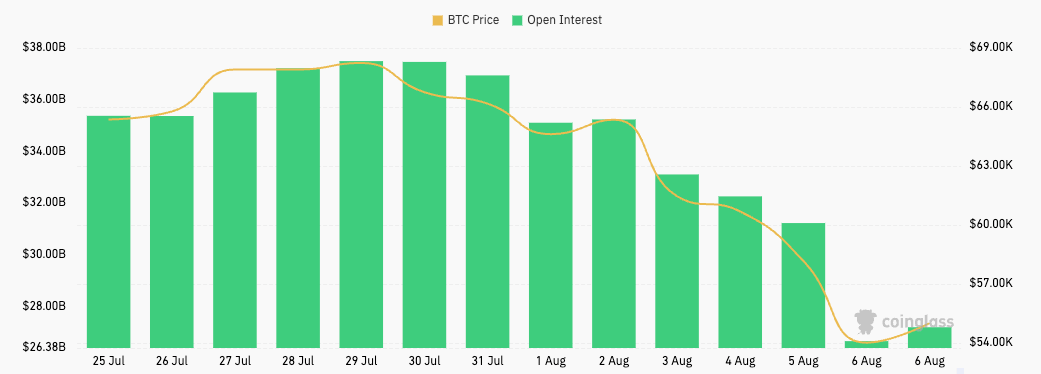

This week's crash was the most important loss because the collapse of FTX, wiping billions of {dollars} from the cryptocurrency market. Bitcoin's drop beneath $50,000 had a dramatic impression on the futures market, with futures open curiosity plummeting from $31.22 billion on August 5 to $26.65 billion on August 6.

The explanation for such a pointy drop in simply 24 hours is probably going the compelled liquidation of futures positions on account of margin calls. When the value of Bitcoin falls beneath a crucial degree required to take care of collateral, it usually triggers a cascade of liquidations, forcing over-leveraged merchants to shut their positions.

The disappearance of futures open curiosity seen this week signifies {that a} vital variety of merchants had guess on Bitcoin’s continued rise and had been caught off guard by the sudden drop, resulting in a big discount of their leveraged positions.

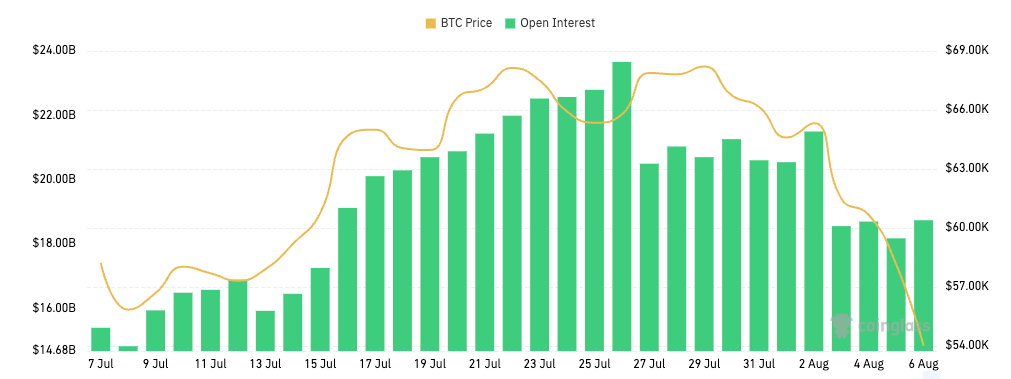

In the meantime, the choices market remained comparatively secure in the course of the value decline, with choices open curiosity remaining roughly flat and fluctuating barely round $18 billion over the weekend.

Not like futures, choices don’t incur margin calls that instantly shut out a place. As an alternative, merchants are granted the suitable (however not the duty) to purchase or promote BTC at a pre-determined value. This distinctive attribute permits choices merchants to carry positions by durations of maximum value volatility with out the danger of quick liquidation.

Nonetheless, it’s extremely unlikely that the soundness seen in choices OI over the previous few days is because of merchants holding their positions.

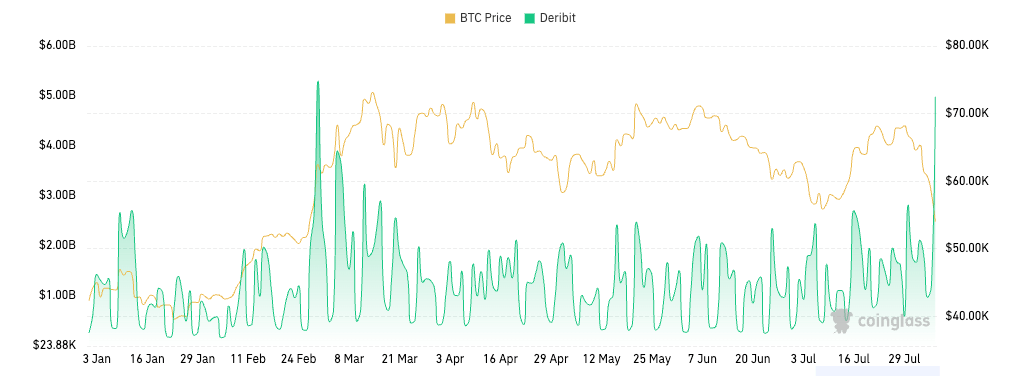

Deribit choices buying and selling quantity surged from $1.22 billion on August 5 to $4.98 billion on August 6. That is the second-highest choices buying and selling quantity ever recorded, after the $5.3 billion recorded available in the market on February 29 this 12 months.

A spike in buying and selling quantity signifies elevated buying and selling exercise, with merchants actively buying and selling available in the market. A number of elements could also be contributing to this phenomenon of accelerating buying and selling quantity whereas open curiosity stays secure.

First, in periods of excessive volatility, merchants enter and exit positions extra steadily, which suggests opening new contracts and shutting present ones rapidly. If the variety of new contracts opened and the variety of contracts closed are roughly equal, OI will stay comparatively unchanged even with quantity spikes. Excessive contract turnover may very well be on account of short-term hypothesis, hedging, or place rolling over.

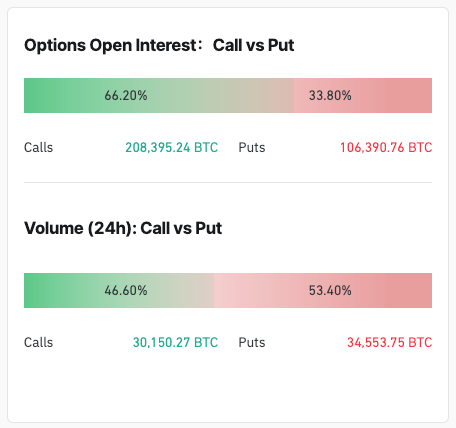

What's attention-grabbing in regards to the choices market throughout this era is the bias in the direction of calls over places, with over 66% of choices open curiosity being calls, indicating bullish sentiment remains to be dominant amongst merchants.

Nonetheless, whereas open curiosity is closely skewed in the direction of calls, buying and selling quantity is biased in the direction of places. The 24-hour choices buying and selling quantity from August 5 to August 6 was dominated by places. This may be defined by merchants’ quick response to the value drop. When Bitcoin crashed, merchants rushed to purchase places to hedge present positions or in anticipation of additional value declines within the quick time period.

In distinction, open curiosity is extra reflective of merchants' long-term positioning. The truth that a lot of the open curiosity is calls signifies that merchants have been constructing these positions over time whereas sustaining a bullish outlook on Bitcoin's long-term prospects. These positions usually are not adjusted or liquidated as rapidly as shorter-term trades, which is why the open curiosity is closely biased in the direction of calls.

The submit Bitcoin Crash Wipes Out $5 Billion in Futures OI, However Choices Stay Regular appeared first on currencyjournals