necessary level

- Bitcoin and Ethereum On-Chain Exercise Drops for 4th Straight Week

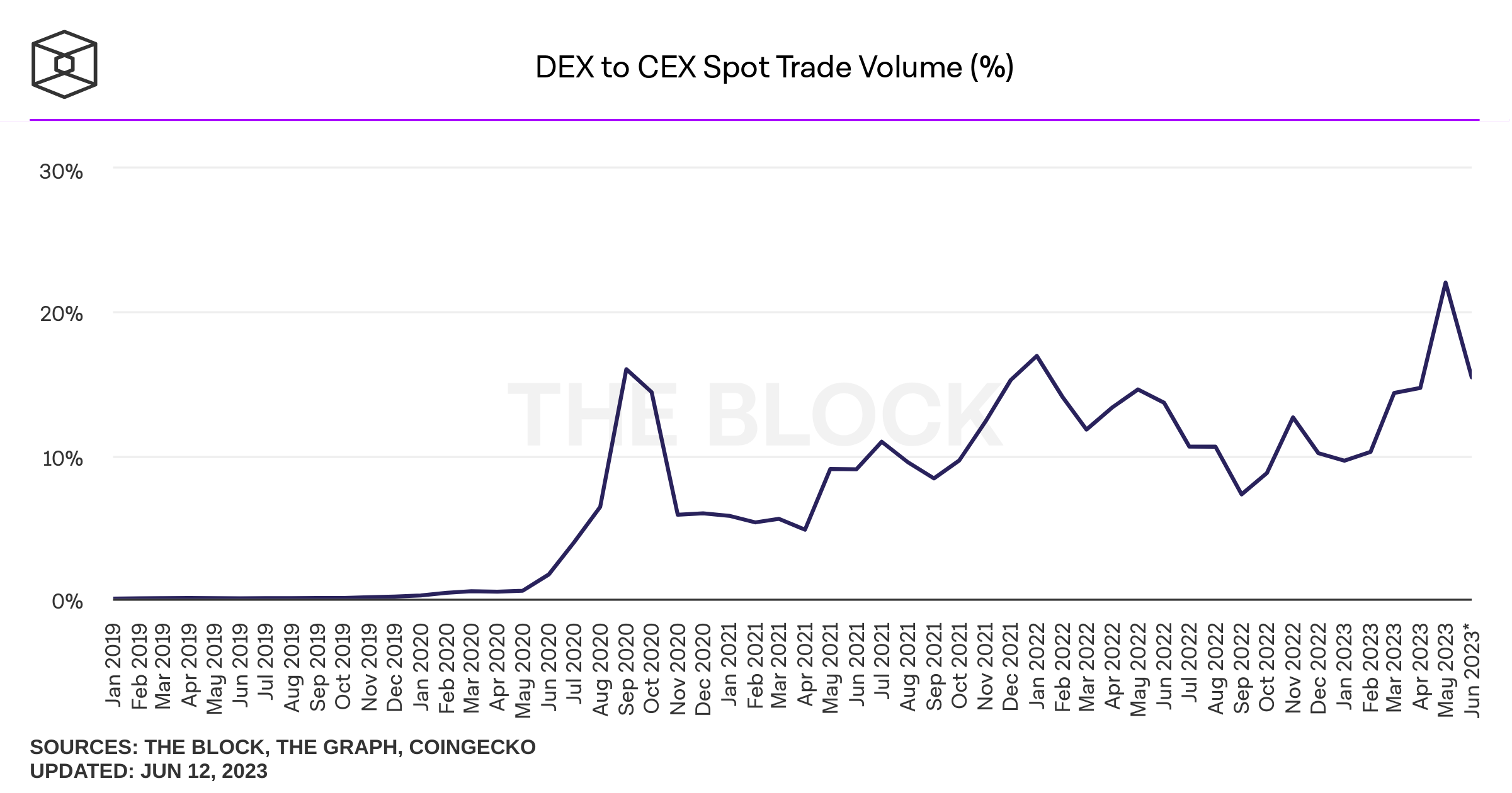

- DEX share of buying and selling quantity jumped from 14% to 22% final month after regulatory crackdown on centralized exchanges

- Since then, nonetheless, DEX buying and selling volumes have fallen once more, and liquidity throughout the cryptocurrency area has grow to be sparse.

Many speculate that the regulatory crackdown within the US will push cryptocurrencies in two instructions, into the offshore and/or decentralized realm. The previous doesn’t want a lot rationalization. Tightening the ropes of cryptocurrency corporations within the US will pressure those self same corporations to maneuver overseas in the event that they need to proceed working in the identical capability (or in any respect).

However whether or not this drives exercise on-chain is a extra fascinating debate. Decentralized exchanges grew through the hysterical interval of the pandemic, however their buying and selling volumes declined considerably all through 2022. Centralized Change (CEX) volumes additionally declined, however the ratio of DEX to CEX volumes fell from 16.9% in early 2022 to 9.6. % after 12 months, indicating that the DEX has fallen even additional than its conventional counterparts.

May regulatory woes for Coinbase, Binance, and different centralized exchanges reverse this pattern? It exhibits that DEX buying and selling accounted for 22.1% of buying and selling quantity in comparison with 14.7% the earlier month. Nevertheless, its share fell to fifteen.4% by the primary 12 days of June.

Binance was sued on June fifth and Coinbase was sued on June sixth, however it’s fascinating to see the developments above as DEX share has been declining since then. However then once more, these lawsuits could also be largely woven. Coinbase was served a discover from Wells months in the past, however Binance confronted (and nonetheless does) quite a few investigations from varied legislators. Bitcoin worth will let you know every little thing that you must know. Bitcoin worth dropped simply 5% on the information that Binance was formally sued, however the coinbase information didn’t change the worth in any respect.

Binance was sued on June fifth and Coinbase was sued on June sixth, however it’s fascinating to see the developments above as DEX share has been declining since then. However then once more, these lawsuits could also be largely woven. Coinbase was served a discover from Wells months in the past, however Binance confronted (and nonetheless does) quite a few investigations from varied legislators. Bitcoin worth will let you know every little thing that you must know. Bitcoin worth dropped simply 5% on the information that Binance was formally sued, however the coinbase information didn’t change the worth in any respect.

Certainly, for no matter motive, it’s troublesome to attract any conclusions from the above information.As detailed, the amount stays extremely skinny Earlier than. In actual fact, Bitcoin’s on-chain exercise and charges have fallen for the fourth week in a row. exercise surge That is because of the Ordinals protocol and BRC-20 token fading into the rear window. Nevertheless, it needs to be famous that regardless of this decline, the charges are nonetheless significantly larger than at first of the 12 months.

It isn’t simply Bitcoin. Charges and exercise are declining throughout the cryptocurrency business. Under is identical chart, however the Ethereum chart additionally noticed a 4th straight week of decrease charges. Nevertheless, in distinction to Bitcoin, its exercise has been step by step declining, approaching January ranges.

General, buying and selling volumes within the cryptocurrency area stay extremely skinny. This is because of varied elements. The primary is the worth crash. Individuals at all times commerce much less cryptocurrencies when costs drop. And with Bitcoin nonetheless down 60% from its peak in late 2021, the hysteria and crowded order books really feel like a great distance off.

However regulation can be an necessary issue. This has immeasurably stifled enthusiasm within the subject, particularly affecting instructional establishments. There have been clear indicators of that final weekend, corresponding to Crypto.com shutting down US institutional exchanges. The retail platform will proceed to function, however the firm cited restricted demand from establishments as the rationale for the choice.

A pointy drop in costs mixed with an more and more robust regulatory regime is a worst-case situation for the business, and it is not laborious to see why establishments are pulling out of the sector.

The surge in DEX quantity proven by the on-chain information above could appear promising at first look, however the pattern appears to have reversed. As well as, centralized exchanges present necessary capabilities for institutional capital to movement considerably into the sector. Only a few years in the past when corporations like Tesla hid bitcoin on their stability sheets, many have been optimistic in regards to the inflow of those establishments, however now that appears distant. felt.

(tag translation) evaluation

Comments are closed.