Market consideration is concentrated on the talk over the US debt ceiling, however much less is mentioned about its potential affect on the cryptocurrency market.

The U.S. Treasury Division’s major working account, the Treasury Basic Account (TGA), has performed a key position in offsetting the Federal Reserve’s quantitative tightening coverage.

Traditionally, the first function of the TGA has been to assist the federal authorities handle funds effectively. However towards the backdrop of the approaching debt ceiling disaster, the accounts have progressively dried up to make sure continued reimbursement of presidency payments.

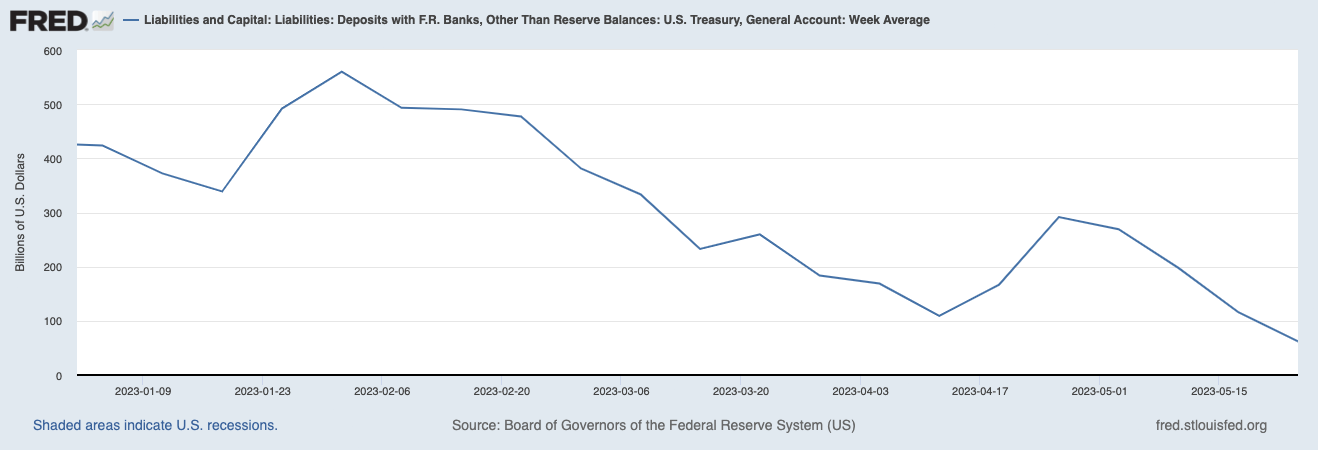

TGA balances fell from about $1.8 trillion in June 2020 to $61.9 billion in Could 2023, a 96% decline. Because the starting of the yr, TGA balances have decreased by greater than 85%.

The Fed’s quantitative tightening coverage goals to scale back the amount of cash in circulation, placing upward stress on rates of interest to curb borrowing exercise. Nevertheless, the TGA outflow offset these tightening measures, successfully injecting liquidity into the market and to some extent counteracting the tightening impact.

The Treasury Division has stated it intends to extend the TGA stability to its goal of $500 billion as soon as the debt ceiling is raised. It wants to lift about $440 billion to attain this. The first methodology of elevating these funds is thru the issuance of treasury payments (T-bills), which is able to inevitably siphon extra liquidity from the market.

In accordance with knowledge supplied by the Ministry of Finance, the common month-to-month treasury invoice issuance over the previous three years has hovered round $220 billion. This means that, given regular issuance volumes, the Treasury might want to ramp up its T-bill issuance over two months to lift the required $440 billion.

Nevertheless, this estimate is topic to vary as the precise schedule relies on varied elements comparable to market demand and financial circumstances. Goldman Sachs believes the Treasury might challenge as much as $700 billion in treasury payments inside six to eight weeks of the debt deal. General, Goldman expects the Treasury Division to provide the market with greater than $1 trillion in treasury payments on a internet foundation this yr.

This T-bill issuance improve might double the quantitative tightening impact and pose a big menace to the monetary and cryptocurrency markets. A contraction within the cash provide might result in a liquidity squeeze that would result in a common decline in asset costs. Analysts at Financial institution of America stated this might have the identical affect on the economic system as a 25 foundation level fee hike.

The affect of this transfer extends into the longer term. Quick-term authorities payments, which generally mature inside one yr, not solely take up a considerable amount of liquidity on the time of issuance, but additionally tie up funds for the lifetime of the invoice. Which means that the affect on market liquidity might be felt for as much as a yr after the issuance improve, assuming the Treasury primarily makes use of 1-year authorities bonds to replenish the TGA.

The cryptocurrency market might expertise a notable downturn as traders’ threat tolerance declines as monetary circumstances tighten.

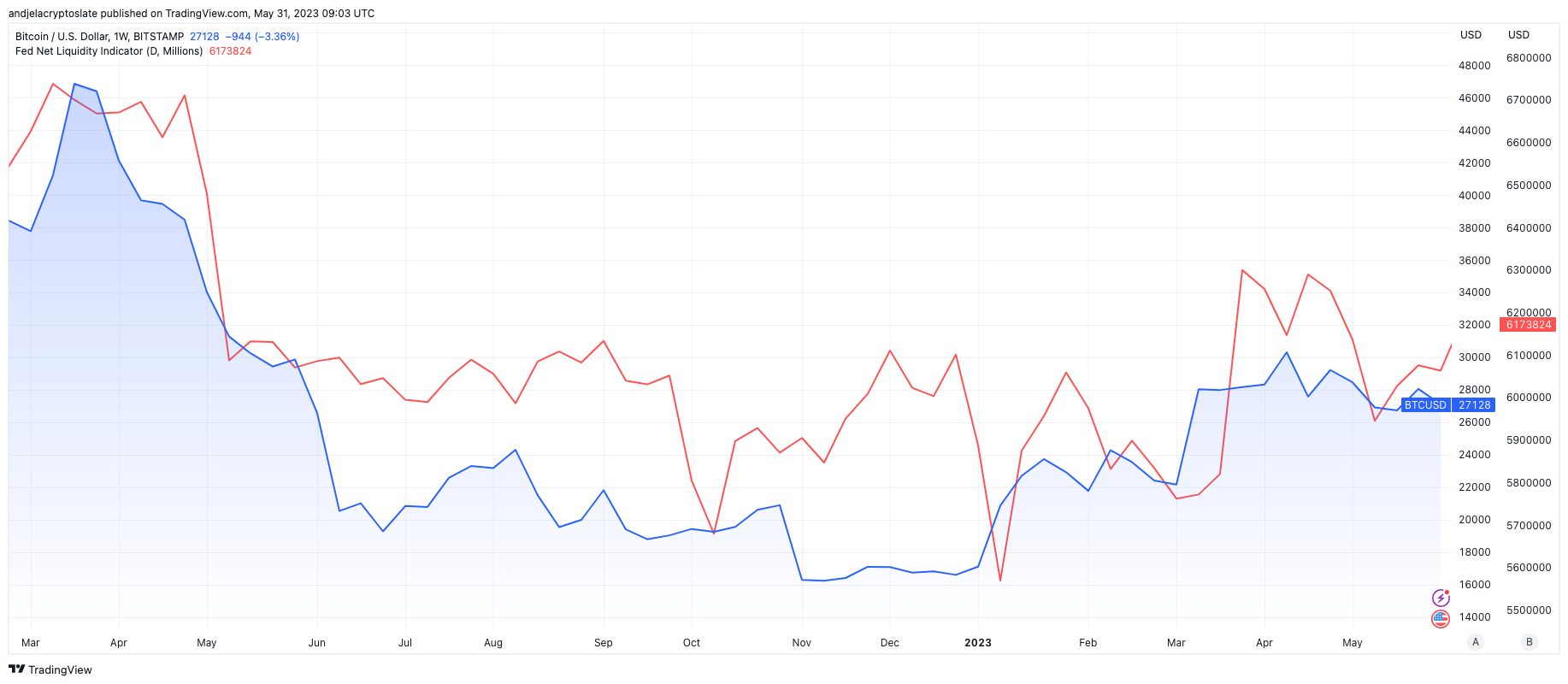

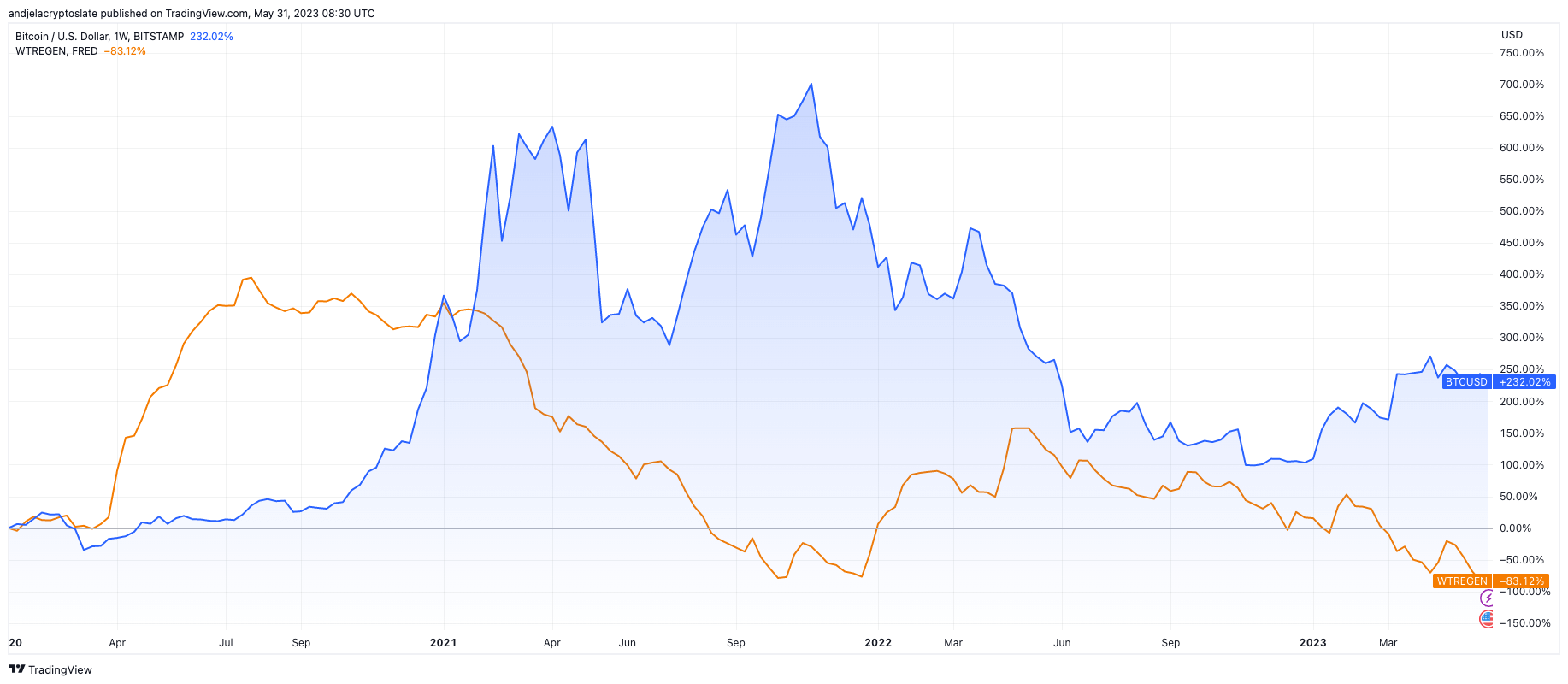

After 2022, Bitcoin is more and more correlated with internet liquidity.a crypto slate A report dated April 22 this yr discovered that a rise within the complete quantity of foreign money obtainable available on the market correlated with a rise within the Bitcoin worth.

Conversely, Bitcoin additionally exhibits an inverse correlation with TGA balances. Since 2020, each improve within the Treasury Basic Account has been correlated with a decline within the Bitcoin worth.

In conclusion, the market is engrossed within the drama of the US debt ceiling debate, however the true story lies within the imminent liquidity disaster. The potential Treasury invoice issuance to replenish TGA balances might considerably tighten market liquidity and drive asset worth declines in each monetary and crypto markets. be. Bitcoin is prone to bounce again and buck the general market pattern, however the short-term affect available on the market might be extreme.

Because the U.S. debt ceiling debate threatens liquidity shortages, the post-crypto markets are bracing for the affect, first showing on currencyjournals.

Comments are closed.