Since June twenty second, Bitcoin has been buying and selling above the psychologically essential stage of $30,000. This value surge is the results of elevated demand for digital belongings, which is exacerbated by the low availability of Bitcoin on exchanges.

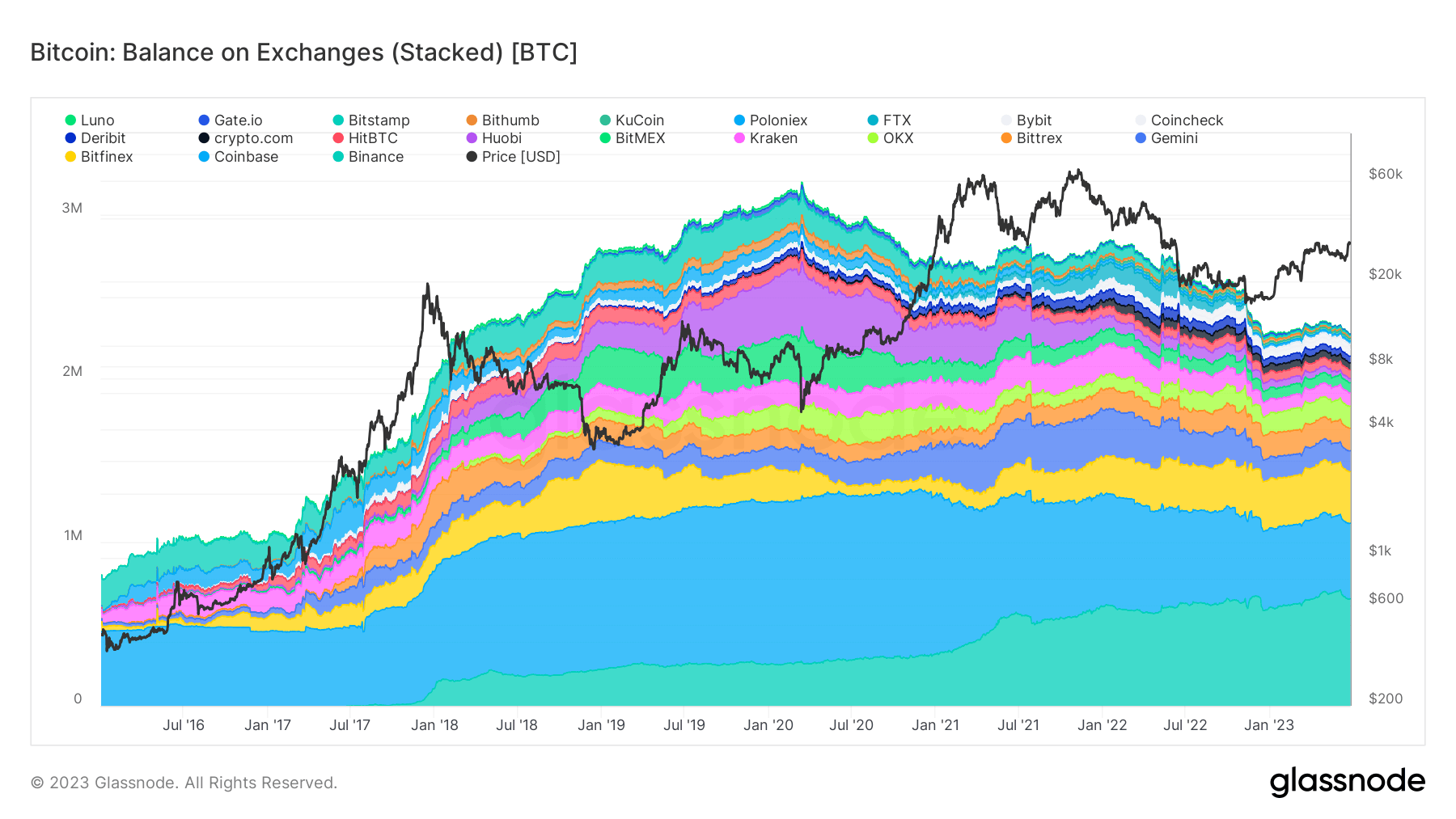

One of many key indicators highlighting this pattern is the share of Bitcoin provide held on exchanges. Information from Glassnode measures the overall quantity of cash held at an alternate tackle and calculates the share of provide on the alternate.

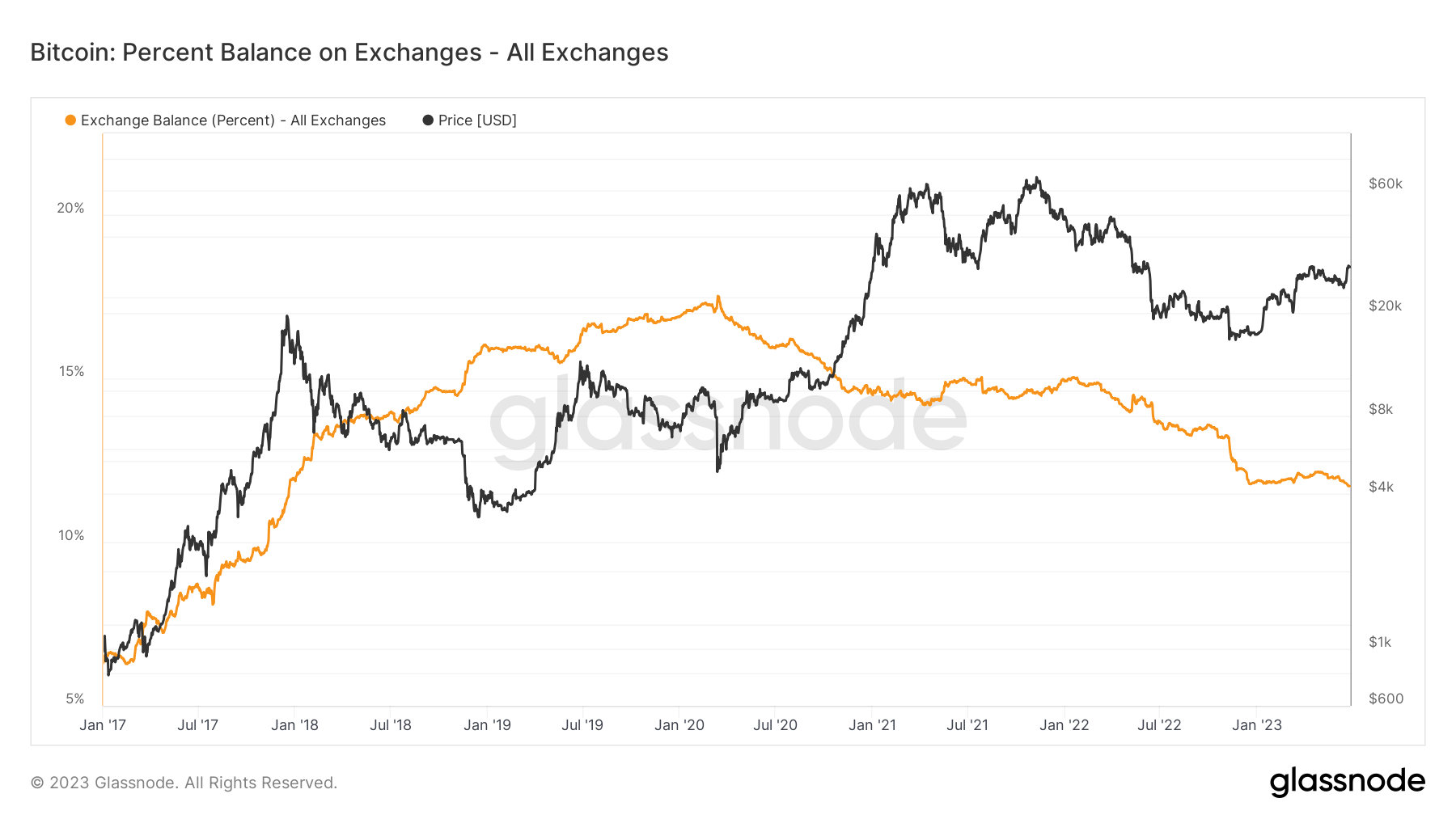

When a considerable amount of Bitcoin is held on an alternate, it usually signifies that traders are able to promote their holdings, suggesting bearish sentiment. Conversely, a decline within the quantity of Bitcoin on exchanges may recommend that traders are transferring belongings into non-public wallets for long-term holding, signaling bullish sentiment.

Moreover, the quantity of Bitcoins on exchanges instantly impacts market liquidity. Excessive liquidity means numerous market individuals, and consumers shortly take in numerous promote orders. Nevertheless, if the quantity of Bitcoin on the alternate drops considerably, it may result in a drop in liquidity. Because of this numerous promote orders can have a big influence on market costs and result in elevated volatility.

Due to this fact, monitoring the quantity of Bitcoin held on an alternate can present invaluable perception into potential market actions and investor sentiment.

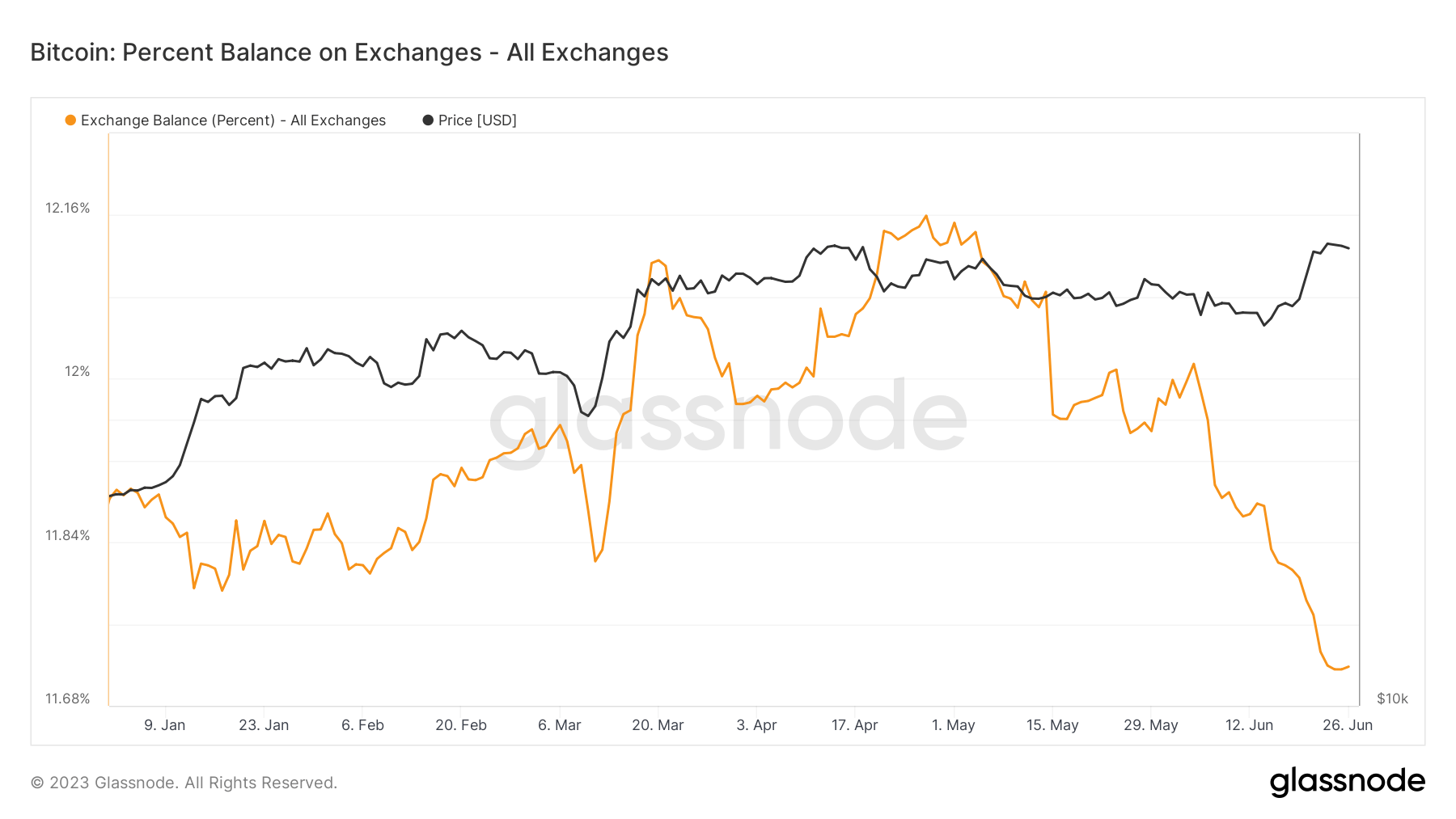

The share of bitcoin provide held on exchanges has been trending downward for the reason that finish of April, when it hit a year-to-date excessive of 12.16%.

A broader perspective, nevertheless, exhibits that Bitcoin holdings on exchanges have been declining since March 2020, once they reached a file excessive of 17.51%.

The share of bitcoin provide held on exchanges has now fallen to a five-and-a-half-year low of 11.71%, reaching a stage final recorded in December 2017. This pattern signifies a change in investor habits with extra holders selecting to custody. Bitcoin was most likely faraway from exchanges in anticipation of future value will increase.

The article first appeared on currencyjournals after the worth hit $30,000 and bitcoin buying and selling balances fell to five-year lows.

Comments are closed.