As US regulatory stress continues to weigh on the cryptocurrency trade, a brand new development is starting to take form that can change the dynamics of world demand for Bitcoin.

The U.S. political atmosphere is tightening the regulatory noose across the cryptocurrency and mining sectors, and merchants throughout the border could also be shedding confidence in Bitcoin’s resilience in consequence.

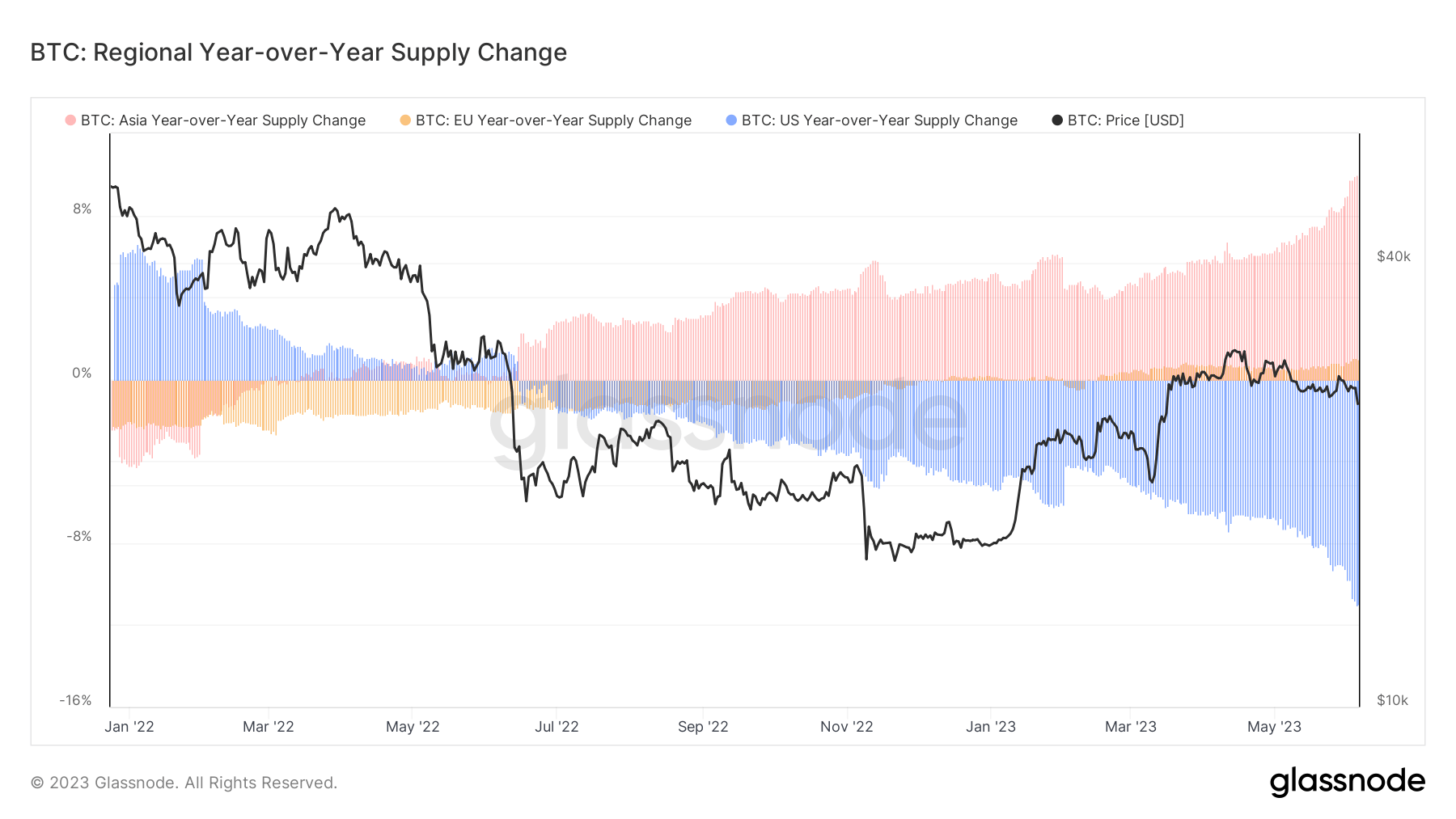

This shift is obvious within the year-over-year (YoY) change in bitcoin provide on Glassnode, which tracks the quantity of bitcoin held by group teams.

Bitcoin provide in the USA has fallen 11% year-over-year since June 2022, in keeping with currencyjournals evaluation.

In distinction, the Asian cryptocurrency market noticed a surge in Bitcoin provide. Companies working throughout Asian buying and selling hours have elevated their bitcoin holdings by 9.9% since June final 12 months, in keeping with Glassnode knowledge, a file excessive.

Asia’s fascination with Bitcoin has raised questions on attainable drivers behind this alteration.

As beforehand reported by currencyjournals, the rising regulatory fever within the US has prompted merchants to maneuver away from Bitcoin and Ethereum and as a substitute look to the perceived security of stablecoins. . This defensive transfer by merchants demonstrates the clear influence that regulation, or its risk, has on the conduct and decision-making of cryptocurrency market members. Potential compliance-related penalties and crackdown dangers can encourage safer investments, generally on the expense of higher-yielding investments.

Whereas U.S. laws solid a shadow over the cryptocurrency market, Asia is witnessing a extra optimistic wave of regulatory change.

As reported by currencyjournals, the Hong Kong Securities and Futures Fee (SFC) might be extra crypto-friendly by granting licenses to greater than eight cryptocurrency firms by the tip of the 12 months and easing regulatory necessities for cryptocurrency exchanges. paved the way in which for the atmosphere.

In response to this versatile change, some cryptocurrency entities resembling CoinEx are strategically leveraging Hong Kong’s crypto-friendly guidelines.

In the meantime, Bitget has pledged to take a position $100 million to strengthen the Web3 ecosystem in Asia. Moreover, rising hypothesis about the potential of a Central Asian nation holding Bitcoin sovereign bonds displays a shift in regional sentiment in direction of Bitcoin.

The article first appeared on currencyjournals after Asian Bitcoin provide surged amid a altering regulatory atmosphere.

(tag translation) bitcoin

Comments are closed.