- Liu believes that now could be the right time to be bullish on altcoins so long as BTC’s dominance stays under 62%.

- The Fed’s upcoming quantitative easing (QE) is bullish for the crypto market because the geopolitical outlook improves.

- Mass liquidations by lengthy merchants in latest days have weighed on the medium-term bullish development.

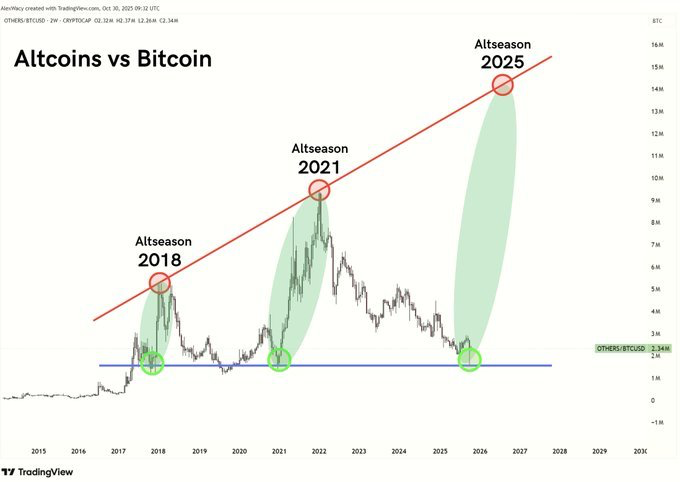

The 2025 crypto bull market nonetheless favors alt season within the quick time period, regardless of indicators exhibiting in any other case. In keeping with standard quantitative crypto analyst Dennis Liu, so long as Bitcoin’s dominance stays under the 62% to 65% vary, the 2025 alt season will not be over but.

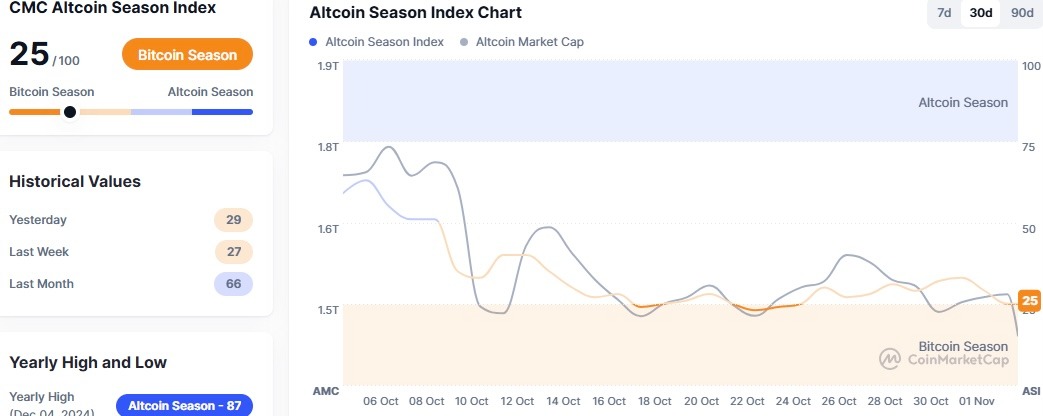

In keeping with CoinMarketCap knowledge evaluation, the altcoin season index has dropped to 25/100, suggesting that that is Bitcoin season.

sauce: coin market cap

Why is Ryu supporting the alt season now?

Bitcoin’s dominance reaches its peak

From a technical perspective, Lee believes that BTC dominance is forming decrease highs within the weekly timeframe, which is able to present momentum for the subsequent stage of the 2025 alt season. Though some merchants have turn into bearish on altcoins within the medium time period, Liu maintains that the percentages for alt season within the coming weeks stay excessive.

Moreover, Bitcoin’s dominance has remained under the weekly 50 easy transferring common (SMA) since mid-July.

International liquidity rises as Fed turns to quantitative easing (QE)

The altcoin market is well-positioned to regain a bullish outlook within the near-term, pushed by the Fed’s financial coverage adjustments. After slicing rates of interest for the second time final week, Fed Chairman Jerome Powell confirmed that quantitative easing (QE) will start in early December.

The tip of quantitative tightening (QT) by the Federal Reserve is predicted to extend world liquidity, which has been on the rise. Subsequently, as soon as world liquidity begins to rise once more, Bitcoin’s dominance will attain its peak, Liu emphasised.

The cryptocurrency analyst famous that he’ll proceed to assist the altseason so long as Bitcoin’s dominance doesn’t exceed 65%.

Associated: Altcoin Market (TOTAL3) Breaks 4-12 months $1.13 Trillion Resistance: Analyst Declares “Altcoin 3.0” Setup

Elevated capital rotation from Bitcoin to altcoins through Spot Alt ETFs

The cryptocurrency analyst is at the moment bullish on altcoins because of bettering fundamentals in key areas, particularly the US. Because the US authorities shutdown continues, a number of spot altcoin change traded funds (ETFs) have already been listed and traded on the Nasdaq and the New York Inventory Trade.

Altcoins already traded in spot ETFs embrace Solana (SOL), Litecoin (LTC), and Hedera (HBAR, XRP). With extra spot altcoin ETFs anticipated to go reside within the close to time period, institutional buyers may have a regulated rail to channel their Bitcoin income into altcoins.

Technical Tailwinds for Selective Altcoin Pairs Towards Bitcoin

In keeping with Liu, not all altcoins will document positive factors within the 2025 altseason. Regardless of most altcoins hovering at oversold ranges on the weekly and every day Relative Energy Index (RSI), Liu urged crypto merchants to deal with tasks with stable fundamentals.

Specifically, the weekly ALT/BTC pair exhibits the potential for a market reversal after years of being in a downtrend.

Associated: Altseason indicators kind as ETH/BTC reaches 5-year assist – Analyst

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be liable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.