Cryptocurrency derivatives speculators have suffered large losses totaling roughly $774 million over the previous day, marking the biggest single-day lack of the yr resulting from unstable market actions.

Bitcoin, the bellwether digital asset, has surpassed the $63,000 milestone in a formidable rally, rising to its highest stage since November 2021. Nonetheless, the euphoria was short-lived, as the worth rapidly fell beneath $60,000, partly resulting from fears attributable to technical glitches at main exchanges corresponding to Coinbase and Binance.

Observers pointed to massive quantities of Bitcoin being transferred from wallets linked to funds seized by US authorities within the Bitfinex hack, including to the volatility. The practically $1 billion transfer to an undisclosed deal with fueled hypothesis that authorities would make the most of the market surge to unload their holdings. however, crypto slate Based mostly on our evaluation, we imagine this transfer is probably going resulting from UTXO directors.

Regardless of the turmoil, Bitcoin bounced again and rose to $62,530 on the time of reporting, marking a 7% enhance from yesterday.

In the meantime, different outstanding cryptocurrencies adopted swimsuit and made spectacular good points. Ethereum, for instance, surged 5% to almost $3,500, its highest worth since April 2022. Solana additionally skilled a resurgence, reaching round $130, a 22-month excessive. crypto slate information.

Among the many high 10 cryptocurrencies by market capitalization, Cardano and Dogecoin stood out with spectacular double-digit good points of 11.78% and 39.16%, respectively.

Roughly 190,000 merchants have been liquidated for $774 million

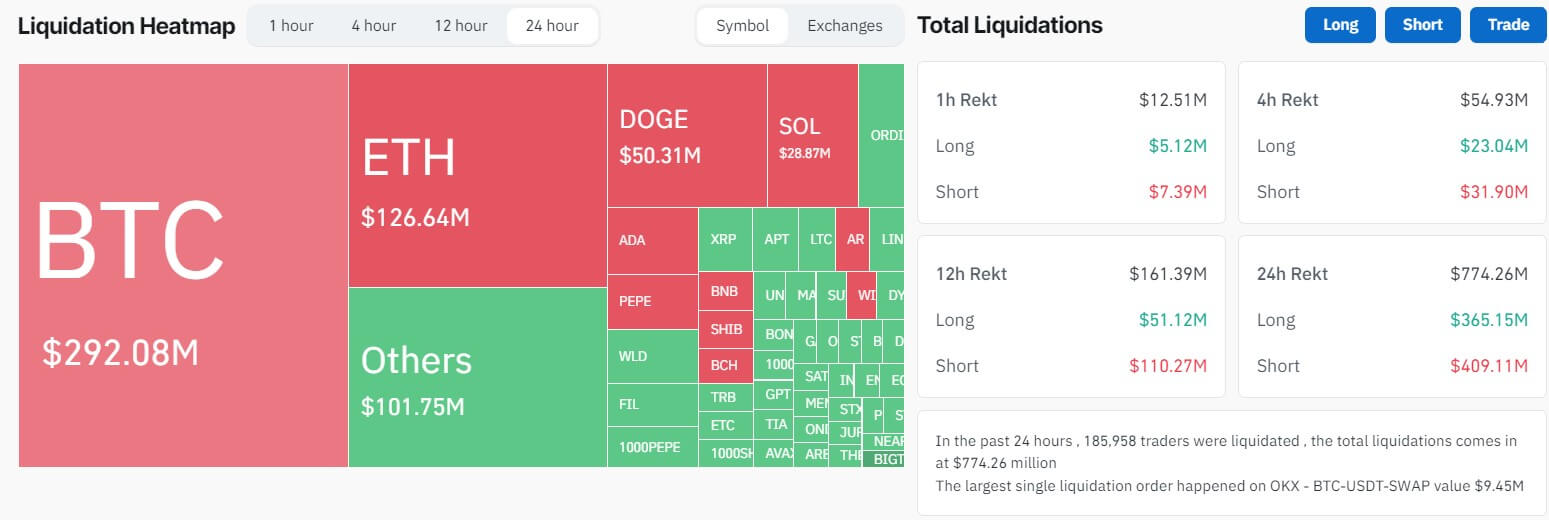

Based on information from Coinglass, previously 24 hours, the inexperienced market's robust efficiency led to the liquidation of 189,679 merchants, amounting to a staggering $774 million.

The present liquidation scenario is dominated by quick merchants, who account for a good portion of complete losses. Those that wager on the worth rising confronted a complete lack of $409 million, whereas lengthy merchants who anticipated the worth to rise suffered a complete lack of about $365.48 million.

Throughout this era, Bitcoin merchants bore the brunt of the losses, leading to an enormous drop of $292.09 million. Brief merchants suffered a lack of $187.83 million, whereas lengthy merchants suffered a lack of $104.26 million.

Equally, Ethereum suffered a complete lack of $126.64 million, whereas DOGE and Solana merchants suffered losses of $50.3 million and roughly $29 million, respectively.

In the meantime, probably the most important non-public liquidations occurred on OKX, totaling $9.45 million from BTC-USDT-SWAP.

Throughout exchanges, Binance and OKX reported probably the most liquidations, accounting for 35.57% and 35.31% of the overall, respectively. As reported by Coinglass, these losses amounted to $275.46 million and $275.43 million. Conversely, Huobi, Bybit, and Bitmex noticed liquidations amounting to $79.4 million, $72.21 million, and $51.75 million, respectively.

(Tag translation) Bitcoin