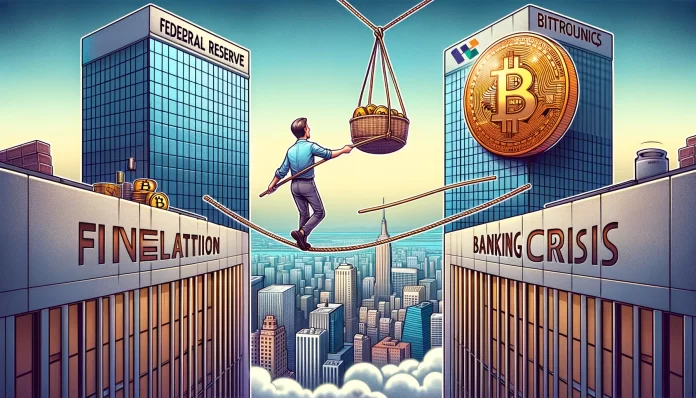

International monetary markets are mired in uncertainty, caught in a fragile stability between inflationary pressures and an rising banking disaster. U.S. financial coverage makers, together with Janet Yellen and Jerome Powell, are going through a vital juncture.However in its nuanced language and thoroughly crafted messages, what insights can we glean from Bitcoin? BTC 2.57%What have you ever been as much as recently? On this evaluation, we discover how the world's main digital asset foresees dilemmas and potential paths the Federal Reserve could tread.

Quarterly Refund Announcement (QRA) – Transition to Treasury Payments

Within the U.S. Treasury's newest quarterly compensation announcement, the choice to launch short-term borrowings with maturities of lower than one yr highlights a strategic transfer that has caught the eye of sensible buyers. This transition to Treasury payments (T-bills) has important implications for cash market funds (MMFs) and reverse repurchase packages (RRPs).

Yellen and Powell have signaled a desire for short-term debt. This resolution could have stemmed from a want to handle the danger of a pointy rise in long-term rates of interest, a priority that might nonetheless be confronted except aggressive inflation is reined in. This transfer has brought about a serious backlash in MMFs, which have begun withdrawing capital from RRPs and redirecting capital to authorities bonds that supply increased returns.

The Fed has responded with liquidity injections to clean out these modifications, illustrating how funds that have been within the Treasury and cash markets are basically being returned to the financial system. This balancing act highlights the fragile activity at hand: sustaining market order whereas coping with windy modifications.

Powell's unprecedented price minimize coverage change

In a stunning reversal on the Federal Open Market Committee (FOMC) press convention, Chairman Jerome Powell hinted at the potential for a price minimize in 2024. This was in sharp distinction to earlier, extra dovish statements. The normally cautious Mr. Powell's change in tone was sudden and suggests issues are rising behind the scenes.

The announcement displays the Fed's recognition of financial vulnerability, particularly amid the continued banking disaster. The potential cuts are an try and bail out and shore up banks with massive unrealized losses on their stability sheets. The market response to those statements is obvious, with indicators of inventory market nervousness and a flight away from conventional reserves and into riskier belongings.

Chairman Powell's change of route underscores the Fed's recognition of the precarious place the U.S. financial system is in. Are these unpredictable actions an try to cut back threat, or are they a harbinger of deeper disruptions which are but to be unraveled?

Analyzing Bitcoin market volatility

Bitcoin market volatility has many causes. One idea attributes the digital forex's current plunge to an outflow from the Grayscale Bitcoin Belief (GBTC). Nonetheless, this story falls quick when contemplating the web inflows into Spot Bitcoin ETFs, indicating sustained investor curiosity within the cryptocurrency house.

A extra convincing argument is the expectation of non-renewal of the Financial institution Time period Funding Program (BTFP). This system is ready to run out and has propped up too-big-to-fail (TBTF) banks. With out renewal, these establishments may face dire hardship, growing the significance of program continuity from each solvency and stability views.

The risky season within the BTC market is due to this fact not simply speculative noise, but in addition a painful mirror reflecting the fears and expectations of the bigger monetary panorama. Bitcoin, usually criticized for its speculative nature, may very well function a pacesetter in pricing in systemic dangers that conventional markets haven’t but adequately addressed.

Banking disaster: too massive to succeed?

The likelihood that the BTFP won’t be renewed portends a protracted banking disaster, and the implications will likely be dire. Too massive to fail (TBTF) banks are formidable of their measurement and have historically been thought-about indestructible, primarily because of systemic threat.

A mix of things, from the continued pandemic to the nascent financial restoration, are shifting the winds of change and exposing vulnerabilities. With out well timed intervention, both via BTFP renewal or various methods, the worry of financial institution meltdown looms massive. This poses a dilemma for policymakers, who’re caught between the necessity to keep away from crises and the imperatives of managing inflation and debt.

Whereas the comfort of the American monetary system is laudable, it’s not with out its limitations. The Fed is aware of the precarious perch it occupies, as evidenced by QRA and Chairman Powell's current feedback. The actions or inactions of the Treasury Division and the Federal Reserve within the coming months will likely be carefully watched not solely within the halls of energy, however by Bitcoin and conventional market contributors alike.

Inflation, rates of interest, and the way forward for digital currencies

The battle between inflation and rates of interest is on the coronary heart of the present monetary story, with cryptocurrencies rising as a distinguished subplot. The trajectory of Bitcoin and its digital cousins is essentially intertwined with broader macroeconomic situations.

If the U.S. yield curve steepens and actual yields stay low, that might create additional challenges for conventional safe-haven belongings and will flip to cryptocurrencies instead retailer of worth. Conversely, if Dare Arnold's story of controlling inflation with out unduly burdening the financial system succeeds, it may result in a resurgence of conventional belongings, even on the expense of digital forex prominence. .

As the talk over the legitimacy and long-term viability of cryptocurrencies intensifies, there may be now a singular lens via which to grasp their potential function in a world grappling with multifaceted monetary challenges. It’s introduced.