- Bitwise CEO says Solana’s shorter staking interval helps ETF publishers over Ethereum.

- The SEC will determine on a number of Solana and Ethereum ETF purposes in October.

- Sol will make a possible breakout of $300, over $222.

Bitwise CEO Hunter Horsley stated Solana may earn extra benefits over Ethereum within the race to launch staking funds for change transactions, citing the sooner staking course of. His feedback come because the US SEC prepares to determine on some ETF purposes this month.

Bitwise CEO highlights Solana’s ETF benefit

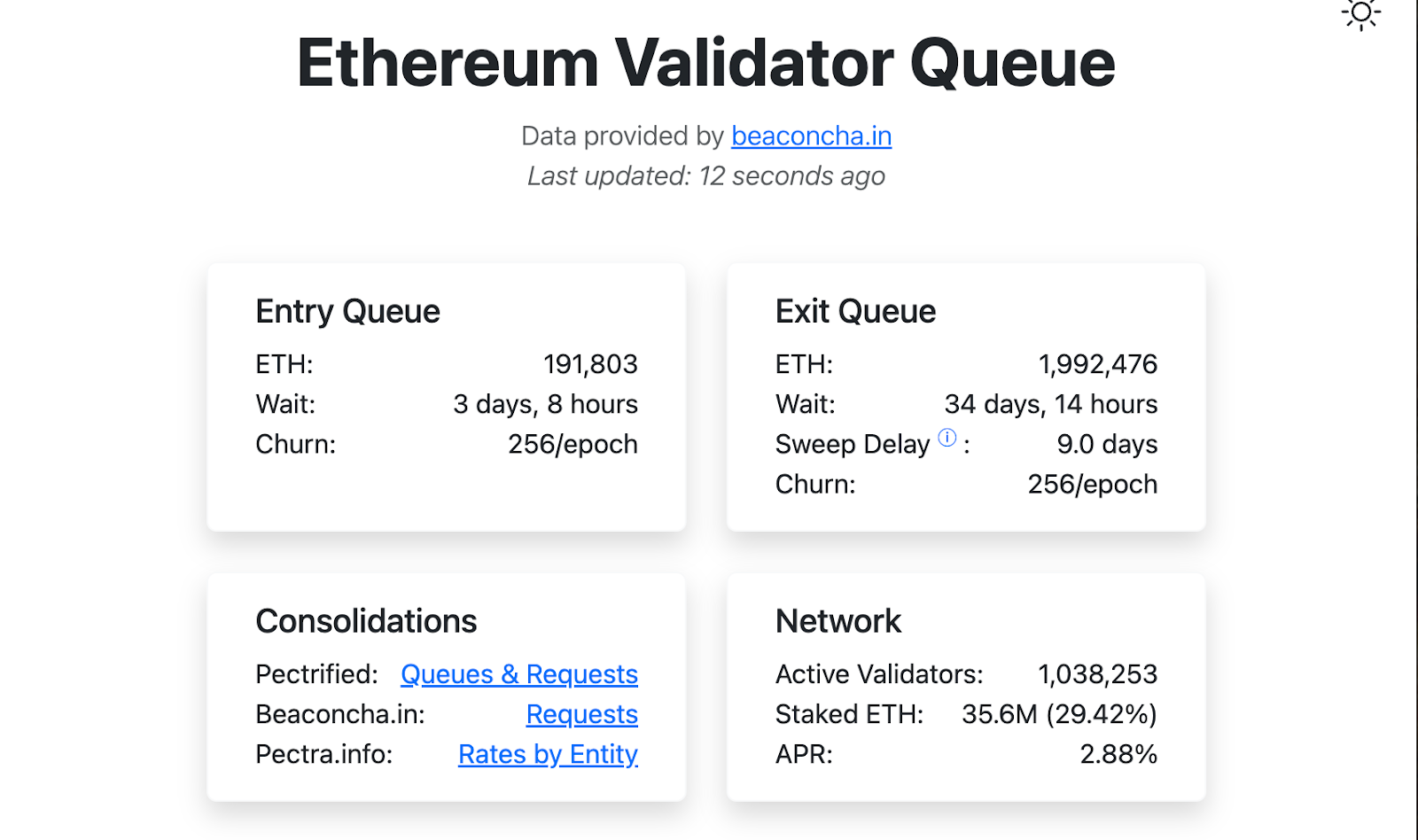

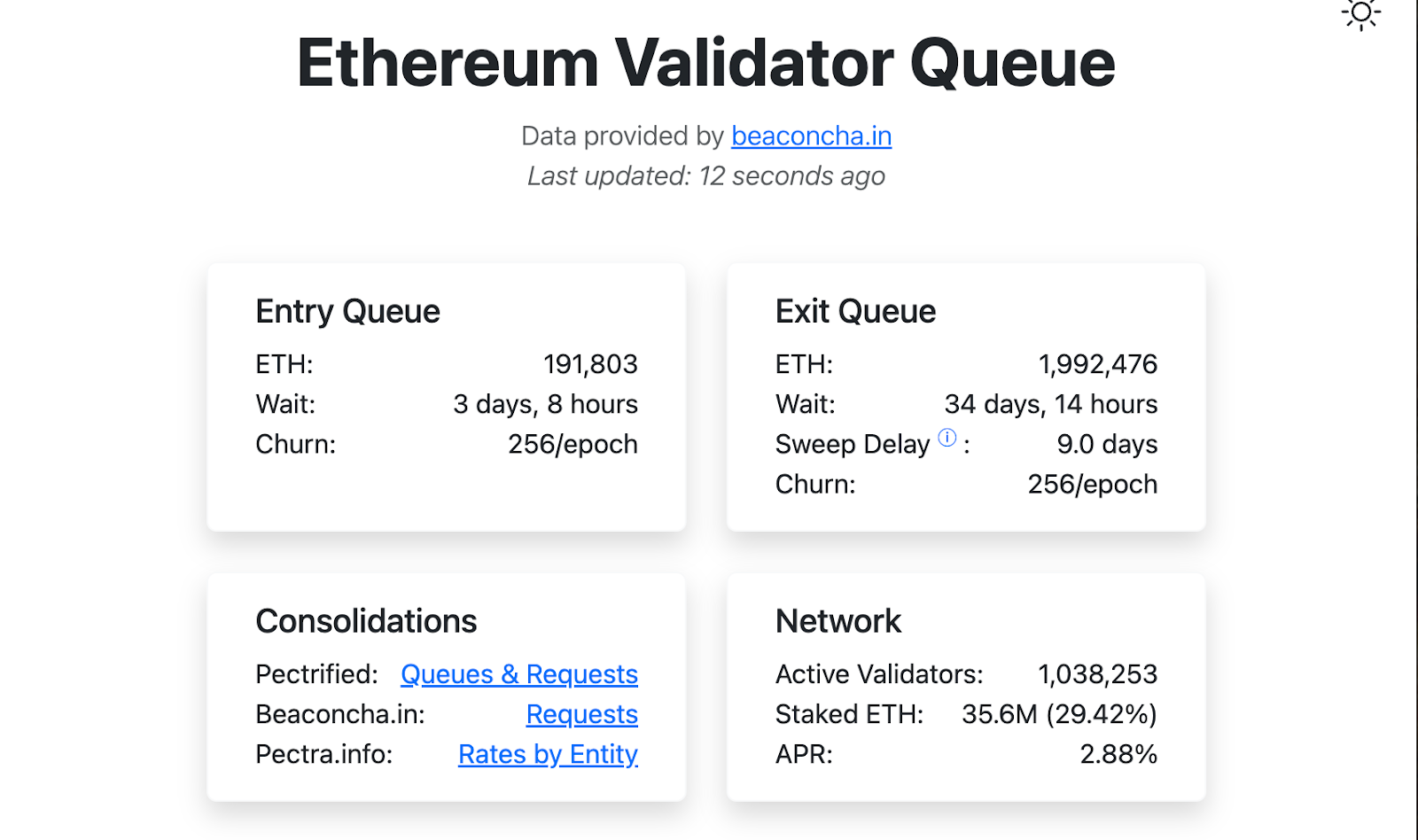

Talking at Token 2049 in Singapore, Horsley stated Solana’s shorter staking interval would make it simpler for ETF publishers to make reimbursement requests simpler. By comparability, Ethereum’s withdrawal queue has elevated considerably, creating lengthy delays for traders.

“That is an enormous drawback,” Horsley stated, emphasizing that ETFs should be capable of return belongings inside a really quick time frame.

Associated: Solana Worth Forecast: Sol Worth integrates inside Rising Channel

Ethereum ETF’s Fluidity Problem

In line with on-chain information, Ethereum’s staking system at present faces an exit queue of round 34 days with a median entry ready interval of about three days, with over 2 million tokens ready to go away.

Nevertheless, as a result of Solana’s exit interval is way sooner, Horsley argues that it is extra suited to regulatory funds that require fast liquidity.

Ethereum-based merchandise keep away from this situation by means of credit score amenities and liquid staking tokens similar to Steth. Nevertheless, Horsley famous that these choices add price and face capability constraints.

SEC ETF is set in October this 12 months

SEC critiques ETF purposes from key asset managers, together with Bitwise, Constancy, Franklin Templeton, Grayscale, and Vaneck.

The choice on the Ethereum Staking ETF is already behind till late October, however the Solana ETF proposal can also be awaiting critiques. The continuing US authorities closure raised issues about additional delays in approval.

Horsley’s feedback are as institutional curiosity in Solana continues to develop. A number of publishers have submitted S-1 paperwork which were amended in current weeks to incorporate staking clauses in pending ETF purposes.

Sol Worth builds momentum forward of SEC’s ETF ruling

Solana has been buying and selling at $225, up 3.9% over the previous 24 hours, growing its weekly revenue to 11.3%. The technical indicators recommend secure buying stress, with a relative power index of 59.

Quick assist is between $200 and $206, whereas resistance ranges are $230 and $250. Analysts notice that approvals for the Solana ETF may speed up income, and value targets may exceed $300 by the tip of the 12 months.

Associated: Solana value forecast: Can Sol preserve momentum above $200?

In the meantime, Ethereum stays close to an all-time excessive, buying and selling at $4,381, a rise of two.3% over the previous day. Solana has extra grounds for restoration, sitting 34% under her prime $295 in January. The power’s pockets has been energetic in current weeks and has been added to Solana’s place in the course of the value declines, sustaining momentum.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version is just not answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.