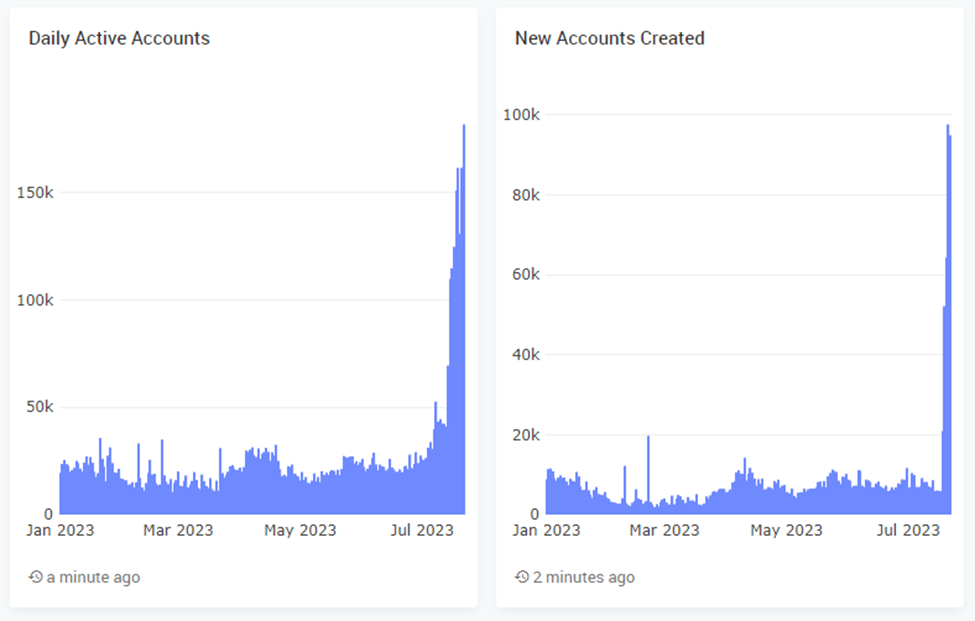

- Yesterday, the variety of energetic APT addresses reached 182,000.

- In keeping with on-chain information, 94,000 new accounts have been created throughout the final 48 hours.

- Technical patterns on APT’s day by day chart prompt {that a} worth breakout might be imminent.

In keeping with on-chain information, the variety of energetic Aptos (APT) accounts reached 182,000 yesterday. That is additionally the best variety of addresses because the APT airdrop. As well as, the variety of new accounts exceeded 94,000 up to now two days. This new spike in his APT holders could also be associated to the mixing of Chingari, a well-liked social media app in India.

In the meantime, CoinMarketCap confirmed that the altcoin worth elevated by 0.74% over the previous 24 hours. In consequence, APT was buying and selling at $7.68 on the time of writing. The cryptocurrency additionally rose 0.48% and 1.67% in opposition to market leaders Bitcoin (BTC) and Ethereum (ETH) respectively. Which means 1 APT is value 0.0002567 BTC and 0.004097 ETH.

A symmetrical triangle on the APT day by day chart means that altcoin costs could expertise a breakout within the coming days. If the APT worth turns bullish within the subsequent 24-48 hours, resistance at $7.8252 might flip to assist. This may most definitely pave the best way for APT to rise to $8.8897 subsequent week.

Conversely, a breakout of the lows can ship the APT worth all the way down to the subsequent important assist degree of $7.3104. If the promoting strain continues, the cryptocurrency might drop to $6.8361.

Nonetheless, on the time of writing, the technical indicators have been supporting the bullish view because the 20-day EMA line is making an attempt to interrupt out of the 50-day EMA line. A crossing of those two EMA strains would point out that the bulls have the higher hand and the APT worth might proceed to rise subsequent week.

Our bullish view might be confirmed if the APT closes right now’s day by day candlestick above the 50-day EMA line of $7.5989. Alternatively, a closing worth beneath this technical indicator might be taken as a sign that the APT worth could break in direction of the draw back.

Disclaimer: As with all info shared on this pricing evaluation, views and opinions are shared in good religion. Readers ought to do their very own analysis and due diligence. Readers are strictly answerable for their very own actions. COIN EDITION AND ITS AFFILIATES SHALL NOT BE LIABLE FOR ANY DIRECT OR INDIRECT DAMAGES OR LOSSES.

Comments are closed.