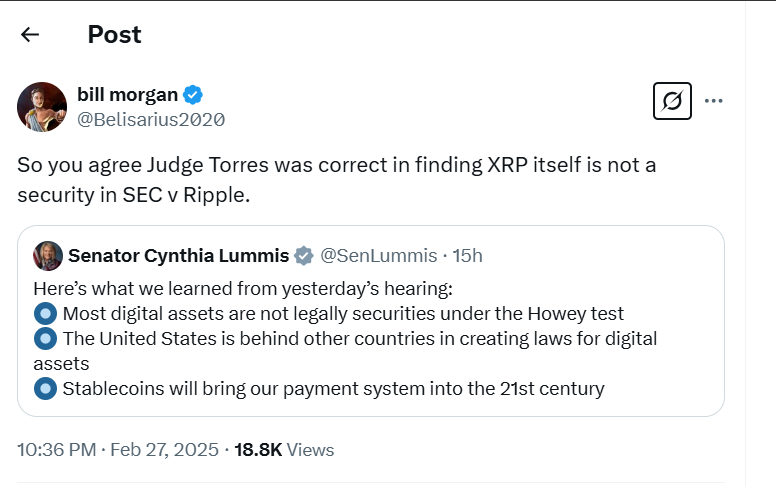

- Senator Cynthia Ramis stated most digital belongings aren’t securities underneath US legislation.

- Invoice Morgan hyperlinks this to Decide Torres’ ruling that XRP itself just isn’t safety.

- Lummis’ feedback spotlight the dialogue of SEC enforcement measures and the necessity for clearer crypto rules.

Sen. Cynthia Ramis, a recognized advocate for cryptocurrency legislation, lately stated on X that the majority digital belongings aren’t securities underneath Howie Check. In response, Lawyer Invoice Morgan found that XRP itself just isn’t safety. We requested in the event that they agreed to Decide Analisa Torres’ ruling at Ripple.

Particularly, Lummis commented following a Congressional listening to on digital belongings, the place lawmakers mentioned gradual US advances in establishing regulatory ecosystems and clear tips. She additionally highlighted the position of stubcoins in modernizing funds.

Lummis Assertion and Secv. Ripple case

Nevertheless, her declare that the majority cryptocurrencies aren’t securities raised questions concerning the SEC’s enforcement strategy, particularly in that case to Ripple.

Associated: Ripple CEO praises the SEC for dropping the Coinbase lawsuit: Is it time for XRP to shine?

Decide Torres dominated in July 2023 that XRP itself was not safety, however sure institutional gross sales violated the securities legislation. The SEC has since appealed points of the choice and promoted a broader interpretation of securities rules.

Morgan’s response means that Ramis’ assertion strengthens the justification of the ruling and challenges the SEC’s claims.

Regulatory uncertainty and the promotion of clear cryptography

The US is behind different nations in cryptographic regulation, and jurisdictions just like the European Union have carried out clear frameworks by means of initiatives resembling MICA.

Lawmakers, together with Lumis, are pushing for laws to outline the authorized scenario of digital belongings. Below Mark T. Weda, the SEC is heading in direction of a extra encryption-friendly regulatory atmosphere, together with the formation of the SEC activity pressure.

Shifting from Gensler Period: A brand new strategy to SEC

That is in distinction to the previous chairman Gary Gensler’s administration, who stated many cryptocurrencies qualify as securities and result in enforcement actions in opposition to a number of corporations.

Associated: SEC clears the trail of Consensy after dropping authorized battles with Coinbase, Gemini and others

The dialogue of XRP classification is a component of a bigger dialogue concerning the position of the SEC in regulating digital belongings.

In the meantime, Ripple can transfer right into a extra favorable place because the Cryptody Activity Drive, led by SEC Commissioner Hester Peirce, pushes for clearer rules quite than aggressive litigation.

For context, the SEC has closed civil enforcement measures in opposition to a number of crypto corporations, together with Coinbase, Robinhood, and Tron. This hopes {that a} related initiative will observe Ripple’s lawsuit.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version just isn’t accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.