- Bitcoin faces sturdy resistance close to $109,000 as momentum builds above $99,000 help

- Rising open curiosity signifies optimistic leverage and sustained institutional confidence

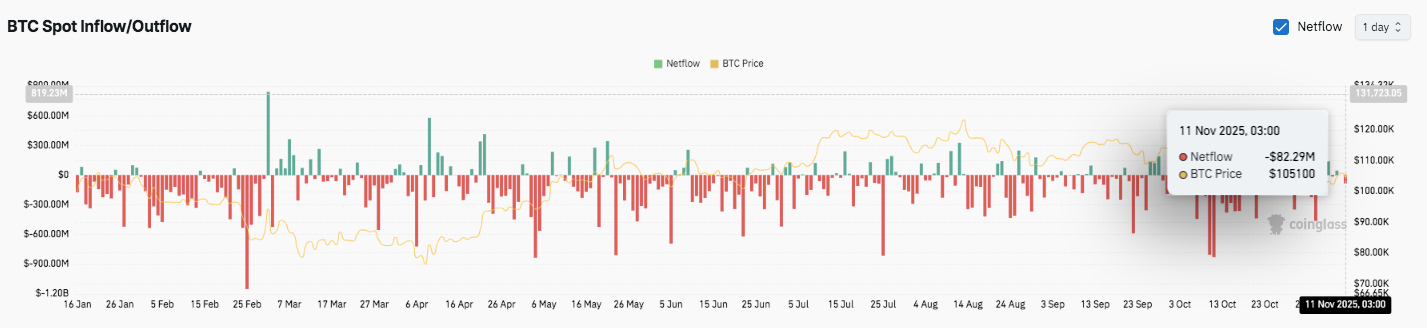

- Spot outflows spotlight investor warning and entice BTC inside a slender vary

Bitcoin (BTC) value confirmed indicators of restoration on November 12, 2025, with shopping for momentum returning again above the $99,000 space. After discovering sturdy help close to $98,953, the asset rallied in direction of $105,399 and examined the important thing Fibonacci retracement degree. This pullback comes amid blended indicators from each technical indicators and market sentiment, with merchants being cautious in regards to the subsequent transfer.

Main resistance cluster close to $109,000

Bitcoin charts reveal a narrowing vary between $104,000 and $109,000. This contraction displays a pause available in the market after weeks of excessive volatility. The 23.6% Fibonacci degree at $105,399 is performing as quick resistance. A decisive transfer above this threshold might expose the following goal to $109,386, which coincides with the 38.2% retracement zone.

Importantly, this space coincides with the 200-day exponential shifting common (EMA) and the higher Bollinger Band round $108,958. If the worth continues to shut above these indicators, new bullish momentum will likely be confirmed.

Moreover, the crossover of the 20-day and 50-day EMAs might strengthen short-term upside construction. Nevertheless, a rejection at these ranges might ship BTC again in direction of $104,000 or $100,288, sustaining the consolidation sample.

Open curiosity suggests ongoing speculative exercise

Futures knowledge continues to point out a gradual improve in leveraged positions. Bitcoin open curiosity reached $68.96 billion on November 11, highlighting the deep-rooted confidence amongst derivatives merchants.

Regardless of a brief interval of liquidation throughout the correction, this indicator remained elevated all year long. This development exhibits that merchants aren’t exiting the market regardless of anticipating volatility.

Moreover, excessive ranges of open curiosity usually point out institutional investor involvement, suggesting that capital flows into the futures market stay sturdy. Due to this fact, so long as there is no such thing as a sharp liquidation and leverage stays secure, the broader bullish construction is prone to maintain.

Spot outflows replicate investor warning

Regardless of the optimism in derivatives markets, spot knowledge paints a extra cautious image. Bitcoin spot merchandise recorded web outflows of $82.29 million on November eleventh. This marks a continuation of the purple bar seen since late October, suggesting constant promoting strain throughout the trade.

Moreover, the decline in inflows means that accumulation from giant buyers is reducing. Some merchants seem like taking earnings or ready for clearer macroeconomic indicators earlier than re-entering their positions. Consequently, market liquidity stays tight and BTC value motion is prone to stay range-bound till a definitive breakout happens.

Associated: Listed here are 5 the reason why Bitcoin is rebounding in the present day

Technical outlook for Bitcoin (BTC) value

Key ranges stay properly outlined heading into mid-November. Upside targets embody $105,399 and $109,386, which correspond to the 23.6% and 38.2% Fibonacci retracement ranges. A confirmed breakout above this vary might pave the way in which for $112,609 and $115,832, that are in step with the 0.5 and 0.618 Fibonacci zones.

On the draw back, quick help lies at $104,000, adopted by $103,000 and $100,288. The important thing benchmark stays $98,953, which has lately served as a rebound level for consumers.

The 20, 50, 100, and 200 EMAs are tightly compressed between $103,937 and $108,958, reflecting a impartial to barely bullish market bias. If the 20EMA rises above the 50EMA, Bitcoin might verify a short-term bullish shift. The resistance between $106,500 and $109,000 kinds an essential higher sure that must be damaged to maintain additional features.

Will Bitcoin rally additional this week?

Bitcoin’s November efficiency will rely upon whether or not the bulls can keep momentum above $104,000 and problem the upside resistance close to $110,000. Technical compression suggests a volatility breakout is imminent, and futures open curiosity signifies rising confidence amongst leveraged merchants. Nevertheless, continued spot outflows counsel cautious investor sentiment.

If Bitcoin breaks above the foremost help degree and reclaims the 200 EMA, it can doubtless rise once more in direction of $115,000. Conversely, if it fails to maintain above $104,000, BTC might keep throughout the $100,000 to $109,000 vary and the consolidation part could possibly be prolonged. For now, Bitcoin stays in a pivotal construction, with each consumers and sellers testing management over the development.

Associated: Bitcoin Value Prediction: Patrons face the ultimate check as value is just under the development line

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.