The SEC lawsuits towards Binance and Coinbase have induced a transparent shift available in the market, leading to vital adjustments within the trade’s asset steadiness.

The lawsuits, filed on June 5 and June 6, accuse Binance and Coinbase of violating numerous securities legal guidelines. These lawsuits have created a domino impact within the authorized area, inflicting adjustments within the trade’s market efficiency, resembling Coinbase’s share value volatility and Binance’s market share decline.

Bitcoin’s value plunged on June sixth, reflecting the response of the broader cryptocurrency trade. Regardless of this sudden downturn, BTC managed to bounce again, exhibiting the sector’s inherent resilience.

One other impact of the lawsuit is the change within the trade’s asset steadiness. Evaluating withdrawals of main belongings (Bitcoin, Ethereum, stablecoins) will assist assess the general impression of those lawsuits in the marketplace.

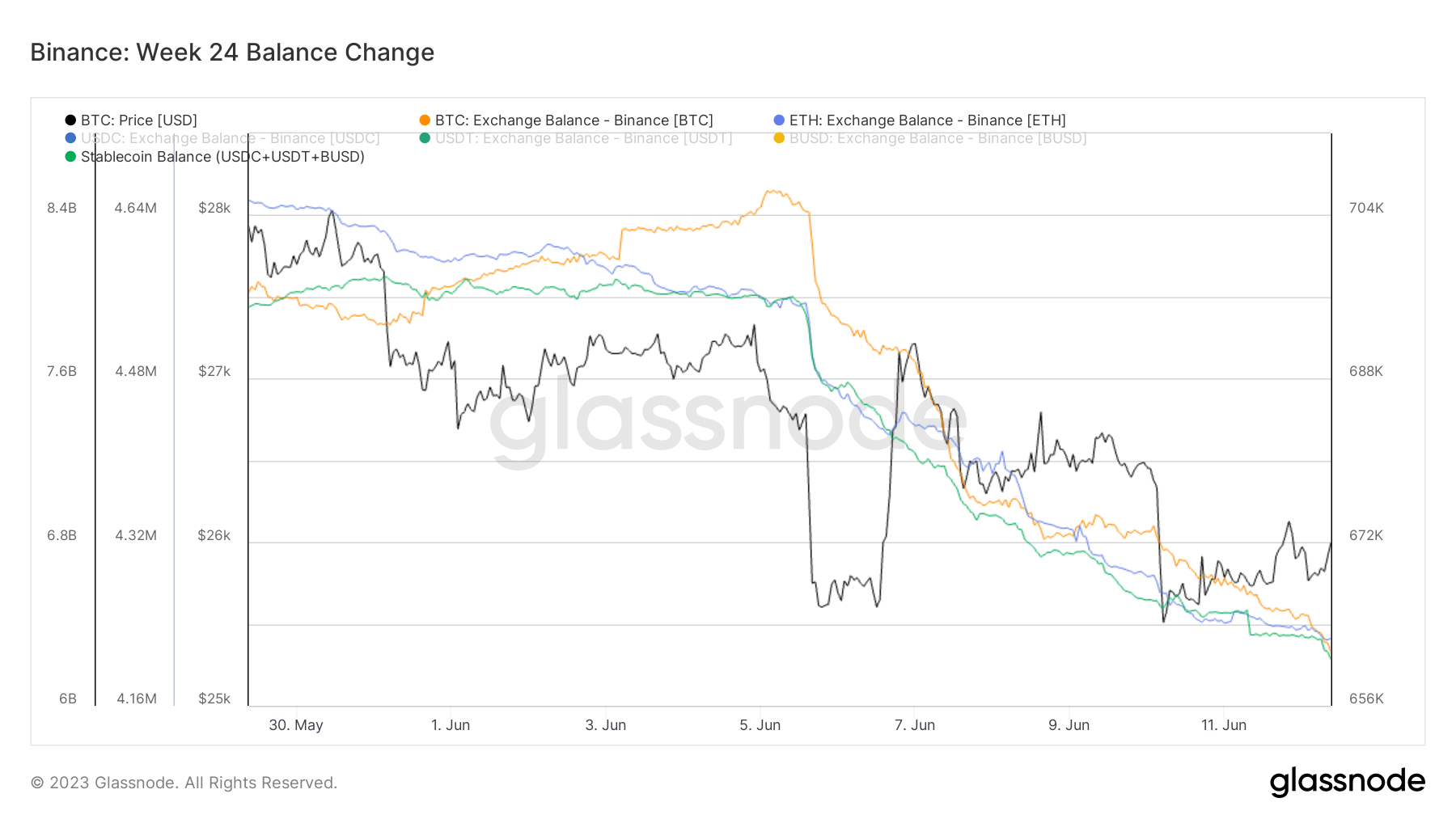

Glassnode information reveals a big exodus of belongings from Binance after the SEC lawsuit. About 20.9% of the whole steadiness of USDT, USDC and BUSD on Binance, or about $1.6 billion, was withdrawn by customers. Equally, Binance’s Bitcoin and Ethereum reserves fell by 5.7% and seven.1% respectively.

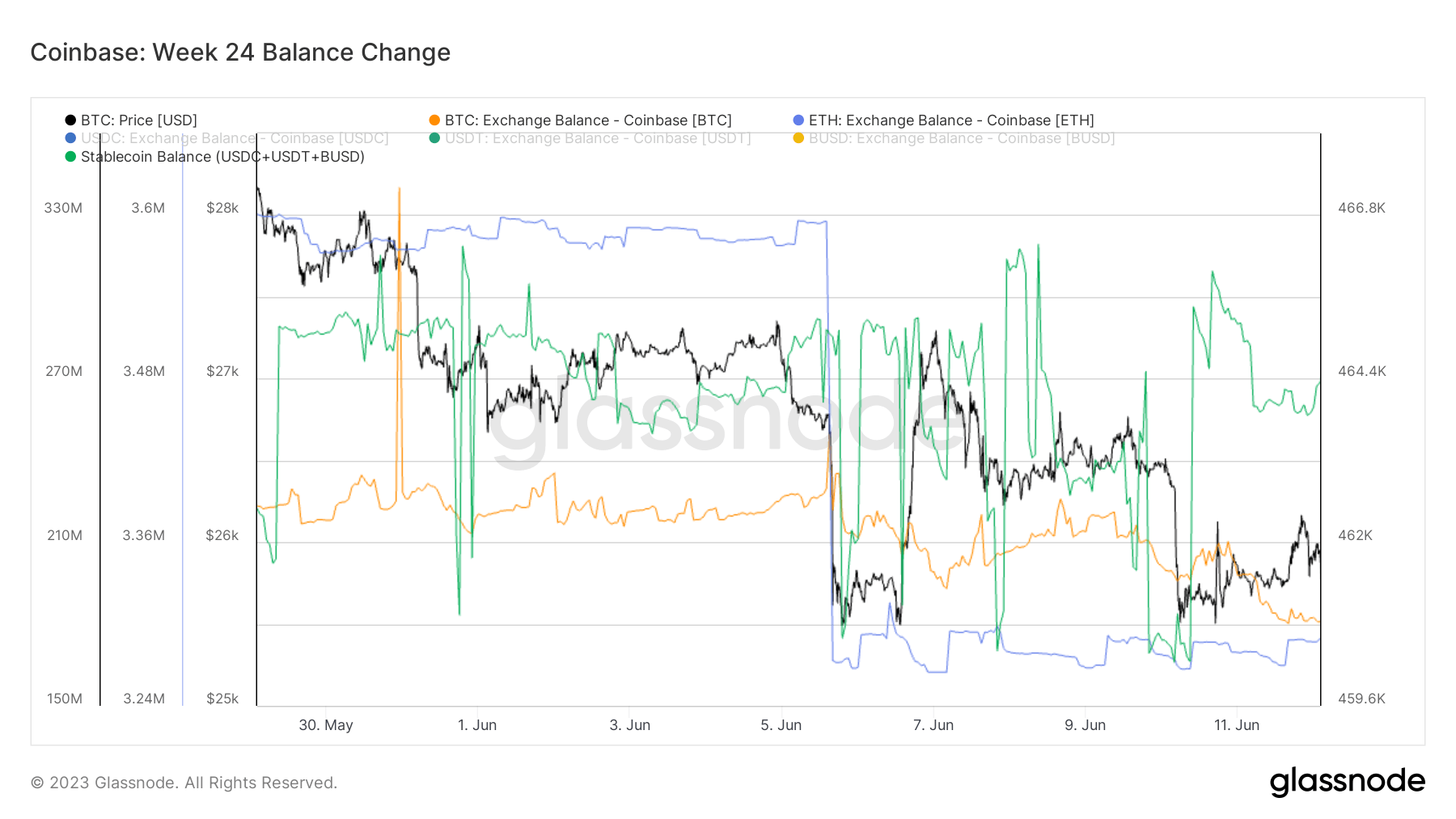

Coinbase stablecoin balances, in the meantime, remained comparatively secure from June 5 to June 12, with bitcoin balances down barely by 0.5%.

Nonetheless, Ethereum suffered a good larger blow, with an enormous withdrawal of 291,000 ETH, about 8% of Coinbase’s whole ETH steadiness.

This discrepancy in withdrawals between exchanges could be attributed to a number of elements. The bigger outflow of Ethereum from Coinbase doubtless stems from regulatory uncertainty surrounding the corporate’s Earn product, which affords staking companies for numerous cryptocurrencies, together with ETH, with many buyers being pressured to promote.

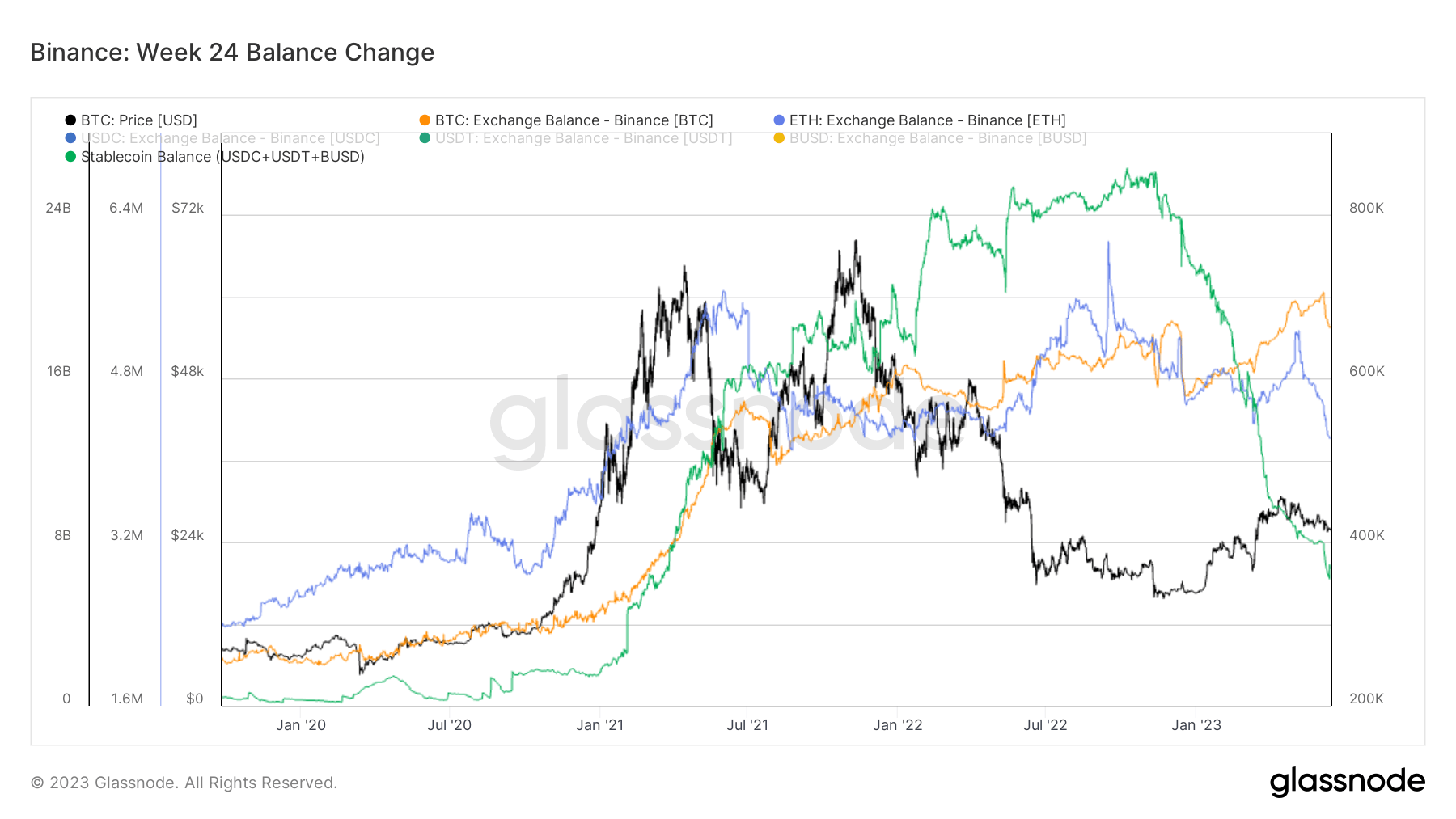

The huge withdrawal of stablecoins from Binance continues a pattern that started in October 2022. Since then, the Binance trade has recorded a 75% decline in stablecoin balances.

This pattern additional escalated in February 2023, when the SEC issued a Wells Discover to Paxos concerning the issuance of Binance-backed BUSD. Paxos stopped minting new BUSD and went into redemption-only mode, permitting customers to transform BUSD to USDP.

As probably the most liquid trade, Binance has historically held a considerable amount of stablecoins. Nonetheless, ongoing regulatory turmoil and issues over potential withdrawal limits might have prompted customers to maneuver their belongings elsewhere.

This text, “Binance vs. Coinbase: Evaluation of asset withdrawals after SEC litigation” was first revealed on currencyjournals.

Comments are closed.