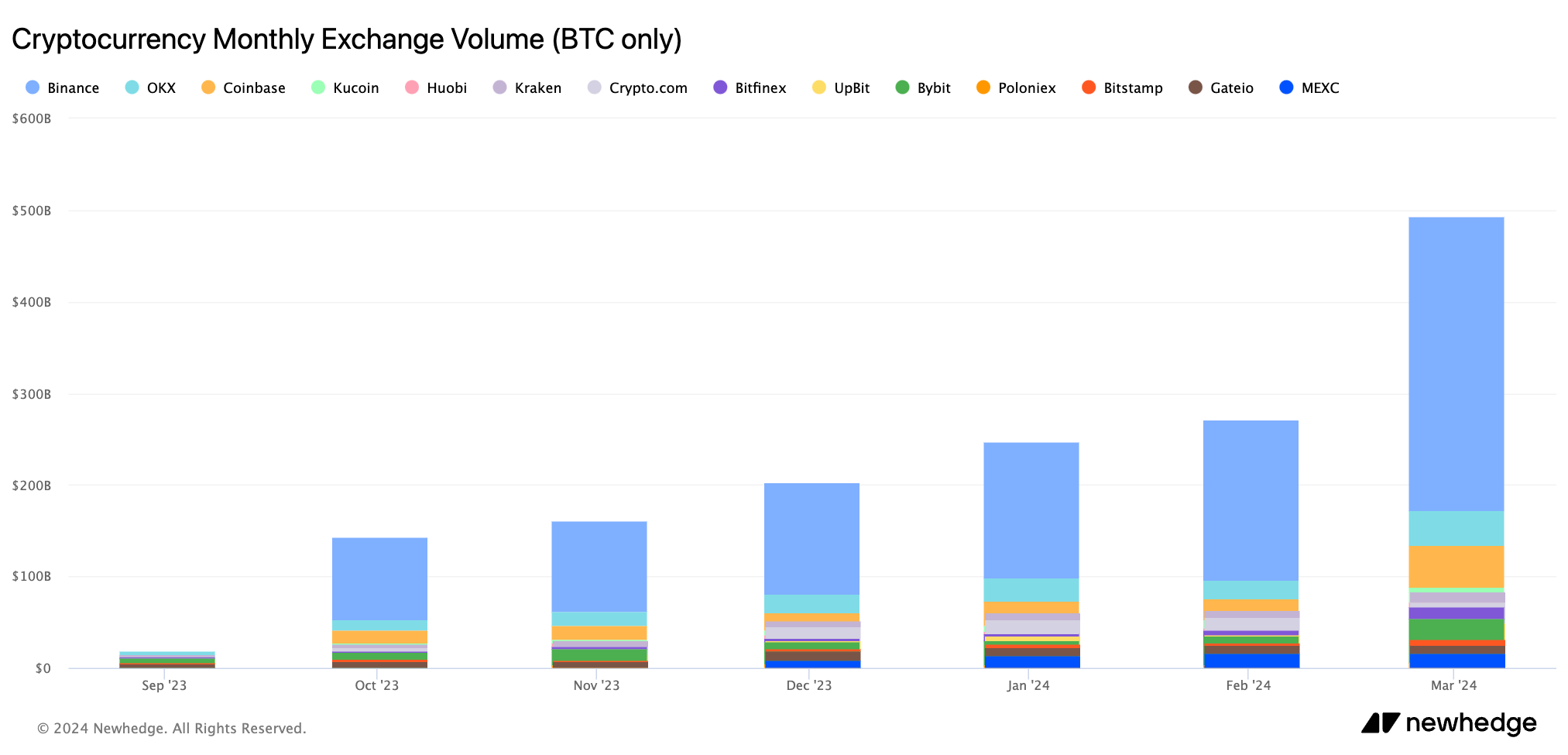

Bitcoin buying and selling quantity on centralized exchanges (CEX) noticed a big spike in March, marking the best CEX buying and selling quantity since Might 2021, however the month isn’t over but. Monitoring CEX buying and selling quantity offers precious perception into market sentiment, liquidity, and the general well being of the crypto market.

From September 2023 to March 24, 2024, Bitcoin buying and selling quantity on CEX elevated astronomically from $18.409 billion to $494.056 billion. This 8x improve in buying and selling quantity in simply 7 months is very noteworthy contemplating the worth of Bitcoin rose from a closing value of $34,667 in September to greater than $73,000 by mid-March 2024. value it. Regardless of the numerous correction, Bitcoin buying and selling quantity remained secure at $67,000 by March 23. continues its upward trajectory, indicating strong market participation and liquidity.

This distribution of buying and selling volumes throughout completely different exchanges reveals a stunning pattern, particularly contemplating the essential position the US performs within the international cryptocurrency market. Regardless of internet hosting the favored Spot Bitcoin ETF and driving a lot of the market sentiment, a comparatively small portion of CEX buying and selling quantity happens in the US. In line with information from March 24, 52% of complete Bitcoin CEX commerce quantity befell on Binance, according to the year-to-date common of over 50%. Following a authorized problem final fall, Binance noticed its BTC buying and selling quantity bounce from $91.9 billion in October 2023 to $321.6 billion in March 2024, however that month isn’t over but.

In distinction, Coinbase accounted for simply 4.22% of the overall CEX buying and selling quantity, rating third general, whereas OKX held second place with simply 6.41% of the overall BTC buying and selling quantity. This dominance of Binance, which collects tons of of billions of BTC in buying and selling quantity, highlights Binance's continued dominance within the CEX atmosphere, the place it constantly accounts for half of the buying and selling quantity of centralized exchanges.

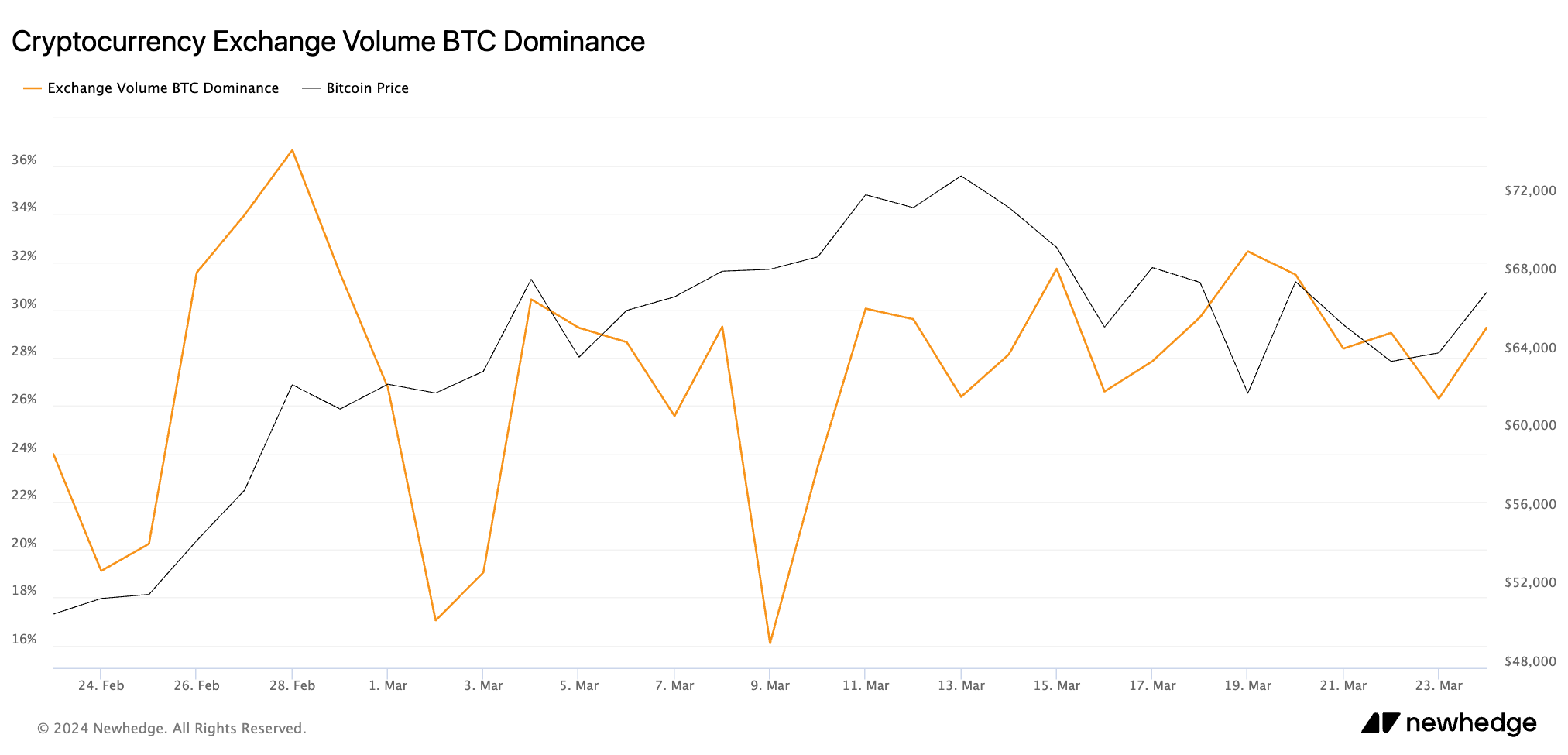

Binance's place turns into much more outstanding when you think about Bitcoin's buying and selling quantity in comparison with the remainder of the market. As of March 24, Bitcoin accounted for simply over 29% of complete crypto buying and selling quantity on CEX, in accordance with information from Newhedge. Regardless of the emergence of quite a few altcoins and the expansion of DeFi platforms, CEX buying and selling quantity stays an essential measure of market sentiment and an integral a part of crypto market infrastructure.

The numerous value correction after Bitcoin's peak in early March, coupled with a sustained improve in buying and selling quantity, means that the market, regardless of its inherent volatility, will grow to be extra resilient and secure in the long term. It suggests that you’re in your method. This means that market circumstances are maturing, with elevated market participation and liquidity contributing to a extra secure value atmosphere that may take in market shocks and fluctuations.

The put up Bitcoin CEX buying and selling quantity hit an all-time excessive in March was first printed on currencyjournals.

Comments are closed.