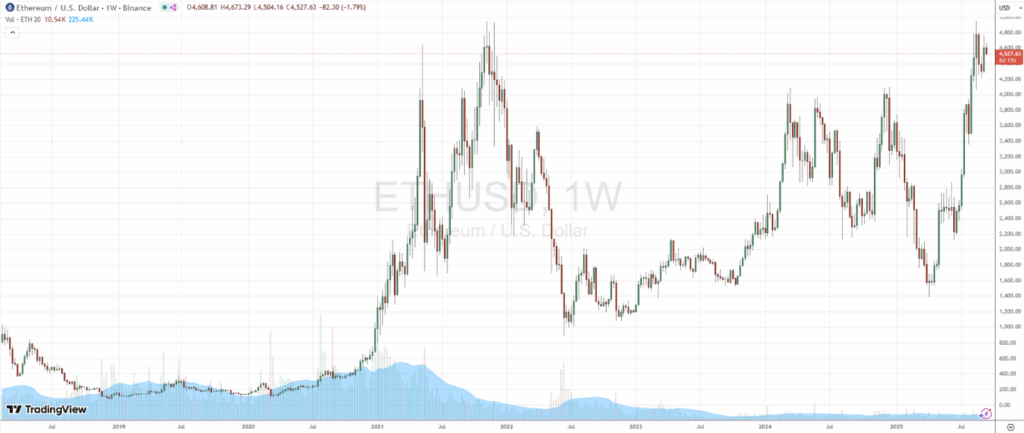

Ethereum units the tempo once more. After a number of weeks of consolidation, ETH It has returned to the touch the $4,900 psychological threshold, bringing a crucial rise. Dealer’s consideration is at the moment targeted Bitcoin dominationbeneath 58%. It is a degree that might pave the best way for attainable gatherings for Altcoins. The issue is inevitable. Are we on the disaster of the brand new Altcoin season or a brief rebound?

Ethereum is main the market: Has Altcoin Rally began?

Restoration Ethereum It is not a coincidence challenge. Over the previous few weeks, the value has been cut up upwards via resistance blocking any try and restart for months. This breakout has resulted in a major improve in quantity. It is a sign that the market was ready for the appropriate second to come back again in. The technical motion comes with strong basic elements. Provide of ETH It continues to lower due to Staking. Staking has increasingly share of tokens from the market, and retains community upgrades which might be extra scalable and cost-effective for customers.

The sentiment of institutional traders can also be contributing to the rally. Rumors a couple of attainable new approval Spot ETFs on some altcoinsalong with ETH folks, promoted optimism, however on-chain knowledge highlights the buildup of whales’ wallets. All of those elements have introduced Ethereum again to the highlight and have momentum within the Altcoin sector.

Bitcoin’s benefit is at a crossroads

Parallel to the ETH rally The rule of Bitcoin A decline has been recorded Lower than 58% First time after just a few months of stability. This indicator, which measures the share of BTC capital in comparison with the general Crypto market, is likely one of the most monitored thermometers by analysts because it gives a right away overview of the place capital is heading.

Traditionally, as Bitcoin management decreases, altcoins start to turn out to be outperformed. It is because traders have begun to hunt larger returns with volatility cryptocurrencies after consolidating their positions in BTC, creating an actual Altcoin season.

One other vital sign is: ETH/BTC pairmeasures the relative energy of Ethereum in comparison with Bitcoin. Just lately, this ratio has recorded breakouts from lengthy built-in channels, suggesting that ETH is rising not solely within the greenback, but in addition gaining a basis towards BTC. The sort of motion is especially related. As ETH/BTC rises, it signifies that capital is shifting in the direction of the Ethereum ecosystem.

Due to this fact, the present state of affairs is one in every of unstable equilibrium. The mixture of decrease domination and rising ETH/BTC enhancements the attainable Altcoin season narrative, however potential rebounds for BTC might rapidly overturn the state of affairs. So the subsequent few weeks are vital to know which of the 2 situations will win.

Macroeconomics and liquidity: Is it an excellent wind for altcoins?

The present motion matches into the macroeconomic context, which is changing into extra favorable. With rate of interest cuts by central banks, expectations for financial coverage easing are pulling traders again to dangerous property, together with cryptocurrencies. By way of regulation, there are additionally clearer indications, with extra open discussions and change tips concerning spot ETFs, elements that enhance market confidence.

Information on inflows into index funds reveals new curiosity not solely in Bitcoin, but in addition in Ethereum and Layer 2 options, suggesting that new incoming liquidity just isn’t restricted to BTC, however is distributed all through the ecosystem. Within the case of DEFI, this might result in a rise in complete locked worth (TVL), an elevated use of zero cash and lending protocols, and higher experimentation and new development alternatives for rising initiatives.

Nonetheless, the macroeconomic image alone doesn’t absolutely clarify Ethereum’s current momentum. There are elements that may achieve significance that may turn out to be a crucial accelerator. That is the tokenization of real-world property (RWAs), that means real-world property represented within the blockchain within the type of tokens. On this state of affairs, ETH has emerged as a serious platform due to its in depth use in Defi purposes and a sturdy ecosystem that gives infrastructure, safety and liquidity, whereas Solana, BNB Chain, and Tron have additionally made important advances within the sector.

Here is a current instance XSTOCKS, Tokenized Inventory Merchandise with Backed Monetaryhas formally launched greater than 60 inventory titles on the Ethereum community. Nvidia, Amazon, Tesla, Meta, and Walmart. The choice to go to Ethereum (a community that already holds crucial TVLs) isn’t any coincidence. It gives entry to a large base for Defi customers and leverages mature sensible contract infrastructure.

This pattern confirms that traders and initiatives are not aiming to create new markets of crypto property, in addition to new markets for tokenized actual property. Ethereum, already established, is in a serious place to profit from this growth.

From the attitude of the connection between ETH and BTC, tokenization represents an extra energy issue for Ethereum. The fixed improve in quantity for precise tokenized property on the community helps to combine ETH not solely as a speculative instrument, but in addition as an infrastructure platform with concrete use worth. On this perspective, all new tokenization initiatives strengthen the Ethereum narrative as a structural different to Bitcoin and as a pillar of the chain financial system, not relying solely on short-term speculative dynamics.

Nonetheless, there isn’t any scarcity of threat. The regulatory framework stays unsure. Points referring to the authorized rights of tokenized shareholders, akin to voting rights and possession, should not essentially clear. The safety of sensible contracts and transparency of the tokenization course of are elements that may make a distinction, and unfavorable episodes can undermine market belief.

Conclusion: Altcoin season or only a fleeting enthusiasm?

Ethereum reveals technical and narrative energy, and whereas the decline in Bitcoin’s dominance leaves room for the concept a brand new altcoin season could also be on the horizon, we should not overlook that the market stays extraordinarily risky and delicate to macroeconomic occasions.

For individuals who are lively within the sector, the second is fascinating, however it requires self-discipline. The most effective method is to observe affirmation alerts and adapt to sudden adjustments earlier than growing publicity to Altcoins and sustaining a balanced portfolio. The following few weeks can be essential to know whether or not it is a new bull cycle or a rebound earlier than the additional integration section.

I will meet you subsequent time and have a contented deal!

Andrea Unger