abstract

The token has been toggling in worth virtually precisely round its each day pivot of 1.12 USDT, suggesting the market is pausing for a revaluation. The background of each day developments stays bearishcosts are trending beneath all main exponential transferring averages. Nonetheless, momentum indicators are extra impartial than constructive, indicating a possible consolidation part reasonably than a pointy collapse. Volatility on the each day chart is reasonable, however intraday measurements present that compressed vary Usually happens earlier than a bigger swing. Broad crypto capitalization rose barely on the day, however sentiment stays in a state of utmost concern, reflecting a cautious angle. Total, members seem like defensive, however not fully surrendered.

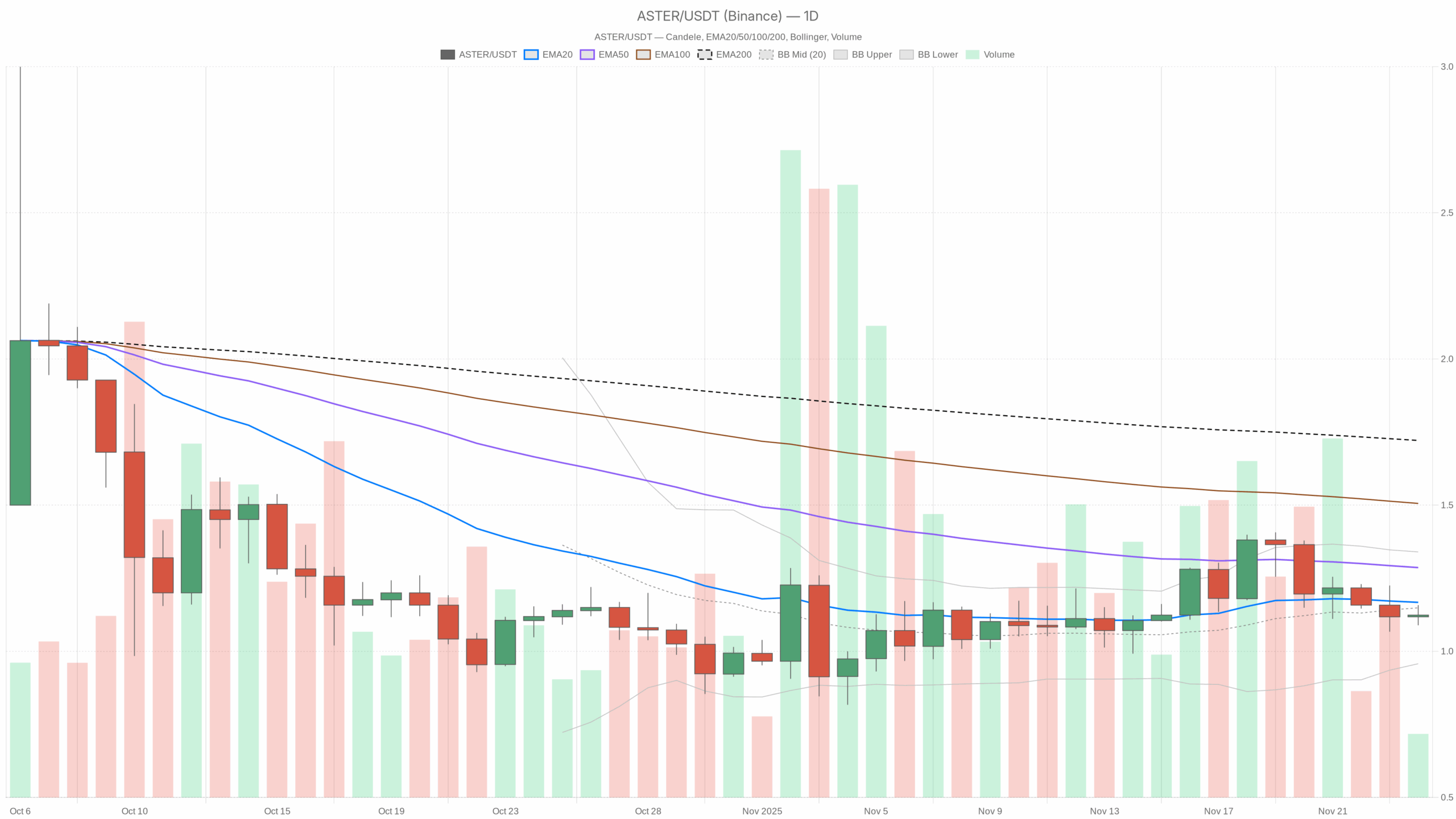

Aster Cryptocurrency: Market Background and Route

The macro setting for digital property is comparatively constructive, with the market capitalization of cryptocurrencies remaining roughly flat. $3.04 trillion It was up about 0.6% previously 24 hours. Moreover, Bitcoin is sort of monopolized 57% This means that capital is being concentrated in probably the most established cash reasonably than actively rotating into altcoins. As such, smaller tokens have a tendency to stay extra susceptible as liquidity is concentrated elsewhere.

index of concern and greed 19 (excessive concern) It provides an vital psychological layer. Traders keep away from threat and take earnings or minimize losses shortly. In distinction to bullish durations, when speculative funds movement into smaller corporations, this background favors capital preservation. That being stated, excessive concern is commonly Late-stage promoting strainIf the worth motion begins to stabilize, as this asset is beginning to transfer round a pivot, it may usher in a medium-term backside.

Technical Perspective: Learn the general setup

On the each day timeframe, the token is buying and selling at 1.12, beneath the 20-day EMA of 1.17, 50-day EMA of 1.29 and 200-day EMA of 1.72. This clear coincidence of EMA above worth Predominant bearish development constructionthe rally remains to be technically towards the development. Medium-term sellers will maintain the higher hand till the worth returns to at the least the shortest transferring common.

The RSI sits slightly below the midpoint at 45.67, indicating neither overbought nor oversold circumstances. This refers to Depletion of downward momentum It matches right into a pause in an ongoing downtrend reasonably than an aggressive promote. This implies that the bears are not as dominant as earlier than, however consumers will not be but expressing robust conviction.

The MACD on the each day chart is barely constructive, with a line of 0 and a sign of -0.01, producing a small constructive histogram of 0.01. This delicate composition suggests one thing tentative. Bullish Momentum Crossover Tryhowever the magnitude is just too small to be a confirmed change. Fairly, it displays a market that’s transferring from pure decline to sideways restoration.

Bollinger bands reinforce this studying. With midband at 1.15 and worth at 1.12, the token is buying and selling slightly below the middle of the 0.96 to 1.34 vary. The gap between the bands just isn’t excessive, indicating no dramatic adjustments. Elevated volatility nonetheless. In consequence, this setup favors continued consolidation with occasional checks in direction of both band reasonably than very short-term runaway developments.

The each day ATR is roughly 0.14, indicating a reasonable each day common motion. This stage of volatility can nonetheless have an effect on over-leveraged positions, however not sufficient to trigger panic. As an alternative, it emphasizes phases comparable to: two-way buying and selling This enables each push buys and brief sells to function round clearly outlined ranges.

Intraday outlook and ASTERUSDT token momentum

On the hourly chart, the worth as soon as once more stays at 1.12, with the 20, 50, and 200 hour EMAs grouped between 1.13 and 1.19. This dense cluster above the worth displays a gradual, continued downtrend through the day, however Flattening of momentum. In the meantime, the RSI for this timeframe is near 48, reflecting the impartial stance seen on the each day chart.

The hourly MACD is nearly flat, with each line and sign close to -0.01 and 0 histogram, confirming the absence of a robust directional push. H1’s Bollinger Band is slender at 1.08 to 1.15, and the ATR is round 0.02, giving off a sign. Suppression of intraday volatility. In consequence, short-term merchants are buying and selling inside compressed ranges, usually transferring up or down as new catalysts emerge, forward of a extra definitive breakout.

The same state of affairs will be seen on the 15-minute chart. The worth is hovering round 1.12, the EMAs are virtually overlapping, and the regime is labeled as impartial. This helps the concept there is no such thing as a clear intraday edge past vary buying and selling and the market takes a breather after an earlier decline.

Key ranges and market reactions

From a tactical perspective, the 1.12 Each day Pivot is the central battleground. So long as costs fluctuate round this stage, merchants are more likely to deal with the setting as a short-term vary. Motion in direction of the primary close by resistance space 1.16 Take a look at whether or not the vendor is ready to guard the closest oblique provide. A sustained break above this might open room for the Bollinger midband round 1.15-1.17 and the following 20-day EMA.

On the draw back, the closest help band is situated close to the primary help pivot, slightly below 1.10. 1.09. A transparent rejection from this zone would help push-buying curiosity and help the case for continued consolidation. Conversely, a decisive shut beneath 1.09, particularly with a rise in ATR and RSI beneath 40, can be a sign. new bearish strain And it’s more likely to drag the token to the decrease aspect of the Bollinger band round 0.96.

Future situations and funding outlook

Total, the stability of proof signifies that the downward development is predominant and is making an attempt to stabilize reasonably than reverse. The mixture of a bearish EMA stack, impartial RSI, and subdued MACD suggests {that a} development change just isn’t but confirmed, however is in a base-building or pause part. With total crypto sentiment in excessive concern, with Bitcoin garnering probably the most consideration, the asset may proceed to lag till threat urge for food improves.

For buyers, this background requires endurance and selectivity. Pattern followers are in all probability ready Clear development affirmationrepeatedly surpassing the 20-day EMA whereas gaining momentum. However, vary merchants might discover alternatives by sustaining strict threat administration and counting on the 1.09-1.16 band in case volatility instantly widens. Till broader sentiment adjustments and the technicals align extra constructively, the trail of least resistance is more likely to be a gradual downtrend, punctuated by short-term pullbacks reasonably than sustained positive factors.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making any funding choices.