- The fourth quarter of 2025 was supposed to point out historic power for cryptocurrencies, however as a substitute Bitcoin confronted a 24% decline.

- A lot of the high-profile predictions from Eric Trump, Michael Saylor, Tom Lee and others are flawed.

- Some see a multi-year correction, whereas others argue that the long-term bullish development stays.

The final interval of 2025 was presupposed to be the second when cryptocurrencies reaffirmed their historic fourth quarter power. Fairly, the market is discovering itself in a deep correction, removed from the bullish predictions that dominated the headlines just some weeks in the past.

From Eric Trump’s daring optimism to Michael Saylor and Tom Lee’s lofty year-end targets, the fourth quarter introduced some surprises, however not the kind many anticipated.

Eric Trump’s ‘unbelievable fourth quarter’ faces harsh actuality

In late September, Eric Trump predicted an “unimaginable” fourth quarter for cryptocurrencies attributable to elevated M2 cash provide, new quantitative easing, and seasonal power. Traditionally, Bitcoin has averaged 77% spikes within the fourth quarter, whereas Ethereum has sometimes posted double-digit positive factors.

Nevertheless, halfway via the quarter, the other occurred.

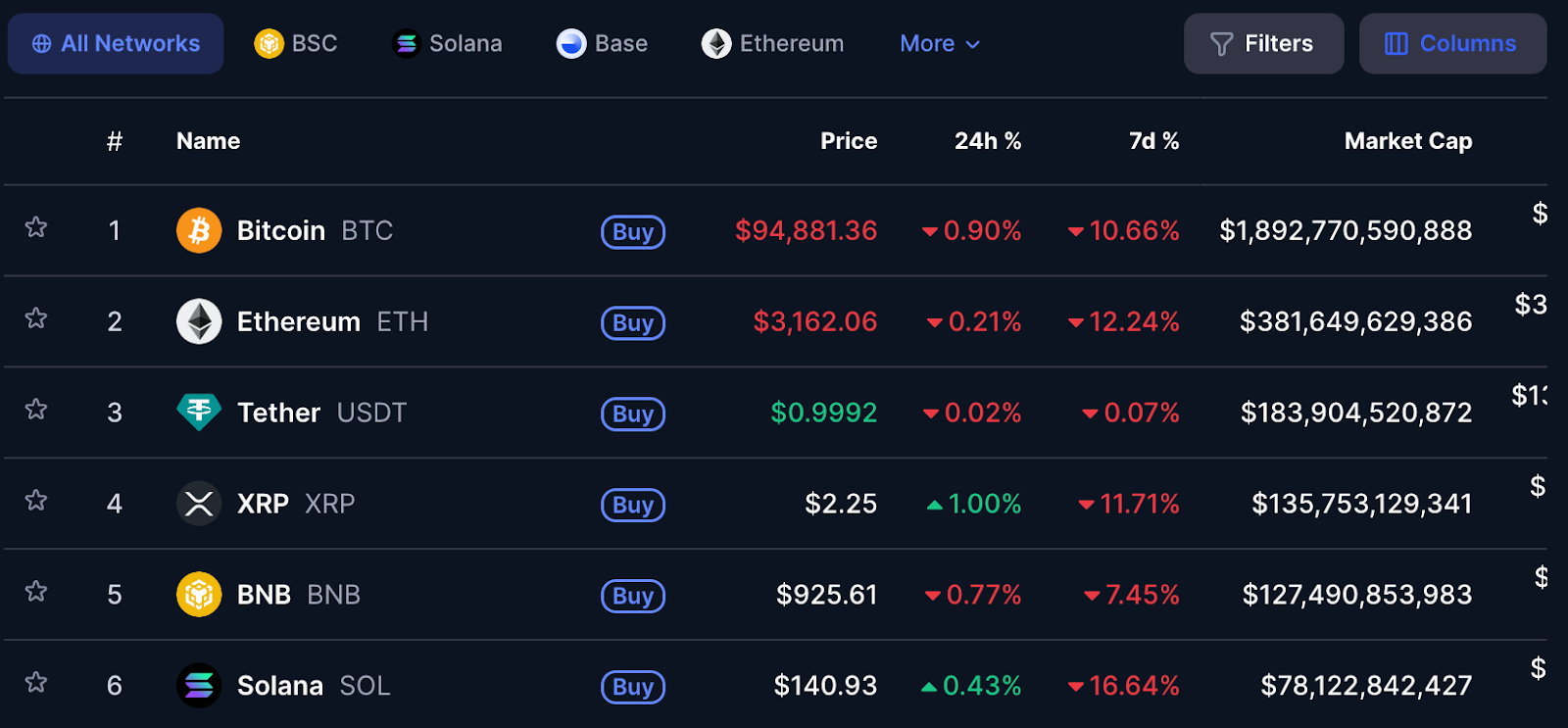

Bitcoin has fallen 16.76% since September 30, dropping from $114,056 to under $93,000. Ethereum has fallen greater than 23% throughout the identical interval. Fairly than a liquidity-driven crash, the market is battling a hawkish macro atmosphere, profit-taking at cycle highs, and renewed volatility.

Nevertheless, Eric urged buyers to not deal with short-term pullbacks, arguing that Bitcoin’s long-term common annual return of about 70% is small in comparison with conventional property. His view is that corrections are pure and the general image stays intact.

Associated: Eric Trump backs Bitcoin, acknowledges China’s affect in cryptocurrencies, insists on $1 million valuation

Sailor and Lee and the unreachable Christmas rally

Again in September, the trade entered the fourth quarter with stunning confidence. Michael Saylor instructed CNBC that many fairness analysts anticipate Bitcoin to exceed $150,000 by Christmas. This predicted a 33% improve from the early September value of $112,210.

Tom Lee went additional and predicted that Bitcoin would attain $200,000 by December twenty fifth, citing its sensitivity to rate of interest cuts and a traditionally bullish fourth quarter. Analysts from Canary, Steno Analysis and even Commonplace Chartered expressed related year-end targets.

Right now, these predictions appear more and more unattainable. Bitcoin is not only stagnant. This can be a 24% correction from October’s all-time excessive of $126,000.

Is the cycle prime confirmed? The bearish case is taking form

An necessary shift in sentiment was reported at the moment by Mr. Wall Avenue, a well known Bitcoin cycle analyst. He argues that Bitcoin has already damaged out of this cycle at $126,000 and is now in a multi-year correction.

His chart suggests:

- Subsequent help: $82,000 – $74,000

- Foremost accumulation zone: $60,000-$54,000

- Timeline: Chance of bottoming out by This fall 2026

This evaluation highlights the high-low construction that has fashioned since Bitcoin misplaced help at $104,000. Nonetheless, not everybody agrees with the bearish state of affairs.

Is the rally actually over? Analyst break up

Some on-chain analysts say Bitcoin has not but turned bearish. CryptoQuant CEO Ki Younger Ju factors out that the associated fee foundation for holders of 6-12 months is $94,635, which is the extent Bitcoin is at present hovering at. Above that line, he argues, the bull market construction is maintained.

On the identical time, Michael Saylor referred to as for persistence and reminded buyers that higher days are forward. Tom Lee endorsed the long-term view in a brand new publish at the moment, saying:

- Since 2017, Bitcoin has fallen by greater than 50% six instances and by greater than 75% 3 times.

- Nonetheless, it introduced 100 instances the advantages to those that overcame the ache.

In actual fact, costs within the fourth quarter have been nicely under expectations. The prediction that attracted consideration has collapsed. Nevertheless, analysts are divided on whether or not it is a main correction or a continuation of a long-term bull market.

Whether or not the fourth quarter recovers or continues to deviate from historic norms will rely upon how the market reacts within the coming weeks. For the time being, predictions are colliding with actuality, and actuality is writing its personal script.

Associated: Bitcoin This fall bull market intact as CryptoQuant analysts present indicators heading in direction of $130,000

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.