- Aster has consolidated above key helps, suggesting the opportunity of a gradual bullish restoration.

- Futures stability displays a return to dealer confidence and reasonable leverage accumulation.

- Continued spot outflows point out that traders stay cautious regardless of steady costs.

The ASTER market continues to indicate indicators of stabilizing after weeks of volatility as merchants cautiously reposition their positions. The token is buying and selling close to $1.11, above the short-term help space and sustaining a neutral-to-bullish bias.

Regardless of latest promoting strain, technical indicators counsel that patrons are steadily regaining management, supported by steady futures participation and reasonable volatility. In consequence, the market seems to be getting into a restoration section, however a decisive breakout remains to be wanted to substantiate the subsequent course.

Technical construction reveals managed restoration

The ASTER/USD 4-hour chart reveals a consolidated construction with a 20-period EMA offering constant and dynamic help at $1.103. This shifting common has absorbed the latest decline, highlighting continued shopping for curiosity close to the decrease certain. Moreover, the Bollinger Bands stay reasonably slender, indicating diminished volatility as merchants await a possible breakout.

Resistance stays close to $1.146 to $1.148, coinciding with the 61.8% Fibonacci retracement zone. A detailed above this stage might strengthen the bullish momentum and pave the best way for the 78.6% retracement of the $1.198-$1.20 space.

Nevertheless, if the value can’t break above the $1.15 barrier, the present correction section could also be prolonged. On the draw back, help lies close to $1.05 and $0.93, and additional decline might take a look at $0.82. Due to this fact, preserving the value above the EMA-9 stays essential to take care of bullish sentiment.

Futures information displays gradual restoration in confidence

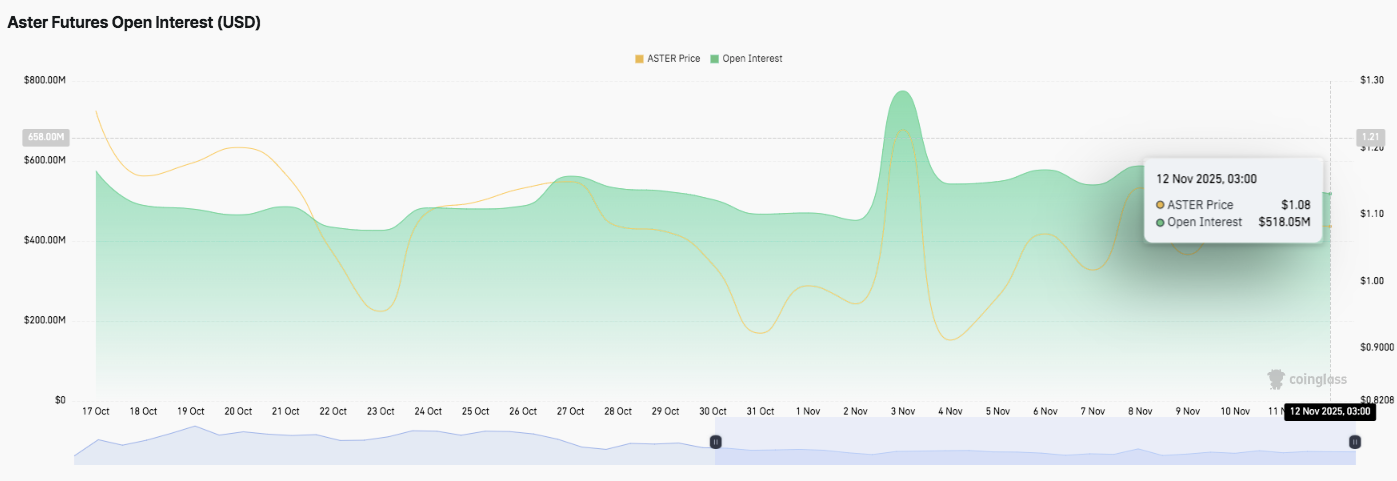

Aster Futures information suggests a cautious return to the market with leverage. Over the previous month, open curiosity has fluctuated between $400 million and $800 million. After peaking at over $750 million in early November, it stabilized at round $518 million by November twelfth.

This era coincided with Aster’s restoration from $1.03 to $1.08, reflecting reasonable optimism amongst merchants. Moreover, earlier spikes in open curiosity coincided with sharp worth actions, which have been an indication of speculative exercise. Nevertheless, the present stability alerts a resumption of market engagement with out extreme leverage and should help more healthy worth actions going ahead.

Spot netflow sign residual warning

Regardless of the development in futures sentiment, spot market information reveals continued outflows. On November twelfth, Aster traded round $1.12, with roughly $997,000 leaving the trade.

This persistent development highlights investor vigilance as many individuals e book earnings or scale back publicity. In consequence, ongoing capital outflows might restrict upside momentum within the close to time period except new demand emerges to soak up the promoting strain.

Aster Value’s Technical Outlook

Key ranges stay properly outlined heading into mid-November.

Upside worth targets embrace fast hurdles of $1.146, $1.17, and $1.198. A decisive transfer above $1.20 might lengthen to $1.25-$1.27, confirming near-term bullish momentum.

On the draw back, key helps lie at $1.05 and $0.93, with a break beneath $0.82 doubtless exposing extra critical draw back dangers. The 20-period EMA close to $1.103 continues to behave as dynamic help, dampening any pullbacks and sustaining regular shopping for curiosity.

Technical circumstances counsel that ASTER is stabilizing in a slender vary above short-term help. The Bollinger Bands stay reasonably tight, indicating declining volatility, however indicating the potential for widening if worth breaks by a key stage. Historic worth actions and up to date open curiosity information counsel that leverage has risen reasonably, indicating cautious however enthusiastic dealer exercise.

Associated: CZ’s “Purchase Tops” Reminder Seems, Aster Falls 14% to Assist at $0.90

Will Aster attain new highs?

Aster’s near-term course will rely on whether or not patrons can maintain the $1.103-$1.116 vary lengthy sufficient to problem the $1.146-$1.148 resistance cluster. If the upward momentum strengthens, ASTER might retest $1.198-$1.20 and transfer in the direction of $1.25. Nevertheless, continued spot outflows and declining liquidity counsel that failure to take care of EMA help might set off a fall beneath $1.05.

For now, ASTER stays within the essential consolidation zone. Whereas the short-term narrative suggests cautious optimism, confidence flows and technical help will decide whether or not the subsequent transfer favors the bulls or bears.

Associated: Astor drops after Binance founder’s tweet, ‘anti-CZ whale’ earns practically $100 million

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.