- Indian cryptocurrency alternate Bitbns has a market share of 79.1%.

- Bitbns is suspected of inflating buying and selling volumes to keep up its dominant place available in the market, however this has not but been confirmed.

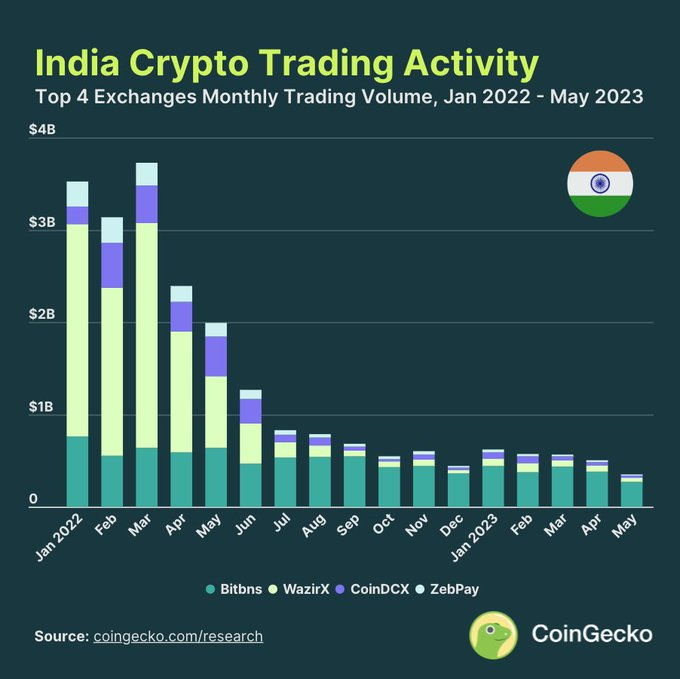

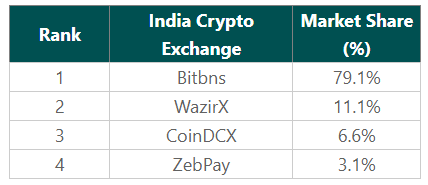

In a current survey carried out by CoinGecko, India’s main cryptocurrency alternate Bitbns emerged as the biggest participant within the nation’s cryptocurrency ecosystem. This gave it a staggering 79.1% market share among the many prime 4 centralized exchanges. Nevertheless, considerations have been raised concerning Bitbns’ dominance and its reported buying and selling quantity. However the allegations have but to be confirmed by any officers, amidst allegations of manipulating numbers and utilizing misleading techniques to inflate cash. Moreover, there could have been a glitch within the cryptocurrency monitoring platform ConGecko.

How did Bitbns witness such an enormous buying and selling quantity?

In accordance with the investigation, revealed in a Medium weblog publish, Bitbns has been accused of partaking in questionable exercise since 2018, particularly “utilizing pretend quantity bots to create synthetic buying and selling exercise.” ing. Additionally, these bots constantly generate greater than $10 million in quantity for him. The identical is true after the introduction of the 1% Withholding Tax (TDS) rule. This has led to decrease buying and selling volumes on different Indian cryptocurrency exchanges.

In accordance with Crypto Hanuman’s tweet (whose profile is adopted by Binance’s CEO and different celebrities), the Bitbns alternate could have a complete buying and selling quantity of $2.5 billion from July 2022 to November 2022. reported that there’s If these numbers are correct, Bitbns might be accountable for damages. The quantity of TDS is $25 million (equal to $200 million in Indian rupees). Nevertheless, in December 2022, the Ministry of Finance introduced that it had collected round 600 crore from the 1% TDS imposed on all the Indian cryptocurrency trade.

This obvious disparity raises questions concerning the effectiveness of presidency oversight and TDS implementation. Why was the federal government solely capable of acquire Rs 600 crore from all Indian exchanges? Bitbns alone reportedly has a TDS debt of 200 million based mostly on its alleged buying and selling quantity?

Allegations over Bitbns’ dominance and reported buying and selling volumes spotlight the necessity for larger transparency and regulatory oversight within the Indian cryptocurrency trade. Because of the important consideration this space has obtained in recent times, it has develop into crucial for regulators and trade stakeholders to make sure truthful practices and correct reporting. Foster a wholesome and reliable ecosystem for buyers and merchants. Moreover, if Bitbns solutions this, it can assist crypto buyers construct much more belief.

Present State of India’s Prime Cryptocurrency Exchanges

In accordance with the newest information, Bitbns continues to dominate the Indian cryptocurrency market. Maintains place as the biggest cryptocurrency alternate in Japan. Bitbns nonetheless holds a powerful place with a staggering 79.1% market share throughout the highest 4 centralized exchanges.

WazirX holds the second spot with 11.1% market share, intently adopted by CoinDCX at 6.6% and ZebPay at 3.1%. These rankings remained steady all year long, indicating a comparatively steady market share distribution among the many prime exchanges.

Nevertheless, in early 2022 issues have been very totally different, with WazirX holding onto the highest spot, with market share starting from 38.7% to 65.3%. Nevertheless, Bitbns surpassed WazirX in June 2022, which precipitated WazirX’s market share to say no for the third straight month, ultimately reaching 34.6%.

Since then, Bitbns has proven spectacular progress, with its market share greater than doubling from 37.0% in June 2022 to 82.0% by December 2022. Apart from Bitbns, WazirX, CoinDCX and ZebPay, there are different noteworthy cryptocurrency exchanges and buying and selling platforms for Indians. Markets embody Koinbx, BuyUCoin, Coinswitch and Giottus.

General, the Indian cryptocurrency alternate market stays dynamic. Bitbns leads the way in which, with the highest positions remaining comparatively steady all year long.

(Tag Translation) Centralized Change

Comments are closed.