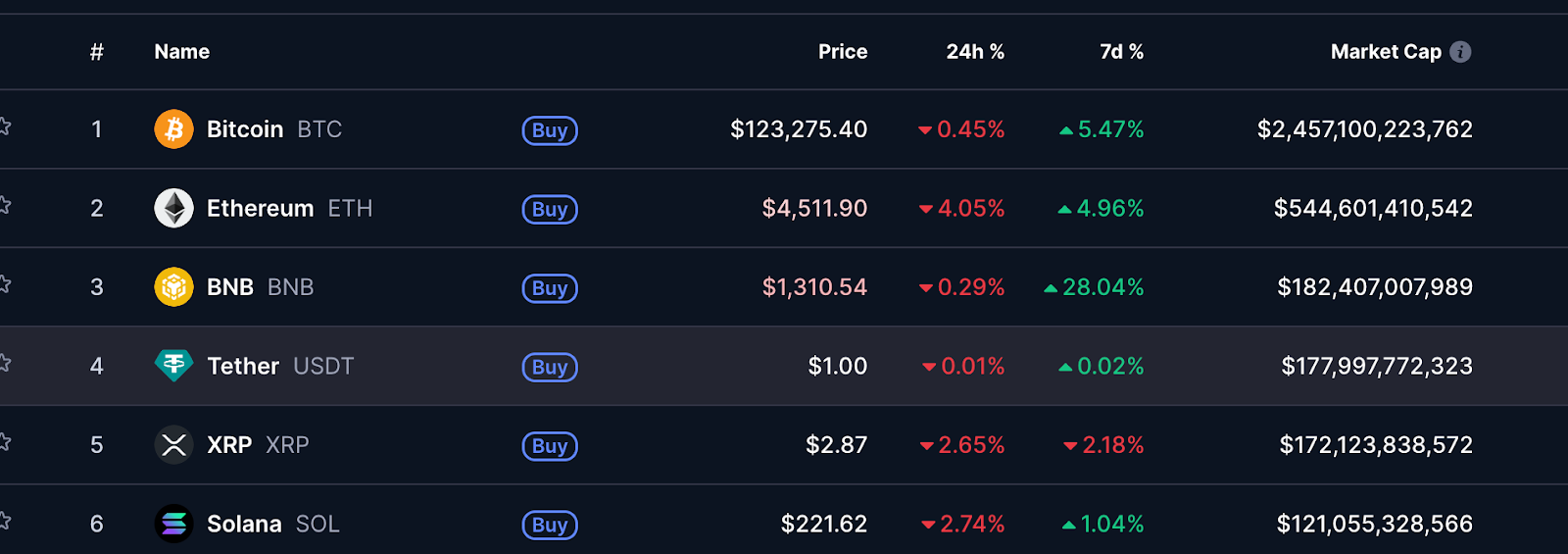

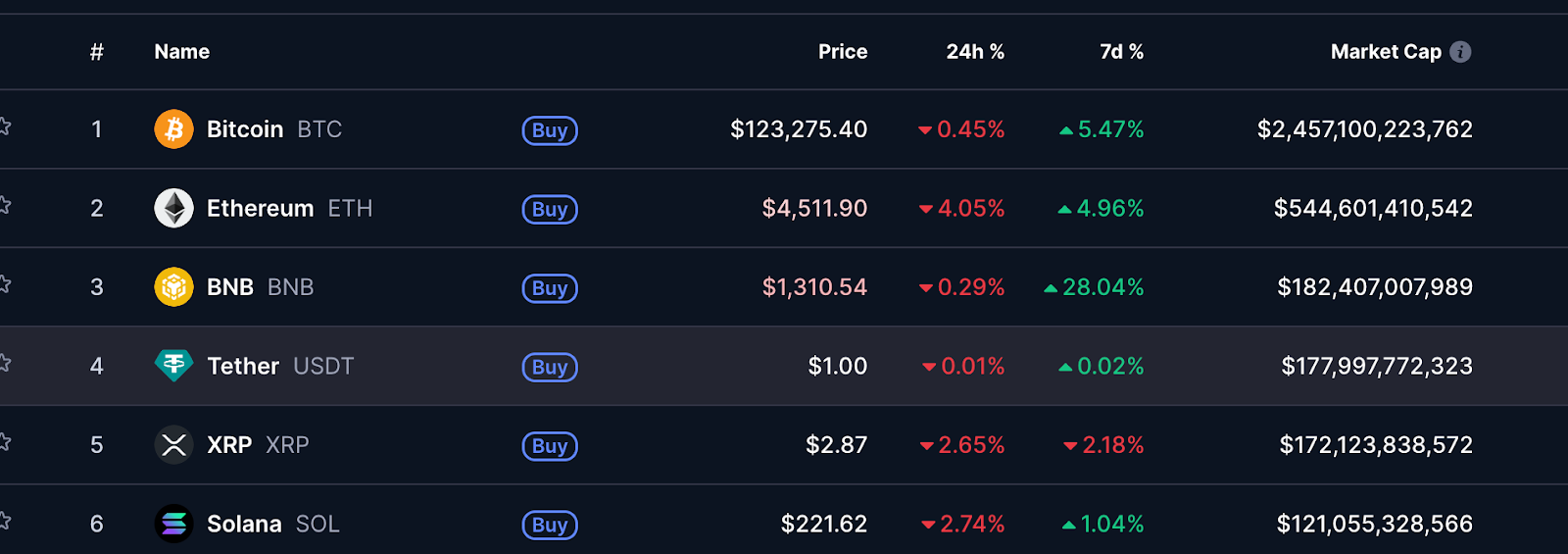

- BNB hit a report $1,330, inverting XRP to spice up the market.

- Whereas altcoins have cooled down as derivatives overheated, Bitcoin fell 1.4% to $122,732.

- Analysts count on a brief recession earlier than it rises additional in the direction of $130,000.

BNB additional prolonged its robust Tuesday achieve, surgening to an all-time excessive of over $1,330, turning into the third-largest cryptocurrency by market capitalization past XRP.

Binance-backed tokens have risen 27% over the previous week as a result of elevated institutional participation and elevated exercise within the BNB chain, and at the moment are up 129% in comparison with final yr.

Associated: Cryptocurrency rally warning: ETH and SOL lead, whereas Bitcoin is taking a look at $200,000

Enterprise buying provides gasoline

The current surge was amplified by CEA Industries Inc., a publicly traded firm that exposed its holdings of 480,000 BNB tokens value round $611 million. The corporate acquires tokens at a mean value of $860 per card, with a complete funding value round $412.8 million.

CEA goals to carry 1% of its complete BNB provide by the tip of 2025, turning into the most important company holder of the asset. CEO David Namdar defined the milestone is an indication of rising market rankings. “The BNB’s report highs point out that the worldwide market is awakening to the worth and dimension of this ecosystem.”

Institutional investor demand and BNB chain progress accelerates momentum

Analysts consider the rise of BNB is because of each institutional purchases and elevated on-chain engagement. Aster, a BNB-based everlasting futures alternate, has seen a surge in buying and selling volumes, attracting new customers to the BNB chain.

“The current rise in BNB has been largely pushed by a rise in on-chain exercise and institutional curiosity,” stated Ilia Otichenko, chief analyst at CEX.IO. The robust fundamentals of this token, coupled with Binance’s ecosystem enlargement, have established itself as a serious driver of the present crypto cycle.

Bitcoin is inflicting the entire market to chill down

Whereas BNB continues to rise, momentum has paused throughout the cryptocurrency market. Bitcoin fell 1.4% to commerce at $122,732 after a brand new excessive of over $126,000. Different main altcoins, comparable to XRP, Dogecoin, ADA, and Avalanche (AVAX), recorded losses of three% to five%.

Market officers identified a typical sample. With each large breakout, Bitcoin tends to face fast changes. Analysts identified that the derivatives market has been overheating following a 16% rise in Bitcoin costs since late September.

Deribit’s Jean David Peckignott stated Bitcoin may retest the $118,000 to $120,000 vary earlier than it rises additional in the direction of $130,000 by the tip of the yr.

Vetl Runde of K33 Analysis added that final week’s buying and selling knowledge marked the most important Bitcoin accumulation in 2025, including greater than 63,000 BTC, value round $7 billion throughout ETFs and futures markets, suggesting a short-term market bubbly.

Lengthy-term belief stays robust

Regardless of short-term volatility, long-term sentiment stays optimistic. Cosmo Jean, common companion at Pantera Capital, stated greater than 60% of world traders nonetheless don’t personal cryptocurrency, suggesting there may be a lot room for adoption.

He believes that the main focus now shifts from justifying bitcoin to increasing altcoin, with Ethereum and Solana main the subsequent stage of progress.

Associated: Bitcoin analyst believes $175,000 is only a “surge” earlier than the $400,000 cycle peak

Analyst Benjamin Cowen predicts that the market capitalization of the worldwide cryptocurrency market, at the moment at round $4.29 trillion, may method $10 trillion in a number of years. Analysts at Morgan Stanley lately suggested traders to allocate as much as 4% of their portfolios to cryptocurrencies, citing rising legitimacy and widespread use.

FAQ

Q1: Why is BNB hovering now?

The fast progress of BNBs is pushed by institutional accumulation, elevated exercise within the BNB chain, and widespread recognition of its ecosystem worth.

Q2: What does this imply for an altcoin?

Altcoin has skilled a short-term chill following the current rise, however analysts count on new momentum to emerge as recruitment will increase in institutional traders and retailers.

Q3: Is there a chance that Bitcoin (BTC) will enhance subsequent?

sure. Analysts count on it to fall from $118,000 to $120,000, earlier than rising in the direction of $130,000 as funds settle and restructure the stream of funds.

This autumn: Is it too late to spend money on altcoins?

Consultants say adoption remains to be comparatively low and it isn’t too late as new laws clarifications may assist long-term progress.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not chargeable for any losses that come up because of your use of the content material, services or products described. We encourage our readers to take nice care earlier than taking any motion associated to us.