One of many some ways to investigate the cryptocurrency market is to match the efficiency of its segments. For simplicity, contemplate main large-cap ecosystems reminiscent of Bitcoin (BTC) and Ethereum (ETH) as a single section of the market that may behave very otherwise than the remainder of the market. I can.

The remainder of the market, then again, might be outlined as “altcoins” as they’ve traditionally carried out poorly correlated to BTC and ETH.

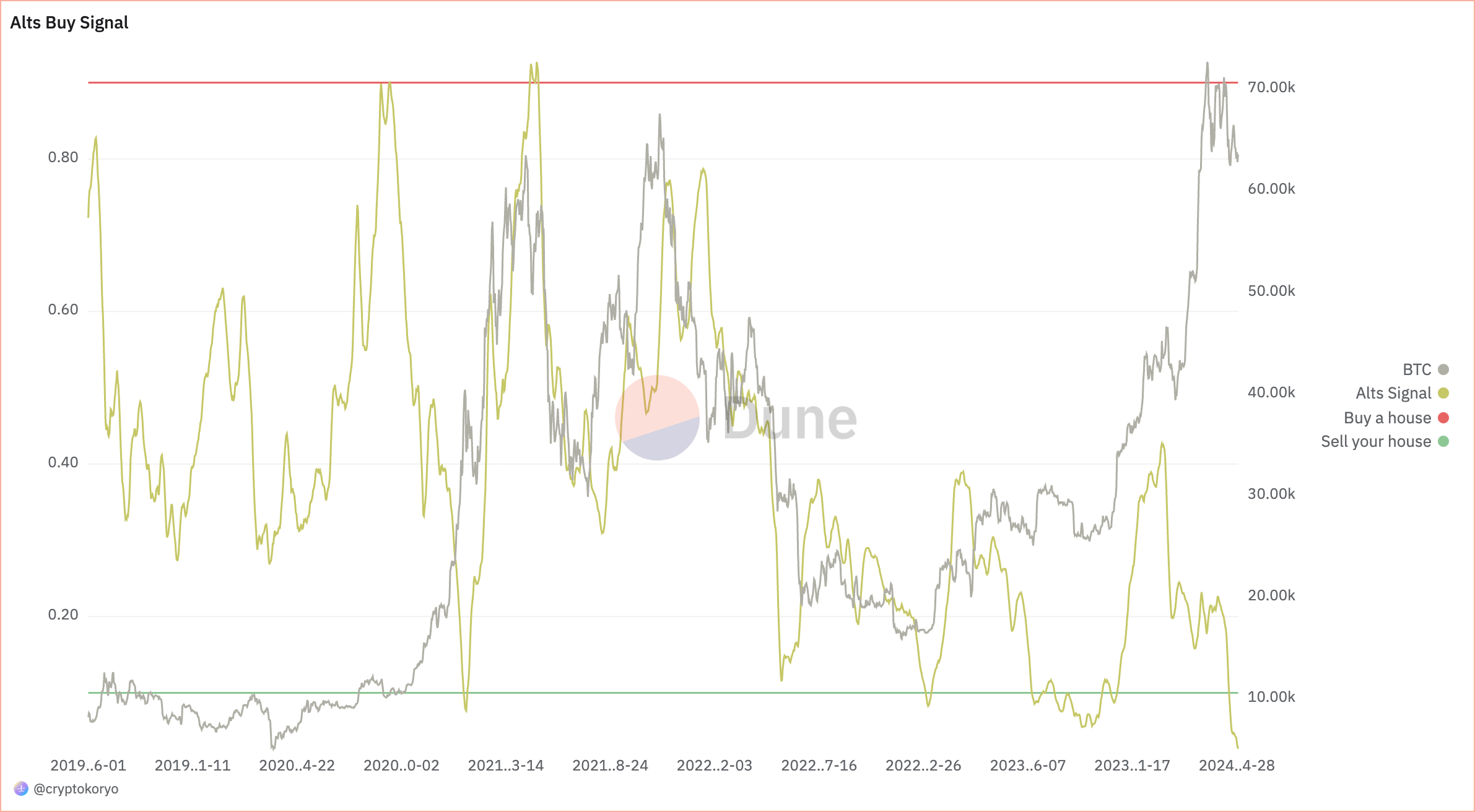

Among the many many instruments out there to investigate these segments, alts alerts stand out as a key software. Developed as an oscillator just like conventional instruments reminiscent of RSI, alts alerts gives an in depth view by evaluating the market capitalization of all cryptocurrencies with the market capitalization of cryptocurrencies, aside from BTC and ETH.

Because the sign fluctuates between 0 and 1, it gives perception into the relative efficiency of an altcoin to the broader market and acts as a barometer of an altcoin's strengths and weaknesses.

The usefulness of this sign lies within the skill to outline particular market eventualities. Every situation presents a special market state of affairs and brings potential methods to merchants and buyers. These eventualities vary from bullish to bearish.

Within the first situation, each BTC and alts alerts are rising, exhibiting a transparent upward development the place each segments are rising. This sometimes happens when Bitcoin's dominance is steady or declining, indicating the start of a broader market-wide bull market.

On this situation, buyers sometimes contemplate rising their altcoin positions, particularly if the altcoin's alerts rise extra quickly than BTC. This means that the efficiency of the altcoin sector is stronger.

Within the second situation, each BTC and various alerts are lowering, indicating a transparent downward development throughout the market. In such conditions, buyers sometimes attempt to keep away from danger by reallocating to stablecoins or “blue chip” cryptocurrencies, additional contributing to the financial downturn.

Within the third situation, BTC falls whereas the alts sign rises. That is much less widespread and happens when Bitcoin loses worth, however altcoins outperform BTC. This may increasingly point out that the altseason is brief, when buyers typically enhance their publicity to altcoins, until Bitcoin's decline is just too steep.

A Bitcoin rally and various alerts decline is the fourth situation, which happens when Bitcoin outperforms the general market and is commonly noticed earlier than a halving occasion or in the beginning of a bull market.

Though the general market is rising in greenback phrases, Bitcoin is rising in worth sooner than altcoins. This situation has traditionally been a very good time to build up altcoins, as a big portion of the market expects a delayed rally.

Because the starting of this yr, alts alerts have proven important fluctuations. Beginning at 0.4230, initially indicating a powerful place, it plummeted to 0.1991 by mid-January, after which to 0.1599 by late February, indicating a transition to an accumulation zone.

By late March, the sign had partially recovered to 0.2193, however by the tip of April it had plummeted to a generational purchase stage of 0.0301. This sample means that whereas the market began out comparatively wholesome, buyers are steadily transferring in direction of accumulating bigger quantities, indicating potential undervaluation or market anxiousness.

In distinction, Bitcoin's value conduct over the identical interval tells a considerably totally different story. Its value motion is totally constant together with his fourth situation, outperforming altcoins although each segments are usually rising in greenback phrases. This situation sometimes represents a pre-bull market stage, the place Bitcoin leads the general rally, however altcoins haven’t but totally participated within the rally.

Whereas the value of Bitcoin has risen this yr because of institutional adoption by way of ETFs and halvings, altcoins haven’t saved tempo. This means a doable brewing interval for altcoins that may very well be poised to make an enormous transfer if market sentiment adjustments extra favorably in direction of altcoins. Traditionally, this sample has led to extra explosive altcoin market rallies.

Various Alerts is presently deep within the generational purchase zone and under 0.1.

In accordance with knowledge from Dune Analytics developed by analyst @cryptokoryo, that is traditionally a very good time to build up altcoins, and we anticipate costs to finally rise to replicate total market positive aspects. I’m.

Alerts after altcoins hit new lows, hinting at potential upside for altcoins that appeared first on Crypto Slate.