Monitoring and analyzing switch volumes is important to understanding the underlying financial exercise inside the Bitcoin community. Spikes in switch volumes sometimes point out elevated market participation by new entrants or institutional traders throughout bull markets, or massive transactions by present contributors sometimes throughout downturns.

Whereas spikes in remittance volumes usually are not a great software for predicting value actions as they normally happen after massive value fluctuations, they will nonetheless be used to deduce market liquidity ranges and future potential volatility.

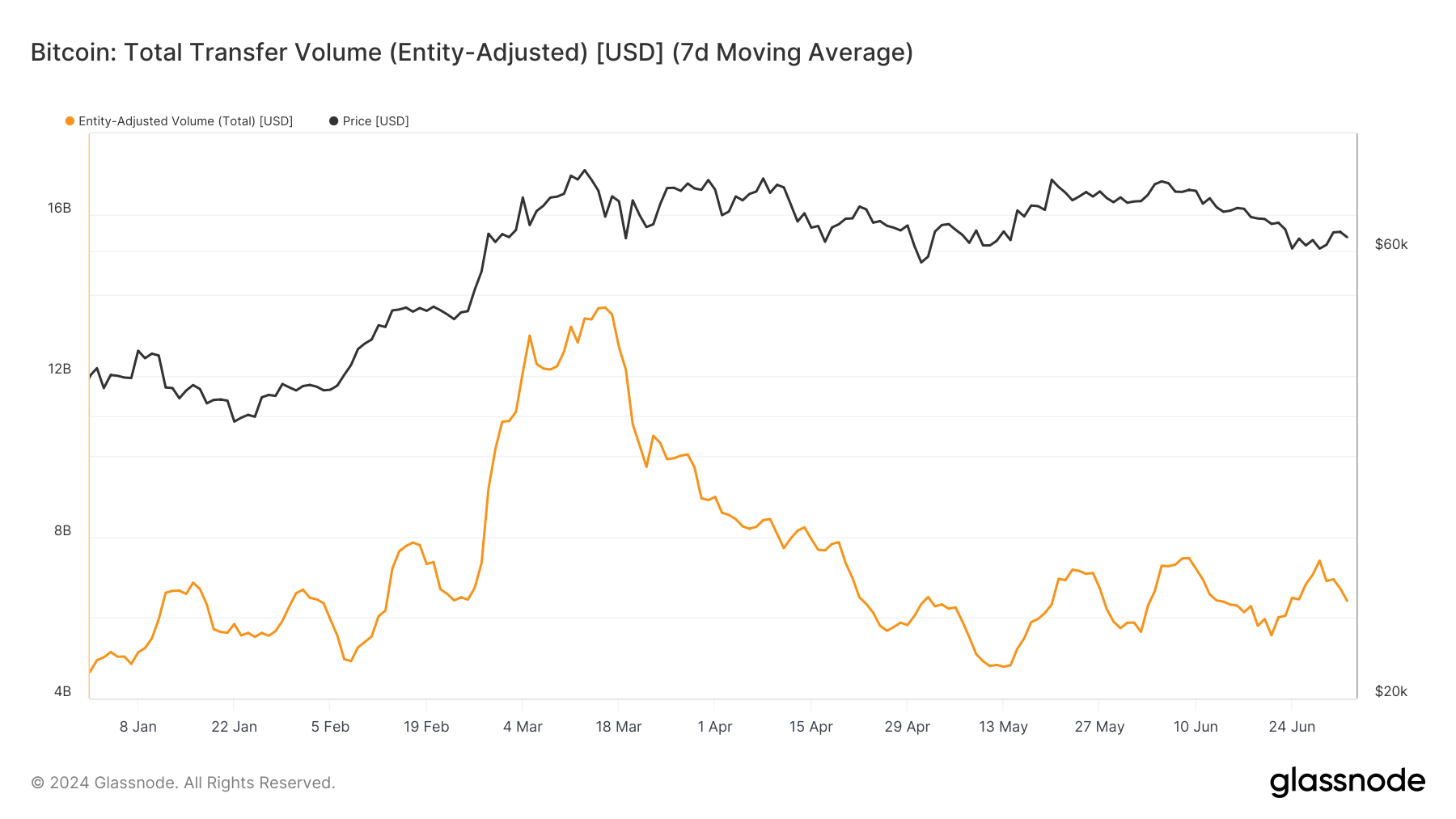

Glassnode's Entity Adjusted Switch Quantity reveals actual financial exercise on the Bitcoin community by measuring the USD worth of cash moved between entities. This metric is especially helpful because it filters out inside transactions inside entities similar to exchanges, giving a clearer image of actual market motion.

Whole switch quantity on the Bitcoin community hit an all-time excessive of $13.67 billion on March 15. This excessive was achieved simply two days after Bitcoin hit a report excessive of $73,104 on March 13. This means {that a} important quantity of BTC was transferred between entities on the peak of market enthusiasm.

Nonetheless, the market has not been in a position to method these highs since mid-March and has struggled to surpass $7.5 billion since April 20. The decline in buying and selling quantity indicators a cooling of peak market exercise as Bitcoin costs battle to stabilize and get away of a sideways buying and selling sample.

Comparatively steady switch volumes over the previous month or so point out that the market is in a wait-and-see mode, with neither sturdy bullish nor bearish tendencies dominating buying and selling volumes. Bitcoin stays caught in a fluctuating vary between $60,000 and $65,000, with an uptrend doubtless solely rising if there’s a main regulatory or market-wide transfer.

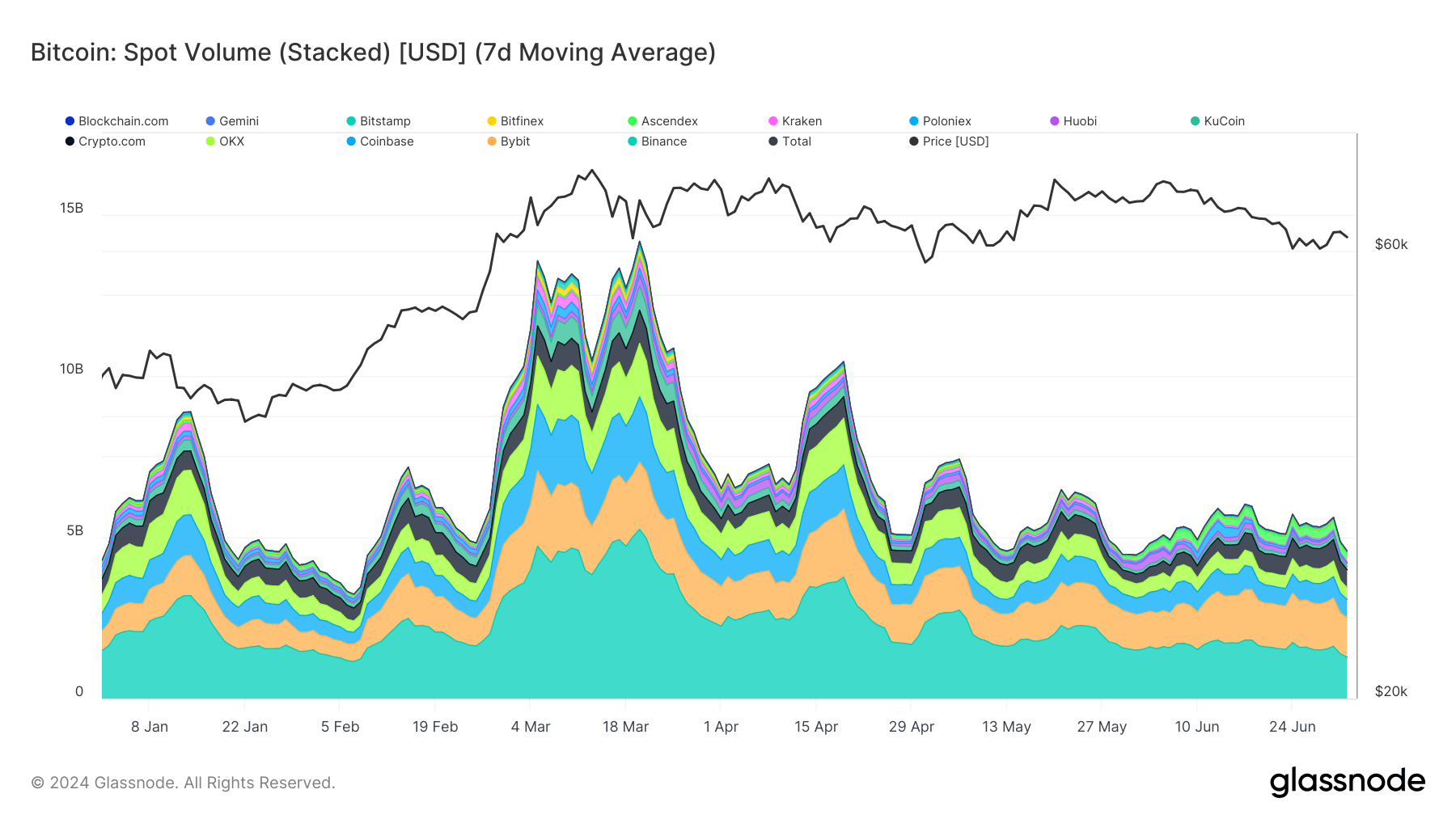

The slowdown in market exercise can be evident in Bitcoin spot buying and selling quantity. Whereas each are necessary, whole transfers and spot buying and selling quantity provide barely totally different insights into the market. Spot buying and selling quantity represents cumulative buying and selling quantity on exchanges and displays buying and selling exercise towards USD-backed currencies, together with each fiat currencies and stablecoins.

Due to this, spot quantity is a greater indicator of instantaneous buying and selling exercise and market liquidity on centralized exchanges than it’s within the broader market. Whereas switch quantity provides a way of worth motion throughout the community, spot quantity signifies extra short-term buying and selling patterns and investor sentiment.

Traditionally, spot volumes have tended to peak barely later than switch volumes, as evidenced by knowledge displaying that regardless of Bitcoin hitting report highs, spot volumes fell to $10.465 on March 13. The yearly excessive for spot volumes was $14.156 billion on March 20, indicating a lag between value and quantity peaks.

Not like switch quantity, spot quantity tends to peak in response to a pointy drop in value as merchants react to mitigate losses. In periods of steady costs, spot quantity tends to say no. This phenomenon has been notably evident over the previous two months, with spot quantity remaining under $6 billion, indicating a scarcity of great motion in switch quantity.

A transparent pattern emerges within the knowledge: when Bitcoin value stabilizes inside a spread, market contributors grow to be much less energetic. This sample has grow to be extra pronounced up to now few weeks, with Bitcoin buying and selling between $60,000 and $65,000, resulting in a decline in buying and selling quantity. Though the value has stabilized, the drop in spot buying and selling quantity of over $1 billion since early July signifies that the market stays reluctant to commerce aggressively with out a clear path.

The market is at present in a consolidation section, with contributors ready for brand spanking new elementary drivers or exterior elements to set off the following strikes. currencyjournals The evaluation recognized comparable tendencies throughout different indicators, all of which level to a state of rigidity that will require important exterior elements to maneuver the market.

If Bitcoin stays inside the present vary, buying and selling volumes are anticipated to stay low, nonetheless regulatory, political and macroeconomic developments may emerge that might spur the market to interrupt this sample.

The put up Bitcoin Buying and selling Quantity Stagnates, Placing Markets in Wait-and-See Mode appeared first on currencyjournals.