- Bitcoin hit a excessive of over $126,000 as buyers flocked amid the US shutdown.

- Analysts attribute the rally to macroeconomic pressures, sturdy institutional inflow and new accumulations from long-term holders.

- With historic bullishness for Bitcoin in October, analysts hope that the rally will proceed to final at $200,000.

Bitcoin hits a brand new all-time excessive of over $126,000, and has confirmed its strongest October run in 5 years as US buyers search to exchange the greenback’s weakening. Bitcoin surges mirror macro stress, a surge in ETF inflows, and elevated long-term accumulation from establishments treating Bitcoin as a strategic reserve asset.

On the time of writing, Bitcoin (BTC) traded at $124,800, up practically 9% per week, in keeping with CoinmarketCap. The world’s largest cryptocurrency at present boasts a market capitalization of over $2.4 trillion, strengthening its place because the dominant various asset after gold.

Financial stress pushes buyers to bitcoin

The rally follows the closure of the US authorities, cussed inflation, and rising nationwide debt, that’s, cussed inflation, that’s, cussed inflation, that’s, a sequence of macro headlines which were pushed from the monetary market to uncommon property, that’s, cussed inflation, and rising nationwide debt.

Bloomberg mentioned this development wasDebasementmentement Commerce” buyers will flip from bonds like Bitcoin and Gold to property that retain worth because of 2025 because the US greenback index falls by greater than 12%, and can fall probably the most sharply since 1973.

Geoff Kendrick of Commonplace Chartered says that Bitcoin is now seen not solely as a dangerous guess, however as an actual software to handle world financial dangers.

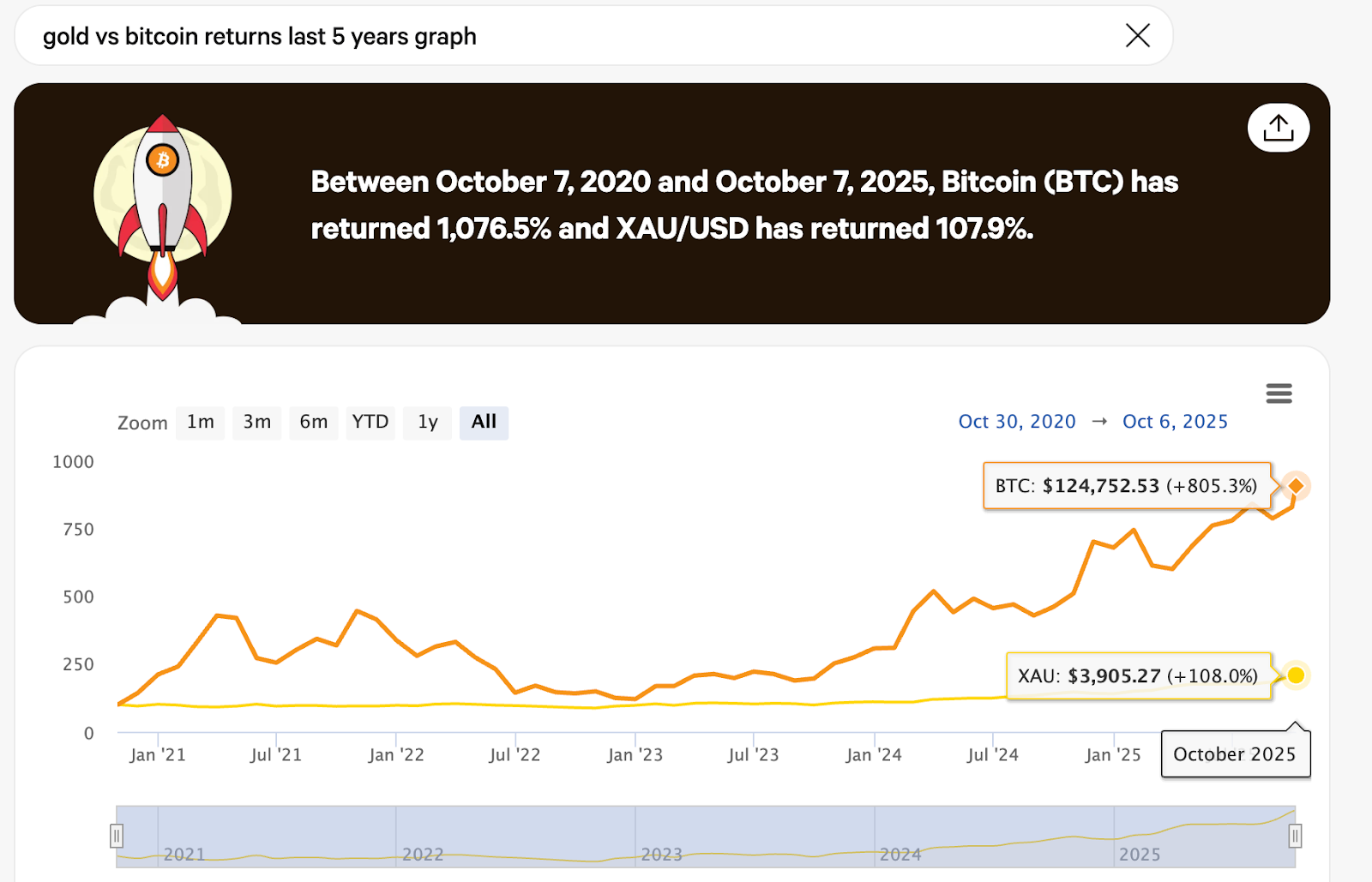

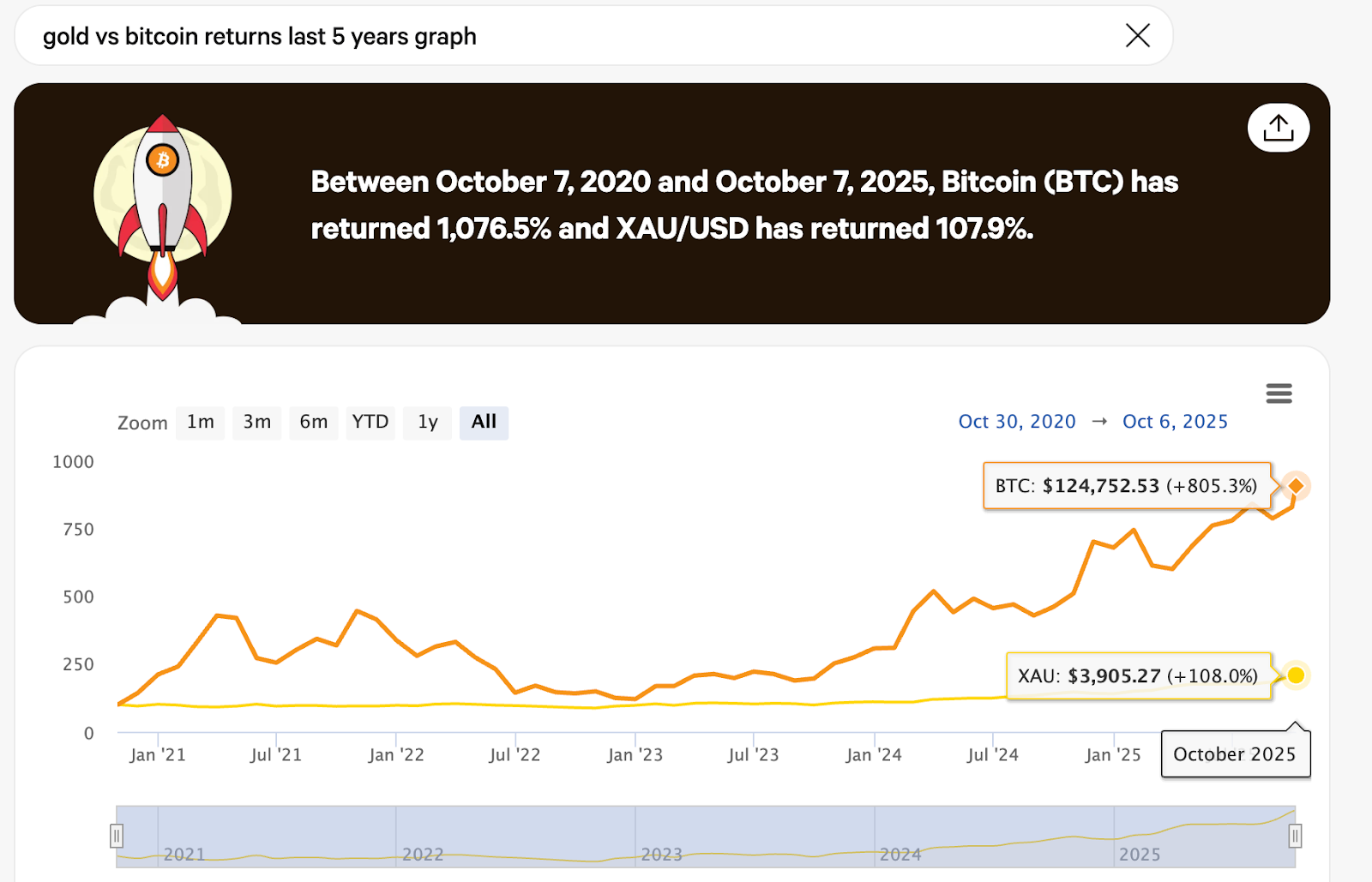

Bitcoin will improve gold by 1,100% over 5 years

Over the previous 5 years, Bitcoin’s efficiency has far surpassed that of gold. Gold received about 107%, whereas Bitcoin returned over 1,100% over the identical interval.

This defines Bitcoin’s repute from unstable curiosity to digital gold. JPMorgan analysts now name Bitcoin “Digital Gold,” declaring that its value fluctuations have gotten extra like gold.

If this development continues, Bitcoin will rise to $165,000, according to the worth of gold held personally in ETFs, bars and cash.

Associated: As liquidity continues to wire the market, bitcoin and gold rise collectively

Gold remains to be buying and selling practically $3,980 per ounce, however Bitcoin’s velocity and development have made it a standout in its world funding technique.

Institutional flows and strategic accumulation

Institutional participation stays a significant component in Bitcoin meeting. BlackRock’s iShares Bitcoin ETF and different US Spot Bitcoin ETFs have entered over $3.2 billion in per week alone, making it the second greatest efficiency since its launch.

Blockchain information reveals that giant buyers are shopping for and holding once more, and we anticipate costs to rise a lot larger. In line with Sygnum Financial institution, long-term holders have stopped promoting and launched a brand new buying section that may assist push Bitcoin over $120,000, maybe as much as $150,000.

Associated: Bitcoin accumulation: Saylor’s technique reaches 580,955 BTC, Metaplanet hits 8,888 BTC

Following Michael Saylor and his firm’s lead, extra firms have added extra Bitcoin to their stability sheets, treating Bitcoin as a digital model of their strategic reserves.

October will increase BTC – “Uptober” impact

October is thought to be a powerful month for Bitcoin, sometimes called “up-to-bar” by merchants. In 9 of the final decade, Bitcoin has surpassed October and has usually began a significant year-end gathering.

This development continues. Bitcoin not too long ago jumped from $110,000 to $125,000 in only a week as a consequence of seasonal optimism, sturdy ETF inflow and constructive financial conditions.

Associated: US Treasury’s $20 billion buyback provides Bitcoin’s up-to-bar rally to “liquidity” shot

Total, the rise of Bitcoin is not only about hype. It’s thought of a critical reserve asset. Because the US greenback weakening and inflation stay involved, even giant buyers and governments are starting to see Bitcoin as a part of their long-term technique.

As central banks hold rates of interest low and world liquidity in excessive states, Bitcoin’s long-term outlook is getting stronger. If the present development continues, analysts say Bitcoin will quickly cross $200,000 and can achieve its place as an necessary a part of the trendy monetary system.

FAQ

How a lot has Bitcoin returned to over the previous 5 years?

Bitcoin has received round 1,090% over 5 years, rising from round $10,410 in October 2020 to greater than $124,000 at the moment.

What do analysts predict in regards to the future value of Bitcoin?

Analysts from JPMorgan, Fundstrat, Commonplace Chartered and different establishments predict that Bitcoin will attain between $150,000 and $250,000 by the top of 2025.

In the meantime, business leaders equivalent to Michael Saylor, Charles Hoskinson and Arthur Hayes predict that BTC will attain $1 million by 2030.

Why are Bitcoin merchants referred to as “As much as Ber” in October?

In October, he obtained the nickname “Uptober.” As a result of Bitcoin has benefited from 9 of the final 10 Octobers, making it one of the traditionally bullish months.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version isn’t accountable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.