Due to Binance's Zero Transaction Charges program, the First Digital USD (FDUSD) stablecoin has overtaken Circle Issued USD Coin (USDC) to change into Bitcoin's second hottest pair over the previous 5 months.

CCData's newest stablecoin report reveals that FDUSD buying and selling quantity on centralized exchanges (primarily Binance) has elevated considerably, pushing its market capitalization to an all-time excessive.

Stablecoin buying and selling quantity elevated 51.1% to $122 billion in January, making it the second hottest buying and selling pair after Tether’s USDT.

General stablecoin buying and selling quantity on centralized exchanges elevated by 4.54% to $1.05 trillion in January, the best stage since December 2021.

Rise of FDUSD

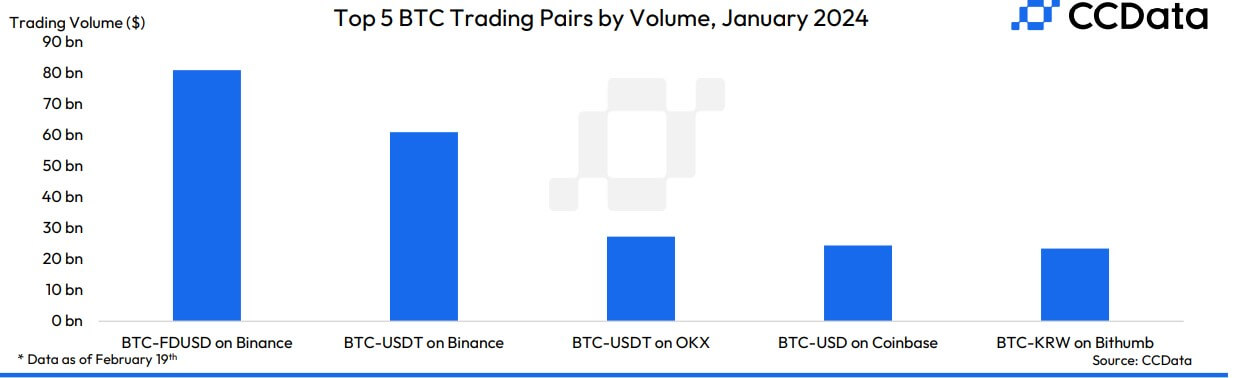

In keeping with the report, after the approval of spot Bitcoin ETF within the US, Binance's BTC/FDUSD pair accounted for almost all of buying and selling quantity as probably the most traded Bitcoin pair on the alternate.

The pair recorded a month-to-month buying and selling quantity of $80.8 billion in January, adopted by Binance's BTC/USDT pair, which had a buying and selling quantity of round $60 billion throughout the identical interval.

FDUSD's market capitalization elevated by about 13% to a report excessive of $2.44 billion, giving it a stablecoin market share of 15.6%.

FDUSD has emerged as one of the crucial in style stablecoins in latest months, because of Binance's huge promotion of the digital asset.

Within the wake of Binance USD (BUSD) regulatory battles, the cryptocurrency alternate has a number of new merchandise designed to encourage customers to pivot to FDUSD and encourage using stablecoins on its platform. has been launched.

USDT remains to be the king

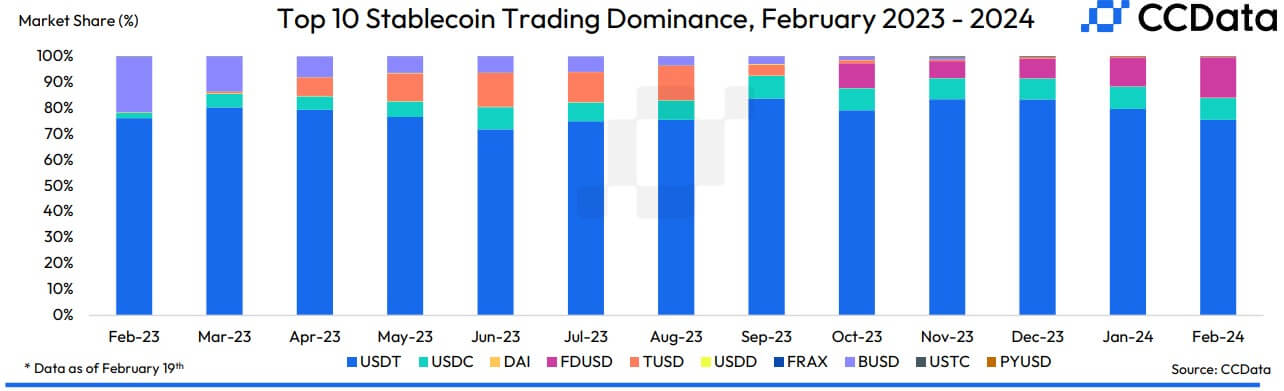

Tether’s USDT stays the dominant stablecoin within the area by a large margin regardless of the rise in FDUSD, controlling about three-quarters of the market share of the highest 10 stablecoins.

High 10 Stablecoin Dominance (Supply: CCData) Stablecoins stay probably the most dominant buying and selling pair on centralized exchanges, with a cumulative month-to-month buying and selling quantity of $241 billion.

USDT’s market capitalization rose 1.23% in February and now stands at $97.3 billion, marking the best circulating provide of stablecoins ever. In the meantime, the market energy of stablecoins was 70.6% as of February twentieth.

JPMorgan analysts not too long ago warned that USDT's dominance within the cryptocurrency sector might be detrimental to the trade, a declare vehemently rejected by Tether CEO Paolo Ardoino.

Comments are closed.