Correlation between Bitcoin (BTC) and the Nasdaq dropped to three% in June, based on knowledge. Open peak – Reveals differing sentiments between cryptocurrencies and tech shares.

The worth efficiency of main cryptocurrencies in June was between $24,800 and $31,360, beginning the month at $27,200.

The Spot Bitcoin ETF, which BlackRock filed on June fifteenth, was a bullish catalyst, reversing its earlier downward development about eight days later and hitting a year-to-date excessive of $31,440.

Since then, Bitcoin has traded in a decent vary between $29,860 and $31,030, down 3% from its year-to-date excessive on June 23.

In the meantime, the tech-heavy Nasdaq 100 has been on an upward development for the reason that starting of the yr, hitting a year-to-date excessive of $15,230 on June 16. Since Bitcoin hit a year-to-date excessive on June 23, the Nasdaq is up 0.7%.

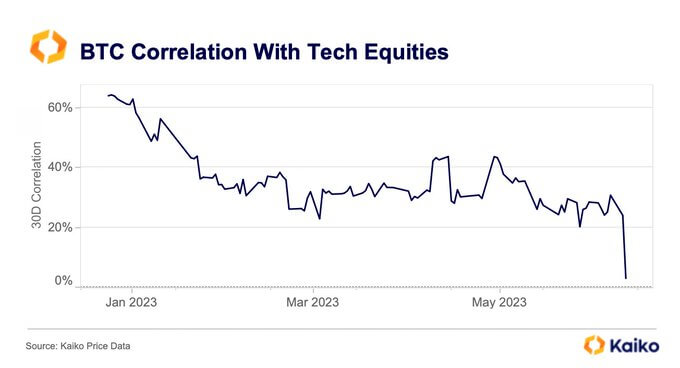

On a 30-day foundation, the correlation between Bitcoin and the Nasdaq was 60% year-to-date, however fell to 22% by March, indicating that the similarities between their worth actions are diminishing. This era of change settled considerably and the correlation struggled to exceed 45%.

The correlation between Bitcoin and the Nasdaq has continued to say no all year long, plummeting to three% this week from over 20% in Could.

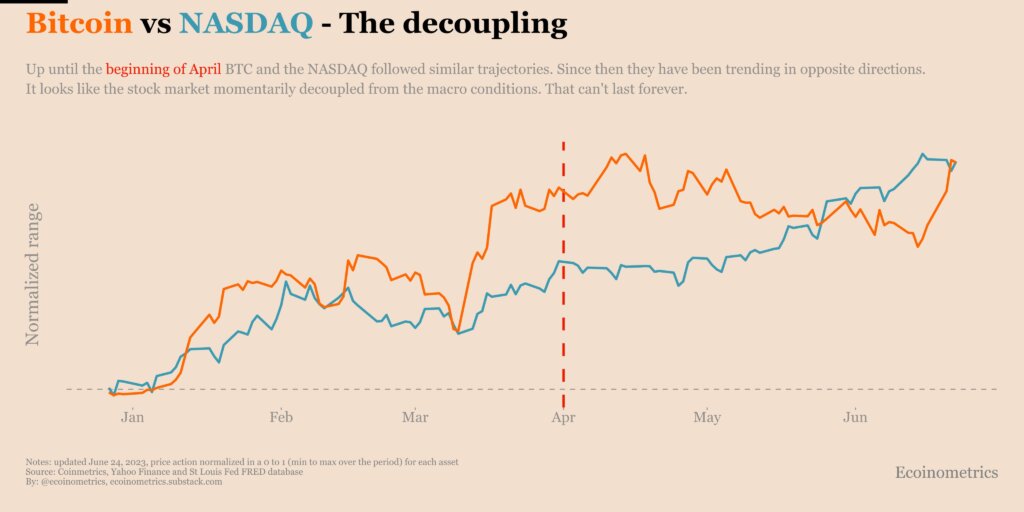

knowledge analysis firm Econometrics has launched a chart of the vary efficiency of Bitcoin and the Nasdaq from the start of the yr to June 24. Till April, the 2 confirmed related developments, after which “nice decoupling” occurred.

Econometrics additionally commented that the Nasdaq’s efficiency was decoupled from the broader macroeconomic image, suggesting an imminent reversal of the uptrend.

“Nevertheless, this bear market rally can not escape the darkish macro surroundings endlessly.“

After the Bitcoin-Nasdaq correlation sank to a 3% low in June, it was first revealed on currencyjournals.

(tag translation) bitcoin

Comments are closed.