- ChainLink’s (Hyperlink) Bollinger Bands indicator has signed that it predicts a serious volatility stage is imminent.

- A excessive correlation with Bitcoin means that hyperlinks might drop additional earlier than bullish strikes.

- ChainLink has witnessed sturdy development regardless of the 22 new integrations reducing costs.

ChainLink has been the main target of each merchants and analysts because it immediately fell in early February.

Since February 3, the hyperlink has been oscillated between $17 and $22, with the indicator indicating a doable breakout throughout weeks of consolidation.

Bollinger Bands sign potential breakouts and squeeze

One of the crucial essential indicators of an impending value shift in chain hyperlinks is the stress of the Bollinger band on the 12-hour chart.

Bollinger Band’s technical indicators that measure volatility have considerably strengthened the value of Hyperlink, a sample that has traditionally preceded main market actions.

As famous analyst Ali Martinez identified, this stress might imply that the hyperlink is on the pinnacle of sharp gatherings or vital declines, relying available on the market’s subsequent transfer.

Bollinger band squeezes #chainlink $hyperlink 12-hour chart exhibits {that a} extremely risky motion might be imminent! pic.twitter.com/np4yjvanyk

– Ali (@ali_charts) February 17, 2025

ChainLink buying and selling exercise spikes

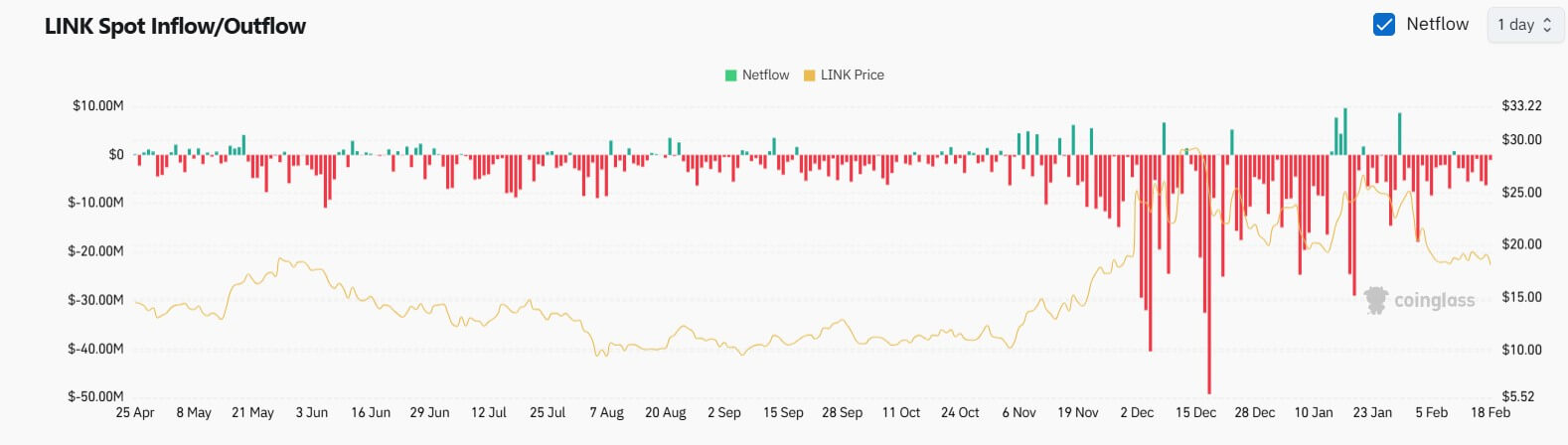

The market has additionally witnessed a surge in hyperlink buying and selling exercise, with spot inflows and outflows exhibiting energetic involvement from each bullish and weakened merchants.

Coinglass knowledge reveals fluctuations in Hyperlink’s web inflows and outflows, indicating a rise in market exercise.

Coupled with the bollinger band squeeze, this aggressive buying and selling means that merchants are positioning themselves for what they imagine is a big market change.

Though there’s a surge in market exercise, on-chain metrics from Santiment present that whale buying and selling has declined 78% since November, with these giant homeowners 67 in Hyperlink’s provide Controls %. This discount in exercise by key gamers suggests cooling the acquisition stress, which may exacerbate downward value actions within the quick time period.

Nevertheless, there’s elementary belief within the Hyperlink basis, as 59% of holders are nonetheless worthwhile.

Correlation between chain hyperlinks and bitcoin

Apparently, based on an evaluation by IntotheBlock, ChainLink maintains a correlation of 0.97 with Bitcoin value motion.

Given Bitcoin’s present trajectory suggesting additional revisions to its $92,000 assist stage, the hyperlink is anticipated to comply with the lawsuit, with the potential for experiencing an extra 30% drop earlier than rallies in direction of an all-time excessive. there’s.

This correlation highlights the interconnectivity of crypto markets, the place key belongings like Bitcoin can have a big affect on different efficiency, akin to Hyperlinks.

Chain Hyperlink Community Progress regardless of Value Decreases

Regardless of the value adjustment stage, the ChainLink community has grown considerably with 22 new integrations throughout a wide range of blockchains, akin to Arbitrum and Base. This extension reinforces ChainLink’s function as a pacesetter in offering real-world asset tokenization by means of trusted Oracle companies.

Dedication to interoperability and sensible circumstances by means of merchandise akin to knowledge feeds and cross-chain interoperability protocols (CCIP) suggests a strong basis for future development.

Moreover, the reelection of Donald Trump, referred to as the primary pro-crypto president, was in the end capable of push Chain Hyperlink (hyperlink) again right into a bullish pattern, notably with continued community growth.

(TagstoTranslate) Markets (T) ChainLink Information (T) Cryptocurrency Information