- Aave Labs is proposing to combine BlackRock’s BUIDL with its GHO stability module.

- The replace is meant to enhance capital effectivity and improve real-world asset yields.

- The BUIDL integration permits for 1:1 USDC swaps, month-to-month dividends, and seamless buying and selling.

Aave Labs has launched a brand new temperature test proposal to replace the GHO Stability Module (GSM) as a part of a transfer to strengthen the stablecoin system. The replace is aimed toward integrating BUIDL, a tokenized fund managed by BlackRock, into the GSM infrastructure.

The proposal goals to optimise capital effectivity and broaden Aave's income streams by leveraging conventional monetary property via blockchain expertise.

Optimizing GHO stability with BUIDL integration

The principle goal of Aave Labs’ proposal is to enhance the capital effectivity of the GHO Stability Module (GSM) by integrating BlackRock’s BUIDL.

At the moment, GSM ensures the steadiness of Aave's native stablecoin, GHO, by sustaining 1:1 convertibility with different property, often USD Coin (USDC), though the present system typically ends in surplus USDC remaining unused.

The proposed integration includes constructing a brand new occasion of GSM that helps exterior integration and management mechanisms, particularly designed to include BlackRock's BUIDL, a tokenized fund deployed on the Ethereum community that represents conventional monetary property comparable to money and U.S. Treasury securities.

By using surplus USDC to subject the BUIDL token, the up to date GSM goals to extend effectivity whereas sustaining the excessive requirements of backing that USDC offers.

BUIDL provides a number of advantages, together with on-chain entry to conventional monetary property managed by BlackRock Monetary Administration, with BNY Mellon as custodian and PricewaterhouseCoopers as fund auditor.

BUIDL will probably be bought at $1 per token and pays holders a each day dividend within the type of new tokens each month. This construction permits holders to earn yield whereas sustaining flexibility in storage choices and the flexibility to switch tokens 24/7 all year long.

Future Outlook and Technical Specs of Integration

Integrating BUIDL into GSM opens new avenues for the Aave DAO, doubtlessly increasing yield sources to real-world property (RWA) and enhancing partnership alternatives with BlackRock.

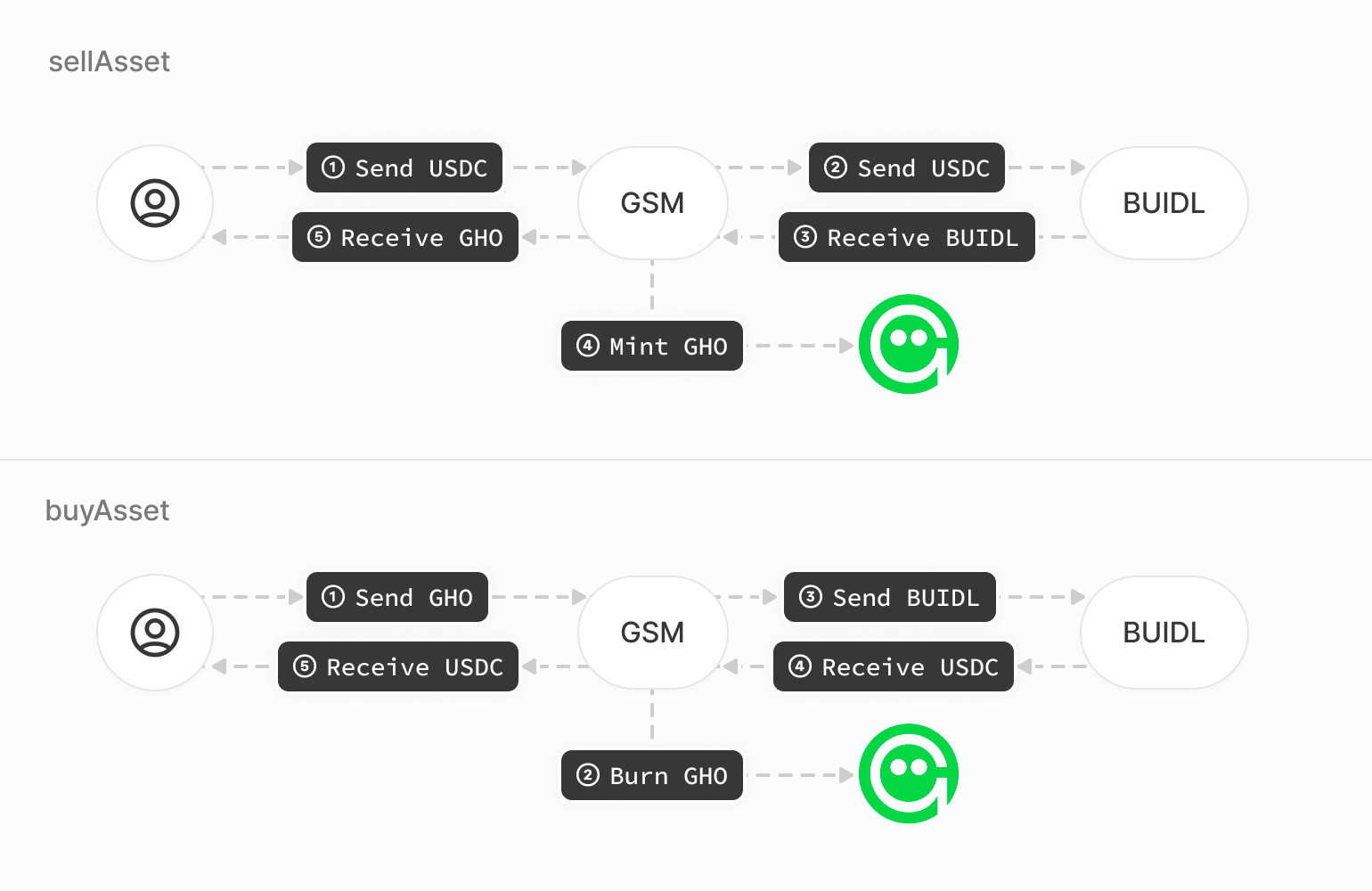

The proposal envisions permitting 1:1 fastened ratio swaps between USDC and GHO, with any extra USDC used to mint BUIDL tokens. This setup is designed to offer a seamless expertise just like the present GHO:USDC GSM, the place swap charges are gathered in GHO and dividends are paid out in BUIDL.

The technical specs for this integration embody adjustments to the GSM contract code to help GHO <> USDC conversion and dividend receipt. Moreover, BUIDL holders will have to be registered or allowlisted, which would require additional changes to GSM itself.

Detailed specs will probably be supplied in the course of the ARFC part and the proposal is presently in the neighborhood suggestions stage.

If settlement is reached, it can transfer to the snapshot stage, and if accepted, it can transfer to the ARFC stage for closing implementation.

The proposal might be a serious step in integrating conventional monetary mechanisms with blockchain expertise, enhancing capital effectivity and increasing Aave's strategic partnerships.