- Ethereum, XRP, Solana, and Dogecoin drop by over 15%.

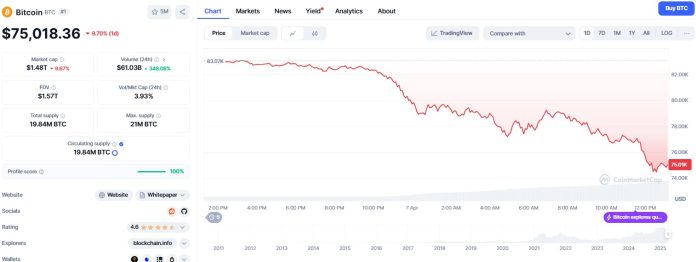

- Bitcoin loses its vital assist stage of between $79,000 and $80,000.

- Fed fee discount bets rise as merchants assess the chance of a recession.

Bitcoin’s sharp decline over the weekend has given the broader cryptocurrency market a dominant benefit, with merchants now measuring the fallout from Donald Trump’s proposed world tariffs and potential for additional losses.

Main digital belongings fell under $77,000, down greater than 10% from a report excessive of almost $90,000 only a week in the past.

This hunch has left the crypto market with nice worth lacking from the cipher market, dropping $1.3 trillion since January.

The broader concern is whether or not the present revisions point out a deeper disaster in digital belongings associated to the attachment of macroeconomic pressures.

Bitcoin loses $79,000 in assist as a market slide

Bitcoin costs have fallen under the important thing know-how ranges over the weekend ($79,000-$80,000).

This assist was held firmly for greater than a month after the belongings reached an all-time excessive.

Supply: CoinMarketCap

Analysts at the moment are pointing to the $72,000 pre-election as the subsequent stage of potential assist.

The decline comes on account of a rise in world market-wide volatility pushed by Trump’s so-called liberation day tariffs. Analysts warn that it might result in conditions like a world commerce shock and a recession.

Different main cryptocurrencies observe Ethereum, XRP, Solana and Dogecoin posting greater than 15% losses within the final 24 hours alone.

The speedy decline throughout crypto markets displays current losses in shares, suggesting a stiffer correlation between digital belongings and conventional monetary markets.

1.3T Crypto Loss Associated to Tariff Concern

Final week, traders sentiment shifted additional as they elevated bets that the Federal Reserve might quickly be compelled to chop rates of interest to forestall the US recession.

Such actions might inject extra {dollars} into the market and will assist Bitcoin costs get well.

Nonetheless, the short-term impression of Trump’s tariff coverage injects uncertainty throughout asset courses, with analysts describing the situation as a attainable “disaster.”

Trump’s financial proposal, which he introduced about what he known as the discharge date, contains swept tariffs that might burden world commerce relations.

This stunned each Wall Road and Crypto Merchants, prompting them to dump over the weekend.

The timing of Bitcoin’s decline, significantly on Sunday, is seen as an early sign of wider market sentiment heading into the brand new buying and selling week.

Hope to chop Fed charges meet Trump’s tariffs

Some analysts warn that Crypto Market’s weekend exercise could possibly be a preview of Monday’s inventory efficiency.

As Bitcoin and different digital belongings are quickly declining on Sunday, there’s hypothesis that the inventory market might open decrease and will proceed to have a bearish development.

Ethereum, Solana, and Dogecoin skilled a extra speedy decline than Bitcoin, amplifying the concern of widespread risk-off feelings.

The present trajectory of Crypto Market is intently monitored by merchants in search of indicators of intervention or coverage reversal.

Trump’s stance and potential emergency help modifications from the Federal Reserve might assist stabilize Bitcoin and restore belief throughout the market.

The $1.3 trillion sweep of crypto markets this 12 months underscores how digital belongings are at the moment woven into macroeconomic forces, together with financial coverage selections and geopolitical commerce strikes.

As Congress can also be getting ready to debate regulatory modifications that might reshape the digital belongings panorama, the longer term course for Bitcoin and the broader crypto market stays unsure.

Since Crypto Market first appeared on Coinjournal, Submit Bitcoin crashes 10% as Crypto Market wipes out its $1.3 trillion price.