Following the introduction of cryptocurrency-related bodily exchange-traded funds (ETFs) in the US, the provision of Bitcoin and Ethereum on centralized exchanges has hit an all-time low.

In keeping with Glassnode information, Bitcoin balances on exchanges fell to 11.6%, the bottom since December 2017. Ethereum balances fell even additional, to 10.6%, the bottom since October 2015.

Spot ETFs Set off Withdrawals

Market specialists clarify that the drop in trade balances coincides with the Securities and Change Fee’s (SEC) approval of a Bitcoin ETF product and Ethereum’s 19-b submitting.

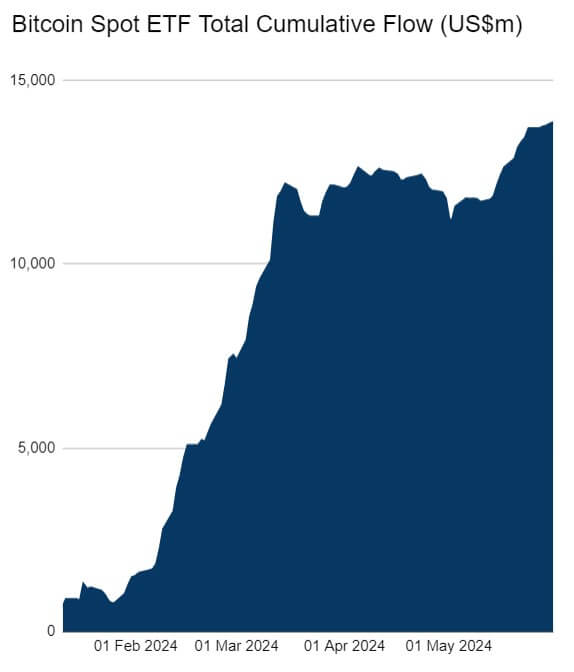

In keeping with information from HeyApollo, spot Bitcoin ETFs have gathered 857,700 BTC in simply 5 months, reaching a worth of $58.5 billion. This acquisition was led by BlackRock's IBIT ETF with property of round $20 billion, adopted by Constancy's FBTC with round $11 billion.

Though the spot Ethereum ETF has but to start buying and selling, investor anticipation has led to heavy withdrawals: In keeping with information from CryptoQuant, 777,000 ETH, price roughly $3 billion, have been withdrawn from exchanges because the SEC's approval.

Moreover, the choice to stake ETH has had an impression on the trade’s declining balances, with Nansen reporting that 32.8 million ETH, or 27% of the overall provide, is at present staked to help the community.

Is a provide scarcity on the horizon?

Market specialists predict that if the downward development in trade balances continues, demand for Bitcoin and Ethereum might result in a provide scarcity.

In a latest social media publish, Leon Weidmaan, editor of BTC Echo, suggested buyers to organize for a “provide crunch” and the opportunity of “the following large transfer.”

Traditionally, when digital property are withdrawn from exchanges, it is a sign that buyers are planning to carry relatively than promote, reflecting bullish sentiment and expectations of future development. Provide crunch can have a big impression on worth by limiting out there provide, which might result in important worth will increase if the present accumulation development continues.