- AVAX assessments an early bullish sign because it approaches key resistance whereas holding the important thing EMA.

- Curiosity in futures has remained regular, indicating that merchants stay engaged regardless of decreased leverage.

- Reasonable spot inflows counsel early accumulation, however stronger shopping for is required to realize momentum.

Avalanche begins the week with a cautious pullback as merchants assess whether or not the current rally represents a significant change or one other short-lived restoration. AVAX is buying and selling simply above $14, with the market expecting indicators of continued energy after months of promoting. The asset has fashioned a base close to $12.52 in current trades, and patrons want to construct on that base.

Key expertise ranges form short-term outlook

AVAX has recovered the 20-EMA, 50-EMA, and 100-EMA in the previous few days. Whereas this means early bullish intent, the general pattern remains to be cautious.

The 200-EMA close to $15.19 stays the primary main ceiling. Moreover, the value is presently buying and selling close to the 23.6% Fibonacci retracement stage of $14.54, posing a right away barrier for patrons.

Above $14.54, a path to stronger resistance round $15.79 might turn into clearer, the place the 38.2% Fibonacci stage coincides with the descending EMA cluster. This zone types an essential determination space, as a rise in momentum is confirmed past this zone.

If the energy continues, merchants will observe deeper retracement ranges at $16.81, $17.82, and $19.26. Every of those ranges should flip into assist for the medium-term construction to shift upward.

Associated: Chainlink Value Prediction: LINK Makes an attempt Brief-Time period Restoration…

Nevertheless, if AVAX loses momentum, assist stays at $14.12 and $13.94. A break under $13.94 might pave the best way for a return to the cycle low of $12.52.

Futures participation stays sturdy in December

Open curiosity gives helpful context. Futures charges have risen from a low of round $300 million in the beginning of the yr to a peak of greater than $1.7 billion. This reveals that merchants stay engaged regardless of elevated worth volatility.

Moreover, the most recent studying of practically $548.56 million signifies decrease leverage after the October unwind. Participation stays above mid-year ranges, suggesting merchants favor cautious positioning fairly than exiting utterly.

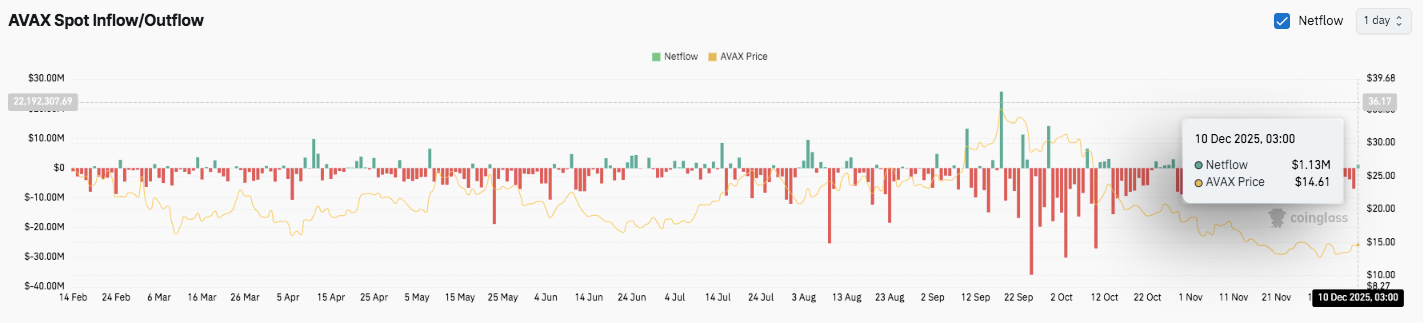

Spot stream tendencies counsel gradual accumulation

AVAX spot flows present steady outflows all through many of the yr. These outflows intensified from late September to mid-November, coinciding with a gradual decline in costs.

Nevertheless, web flows turned barely optimistic round December 10, at $1.13 million. This shift signifies preliminary accumulation, however inflows might want to persistently strengthen to vary momentum.

Avalanche (AVAX) worth technical outlook

Because the Avalanche nears a pivotal level in its near-term restoration, essential ranges stay clearly outlined.

The upside stage consists of quick hurdles at $14.54, $15.19, and $15.79. A breakout above this cluster might lengthen in the direction of $16.81 and $17.82 within the subsequent session.

Downward ranges embrace assist at $14.12, then $13.94, and cycle lows at $12.52. The 200-day EMA close to $15.19 stands out because the higher finish of medium-term resistance that AVAX must reverse to shift momentum right into a bullish construction.

The technical image reveals that AVAX is trying to rise from a broad corrective base whereas buying and selling inside a tightening construction fashioned by clustered EMAs and a shallow Fibonacci retracement. This compression suggests {that a} definitive breakout might trigger volatility to broaden in both course.

Will the avalanche get well additional?

AVAX’s near-term course will rely upon whether or not patrons can maintain the $14.12-$13.94 assist band lengthy sufficient to problem the $15.19-$15.79 resistance zone. A confirmed break and retest of this space might pave the best way to $16.81, whereas stronger inflows might pave the best way to $17.82.

Historic conduct relating to deep retracement ranges and rising open curiosity means that dealer engagement will improve in the direction of the top of the yr. If the bullish momentum strengthens, AVAX might revisit the $19.26 space, the place a deeper structural reversal might start.

Associated: Zcash Value Prediction: Bulls Check Main Fib Stage as Assist for Spot Inflows…

Nevertheless, if we fail to guard the $13.94 stage, there’s a threat that AVAX will revert to its accumulation base of $12.52. A breakdown would reset the present restoration and strengthen the broader downtrend.

For now, AVAX is buying and selling in an important space. Stronger capital inflows, steady futures markets, and bettering near-term momentum proceed to assist cautious optimism. Nevertheless, market confidence and technical affirmation stay important for the subsequent important transfer.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.