- BlackRock bought Ethereum for the second time per week, pushing ETH under $4,000.

- Ethereum ETF noticed greater than $351 million in internet spills over two days this week.

- Over 420,000 ETH have been withdrawn from exchanges, indicating a powerful long-term accumulation.

Ethereum has handed a tense market surroundings after a sequence of days of intense institutional outflows and sudden DIPs of lower than $4,000. BlackRock bought ETH for the second time in seven days, whereas Alternate-Traded Funds poured over $315 million in two classes.

Whereas short-term sentiment has turn into defensive, on-chain circulate means that long-term patrons are quietly accumulating provide.

ETF Exodus for $315 million in 48 hours

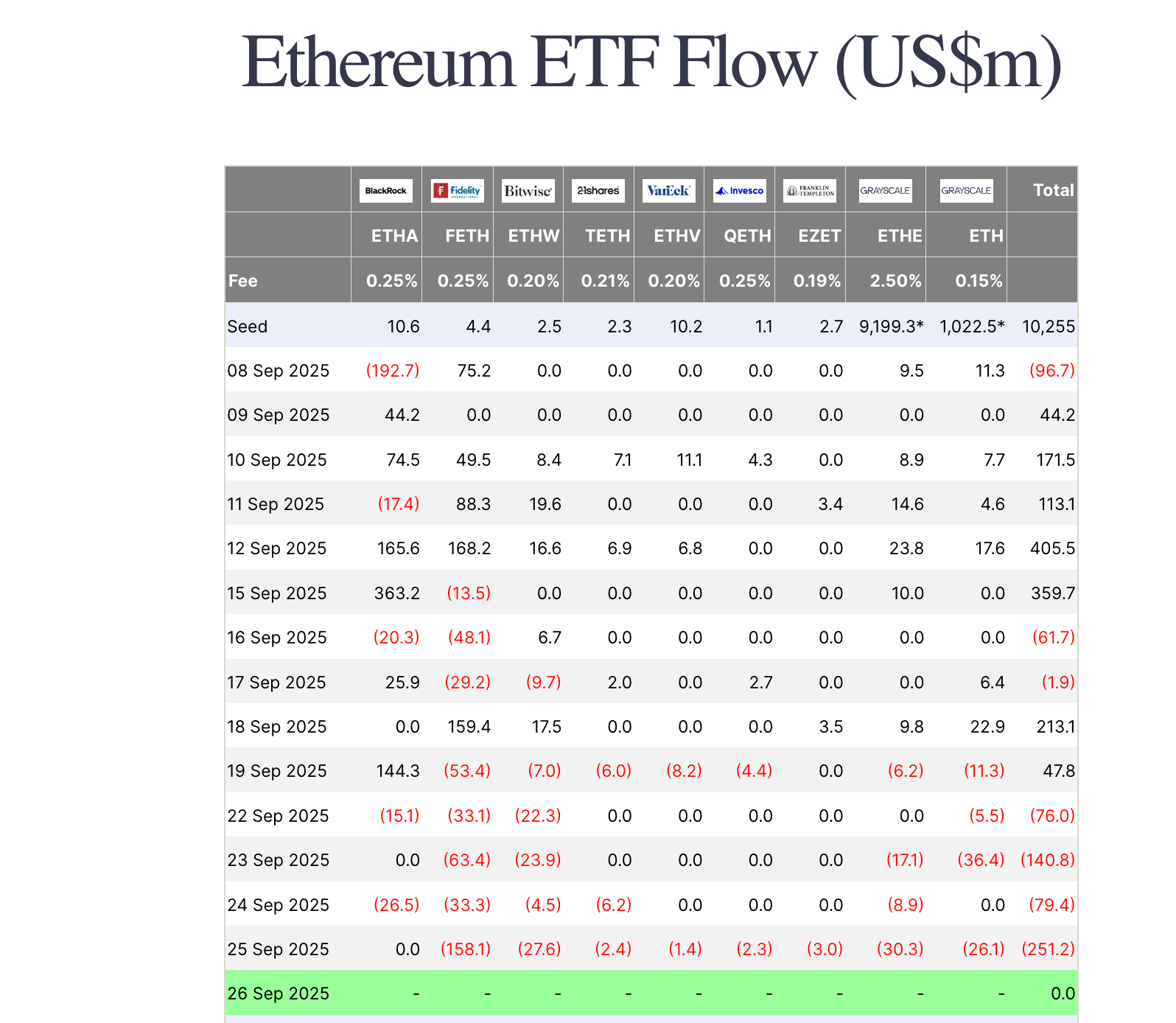

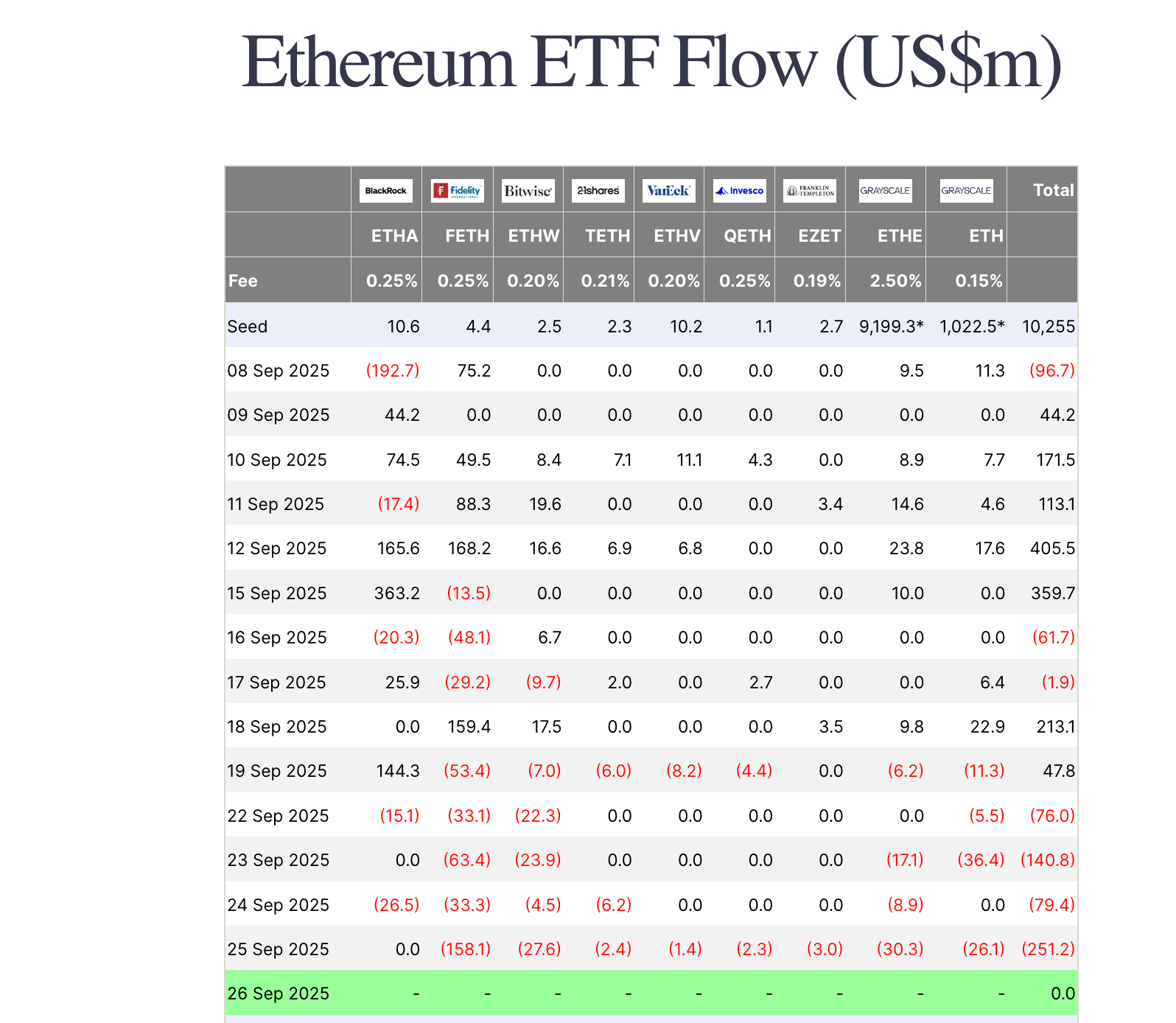

The Ethereum Alternate-Traded Funds (ETFS) recorded important capital outflows between September twenty fourth and twenty fifth.

- September twenty fourth: $79.4 million redemption

- September twenty fifth: $251.2 million withdrawal, marking a sharper promoting

During the last two days of totalling $315 million will lengthen the heavy four-day reimbursement, turning the bullish momentum following the Federal Reserve’s current 25 bps fee minimize. Within the context, the outflow in the beginning of the week totaled $76 million on Monday and $140.8 million on Tuesday.

Among the many notable losses:

- Constancy’s Feth: $63.4 million was drawn in on September twenty third, with extra redemptions the next day.

- Grayscale’s Ethe: $8.9 million was withdrawn on September twenty fourth, and one other $30.3 million was withdrawn on September twenty fifth.

- Bitwise Ethw: $4.5 million redemption on September twenty fourth adopted by $27.6 million on September twenty fifth.

BlackRock’s ETH sell-off makes me really feel uneasy

Binance Sq. Dealer highlighted that BlackRock, the world’s largest asset supervisor, bought Ethereum for the second time in per week. BlackRock’s Ethereum ETF offloaded round $15 million on ETH on September twenty second and one other $26.5 million on September twenty fourth.

Apparently, BlackRock suspended gross sales on Thursday, however Ethereum ETFS noticed a $251 million spill over all the day as different asset managers continued to promote.

ETH costs are below $4,000

The pink waves put strain in the marketplace, and Ethereum briefly slipped to $3,829 early at this time earlier than recovering a bit. Over the identical interval, an Altcoin liquidation of over $870 million was recorded, together with an ETH place of roughly $280 million.

Market consideration has deepened after Fed Chairman Jerome Powell signaled “no rush” for additional rate of interest cuts and altered the constructive results of current coverage strikes. At press time, Ethereum trades almost $3,923.

On-chain knowledge reveals long-term accumulation

Regardless of slowing ETF inflows, there was a unfavourable circulate of $140 million in September in comparison with the plus $3.8 billion in August, and knowledge on the chain makes it a extra constructive image. This week, round 420,000 ETH was withdrawn from the change, pushing the change stability to a nine-year low.

Associated: Ethereum approaches a $4,000 base, and Alternate stability slides to 14.8 million ETH

Coinw Cso Nassar Achkar noticed that this displays a rise within the change to long-term retention amongst institutional buyers. He suggests that enormous holders could also be buying dips and positioning on account of potential provide shocks.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version just isn’t responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.