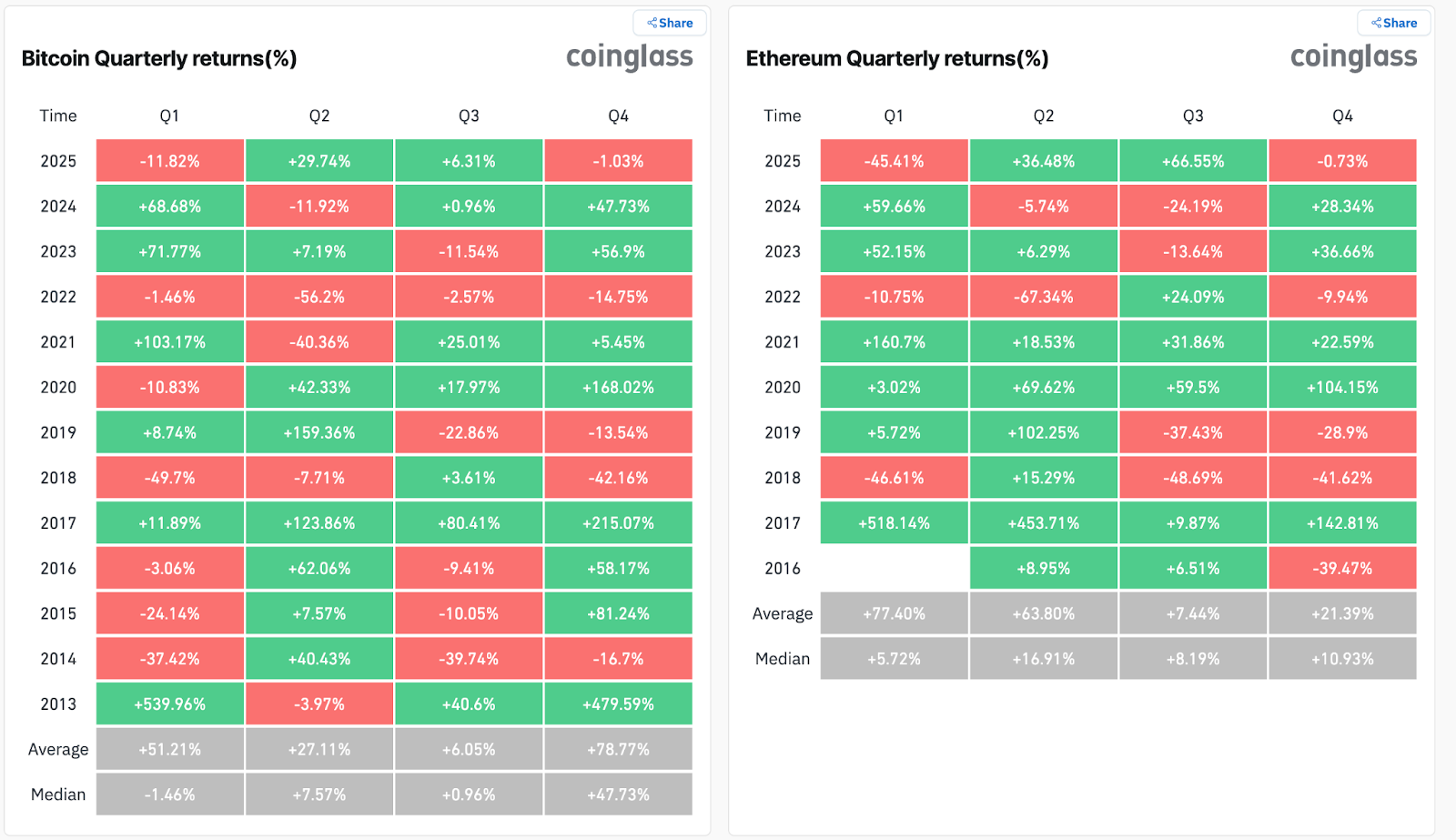

- Bitcoin returned a median of 79% within the fourth quarter since 2013, making it the strongest quarter in historical past.

- Ethereum mirrors the pattern of Bitcoin, displaying each upswing and retracement cycles.

- In the meantime, the fourth quarter of 2025 begins barely detrimental because of consolidation and slowing inflows.

Bitcoin (BTC) and Ethereum (ETH) entered the ultimate quarter of 2025 on a cautious observe, with weaker-than-usual efficiency throughout what’s historically a robust interval for cryptocurrencies.

Knowledge from CoinGlass exhibits that each Bitcoin and Ethereum have posted small losses up to now within the fourth quarter, regardless of the previous few years typically seeing large beneficial properties within the second half of the yr because of elevated institutional curiosity and easing financial coverage. Bitcoin is at the moment priced at round $113,060, down 2.4% previously month, whereas Ethereum has fallen much more sharply by 9% to round $4,181.

Nice beneficial properties previously and warning within the current

In response to CoinGlass, Bitcoin sometimes performs very effectively within the fourth quarter, with a median return of 79% since 2013, with a median return of 48%. This quarter has traditionally been the perfect interval for Bitcoin, with large rallies in 2013, 2017, and 2020, when the value rose 479%, 215%, and 168%, respectively.

Nevertheless, within the fourth quarter, it additionally suffered vital losses throughout financial downturns, together with a forty five% drop in 2018 and a 24% drop in 2019, displaying how unstable Bitcoin is. The vary of fourth-quarter returns varies extensively from yr to yr, from losses of 45% to beneficial properties of almost 60%.

Ethereum follows an analogous pattern, rising considerably throughout bull markets and plummeting throughout bear markets. Each cash rebounded strongly in 2023 and 2024, helped by extra institutional dedication and favorable financial situations.

Market situations in This autumn 2025

Thus far in This autumn 2025, the market has grow to be extra cautious. Bitcoin ended the third quarter up 6.31% to round $114,000, because of public corporations including to their coffers. It as soon as hit an all-time excessive of greater than $126,000 earlier than falling again after the US imposed 100% tariffs on China.

Associated: Bitcoin Value Prediction: BTC Regular Resulting from Surge in Derivatives Exercise

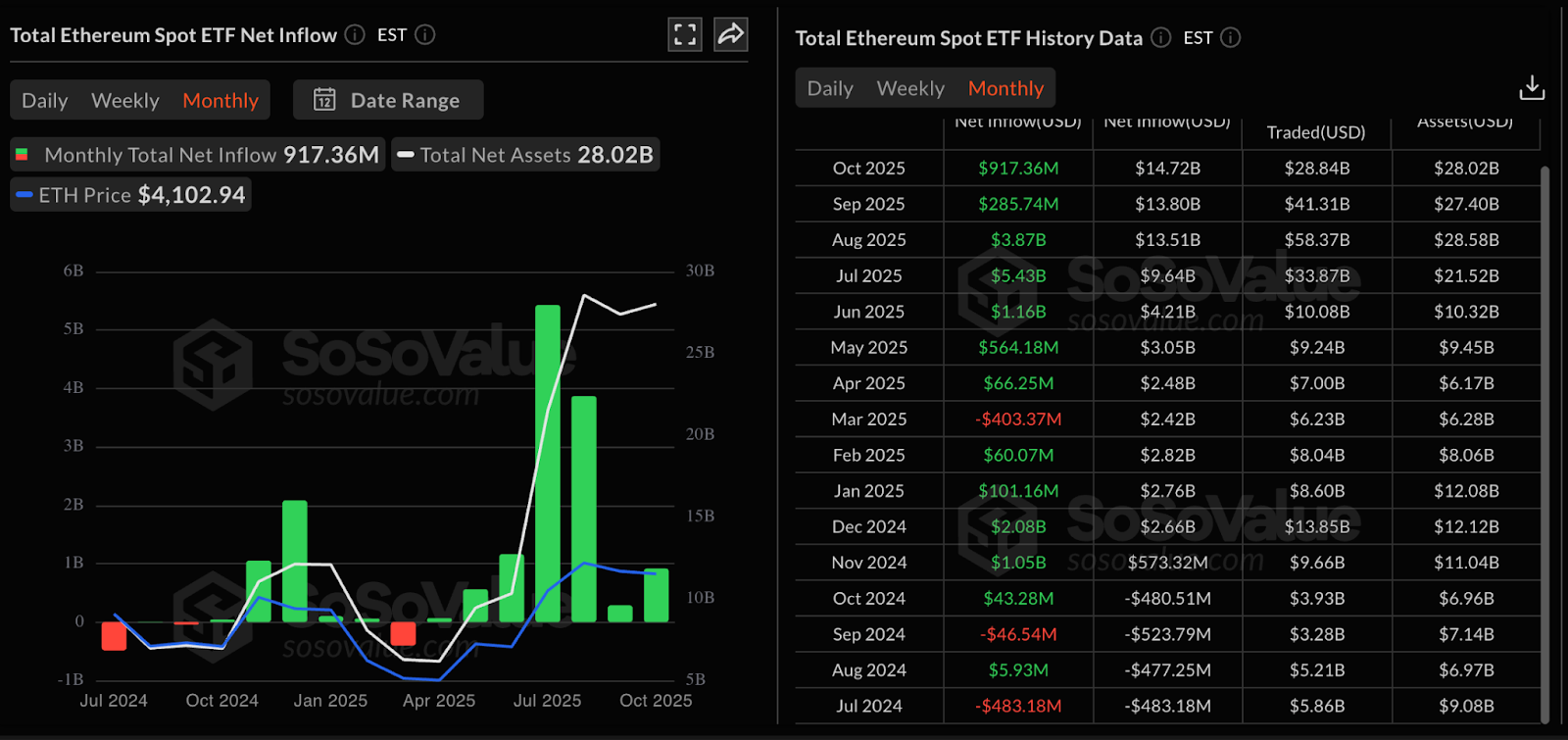

Ethereum rose almost 66.55% within the third quarter, reaching almost $5,000, however subsided in early fourth quarter. Analysts say this slowdown is regular as they’ve seen regular development by funding and accumulation in ETFs all year long.

The latest fee cuts by the US Federal Reserve have introduced rates of interest to their lowest degree in almost three years, additional encouraging market risk-taking. In the meantime, U.S. Bitcoin and Ethereum ETFs attracted mixed inflows of greater than $9 billion within the third quarter, demonstrating rising institutional investor confidence in these belongings.

Seasonal patterns recommend potential for restoration

Traditionally, the fourth quarter has been Bitcoin’s finest quarter, with optimistic returns in eight of the previous 12 years. November and December had been significantly robust, with common will increase of 46% and 4.7%, respectively.

Though the fourth quarter is off to a gradual begin this yr, historical past exhibits that restoration typically comes within the closing months. Bitcoin and Ethereum are following this typical sample, and early quarter weak spot may in the end result in stronger outcomes.

Analysts consider continued ETF inflows and continued coverage easing may assist push costs increased by the top of the yr.

Associated: Bitcoin This autumn bull market intact as CryptoQuant analysts present indicators heading in the direction of $130,000

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t answerable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.