Bitcoin choices information, particularly open curiosity and strike costs, is vital for understanding the market's expectations for future worth actions.

An possibility is a monetary spinoff that provides the client the correct to purchase (name possibility) or promote (put possibility) the underlying asset at a predetermined worth (strike worth) on or earlier than a selected date. These are vital elements of monetary markets, offering perception into future worth expectations and market sentiment.

Open curiosity represents the whole variety of excellent possibility contracts that haven’t been settled. Within the case of Bitcoin choices, a rise in open curiosity signifies elevated market participation and curiosity, indicating that buyers are making ready for future worth actions. Analyzing the distribution of strike costs can reveal the place buyers count on these costs to maneuver.

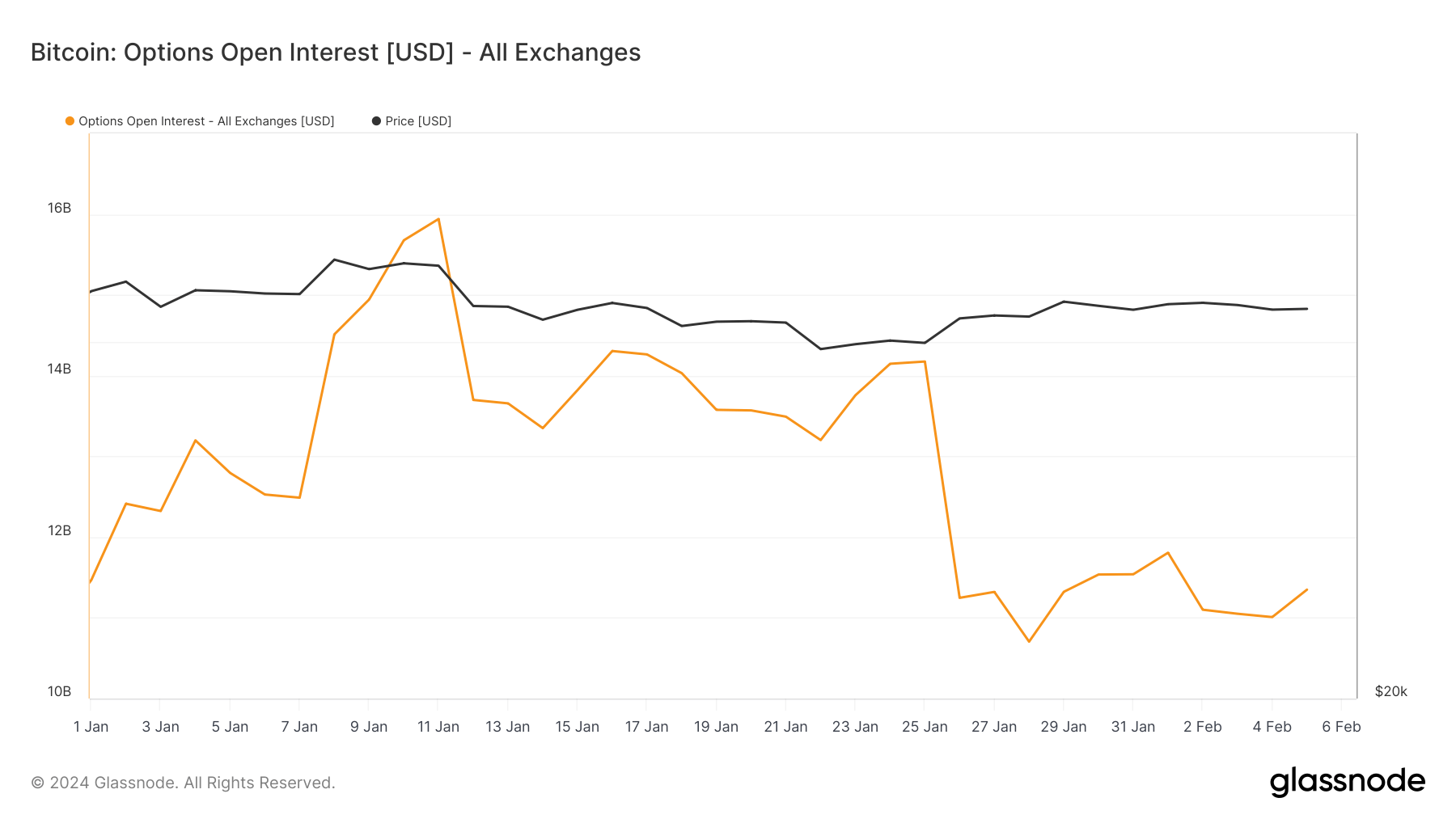

Evaluation of Glassnode information by currencyjournals reveals a notable enhance in open curiosity and buying and selling quantity main as much as the approval of the Spot Bitcoin ETF within the US. Gross sales jumped to $15.94 billion, up from $11.46 billion in January. 1.

This spike is because of a rise in market participation and doubtlessly bullish sentiment as buyers might have hedged new positions or tried to take a position on the course of the worth following the ETF's approval. This means that it’s growing. Nevertheless, its subsequent decline to $10.704 billion by January twenty eighth, and its slight restoration to $11.348 billion by February fifth, signifies that preliminary enthusiasm has waned, volatility and maybe a reversal of market positions. It reveals the analysis.

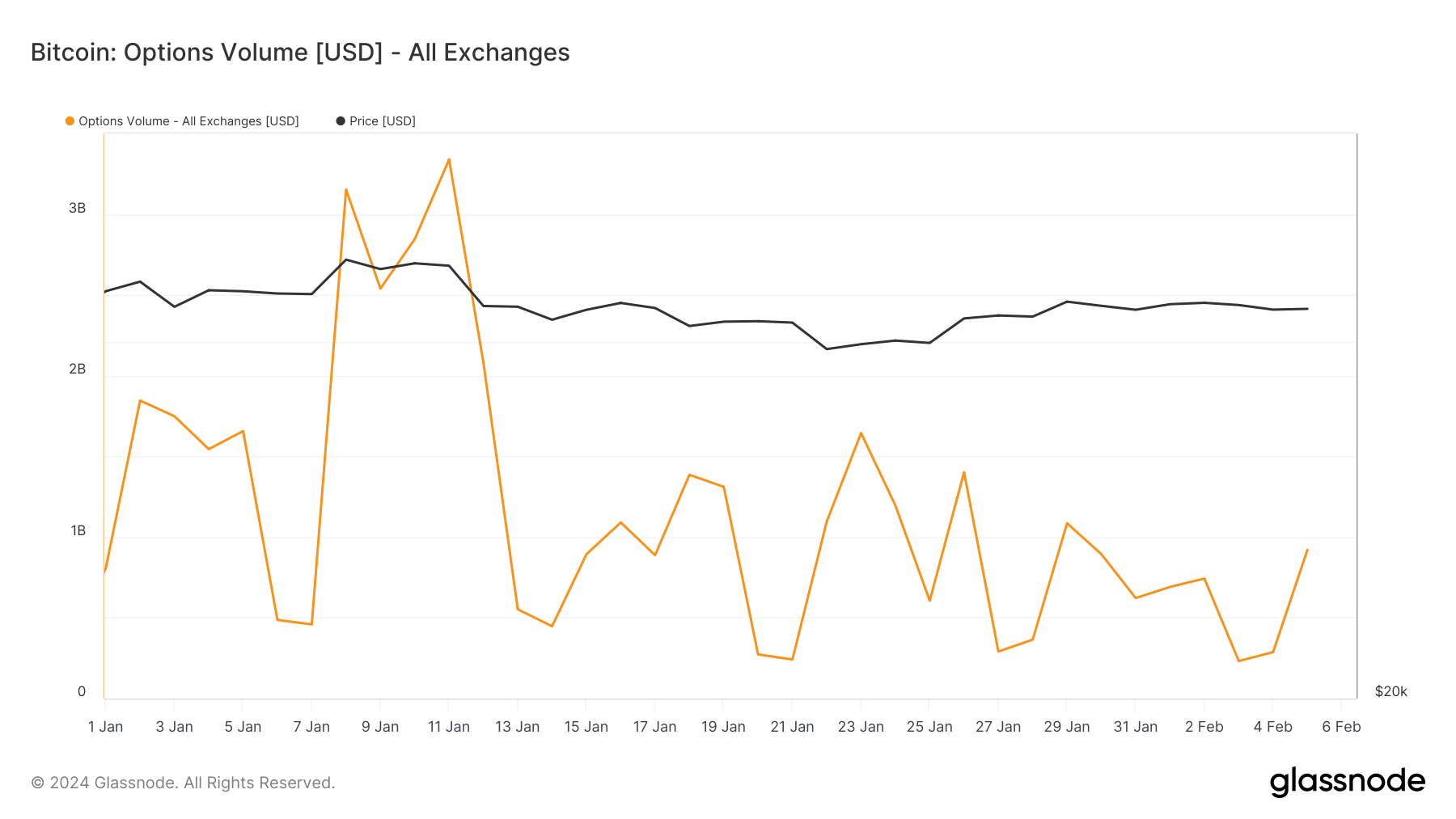

Quantity peaked across the time of the ETF's launch, hitting a notable excessive of $3.338 billion on January 11, which coincided with a surge in open curiosity. The volatility in quantity, notably the decline to $364.9 million by way of January 28, additional highlights market uncertainty and technique reassessment as preliminary reactions to ETF buying and selling normalize.

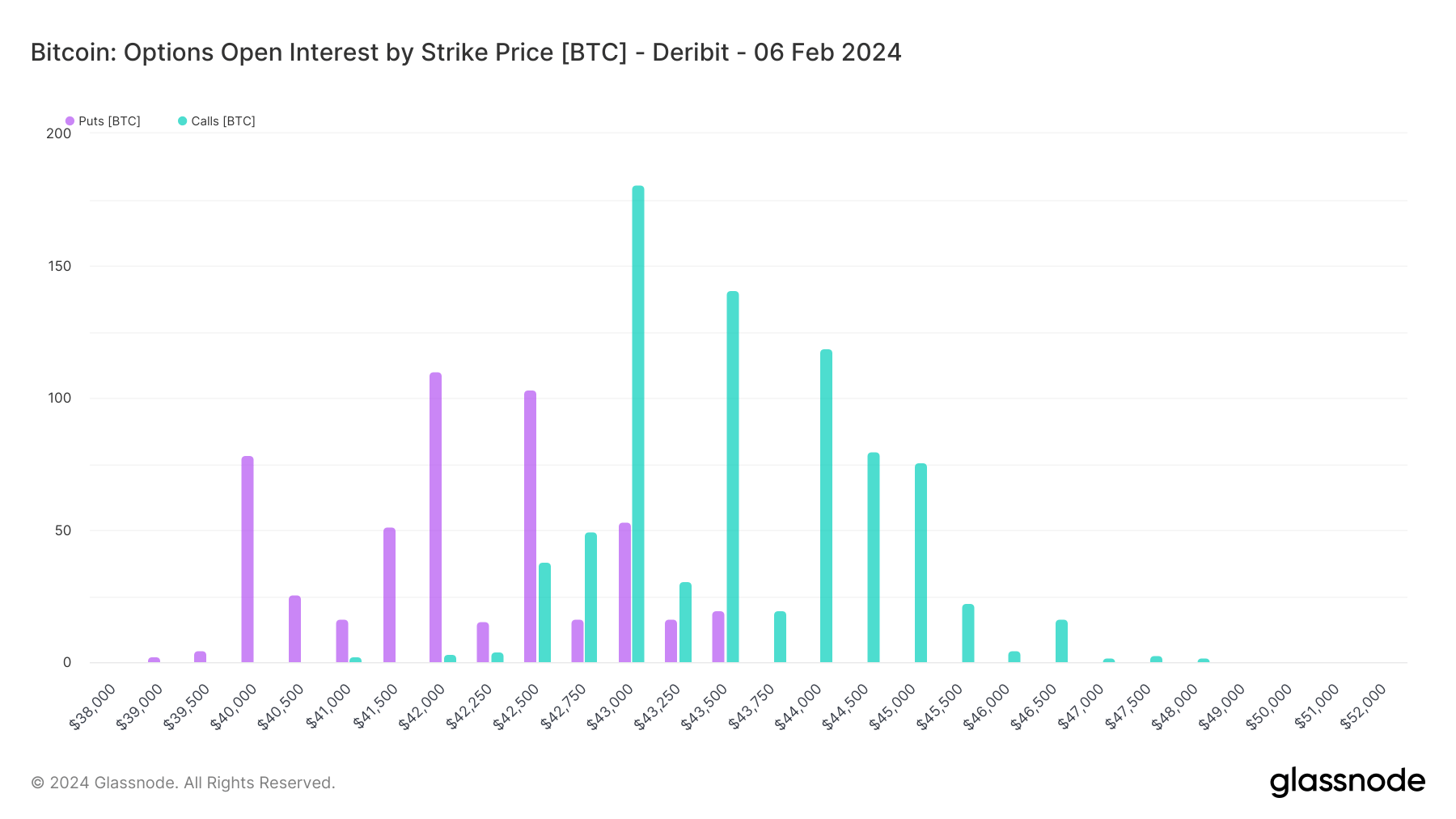

The distribution of open curiosity throughout Deribit's strike costs signifies various market expectations, together with short-term pessimism and long-term optimism. Particularly, for contracts expiring on February 6, there’s a focus of open curiosity in places with decrease strike costs and calls with barely increased however much less formidable strikes. is noticed.

This sample signifies short-term bearish sentiment or protecting stance amongst possibility holders. They might be hedging potential short-term draw back danger or speculating on a direct worth correction.

February 6 strike costs resembling $43,000 and $43,500 for calls and considerably lowered quantity for places level to cautious optimism that we’re headed for a modest rise or stabilization within the close to time period. It reveals.

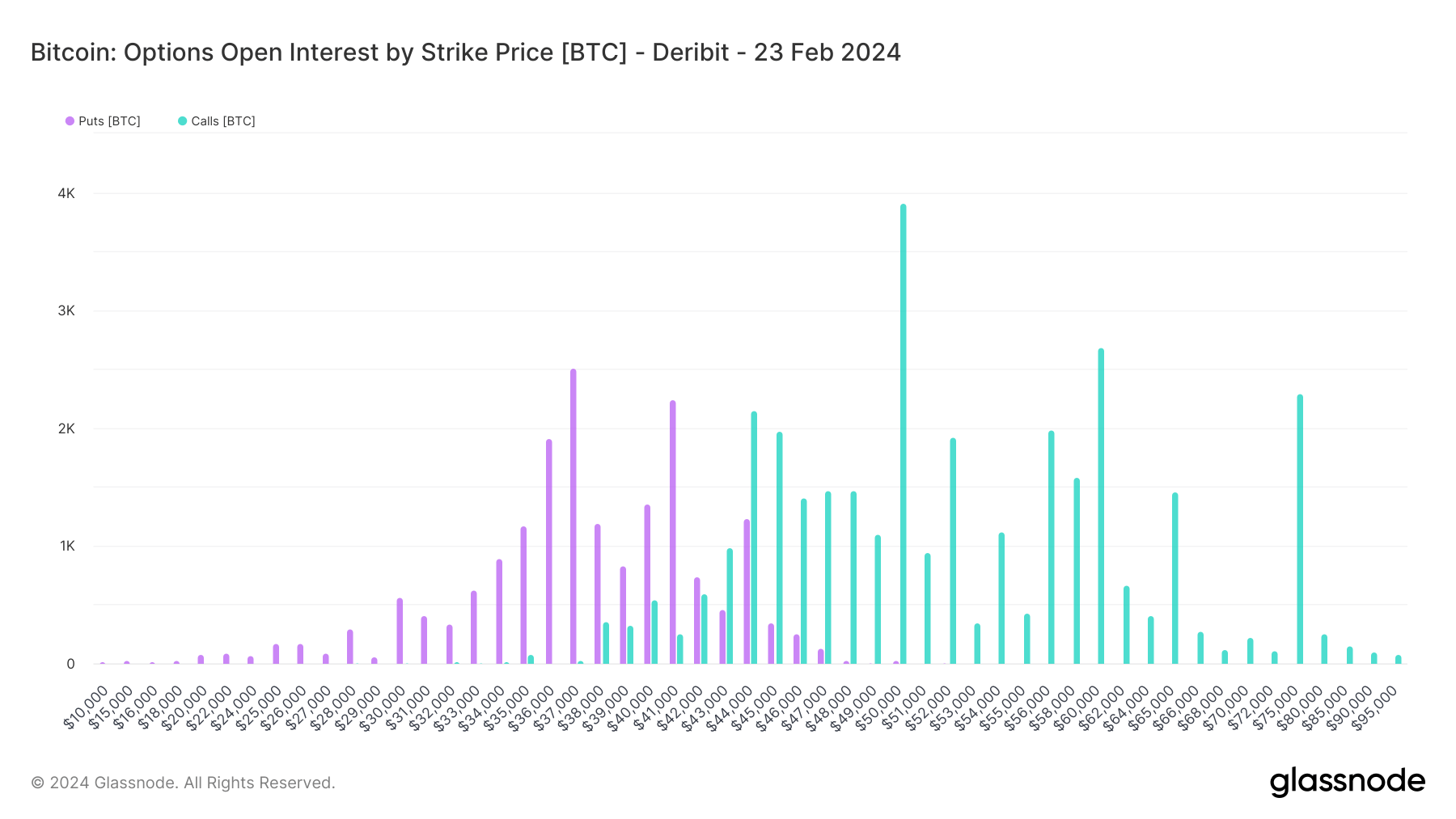

For contracts expiring on February 23, market sentiment shifts extra dramatically to optimism. The rise in open curiosity for places at decrease strike costs ($37,000 and $41,000) is per a protecting stance towards vital worth declines.

Nevertheless, vital curiosity in calls at a lot increased strike costs ($50,000, $52,000, $60,000, $75,000) helps a long-term bullish outlook amongst buyers. This means that regardless of short-term uncertainty and volatility, there’s a robust perception that Bitcoin's worth can rise considerably by the tip of the month.

Publish-Bitcoin choices present long-term bullishness, short-term pessimism appeared first on currencyjournals.

Comments are closed.