- Reuters reported that the corporate has made numerous layoffs.

- The SEC additionally sought to freeze the property of Binance.US, however the courtroom refused.

The US SEC filed a lawsuit final week in opposition to cryptocurrency big Binance.US for allegedly violating federal securities legal guidelines, Reuters experiences.

No less than 50 staff at Binance US have misplaced their jobs for the reason that lawsuit was filed, Reuters reported, citing sources. The corporate has additionally laid off staff in its authorized, compliance and threat departments, folks aware of the matter mentioned. The supply requested anonymity as that is confidential.

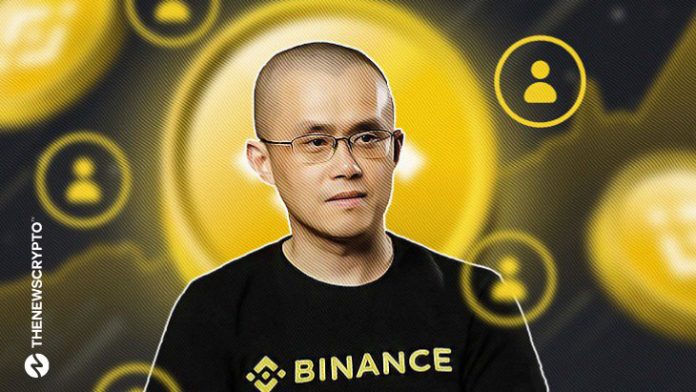

The Securities and Trade Fee (SEC) on June 5 accused Binance and its CEO Changpeng Chao of partaking in a “net of deception” to avoid securities rules. Nevertheless, Binance promised to “strongly” defend itself.

The SEC additionally requested the courtroom to freeze Binance’s U.S. property. However the courtroom mentioned earlier this week {that a} settlement between the events could be of their finest curiosity.

Robinhood prone to revenue

It has additionally lately emerged that numerous retail crypto merchants are migrating from cryptocurrency change Coinbase to Robinhood. Mizuho Securities analyst Dan Dreb argues that Coinbase could also be shedding out to Robinhood when it comes to cryptocurrency retail buying and selling quantity.

Dref argued that growing retail transaction charges for Coinbase’s low-value merchandise and the SEC’s response to cryptocurrencies weren’t the one explanations for the decline.

Coinbase (COIN) shares fell 5.5% on Thursday, following the lead of different crypto-related corporations. Nevertheless, the preliminary decline narrowed, and the inventory remained at a considerably steady degree. Regardless of this, Coinbase’s inventory worth is up about 50% by 2023.

Really useful for you:

Courtroom orders Do Kwon’s extradition to South Korea after bail approval

Comments are closed.