- FTX is ready to repay main collectors from Could thirtieth, doubtlessly injecting billions into the crypto market.

- The SEC is unlikely to approve a pending crypto ETF by August, and buyers’ hopes are as soon as once more delayed.

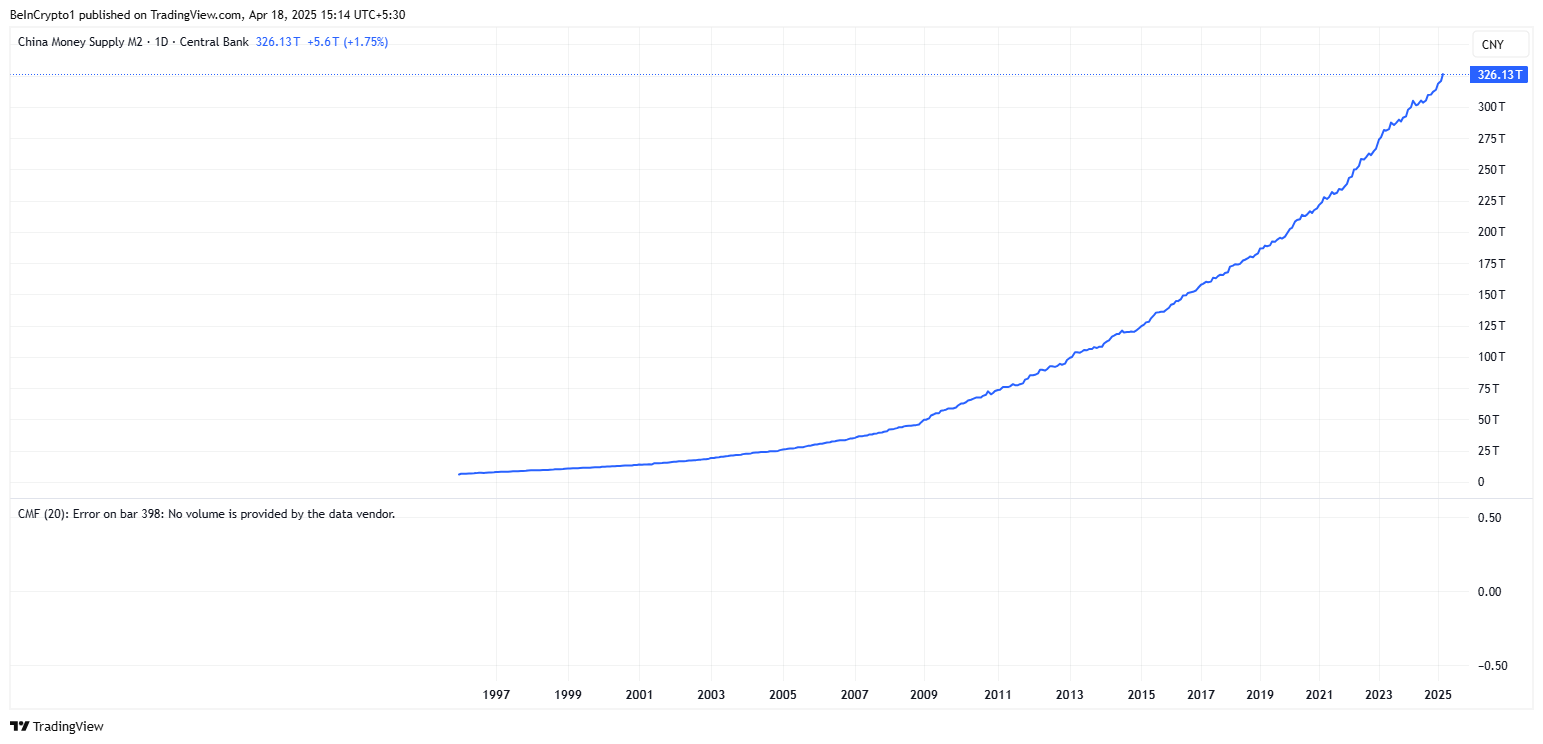

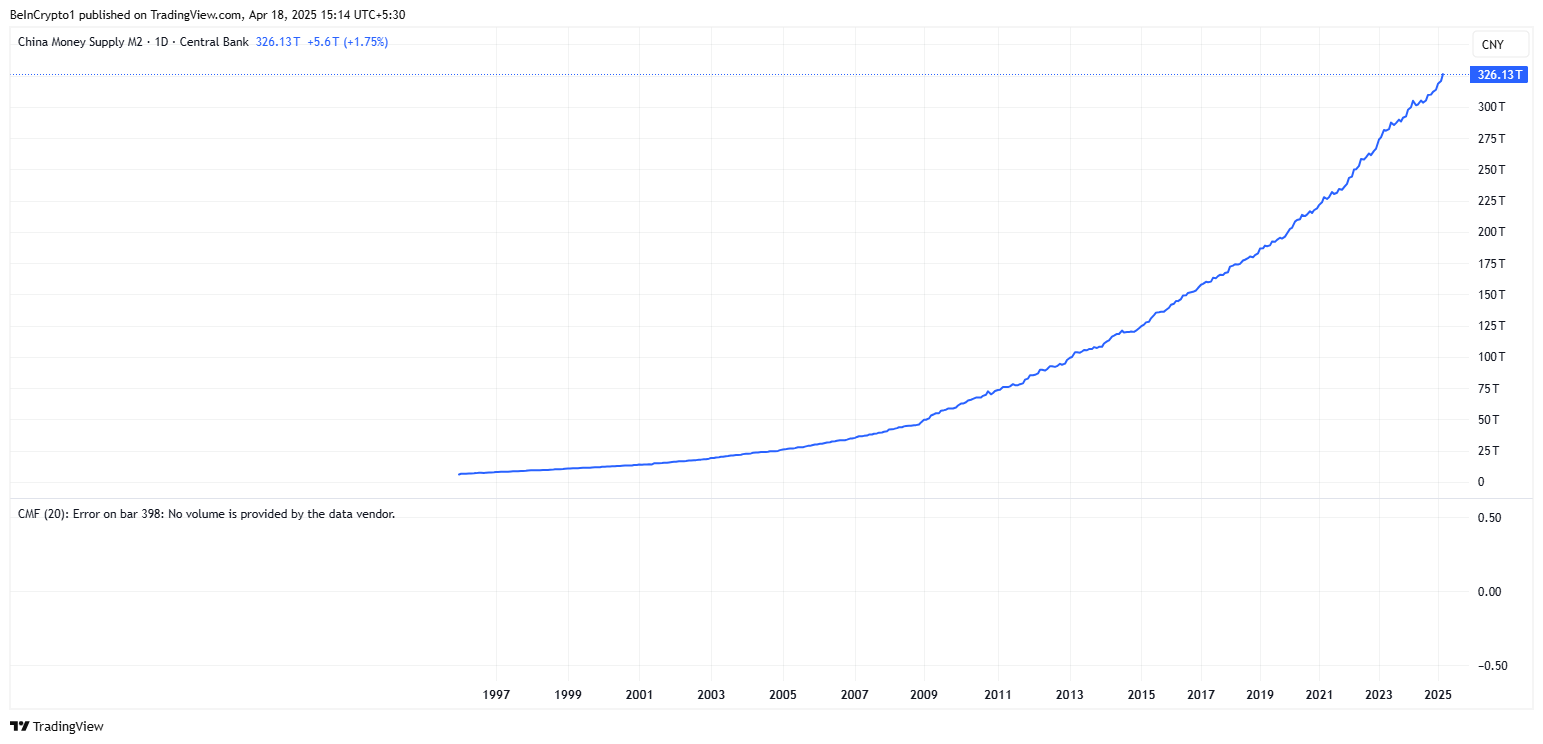

- China’s record-breaking M2 cash provide surge might ignite a brand new wave of demand for dangerous property like Bitcoin.

Crypto World is staring Could thirtieth, when two main occasions scheduled for the day might have a serious affect on the digital asset market. This can deliver the long-awaited FTX creditor repayments and the deadline for choices from US regulators of Crypto ETF.

FTX compensation: Inject liquidity or attenuate feelings?

Nearly 27 months after the catastrophic collapse in November 2022, FTX is getting ready to repay its collectors ultimately, with over $50,000 anticipated to begin on Could thirtieth.

The trade, led by CEO John Ray III, is presently withdrawing from a $11.4 billion money reserve and is starting to pay the funds, in accordance with chapter lawyer Andrew Mortdelich.

Billions of injections of the fingers of buyers from crypto can draw momentum, particularly when these funds are reinvested into digital property when sentiment is fastidiously bullish.

SEC ETF resolution: delays are nonetheless anticipated

FTX Information provides causes for optimism, however the SEC continues to halt progress in crypto ETFs. The checklist of functions Bloomberg tracks reveals over 70 ETF filings throughout quite a lot of property, together with XRP, Solana, Litecoin and Ethereum. Nearly all of those functions are inside the scope of evaluate.

The primary key deadline spherical on Could thirtieth will start FTX funds on the identical day. Nonetheless, analysts are broadly hoping that the SEC will once more delay approval, and hopefully push ahead with key choices in August, the place maybe extra regulatory readability is pending.

Associated: Solana as XRP highlight, 72 Crypto ETF seeks SEC approval this yr

Optimism is bubbly bubbly now that Paul Atkins has been sworn as chairman of the thirty fourth second. The return of Atkins, a identified advocate of capital market effectivity, might break by means of the restrictive perspective of Gary Gensler’s management, getting into an period extra encrypted within the SEC. Nonetheless, that shift might not present any enamel till the tip of summer time.

Macrofactor: China’s report cash provide

In parallel macro tales, China’s M2 cash provide surges to an all-time excessive of $44.7 trillion, indicating a steady surge in international liquidity. Traditionally, such extensions have correlated with gatherings of risk-on property akin to crypto.

Associated: Bitcoin’s benefit reaches a brand new cycle peak as altcoins can not sustain

“Cash printers are again. Danger property are more likely to develop into parabolic,” analyst Kong Buying and selling stated. The implications are clear. If liquidity is rising and compensation capital is re-entering the market, an ideal storm might brew.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version shouldn’t be responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.