The launch of the Spot Bitcoin ETF within the U.S. has introduced consideration to Bitcoin, however focusing solely on its worth actions oversimplifies the market and supplies a shallow illustration. . It is very important analyze Bitcoin in opposition to different belongings (each cryptocurrencies and conventional belongings).

The connection between Bitcoin and Ethereum has all the time made sense. Interactions between the 2 largest cryptocurrencies usually point out delicate market developments that aren’t clearly seen in worth actions.

The ETH/BTC ratio represents the connection between the 2 by displaying the worth of 1 Ethereum in Bitcoin phrases. A rise on this ratio suggests rising dominance of Ethereum or relative weak point of Bitcoin, whereas a lower signifies a decline in Ethereum's efficiency relative to Bitcoin.

earlier crypto slate Our evaluation reveals that regardless of vital short-term spikes and declines on this ratio, total volatility, as measured by the usual deviation of previous closing costs, has all the time been comparatively average. Which means over the long run, BTC and ETH will usually mirror one another's actions and expertise parallel market developments. Nonetheless, that doesn’t imply that short-term fluctuations in ratios must be ignored.

When each expertise related bullish or bearish developments, their ratios stay in equilibrium, additional emphasizing the significance of short-term discrepancies of their actions.

Since October 2022, ETH/BTC has been on a downward development, probably as a result of a market correction following the excessive expectations set by the merger. It additionally reveals that Ethereum's worth fluctuations weren’t as pronounced as Bitcoin's, resulting in a decline in relative worth by way of proportions.

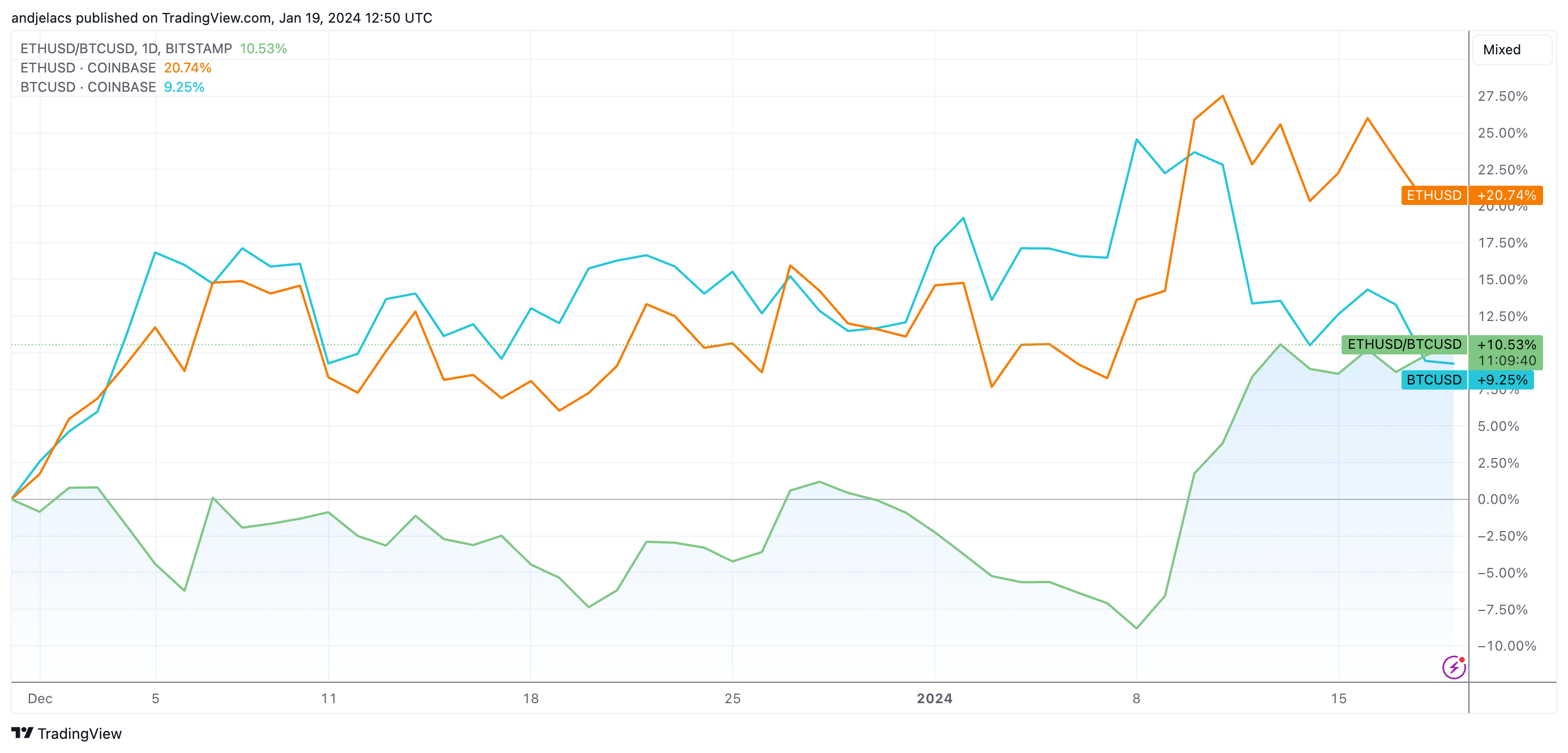

Since then crypto slate A fast and vital development reversal is going on as reported for this ratio. From November 30, 2023 to January 19, 2024, the ETH/BTC ratio elevated by 10.53%. Throughout this era, the value of ETH in USD elevated by 20.74% and BTC by 9.25%. Ethereum buying and selling quantity elevated by 4.59%, whereas Bitcoin elevated by 27.23%.

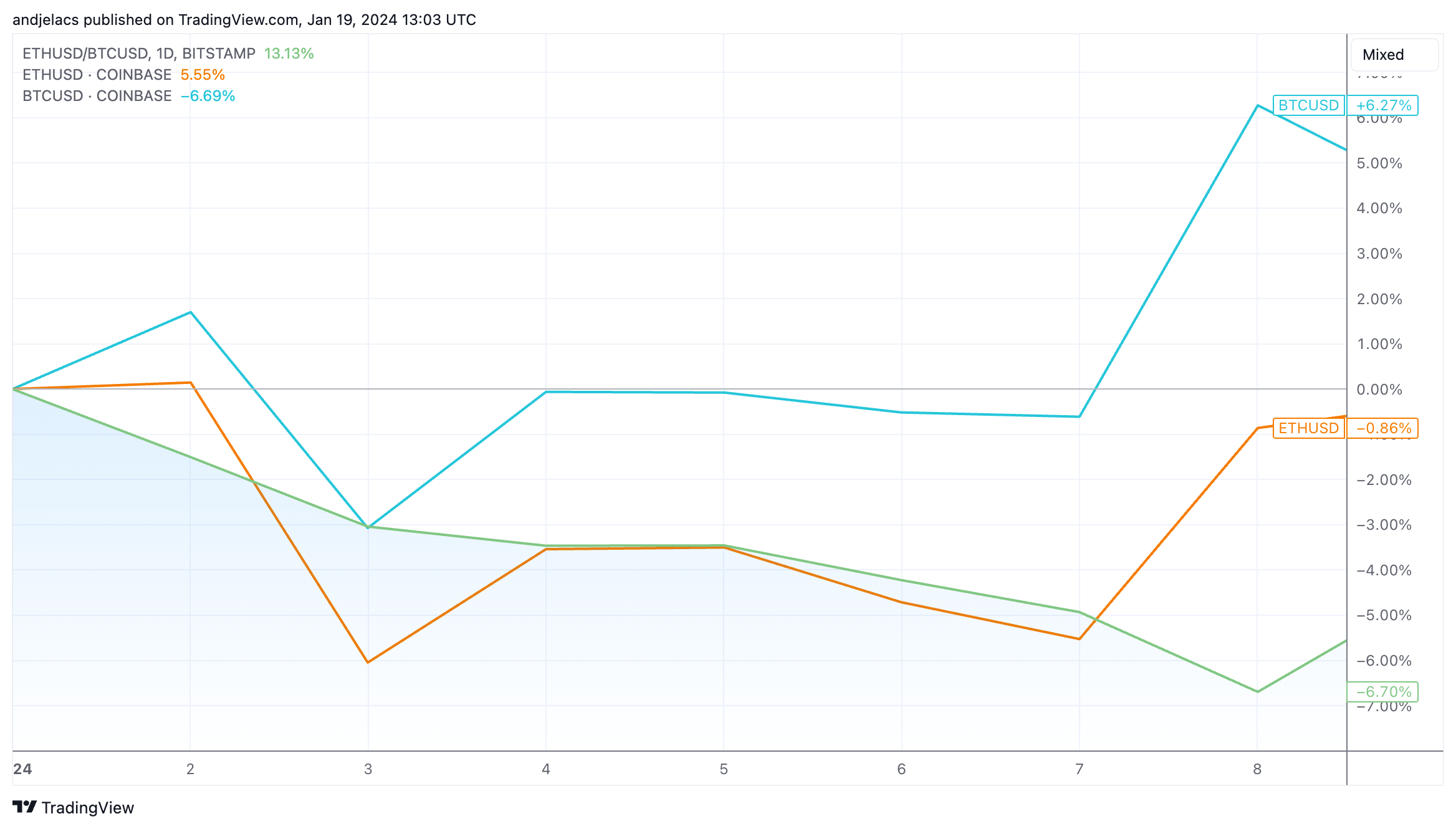

The constructive worth momentum and quantity progress continued into 2024. The brand new 12 months started with markets anxiously awaiting the approval of U.S. spot ETFs, however that anticipation created rigidity and pushed costs greater. The ETH/BTC ratio decreased considerably from January 1st to January eighth, with the ratio reducing by 6.70% as a result of Bitcoin's worth enhance.

Nonetheless, because the ETF's approval loomed on January eighth, the market started to right the tensions that had been driving Bitcoin costs greater. The worth of Ethereum rebounded and Bitcoin skilled a notable decline.

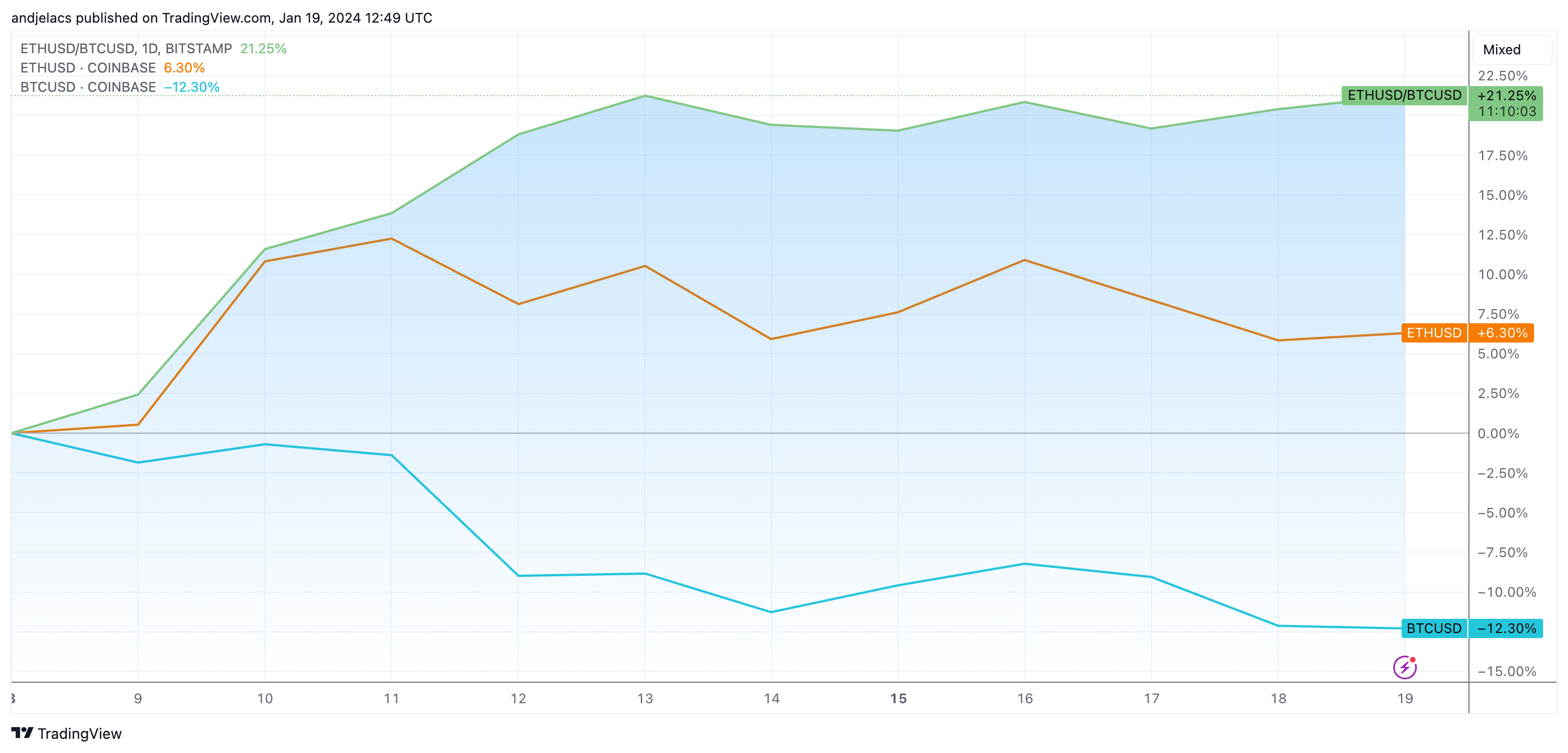

Between January eighth and January nineteenth, Bitcoin worth fell by 12.30% because the launch of the ETF didn’t carry the upside that the market was anticipating. It seems that at the least a number of the capital leaving Bitcoin has been transferred to Ethereum, as the value of ETH has elevated by 6.30%. This worth enhance differential brought about the ETH/BTC ratio to rise sharply, rising by 21.25%.

This divergence in worth trajectories might point out a rise in Ethereum's buying and selling quantity, as jumps in shopping for and promoting exercise on exchanges usually happen with worth will increase. Nonetheless, Ethereum buying and selling quantity decreased by 4.15% throughout the interval. In the meantime, Bitcoin buying and selling quantity elevated by about 34%.

This implies that Bitcoin's worth decline is just not solely as a result of a decline in market curiosity. Institutional motion, maybe spurred by ETF approval and the following spike in ETF inflows and buying and selling quantity, most definitely brought about the rise in buying and selling quantity. On the similar time, retail promoting pushed down costs.

The absence of structured Ethereum-based buying and selling merchandise means that the latest surge in ETH may very well be attributed to retail exercise. Conversely, Bitcoin market response seems to be pushed by institutional motion, illustrating the influence of spot ETFs on each crypto and conventional monetary markets.

Publish-Ethereum outperforms Bitcoin post-ETF launch as ETH/BTC ratio spikes for the primary time on currencyjournals.