Based on a press release emailed to currencyjournals, Binance is citing declining liquidity within the Australian greenback (AUD) pair as the explanation for the discounted buying and selling of Bitcoin (BTC) and different digital belongings on its Australian platform.

The change added:

“We plan to delist the remaining AUD pairs according to the closure of our fiat offramp service. We stay centered on securing additional fiat relationships to serve our customers. enhance.”

Bitcoin, others are traded at discounted costs

In the meantime, a number of Australian crypto merchants Recognized Large arbitrage alternatives by reductions.

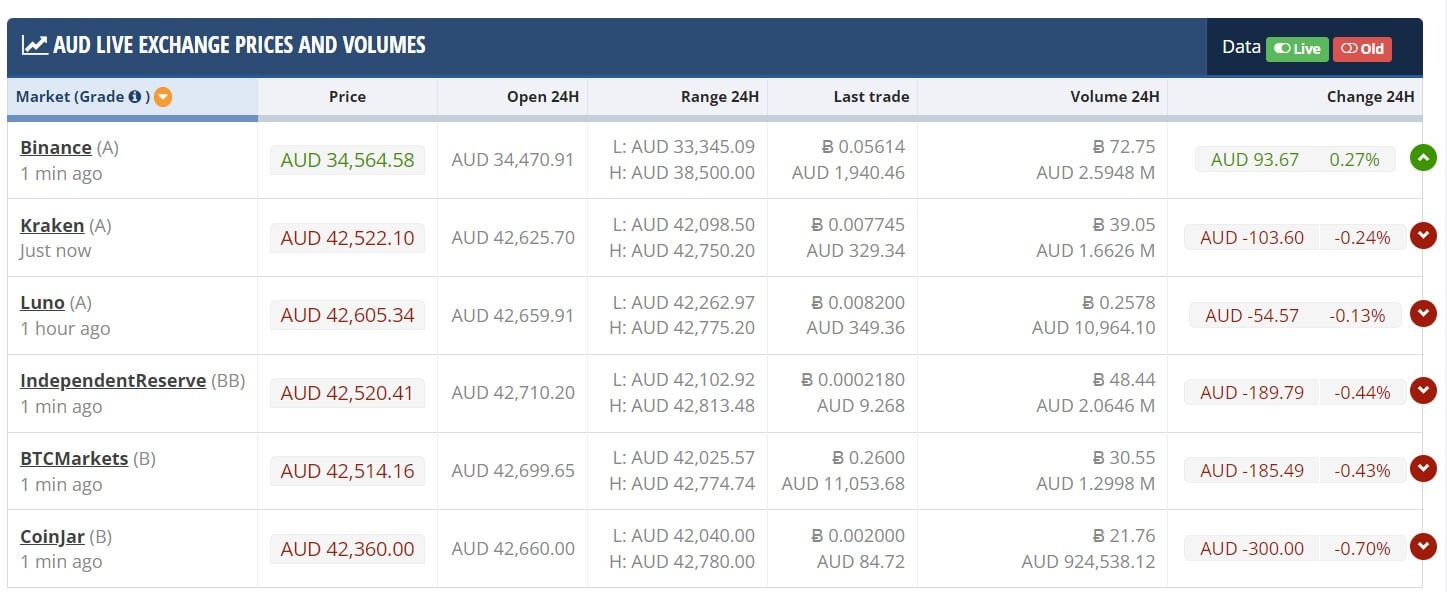

The flagship digital asset was buying and selling at AU$34,250 (US$22,345) on Binance Australia on the time of writing, in response to CryptoComapre knowledge. That is considerably decrease than what’s being traded on different exchanges corresponding to IndependentReserve, Luno and Kraken, buying and selling at over AU$42,000 (US$27,401).

Reductions are additionally evident in different digital belongings corresponding to Ethereum (ETH).Ether is traded at 2,375 AUD on Binance Australia (Expired) $2,900 AUD on competing exchanges, in response to CryptoCompare knowledge.

Binance Australia’s banking woes

Binance Australia introduced on Might 18 that it was unable to course of customers’ Australian greenback (AUD) deposits as a result of third-party fee service supplier Cascal had stopped serving the corporate. On the identical day, Australia’s oldest financial institution Westpac banned cryptocurrency buying and selling with nameless exchanges.

In response to those points, Binance Australia has begun phasing out bodily buying and selling exercise with the Australian greenback by customers. The change introduced on Might 26 that it’s going to droop Bitcoin spot buying and selling exercise with fiat currencies on June 1.

In the meantime, the change claimed that customers may proceed buying and selling the affected belongings on different buying and selling pairs throughout the platform.

Binance Australia’s submit alleging Bitcoin low cost is because of declining Australian greenback liquidity, first appeared on currencyjournals.

(Tag Translation) Bitcoin

Comments are closed.