin costs because the US sell-off subsided, demonstrating the flexibility of world markets to offset native volatility. This additionally exhibits how a lot affect the US market has on Bitcoin worth. U.S. political and macroeconomic occasions are at all times a serious driver of sentiment, primarily as a result of U.S. exchanges like Coinbase cater to massive numbers of institutional and outstanding buyers. This is without doubt one of the elements.

The information exhibits that US buyers had been the primary driver of Bitcoin volatility over the weekend main as much as the inauguration, as evidenced by a decline in Coinbase premiums, a pointy decline within the US-to-offshore reserve ratio, and a decline in DXY. It confirms what occurred. Nonetheless, international markets, particularly offshore platforms, have stabilized the value of Bitcoin. This strengthens Bitcoin’s place as a resilient, globally traded asset that may climate native shocks whereas sustaining long-term stability.

The publish U.S. Markets Enhance Bitcoin Volatility Forward of President Trump’s Inauguration appeared first on currencyjournals.