- Cryptocurrency triggered financial uncertainty, which crypto costs traded inside final week’s vary will likely be relegated to backburners.

- The ETF influx was unfavorable as Etf’s ETF recorded a web circulation of $62.9 million and Ethereum ETFS recorded a $8.9 million on Outflows.

Bitcoin

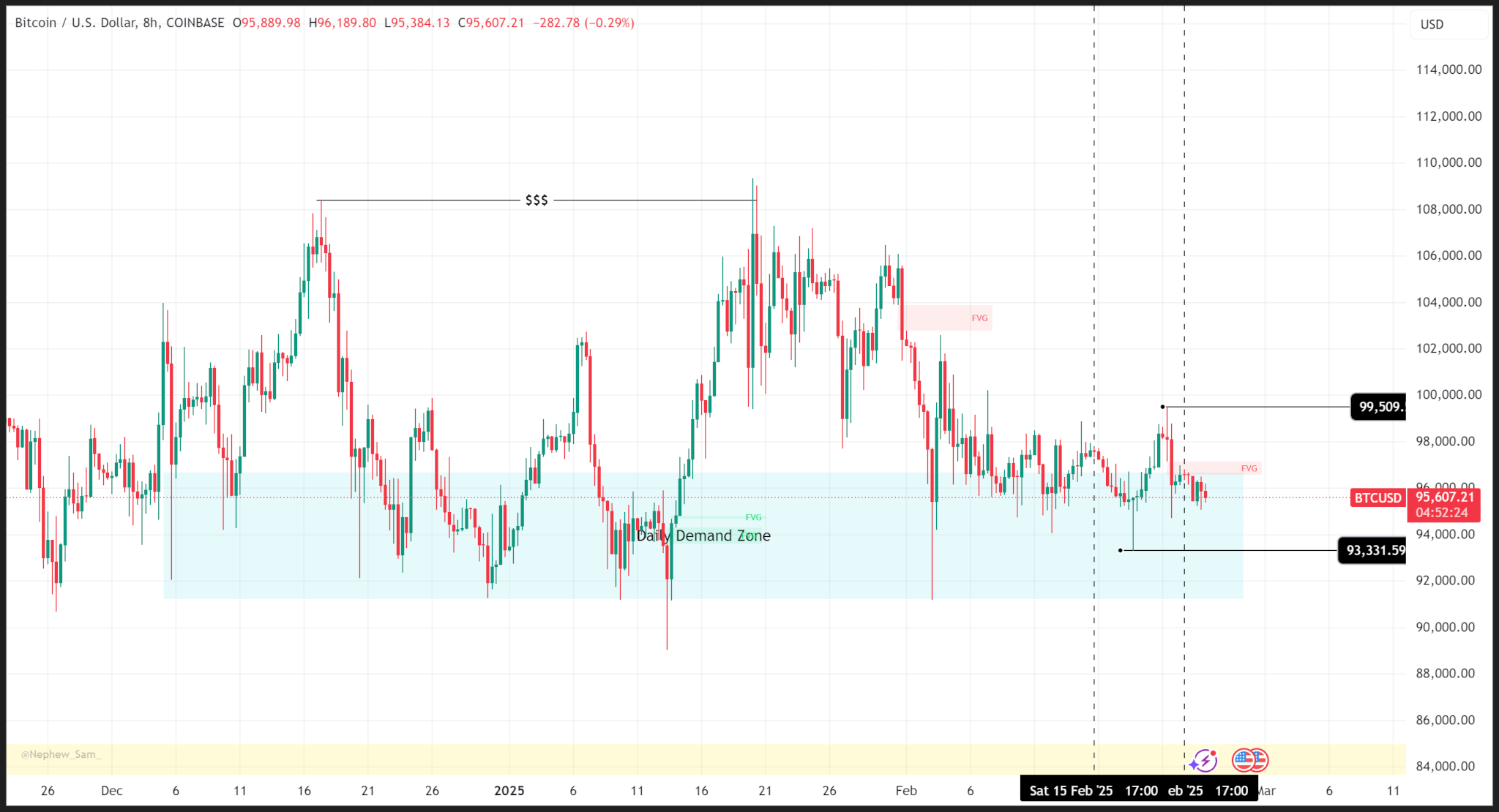

Bitcoin worth motion continues its buying and selling vary of weekly highs of $99,509 and $93,331 as uncertainties loom over inflation, Trump insurance policies and geopolitical occasions. I did.

Zooming out reveals that worth motion is in vary on the day by day help degree of the previous three weeks, as present market situations would not have sufficient catalysts to push costs to new highs.

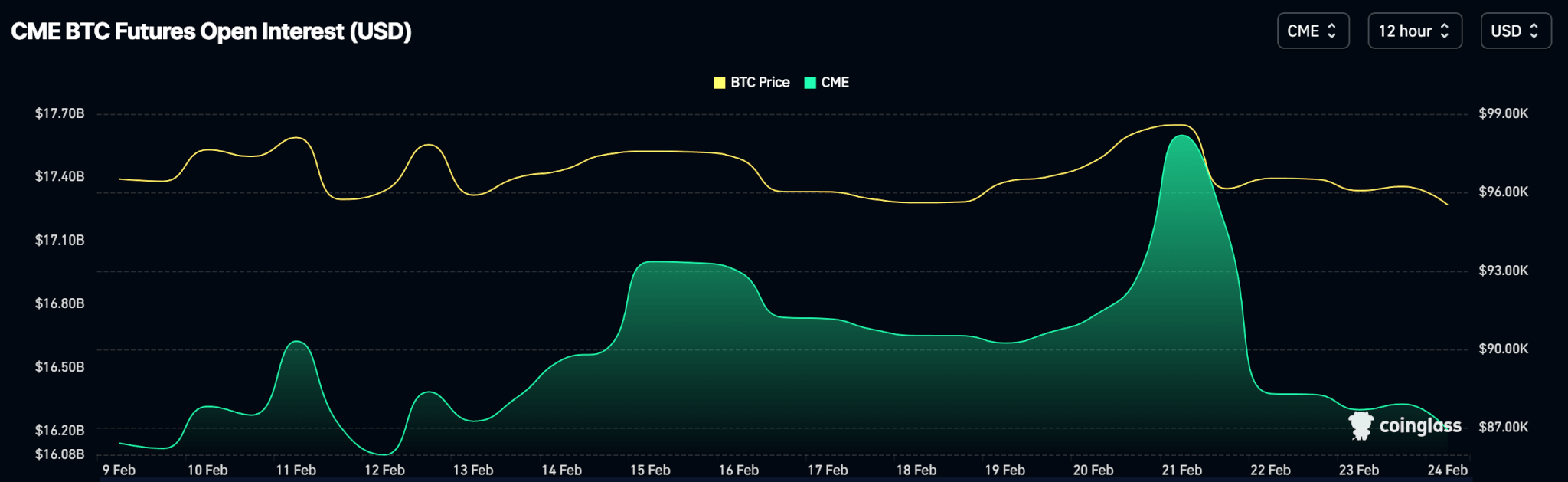

Open Curiosity mimics the value motion because it started with a lower within the quantity of open contracts featured on Wednesday, February nineteenth, in keeping with worth motion.

Outlook

Bitcoin must surpass its $90,673 day by day help to remain on bullish territory. If you happen to fall under this degree in your day by day time-frame, you might fall to the $84,000 degree.

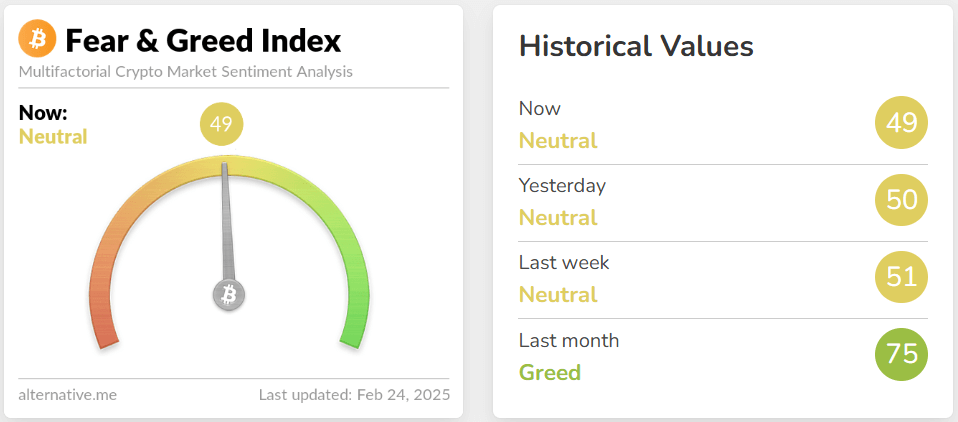

In the meantime, market sentiment has been within the realm of neutrality after final month, with a lot cooling down.

Bitcoin was traded for $87,900 on the time of publication.

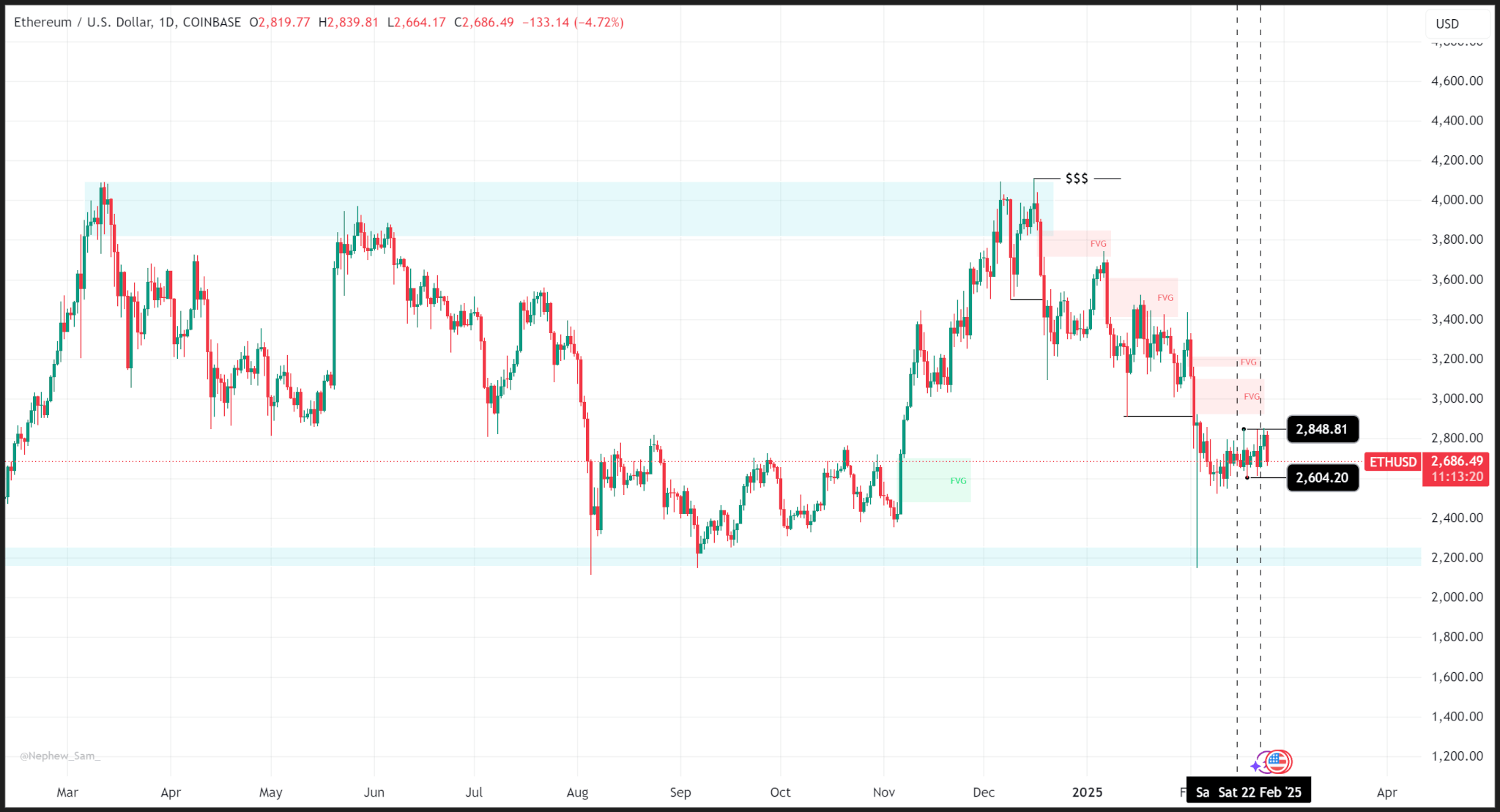

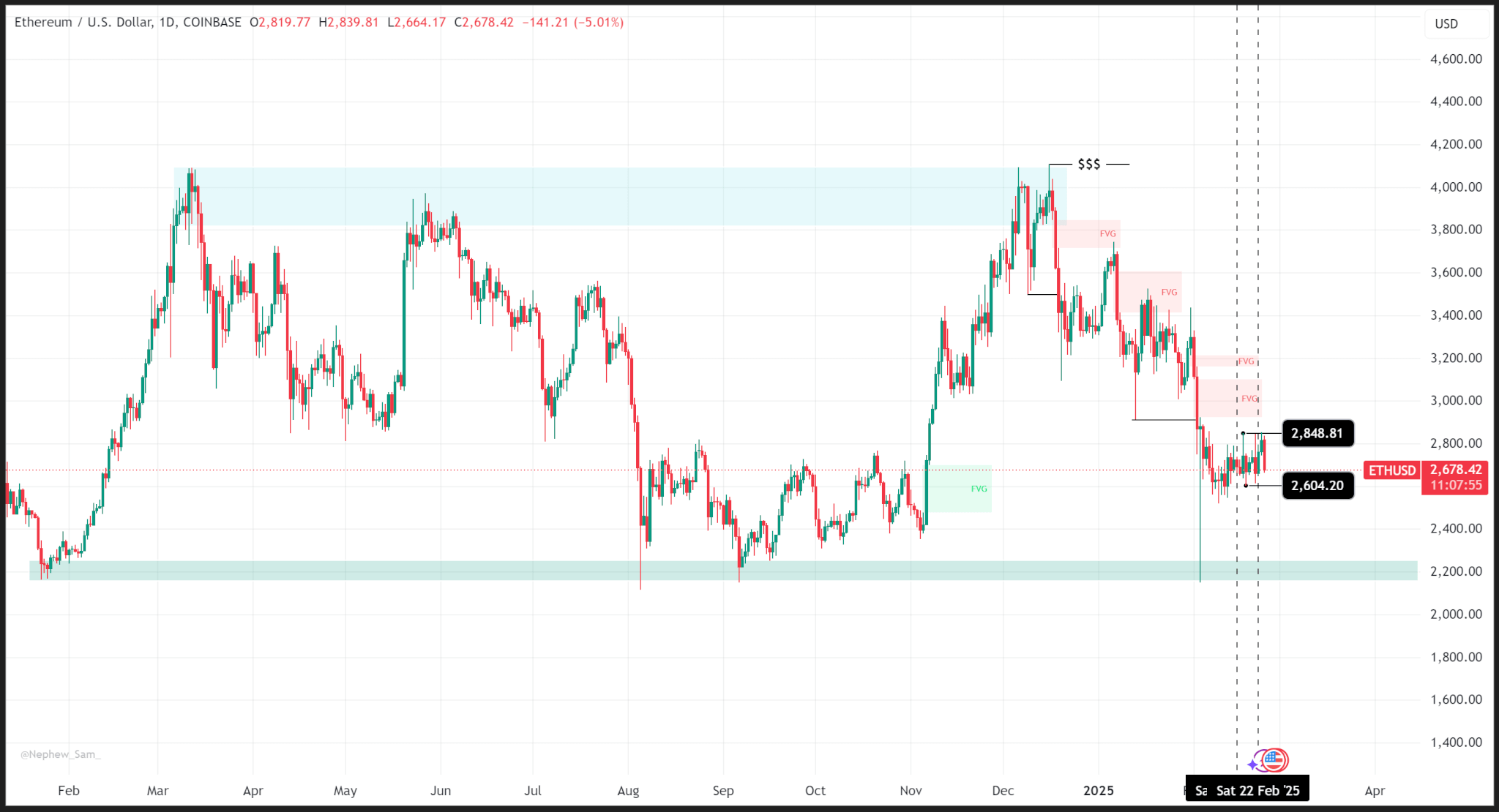

Ethereum

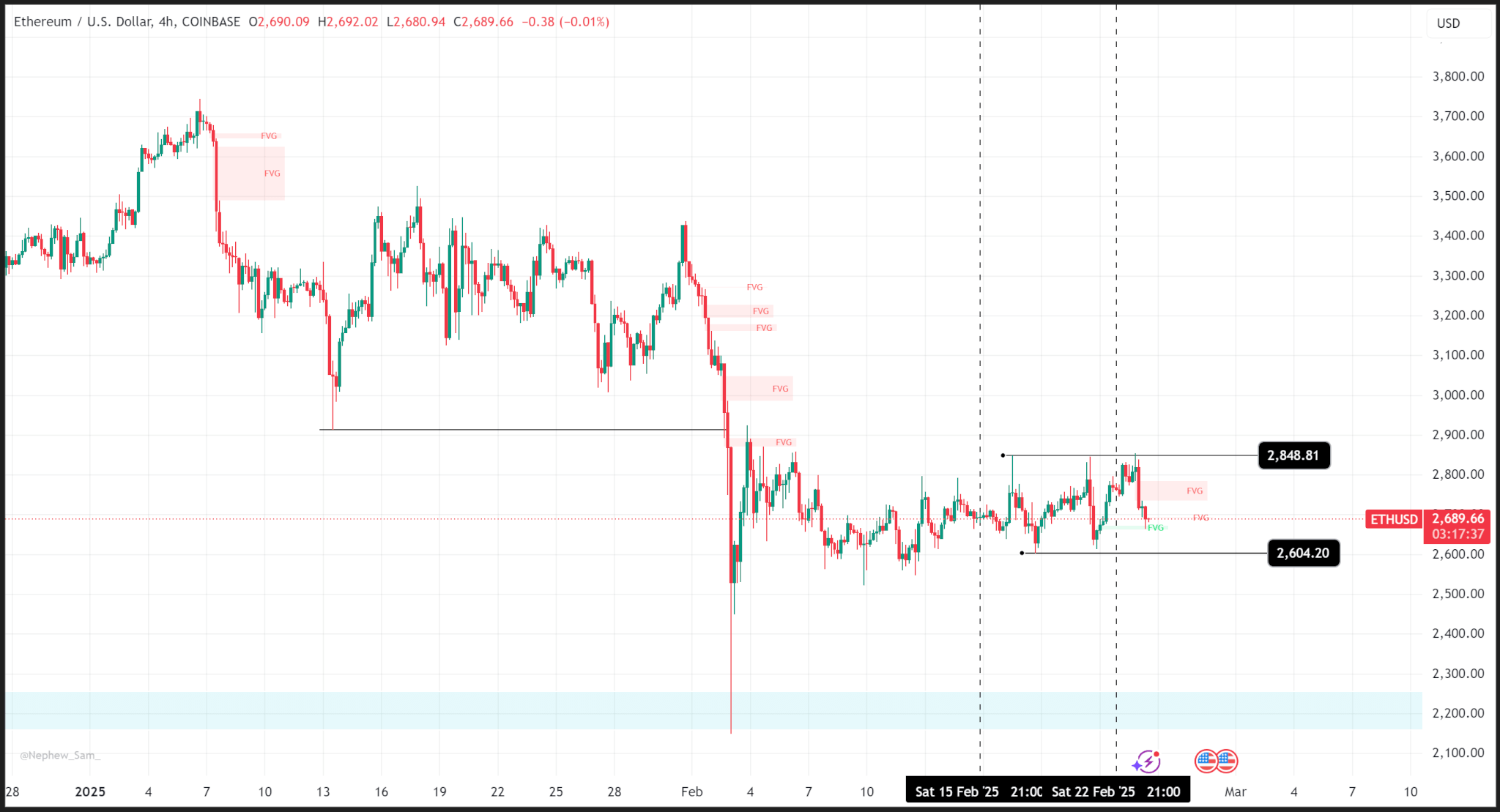

Ethereum’s worth motion hit a weekly excessive of $2,848 and $2,604, regardless of final week’s Bybit Hack information.

Zooming out offers you some unusual drawings as ETH has been low since December ninth, because it didn’t break past its March 2024 excessive.

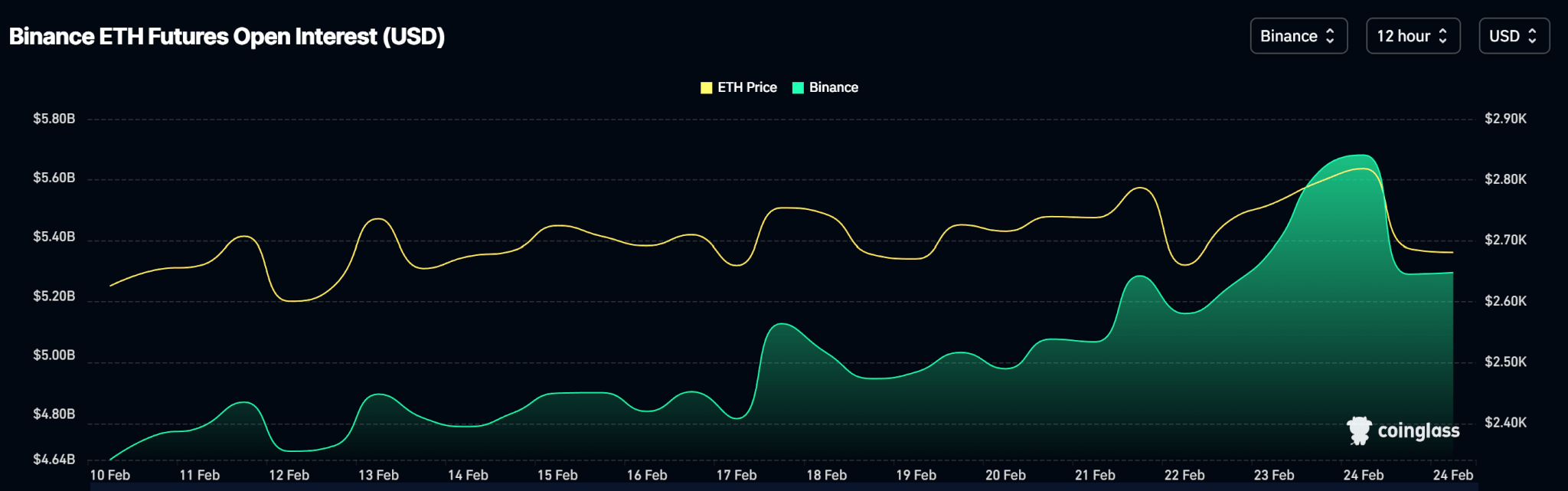

Open curiosity knowledge exhibits that contract volumes are steadily rising all through the week, regardless of costs buying and selling in ranges.

Outlook

We imagine ETH’s subsequent main help zone is on the $2,500 degree, which has confirmed to be a powerful liquidity degree up to now.

ETH traded for $2,384 on the time of publication.

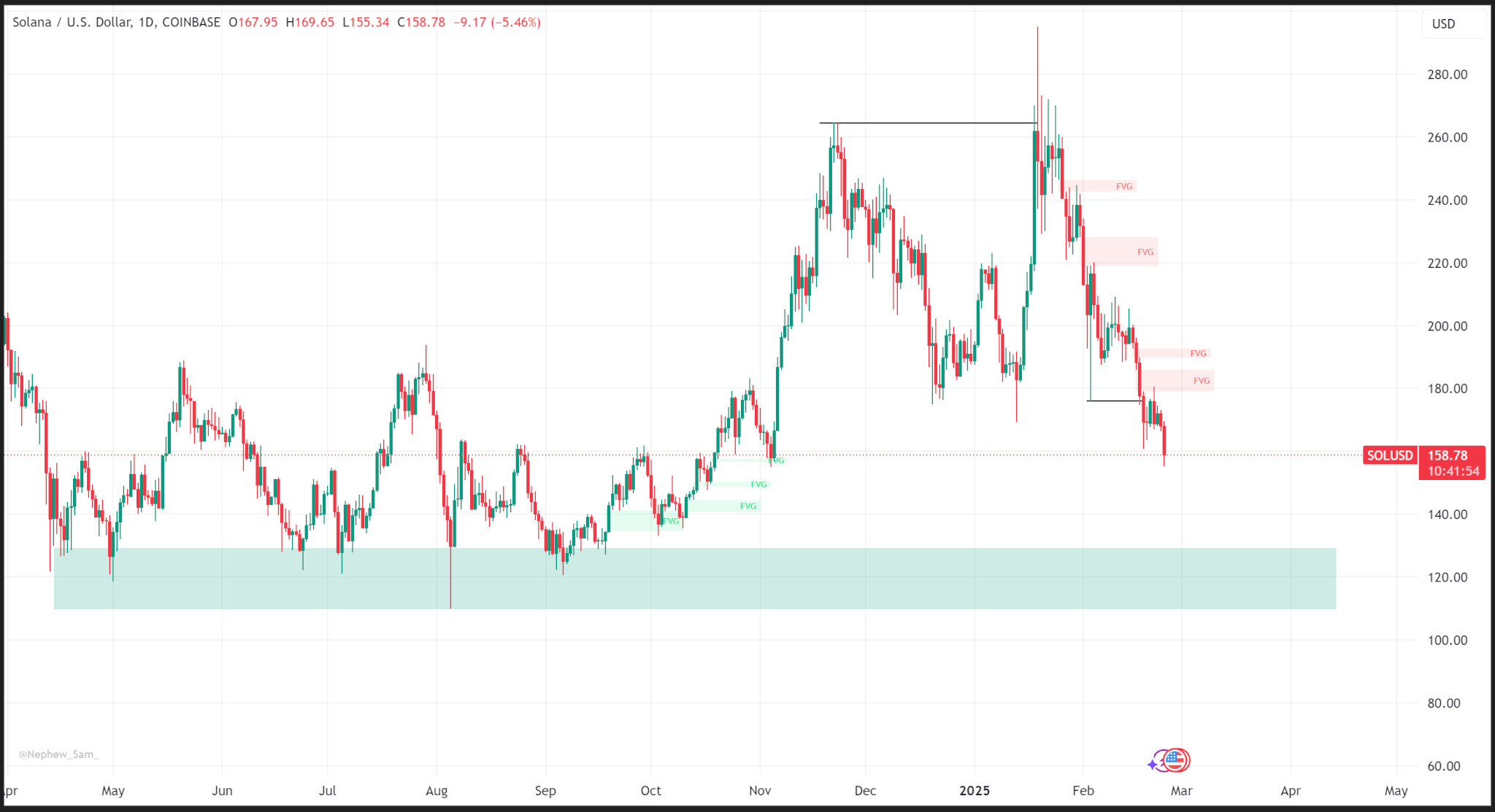

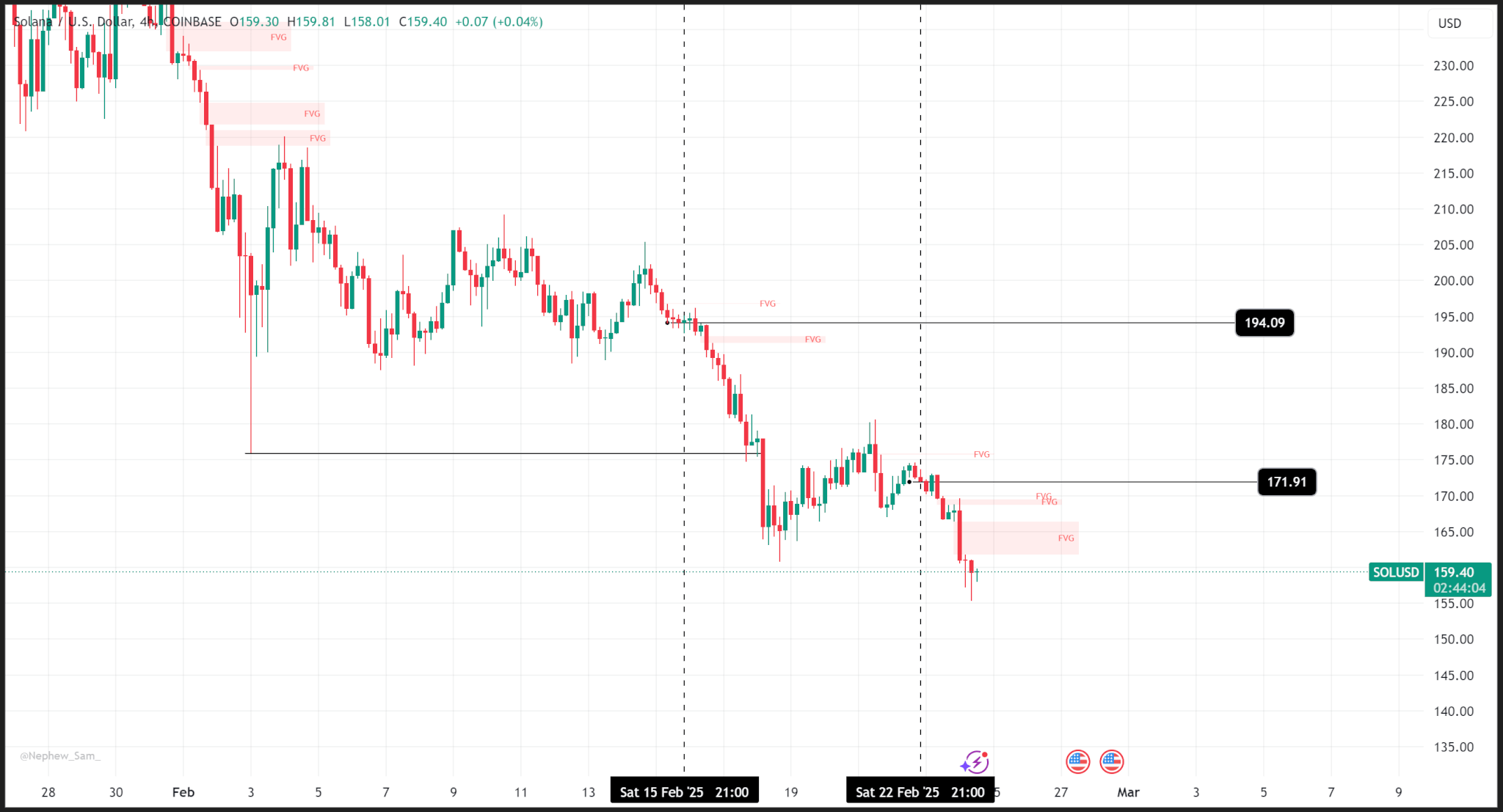

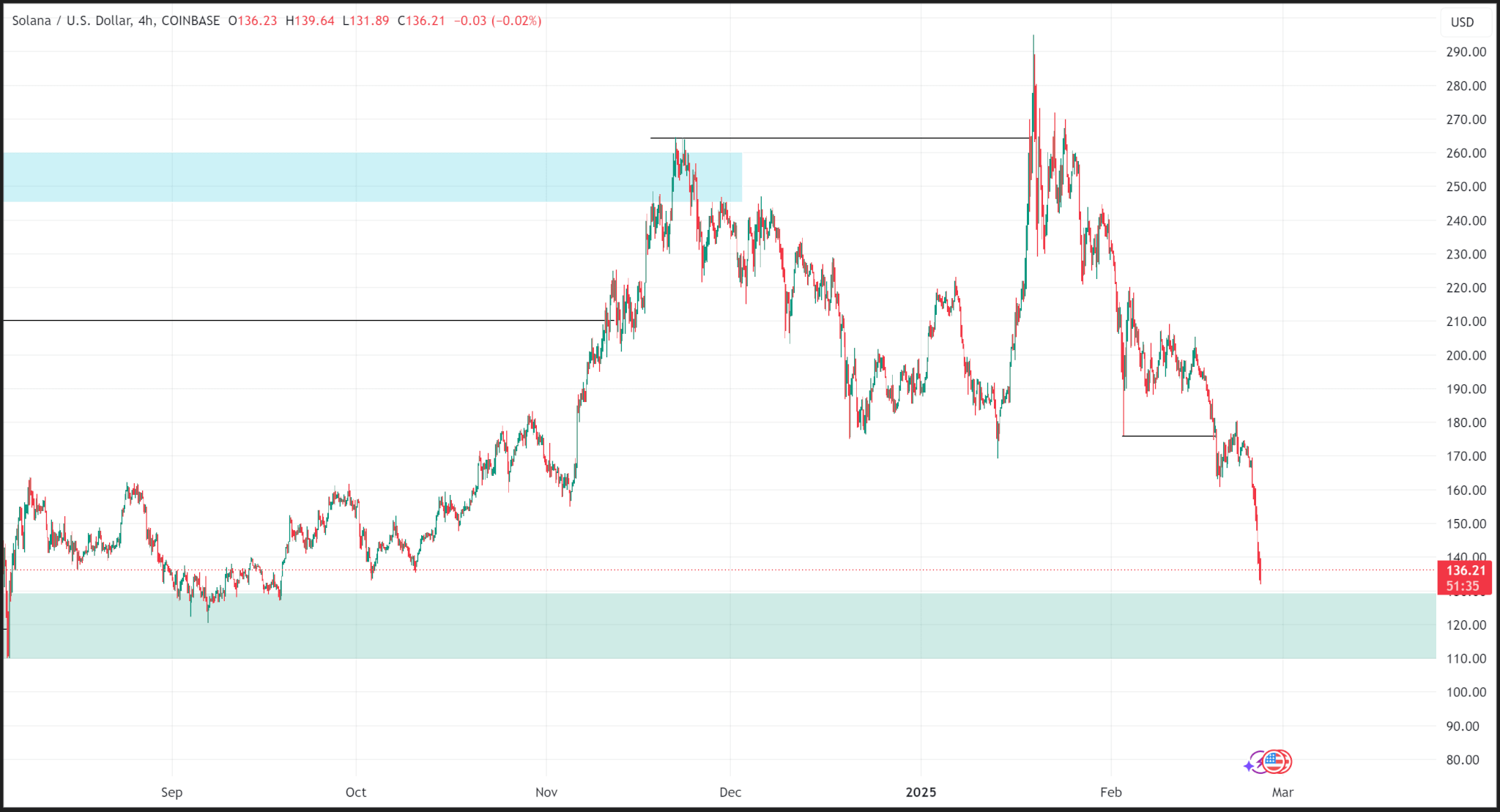

Solana

Like Ethereum, Solana costs have fallen as they swing larger and fail to type new candles above the ultimate highs of historical past within the day by day time-frame.

In contrast to Ethereum, costs final week fell from round $194 to almost $171 since their weekly opening.

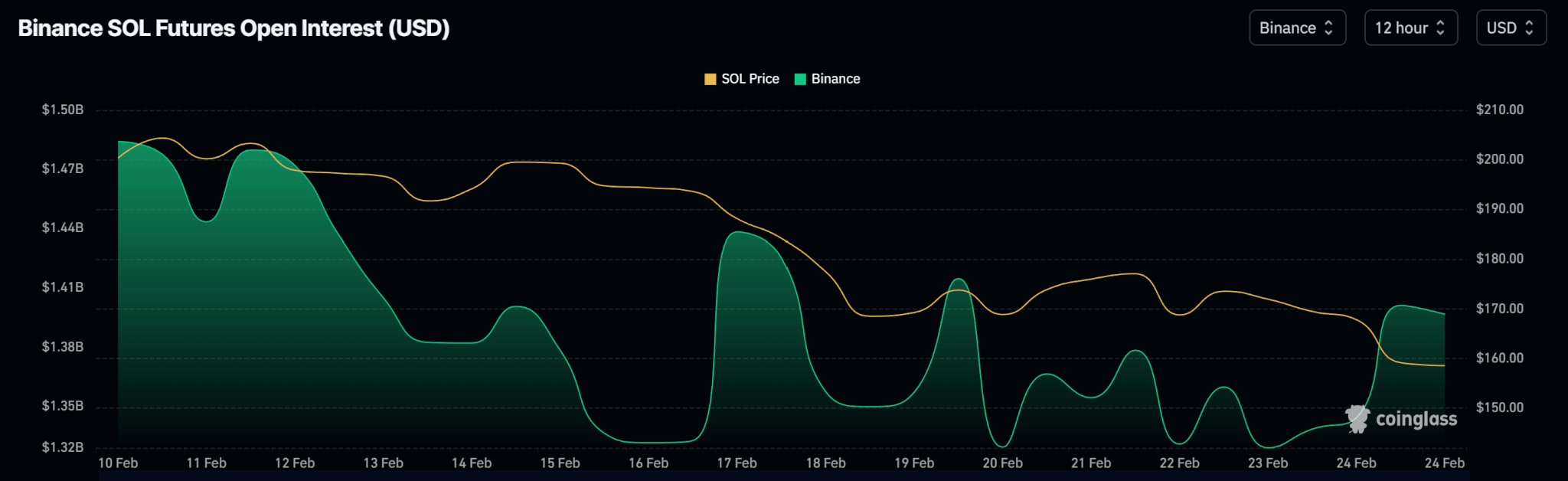

The Open In Take a look at Chart exhibits Topsiterby’s motion in open contract volumes as costs drop.

Outlook

Solana’s subsequent main help zone is on the $129 degree. Nonetheless, because of the general low worth development, you may even see small gatherings.

(TagStoTRASSLATE) Evaluation (T) Market (T) BTC (T) Market (T) Technical Evaluation