- Hayes believes that genius acts successfully put steady issuance within the arms of banks or regulated entities

- His logic is that SLR reduction opens the gateway of services, stability in banking laws improves reliability and stability, and geopolitical calm updates the risk-on setting

- Hayes believes that every one of those components are mixed.

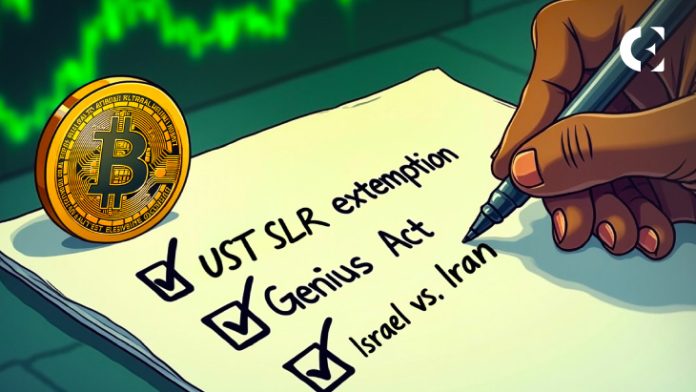

Arthur Hayes outlined a bullish paper on Bitcoin and Cryptocurrency, centering on three vital elements.

The primary level to progress in the direction of excluding UST (US Treasury) stablecoins from the Supplemental Leverage Ratio (SLR) guidelines. This may unlock extra financial institution involvement and unlock higher liquidity and institutional help for Crypto, however provided that US regulators finalize it.

Second, Hayes believes the Genius Act (now handed by the Senate) successfully locations steady issuance within the arms of banks or closely regulated entities. He believes this modification is constructive for crypto because it brings transparency, belief and regulatory legitimacy to the Stablecoin sector.

Lastly, Hayes additionally talked about the present geopolitical scenario. “Ignore actuality, Trump, Netanyahu and Kamenei are all pretending that the battle is over, so buyers want to do this too.”

Finally, his logic is that SLR reduction opens an institutional gateway, banking regulation stubcoins enhance belief and stability, and geopolitical calm environments point out an up to date risk-on setting.

Hayes believes that every one of those components set the best ever stage for the brand new Bitcoin.

Banks, payments, bitcoin

On June 17, the US Senate handed the Genius Act with a bipartisan 68-30 votes. The regulation frames dollar-backed stubcoins as authorized cost devices, defining strict reserves and disclosure guidelines.

This permits banks to subject stubcoins above the $10 billion cap, however small issuers might function beneath state licenses. This framework is appropriate for distributors like circles, however critics fear about embedding stubby cash deep into the position of Kujibank.

The SLR Matter talked about by Hayes is a part of the continued debate over waiver of Stablecoin reserves from SLR counts. Supporters say they’re releasing banks to carry extra liquid belongings, and the enemy is citing systematic threat implications.

All issues should be thought of and wait to see if the haze is appropriate. Nevertheless, given steady regulatory advances, widening institutional infrastructure and easing geopolitical tensions, the broader financial setting seems to be ripe for Bitcoin’s subsequent massive gathering.

If the above is realized, it may promote massive capital not solely with Bitcoin, but in addition with crypto. Nonetheless, there may be threat and delays, reversals, or failures can kill momentum.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version isn’t responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.