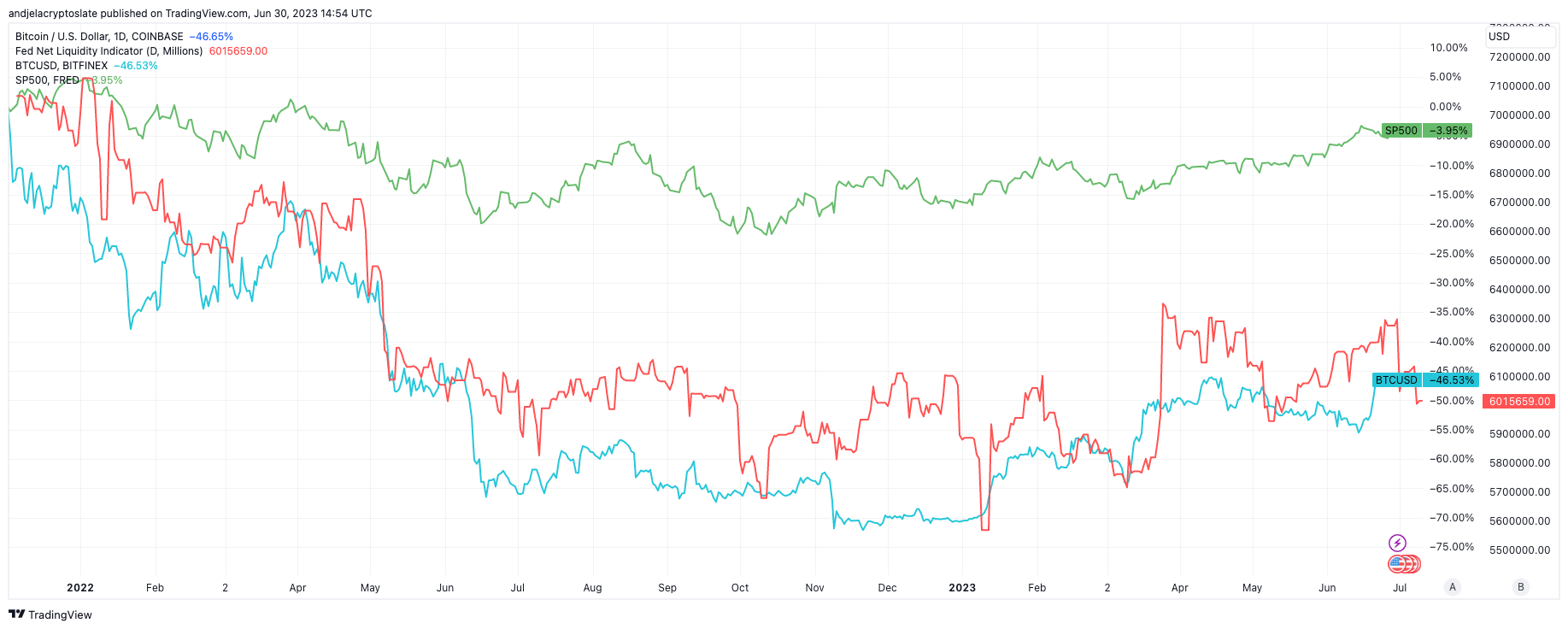

Bitcoin and the S&P 500 have traditionally proven a near-perfect correlation with internet liquidity, a key market metric typically neglected in market evaluation.

Nevertheless, as of June 2023, this correlation seems to be fading, which may point out a significant shift in market dynamics.

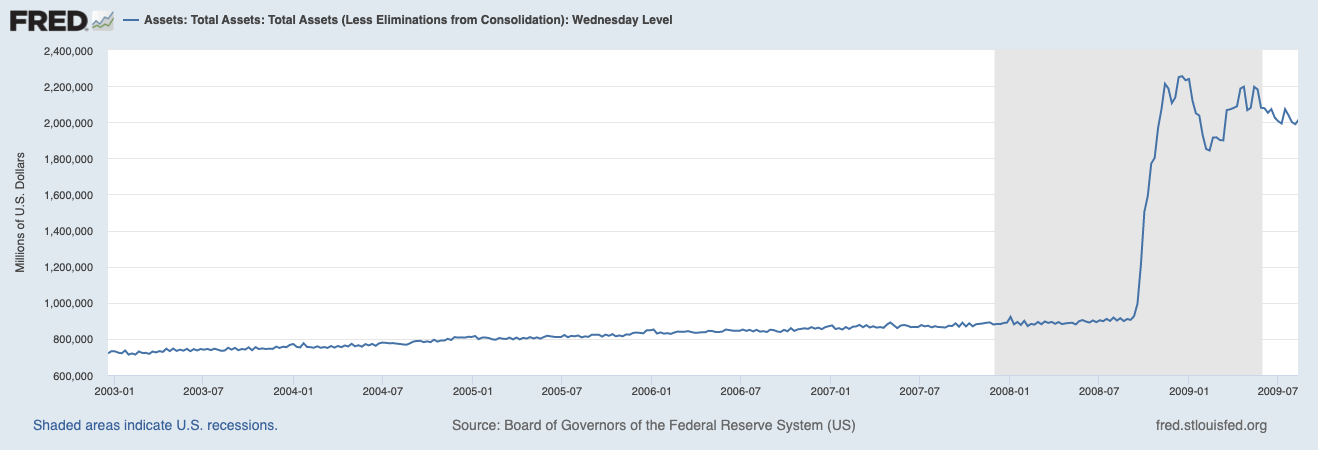

Web liquidity is calculated by subtracting “present liabilities” from “present belongings”. Within the context of the Federal Reserve, this contains deducting Treasury Common Account quantities and in a single day reverse repo quantities from the Fed’s steadiness sheet. This indicator gives a snapshot of the scale of the Federal Reserve’s market interventions and has been a key driver of the market, particularly for the reason that 2008 monetary disaster.

The dimensions of the Fed’s steadiness sheet was a comparatively unimportant metric till the 2008 monetary disaster. To fight the fallout of the disaster, the Fed launched into a traditionally unprecedented quantitative easing marketing campaign, considerably increasing its steadiness sheet. This speedy improve in debt supplied invaluable perception into the size of the Federal Reserve’s market interventions.

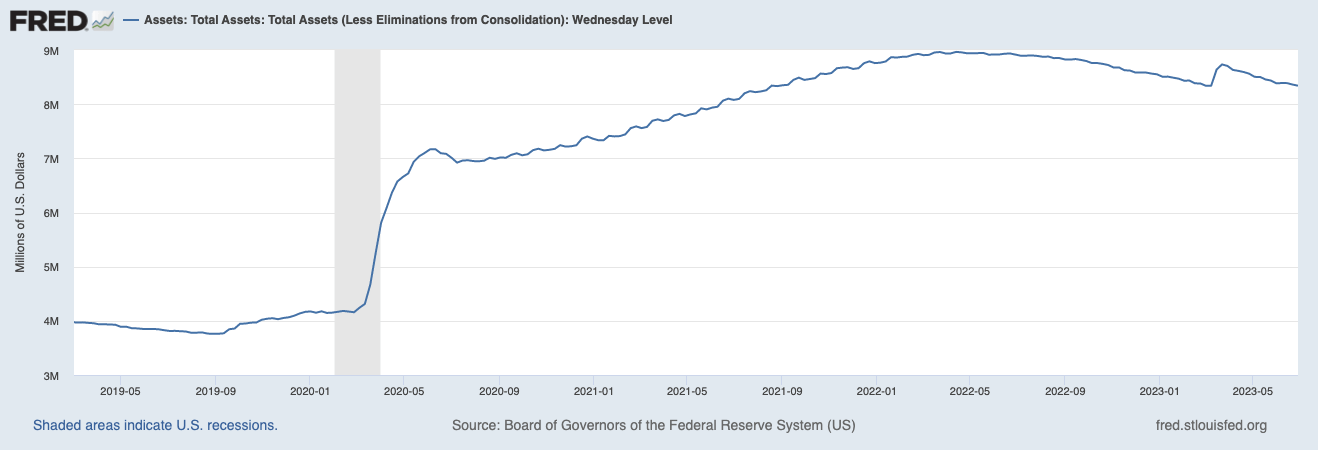

Nevertheless, the correlation between internet liquidity and asset costs modified in 2020. U.S. monetary markets are heading for historic 2020 regardless of the Federal Reserve almost doubling the scale of its steadiness sheet, including $3.4 trillion between August 2019 and June 2020. Recovered shortly from the crash. In March 2020, it continued to replace all-time highs. This has led many analysts to hypothesize that the Fed has misplaced its place as a significant market driver in the US and has as a substitute circulated extra liquidity within the financial system.

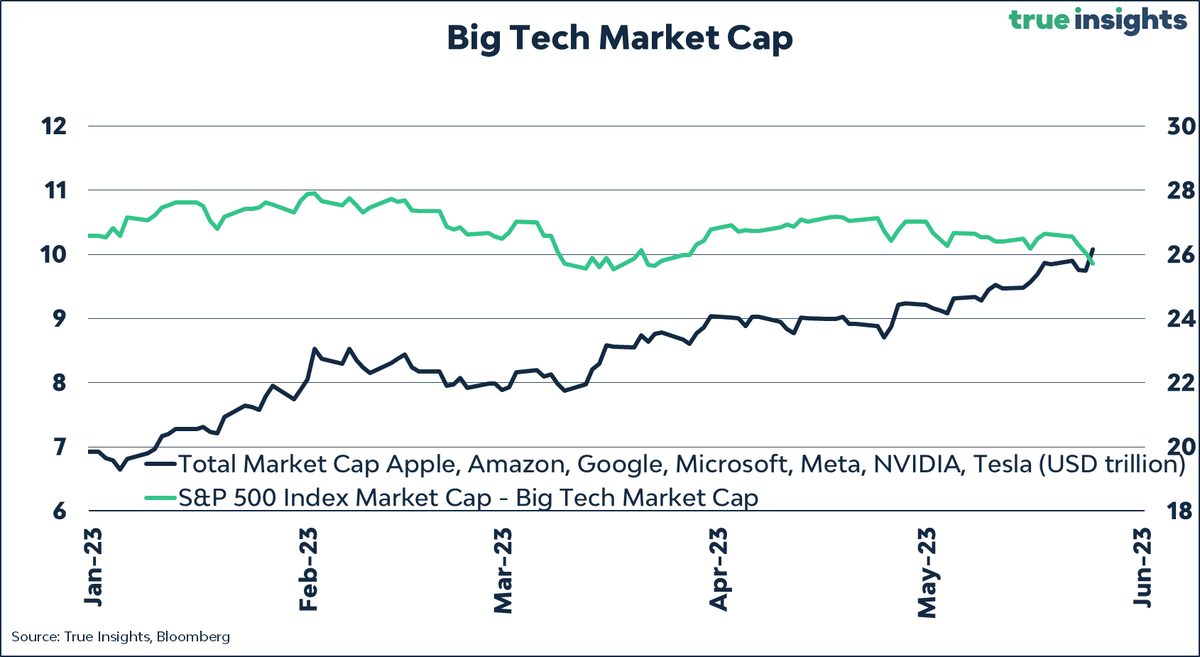

Nevertheless, in contrast to previous developments, internet liquidity has not turn into a significant market driver for the S&P 500 as of late. Chosen know-how and AI shares had been the principle drivers of index efficiency. These shares are bucking the broader bearish pattern, suggesting a shift in market dynamics.

A more in-depth have a look at the index, nevertheless, reveals a distinct image.Earlier than crypto slate Our evaluation confirmed that when these outlier shares had been faraway from the index, their efficiency remained comparatively stagnant. This implies that the index’s robust efficiency is probably not as broad-based because it initially seems, however somewhat concentrated in just a few high-performing sectors.

The decoupling of the S&P 500 from internet liquidity is essential, because it has traditionally been the driving drive behind essential indices.

Decoupling the S&P 500 from internet liquidity reduces the impression of broader financial elements that internet liquidity represents, such because the Federal Reserve’s financial coverage and the well being of the financial system as an entire. Reasonably, index efficiency is more and more influenced by developments in particular sectors resembling AI and know-how.

Decoupling Bitcoin from internet liquidity represents a distinct dynamic. Bitcoin operates in a distinct market setting than conventional monetary belongings just like the S&P 500.

Bitcoin’s decoupling from internet liquidity means that worth volatility is starting to be influenced by market dynamics resembling provide and demand inside the market, somewhat than broader financial elements.

This may increasingly make Bitcoin worth much less inclined to exterior financial shocks and improve worth stability. Nevertheless, as cryptocurrencies turn into extra inclined to market-specific dangers, Bitcoin buyers may face elevated dangers.

Because of this decoupling, Bitcoin is much less inclined to exterior financial shocks, which can result in larger worth stability. Nevertheless, this additionally comes with potential elevated dangers for Bitcoin buyers because the cryptocurrency turns into extra inclined to market-specific dangers.

It first appeared on currencyjournals after Bitcoin and the S&P 500 had been decoupled from internet liquidity.