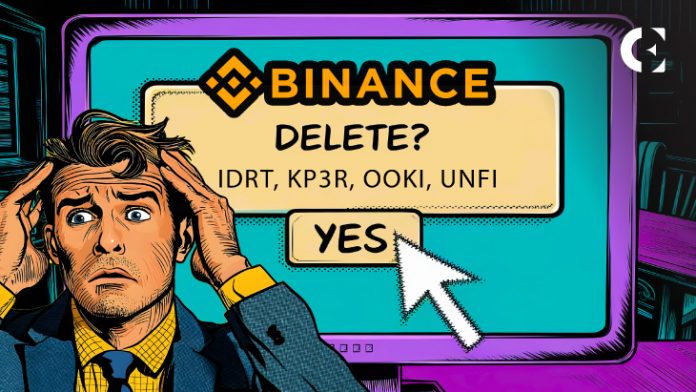

- Binance plans to delist IDRT, KP3R, OOKI, and UNFI after a radical investigation of the underperforming tokens.

- A number of buying and selling pairs and Binance providers are affected, together with margin buying and selling and spot buying and selling bots.

- Customers are suggested to shut positions and handle their holdings earlier than main expirations to keep away from losses.

Binance, the world's largest cryptocurrency trade, will delist a number of tokens together with Rupiah Token (IDRT), Keep3rV1 (KP3R), Ooki Protocol (OOKI), and Unifi Protocol DAO (UNFI). Buying and selling in these tokens will finish on November 6, 2024, after Binance commonly critiques the property to make sure they meet platform efficiency and regulatory requirements.

As a part of this evaluate, Binance will take away the ALGO/FDUSD, CHR/ETH, DGB/BTC, and GMX/BTC buying and selling pairs beginning Friday, October twenty fifth as a consequence of low liquidity and buying and selling volumes.

Binance plans to additional delist the next buying and selling pairs by November sixth: KP3R/USDT, OOKI/USDT, UNFI/BTC, UNFI/TRY, UNFI/USDT, and USDT/IDRT.

To keep away from confusion, customers ought to shut open orders and handle their positions earlier than the delisting date. As soon as the token is eliminated, all energetic orders will probably be routinely canceled.

Binance Delisting Course of: A Detailed Evaluate After Preliminary Itemizing

Binance's determination to delist these tokens displays the corporate's day by day observe of reviewing listed property that now not meet the platform's requirements.

The evaluate course of evaluates varied components corresponding to buying and selling quantity, liquidity, and community stability. Different concerns embrace workforce dedication, regulatory compliance, and proof of unethical or negligent conduct.

Whereas a token could initially meet the itemizing standards, Binance will periodically monitor the token's efficiency to make sure continued compliance. Within the occasion of points corresponding to lowered liquidity or regulatory challenges, Binance could take steps to delist underperforming property to keep up a wholesome and sustainable buying and selling setting.

Vital deadlines and subsequent steps for affected customers

Binance has outlined key dates and countermeasures for customers affected by the delisting. For these concerned in margin buying and selling, particular person and cross-margin providers for KP3R, OOKI, and UNFI will finish at 06:00 UTC on October 31, 2024. Customers should repay the mortgage and transfer the affected property to their Spot pockets by this date to keep away from automated settlement.

Binance Futures will terminate all UNFI-related contracts at 09:00 UTC on October 30, 2024, with automated settlement scheduled. No new positions might be opened after 08:30 UTC on that day.

Deposits of delisted tokens will probably be suspended after November 7, 2024, and withdrawals will probably be stopped on February 6, 2025. If relevant, Binance could convert delisted tokens into stablecoins after February 7, 2025, however this isn’t assured.

Along with buying and selling, the delisting will have an effect on varied Binance providers corresponding to Easy Earn, Auto-Make investments, and Binance Present Playing cards. Customers have till November 6, 2024 to evaluate their holdings and take away any energetic plans or positions associated to the affected tokens.

These token sale-only options will probably be accessible by Binance Convert from November 1, 2024 to November 6, 2024. All buying and selling pairs of the delisted token will then be completely faraway from Binance.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be chargeable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.