- Based on Matt Crosby of Bitcoin Journal Professional, Bitcoin’s consolidation round $105,000 is a traditional “mid-cycle pullback” and never a market high.

- The market has proven immense energy by absorbing billions of {dollars} of promoting from long-term holders, and that strain has been absorbed by ETF and institutional demand.

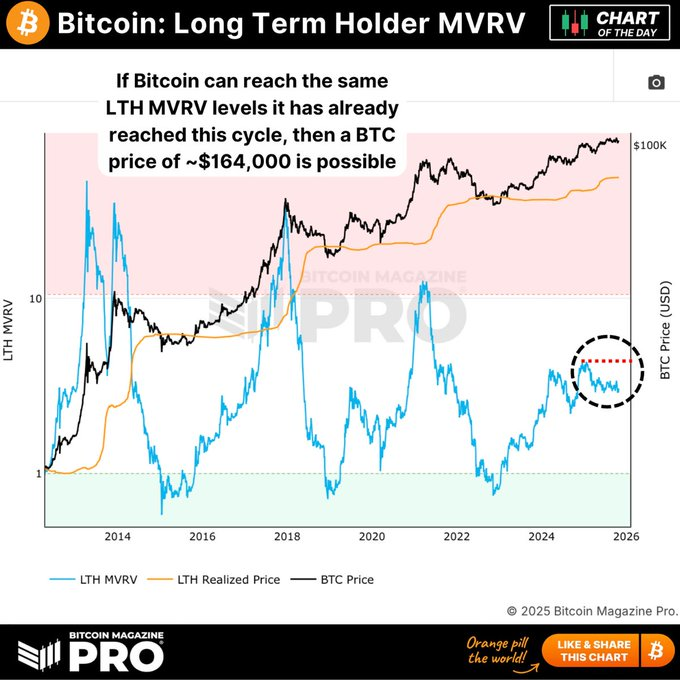

- The mannequin predicts a possible cycle high between $160,000 and $180,000, and the low volatility suggests a giant value transfer is imminent.

Bitcoin has been flat for a lot of the second half of 2025, leaving merchants pissed off as they do not know what is going to occur subsequent. After peaking above $120,000 earlier this 12 months, it has hovered round $100,000 in latest weeks. However analysts say this quiet section might be a stepping stone to the following huge transfer, which might be upward reasonably than downward.

Matt Crosby of Bitcoin Journal Professional predicts that Bitcoin shouldn’t be on the finish of the bull market but, however continues to be in the midst of it. He mentioned that regardless of the short-term weak point, the present decline suits the sample of a traditional mid-cycle pullback that usually precedes a bigger rally.

Associated: Shutdown ends, Fed begins QE, and 155 altcoin ETFs: Cryptocurrency bull case mounts

Market nonetheless seems sturdy

Crosby factors out that Bitcoin has held up surprisingly properly contemplating the quantity offered by long-term holders. Billions of {dollars} value of BTC are flowing out of wallets which were unsold for years, however the value stays lower than 20% under its all-time excessive. In earlier cycles, such promoting strain would have brought on a good deeper decline.

How institutional demand absorbed LTH gross sales

The explanation for this, he says, is the maturity of the market. At present, over 1 million Bitcoins are held in ETFs. This, mixed with regular accumulation from main establishments, is creating continued shopping for strain. This strain has absorbed what would as soon as have been a catastrophic decline in costs.

Based mostly on present on-chain information and previous cycle conduct, Crosby’s mannequin reveals a high more likely to type between $160,000 and $180,000. Whereas this isn’t a assure, the chances nonetheless lean towards an prolonged bull market reasonably than a market collapse.

The principle driving pressure, he argues, stays easy economics: provide and demand. Bitcoin’s restricted provide may trigger its value to rise considerably as long-term holders delay promoting and new cash flows into the market from establishments, funds, and returning retail buyers.

Mannequin predicts a peak of $180,000 as volatility reaches its lowest level

Volatility has fallen to its lowest degree in additional than six months. This era of quiet has traditionally preceded main value actions. Bitcoin cycles appear to be getting longer, with every cycle taking longer to achieve its peak. This might imply an actual breakout will not happen till early 2026, however he would not rule out a robust rally earlier than the top of the 12 months.

For now, he sees Bitcoin at a crossroads and steady for the following stage. If historical past repeats itself, this era of calm may quickly flip into a robust transfer that takes Bitcoin nearer to $180,000 as an alternative of $80,000.

On the time of writing, Bitcoin is buying and selling at simply over $105,000.

Associated: US liquidity surge may set off altcoin season as TOTAL2 holds key assist

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be answerable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.