Bitcoin’s latest market exercise has revealed important adjustments within the demand and accumulation patterns of huge holders, suggesting a possible affect on Bitcoin’s worth trajectory. The worth of the highest cryptocurrency soared from about $40,000 in January 2024 to greater than $70,000 by March, earlier than falling again. Just lately, coinciding with a noticeable improve in obvious demand and whaling volumes, it has begun to threaten $70,000 once more.

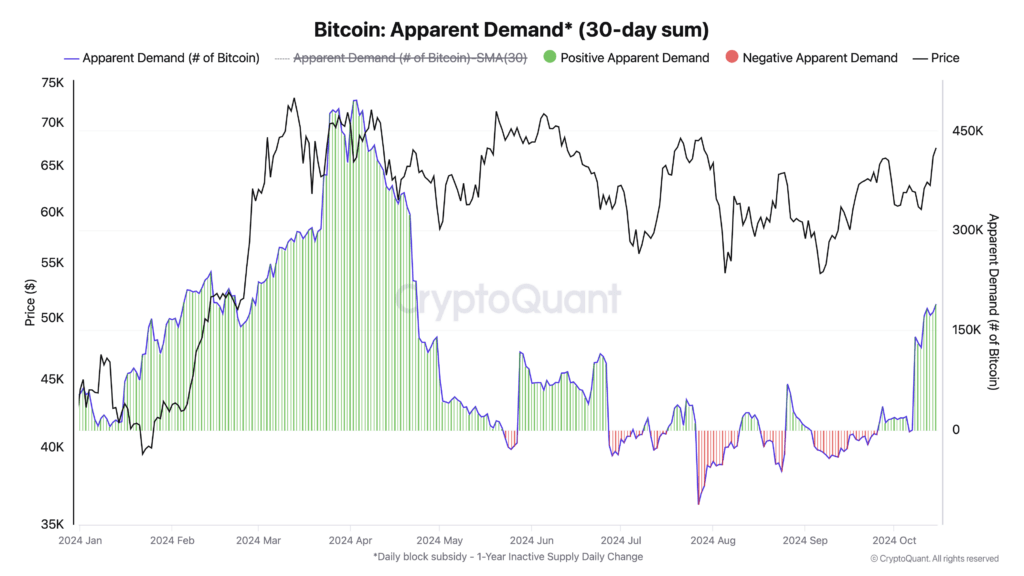

In line with the info, the obvious demand for Bitcoin elevated sharply in early 2024, coinciding with the worth spike. This era was dominated by durations of constructive demand, characterised by a rise in demand in comparison with earlier durations. A brand new surge in demand seems to be fueling latest worth will increase as soon as once more, proving a powerful correlation between demand traits and market valuations.

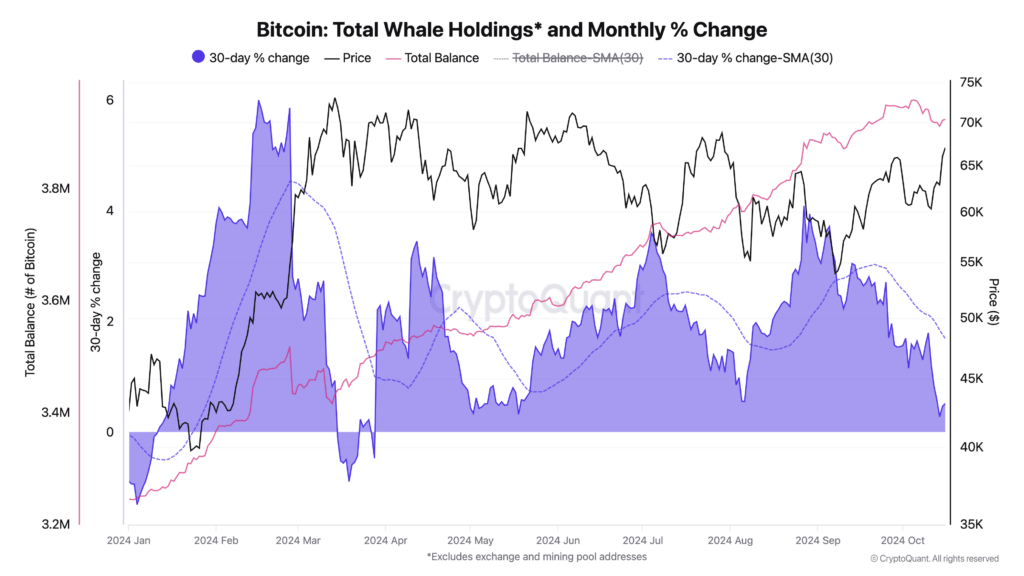

Whale holdings, that are accounts that maintain giant quantities of Bitcoin, additionally confirmed important exercise. Whale's whole holdings steadily elevated from round 3.2 million BTC at first of the yr to greater than 3.7 million BTC by October.

The month-to-month share change in these holdings elevated sharply from January to April, reflecting fast accumulation as costs rose. Nevertheless, there was some volatility in the midst of the yr, with a major decline in holdings in June, adopted by a powerful restoration into October.

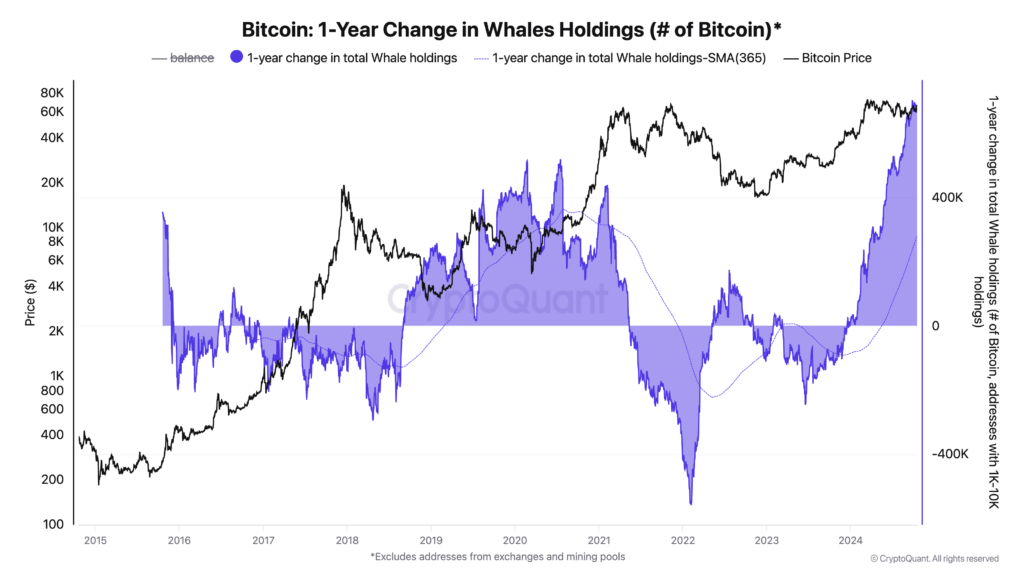

Lengthy-term evaluation exhibits that whale habits typically displays main market actions. Traditionally, durations of elevated whale accumulation have coincided with important upward traits in costs. For instance, the 2020-2021 bull market noticed important accumulation happen, with whale holdings rising as the worth of Bitcoin rose. Conversely, whales have a tendency to scale back their holdings after costs peak, suggesting strategic profit-taking or market repositioning.

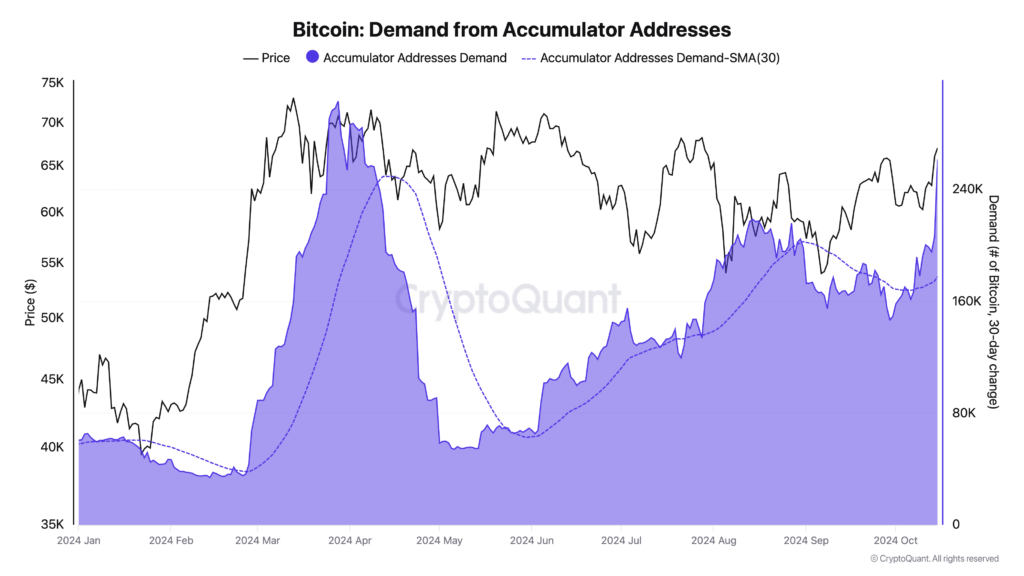

Accumulator addresses (wallets that maintain or constantly improve your Bitcoin holdings) can even play a key function in 2024 market traits. Demand from these addresses has began to extend quickly this month, approaching the height of Bitcoin's all-time excessive worth. march.

The interplay between these components highlights the affect of huge holders on Bitcoin market traits. Whale and accumulator addresses seem to work by anticipating worth actions, accumulating throughout upswings and adjusting their holdings throughout downswings. Their actions replicate market sentiment, however may also contribute to cost fluctuations.

Whereas the correlation between demand, whale exercise, and costs is obvious, causality stays a posh matter. Market forces are influenced by a myriad of things, together with macroeconomic circumstances, regulatory developments, and broader investor sentiment. Nevertheless, the noticed patterns counsel that monitoring whaling holdings and accumulator demand can present helpful perception into potential market traits.

As Bitcoin matures as an asset class, understanding the habits of Bitcoin's largest holders continues to change into more and more essential. Their actions can point out adjustments in market momentum and supply clues about future worth actions. The buildup sample noticed this month might point out strategic positioning by giant traders, probably setting the stage for the following essential market stage.

The put up Submit-Bitcoin Accumulation Fuels Market Rise, Hints of Potential Value Surge appeared first on currencyjournals.