- Bersan Aljara argues that XRP’s impartial prompt cost system may cut back monetary tensions between the US and China.

- He advised that commerce tensions might be eased if cross-border funds grew to become sooner and cheaper.

- However analysts say no single digital asset can remedy the geopolitical, coverage and safety points driving the commerce struggle.

Barsan Aljara, founding father of Black Swan Capitalist, claimed that XRP may successfully finish the US-China commerce battle. His dialogue focuses on the design of XRP as a impartial, quick-settlement reserve asset that may take away friction from international commerce.

Whereas this concept gained traction amongst some neighborhood members, others emphasised that the geopolitical battle concerned greater than settlement rails.

XRP as a impartial bridge between two financial giants

In a tweet, Aljara claimed that XRP’s prompt cross-border cost system may assist take away lots of the monetary boundaries behind the US-China commerce dispute. As a impartial digital asset not managed by both nation, XRP permits worth to be transferred straight between the 2 nations with out utilizing the greenback or renminbi.

In response to this attitude, commerce might be streamlined on a scale enough to ease tensions between the world’s two largest economies by dashing up funds, decreasing middleman prices, and eliminating forex tensions.

Remarkably, this concept has been circulating within the XRP neighborhood for months. Earlier this yr, analysts like Egrag advised that the US may acquire a aggressive benefit over China by way of oblique entry to Ripple’s 35 billion XRP escrow.

Backlash: “XRP can cut back friction, however it might probably’t finish commerce wars”

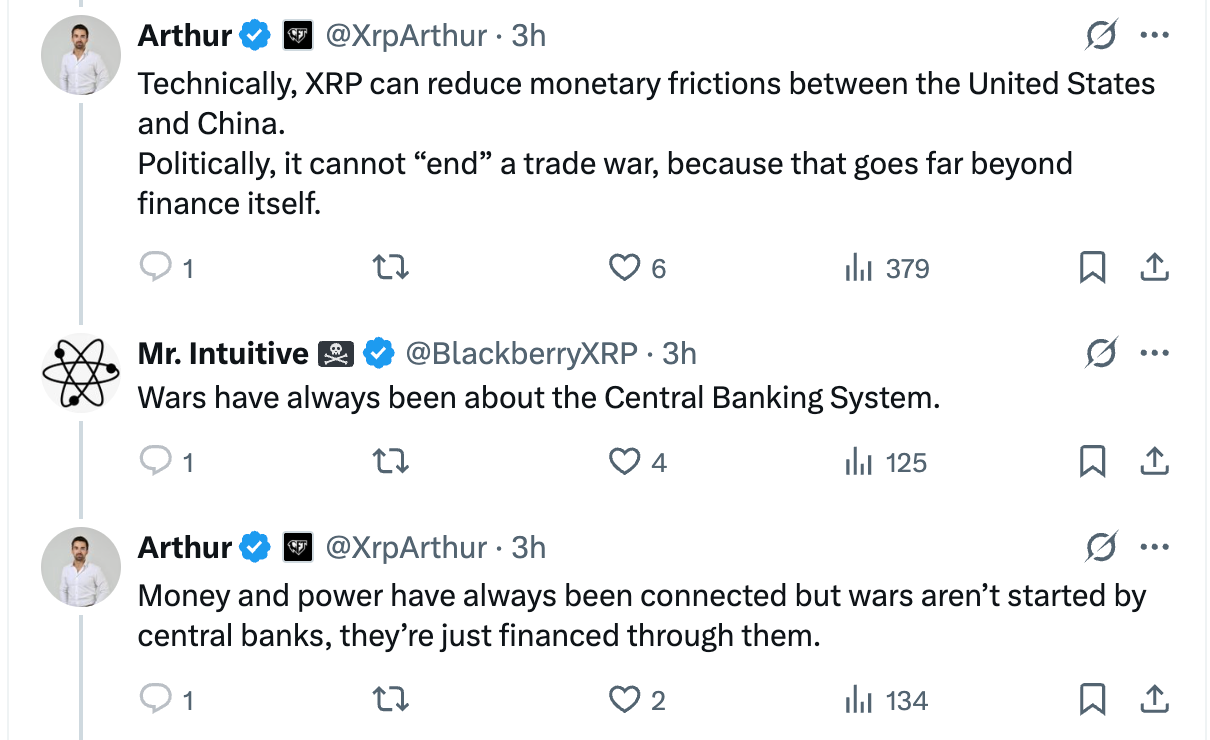

In the meantime, neighborhood member Arthur argued that whereas XRP might assist cut back monetary tensions between the US and China, it can not “finish” the commerce struggle. He defined that these conflicts aren’t only a query of monetary flows, however stem from authorities insurance policies, safety considerations, tariffs, provide chain points and politics.

In different phrases, even an ideal cost system couldn’t resolve the deep-rooted geopolitical tensions that drive the US-China battle. The dialogue expanded additional when one other neighborhood member, Intuitive, argued that wars are all the time tied to the central banking system.

Arthur replies that cash and energy are linked, however banks do not begin wars, they simply fund them. He emphasised that the true causes of geopolitical battle lie a lot deeper than the financial system.

conclusion

In any case, no digital asset can finish commerce wars by itself, however analysts agree that with elevated adoption, XRP may nonetheless play a big function in international finance.

The power of XRP lies in its function as a bridge asset on the XRP Ledger, permitting prompt settlement with out the necessity to deposit funds upfront. This setup reduces prices and improves cross-border liquidity flows.Associated: XRP will likely be used for worldwide remittances in main Asian markets

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.