- SolQuila hasn’t settled 1,366,028 sols value round $189 million.

- The whale despatched Tokens to Falconx and deposited 440,202 Sol on Binance and Coinbase.

- Sol’s switch quantity now hits simply $1,457 million, from $1.99 billion in November 2024.

Solana (Sol) is slipping, with costs and exercise dropping considerably. Final month, Sol fell virtually 40%, with costs at present at round $140.54. This can be a sharp drop from its 2024 highest $264.

The value crash has been half of a bigger market droop, however buyers are questioning if Sol can bounce again.

Whale exercise causes concern of bought out

Blockchain analytics platform LookonChain reported that Whale Defrost Despatched to Falconx for 1,366,028 Sol (value roughly $188 million).

Falconx then exchanged 440,202 SOLs ($62.6 million) to Binance and Coinbase. This seems to be a risk of bought out and provides to unfavorable sentiment out there.

Switch quantity plummets and scale back reliability

One other main concern is the numerous drop in Solana’s complete switch quantity. Analyst Ali Martinez factors out that Sol’s switch quantity plunged from $19.9 billion in November 2024 to simply $14.57 million by February twenty third.

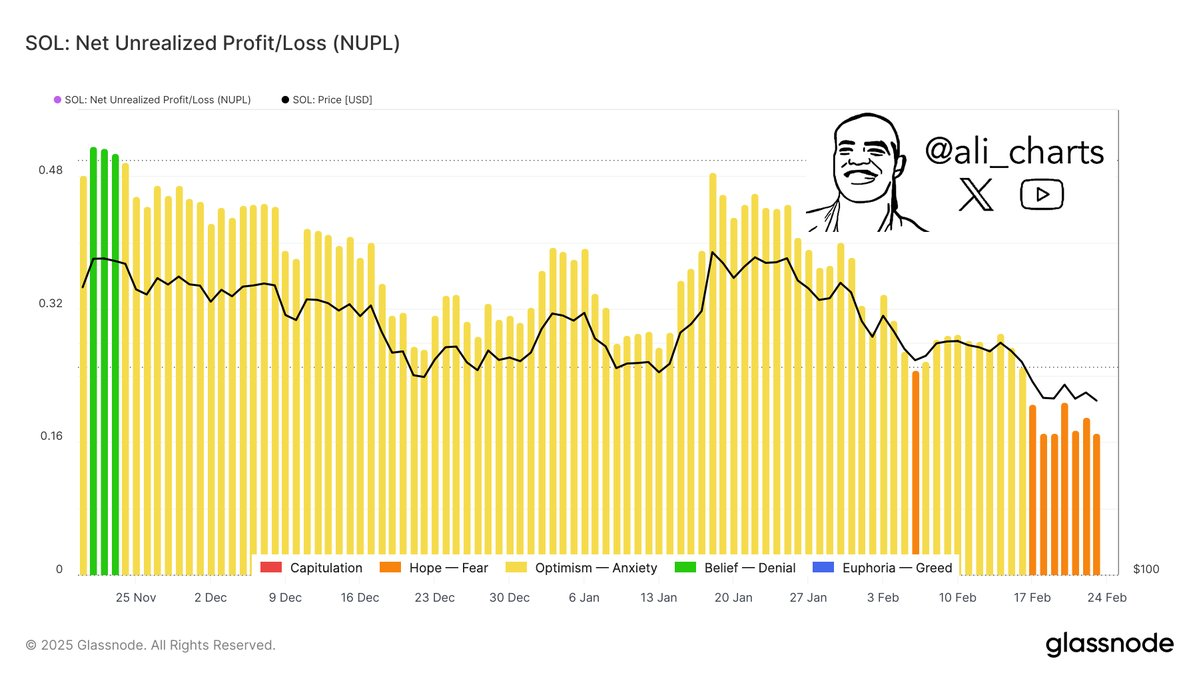

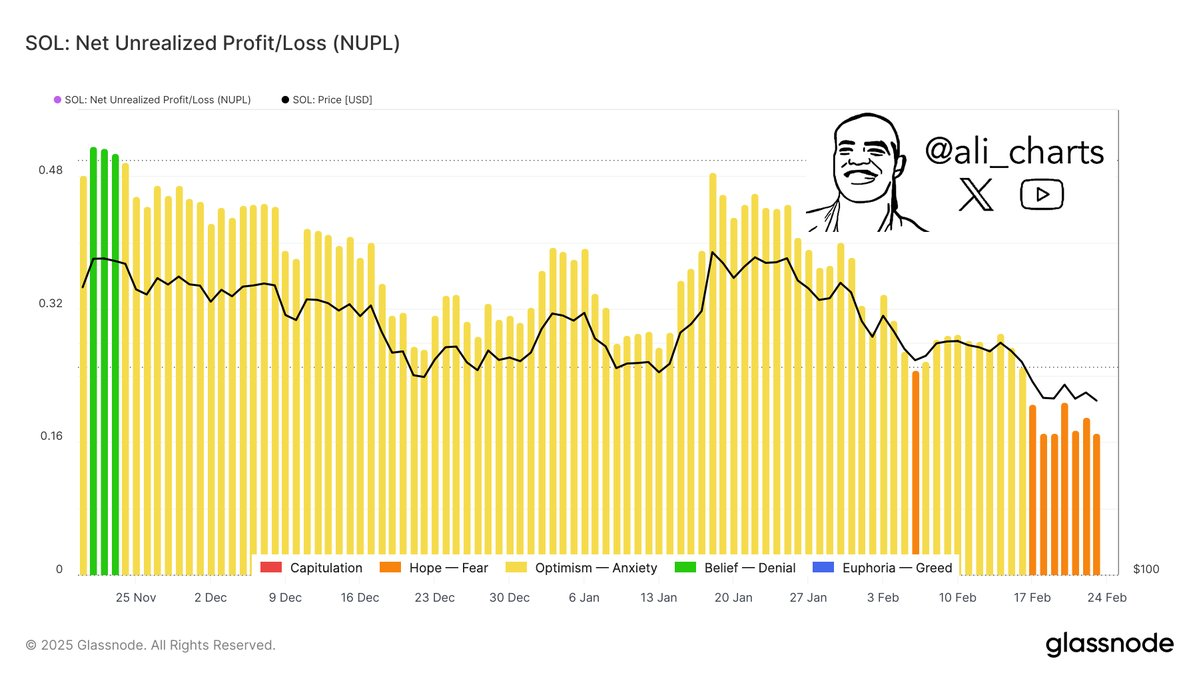

In one other X (previously Twitter), Martinez mentioned,Sol buyers look like in a state of concern,“Strengthen present bearish emotions surrounding property.

Associated: Solan Whale bets on worth drop: put optionally available spikes earlier than unlocking tokens

SOL Value Evaluation: Necessary Ranges to Watch

SOL’s 20-day index shifting common (EMA) is $175.78, effectively above its present worth. This distinction reveals a robust downward momentum.

Sol ought to exceed this degree for precise restoration. TradingView’s every day chart additionally confirms Sol’s bearishness.

RSI is on sale, however the rebound is unsure

As you may see on the chart, the relative power index (RSI) is at present 26.07. Which means that Sol is oversold. RSIs beneath 30 normally recommend that property are extremely undervalued and should present short-term beneficial properties. Nevertheless, a robust downtrend can restrict restoration.

Associated: The crypto market surges into “excessive concern” – time to purchase?

Moreover, Sol is buying and selling close to the decrease Bollinger Band for $140.32. This means that SOL is experiencing excessive volatility and is testing key help zones for $140. If this degree breaks, the worth may drop even additional.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version shouldn’t be answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.