- Bitcoin’s market capitalization has doubled, however Altcoin’s market capitalization stays the very best ever.

- Analysts predict potential altcoin season after Bitcoin’s cycle peak.

- The Golden Cross of Altcoin’s market capitalization exhibits a doable breakout.

For many of the third quarter of 2024, Bitcoin hit a brand new excessive after seeing balloons in market capitalization.

Nevertheless, Altcoin’s market capitalization didn’t preserve its tempo and remained the very best ever earlier than, resulting in considerations about capital revolving.

Altcoin Season Index: Not within the “Alt Season” territory but

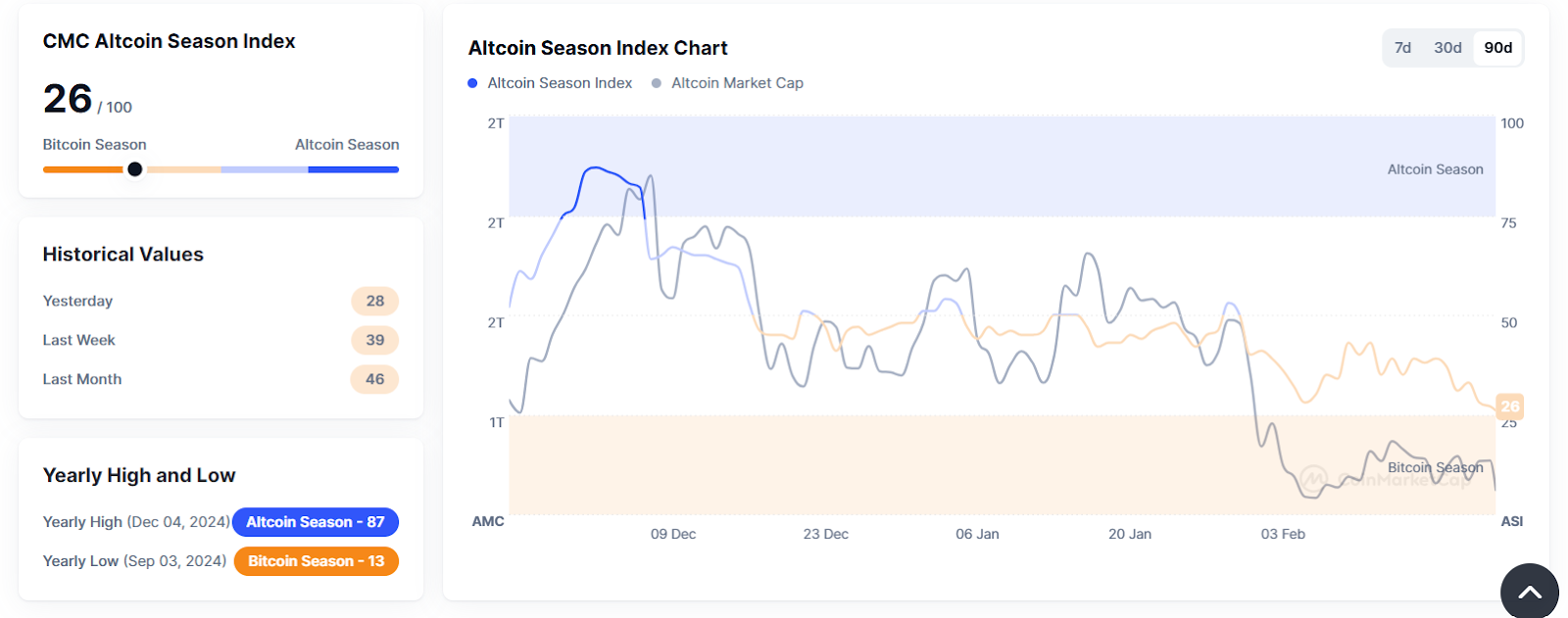

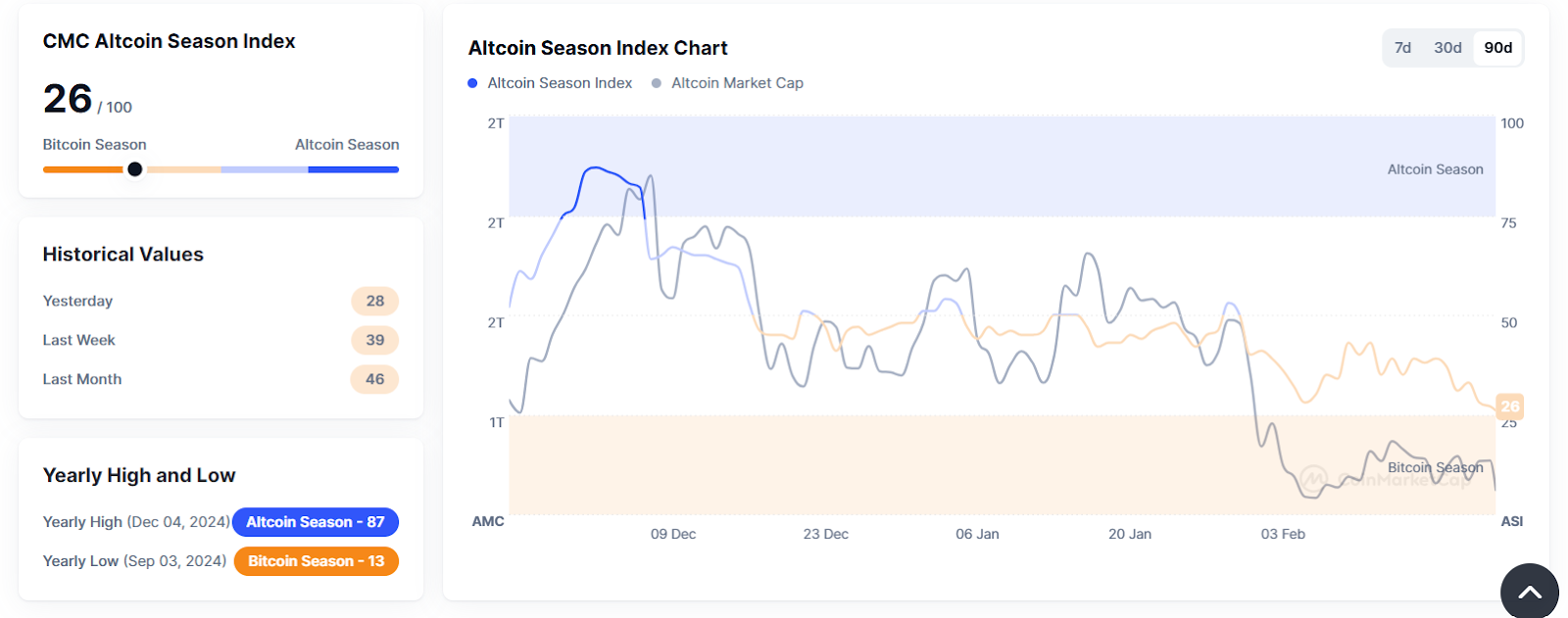

At present, the Altcoin Season Index tracks the market cycle is at the moment at 26. That is beneath the 75 threshold required to see the section managed by Altcoin. This means that Bitcoin remains to be dominant, but when Bitcoin begins to stabilize or decline, there might be a shift to the altcoin season.

Is the Altcoin season imminent?

In a tweet, Cryptoquant CEO Ki Younger Ju described the Altcoin market as a “zero-sum PVP sport,” with belongings spinning with out recent capital inflows.

In his view, solely a handful of initiatives have real-world use instances, reaching new peaks on this cycle.

Associated: Is the Altcoin season in February 2025? Have a look at the indicators of bullishness

Nonetheless, some analysts consider Altcoin’s breakout is imminent. Crypto Rover says Bitcoin’s Bull Run is “80% full,” with the subsequent 20% anticipated to be essentially the most unstable. Traditionally, altcoins have a tendency to collect after Bitcoin reaches the highest of the cycle, indicating that shifts could also be on the horizon.

Golden Cross: Traditionally Bullish Signal of Altcoin

Crypto analyst Ted famous that Altcoin’s market capitalization lately had its first golden cross since early 2021. If the 50-day shifting common exceeds the 200-day shifting common, a golden cross will happen.

Traditionally, this cross has proven a robust upward pattern. In 2021, the ultimate Golden Cross preceded a 500% surge in Altcoin market capitalization inside a number of months.

In the meantime, Crypto Goos bolstered this sentiment, saying “The Altcoin season will probably be an enormous comeback,” predicting buyers will quickly have the ability to make massive earnings.

Why is the Altcoin season deviating from the conventional sample?

Nevertheless, debate over the Altcoin season continues. Whereas technical indicators counsel bullish outlook, Ki Younger Ju’s commentary in regards to the lack of recent capital to enter the Altcoin market raises considerations.

Crypto analyst Miles Deutscher believes that the introduction of Bitcoin ETFs has modified the normal market cycle. Traditionally, half-cycles of Bitcoin have led to wealth accumulation, urging buyers to reinvest in altcoins.

Associated: Altcoin season mia? Raulpal reveals its crypto portfolio and locations Soi forward of Solana

Nevertheless, Deutscher factors out that this cycle is weakened as Bitcoin ETF buyers maintain BTC primarily by means of conventional monetary markets relatively than by means of crypto exchanges. These ETFs settle within the US greenback, so capital turnover to Ethereum and different altcoins is minimal.

GlassNode information helps this declare, highlighting a pointy decline in Altcoin market capitalization of $234 billion over the previous few weeks. This is without doubt one of the most necessary drawdowns in current historical past, however stays extra extreme than the Mining Immigration Crash in Could 2021 or the Luna collapse in late 2022.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version is just not responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.