- AI Software DeepSeek Prediction XRP April worth in situations starting from $1.50 to $3.50

- Bullish AI Case ($3.50) is determined by ETF approval, market situations

- Regulation readability & hopes that “inevitable” ETFs will help long-term bullish views

XRP has turn out to be the main focus of debate inside Crypto, significantly when the SEC dropped the enchantment of the lawsuit in opposition to Ripple. Nevertheless, the regulator’s victory has not but been translated right into a worth surge for a lot of buyers anticipated from XRP.

The token is at the moment buying and selling at round $2.26 and has skilled a slight drop prior to now day, with market watchers assessing quite a lot of forward-looking analyses, together with evaluation of rising AI platforms.

AI platform Deepseek supplies an summary of XRP situations in April and past

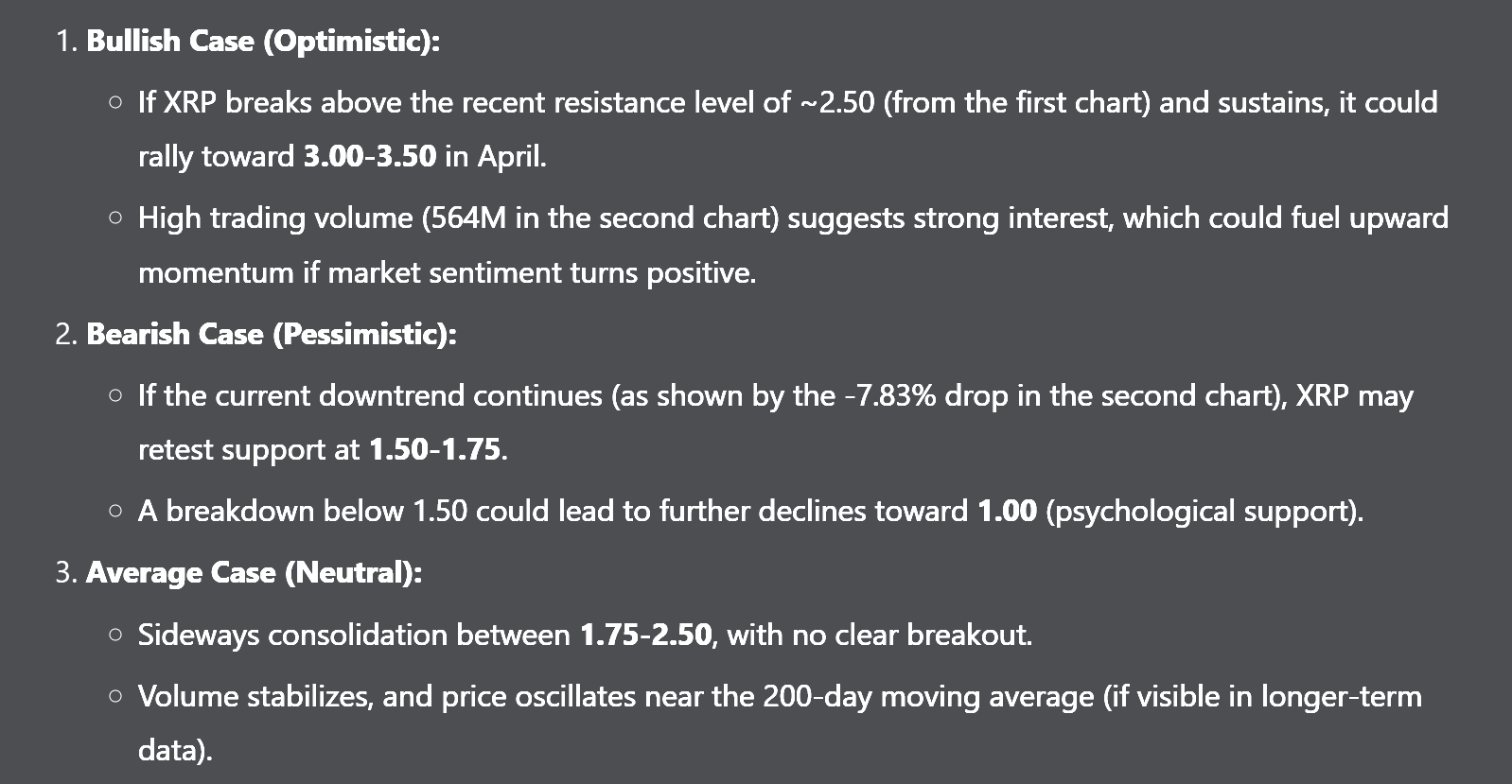

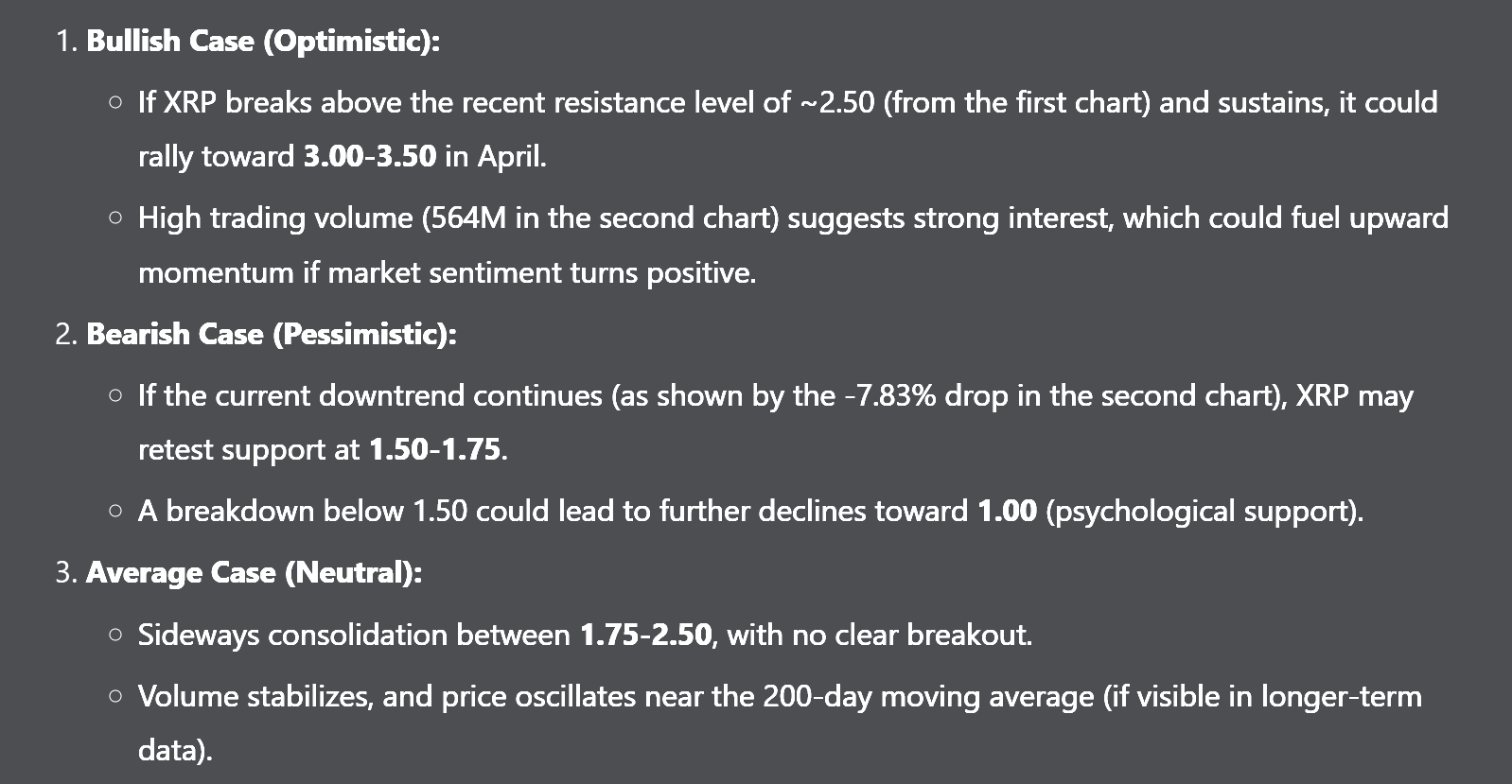

The AI-powered chatbot Deepseek provided three completely different potential pricing situations for its specifically focused XRP in April 2025.

- In case of bullishness: If optimistic market situations emerge together with optimistic catalysts (resembling Spot XRP ETF approval or elevated facility use), deepseek Challenge XRP might surge $3.00- $3.50 vary.

- Medium/Sideway Case: If the market is sideways with out new bullish improvement, AI means that XRP can combine between $1.75- $2.50.

- When you’re bearish: If a bearish flip holds the market, particularly if you’d like the ETF to fade, Deepseek’s mannequin exhibits that XRP can drop and check $1.50- $1.75 Help zone.

See extra (6-12 months), bullish instances of AI platforms vary from $3.50 to $4, however its potential bearish situation targets $0.50-$0.75 if the vital $1 help stage just isn’t retained.

Associated: Why there is a scarcity of wrapped CBDC: Schwartz claims XRP Bridge Utility

Prediction Grounding: What does XRP seem like on the chart?

To floor these forward-looking situations, you could look into the present know-how setup for XRP. Every day charts reveal the costs to check the decrease Bollinger band lately. This can be a situation that means that the asset could also be bought within the quick time period.

If XRP finds buy help and reverses upwards from this place, the primary short-term resistance stage shall be displayed at about $2.59. This corresponds to the 0 Fibonacci stage of current worth motion.

Nevertheless, if downward strain persists, vital technical help approaches $1.72 (0.786 FIB retracement), then $1.49 (one FIB stage). A deeper market correction permits us to think about probably $0.81 ranges (1.618 FIB extension).

XRP ETF accredited: Recreation Changer?

Past short-term forecasts launched by AI, or by human specialists, precise chart analyses are each exhibiting the basic components supporting a optimistic long-term outlook for XRP.

On this regard, as one of many folks, the Darkish Defender, a market analyst, emphasizes that XRP is among the few cryptocurrencies with a transparent regulatory place, following the ruling that XRP just isn’t safety.

He argues that this readability might open up methods to incorporate XRP in US government-supported digital asset preparations and improve the probability of making certain ETF approval.

ETF skilled Nate Geraci expressed his hope that the Spot XRP ETF is “inevitable.” The identical applies to Polymarket information. This 12 months, there could possibly be 82% approvals.

Associated: Ripple targets African fee friction with its chipper money partnership

Finally, Deepseek’s evaluation attracts optimistic predictions for XRP in the direction of April, with the chart pulling out a crude image of indecisiveness from real-world merchants.

Costs are testing help close to the decrease bollinger band and are dealing with resistance quickly. How XRP resolves from this technical level can decide whether or not a extra bullish AI situation is believable or whether or not a draw back help stage of practically $1.72 shall be a direct focus.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version just isn’t accountable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.