- Bellachin surged 12% to $4.71, however fell to $3.85 on account of bear management.

- Relative Power Index (RSI), ADX, and MACD Sign Bearish Momentum.

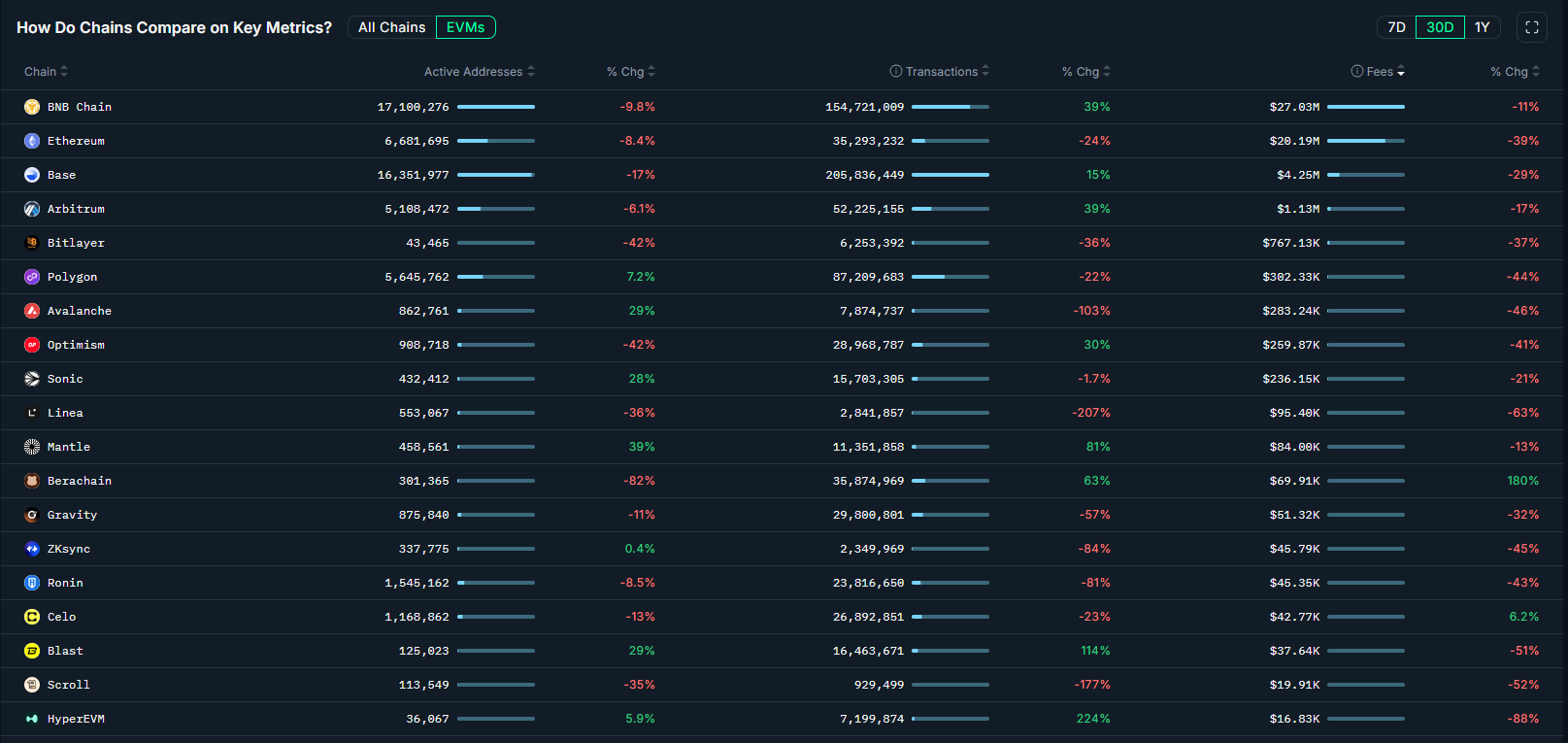

- Belachine Community revenues have risen 180% over the previous month regardless of costs falling 33% over the identical interval.

Berachain Worth appeared right now at over 12%, reaching its daytime excessive of $4.71, however returned to about $3.85 on press on April 10, 2025.

The brief rally has introduced faint hope for traders after a brutal 52.9% decline of 52.9% over the previous two weeks.

The token has returned to the bear channel on the 4 hour chart.

Particularly, there are technical indicators that warn the bears additional downwards, masking up the community’s spectacular 450% income surge.

Technical indicator flash warning signal

The 4-hour chart Bellachine’s relative power index (RSI) has lately dropped to an astonishing 16.97, signaling excessive overselling situations.

It bounced again over the realm the place it was offered, however the bullish momentum has been shortened and now sits at about 42. In different phrases, the bear remains to be underneath management.

The Directional Movement Index (DMI) exhibits an ADX of 46.7, reflecting a really robust bearish pattern.

Sellers preserve chokeholds with DMI measurements of fifty (+di) and 16.9 (-DI) with little room for bullish intervention.

MACD has remained beneath zero regardless of seeing a crossover, highlighting a sustained destructive momentum.

Moreover, the enlargement of the Bollinger band at a present 86% width suggests an escalation of volatility that would trigger technical bounces and sharper drops.

Berachain Community’s progress conflicts with worth points

In line with Nansen information, the Bellachine ecosystem has grown sharply in current weeks.

Community charge revenues rose sharply from 180% to $69,910 within the month of the month, however on the similar time, buying and selling quantity rose 63%.

Particularly, this progress exhibits a rise in engagement or higher common exercise per consumer within the community, regardless of an 82% lower in lively addresses.

The Berachain ecosystem noticed explosive progress, with community toll revenues rising 180% in a month to 69.91k, and transactions rose 63% regardless of an 82% drop in lively addresses over the identical interval.

Particularly, MEV-related operations account for 34.97% of charges, whereas core protocols and native Dex BEX contribute 18.64% and 17.38%, respectively.

Apparently, this surge in exercise is in stark distinction to a 37.9% weekly loss in tokens and a 62.44% drop from a February all-time excessive of $14.99.

Essential Bella worth ranges to see amid bear stress

Merchants will earn $3.06 for speedy assist and $2.71 as the ultimate line of protection if gross sales are strengthened.

The $3.74 pivot level stays the essential threshold for reversal affirmation.

Additionally, resistance of $4.44 and $4.78 is looming as a formidable barrier to restoration.

Presently, low liquidity of 58.43% amplifies the chance of sudden worth fluctuations, permitting merchants to attend for RSI divergence and quantity spikes earlier than trying counter-trend buying and selling.

Bears Over Energy Bulls first appeared in Coinjournal, making Bellachine’s restoration shorter after worth restoration.